Why Are Stablecoin Giants Tether, Circle Developing Blockchains?

Image Source: Pexels

The race for control over payments infrastructure is accelerating, and stablecoin issuers like Tether and Circle are no longer content to rely solely on Ethereum, Solana, or other general-purpose blockchains. Instead, they’re building dedicated blockchains to hardwire their tokens into the global financial system.

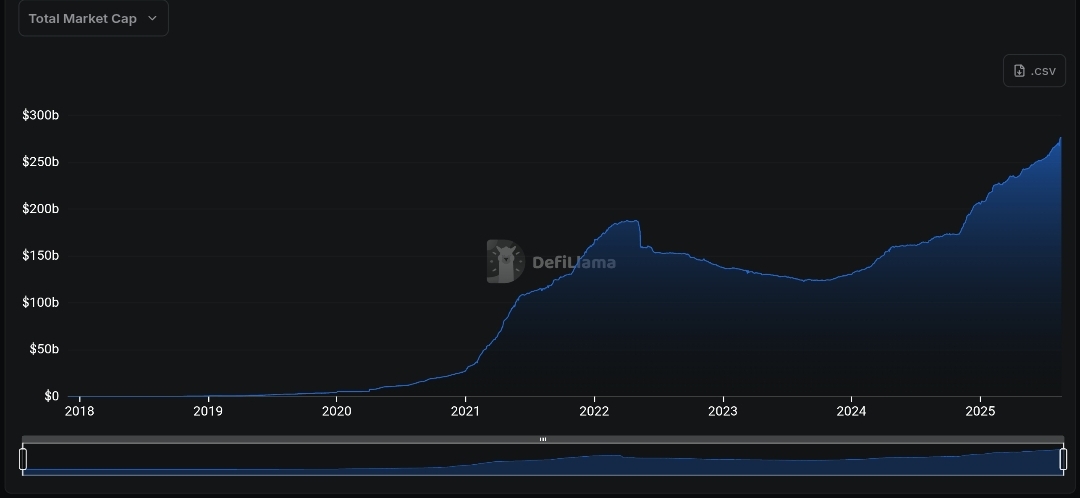

The overall stablecoin market capitalization has climbed to over $250 billion in 2025, up sharply from roughly $140 billion last year, according to DeFiLlama. This includes $155 billion from Tether and $60 billion from Circle.

(Click on image to enlarge)

Source: DeFiLlama

But as volume grows, so do the pain points, such as unpredictable gas fees, congested networks, and dependence on blockchains optimized for DeFi speculation rather than low-cost, high-throughput money movement. These have led to the growing trend of issuers backing and launching their dedicated chain.

From Stable to Arc: Stablecoin-Native Blockchains Take Shape

The most notable example is Stable, a new Layer 1 network centered around the largest stablecoin, Tether’s USDT. Announced in July, Stable, which brands itself as the first “stablechain,” where USDT is used as the native gas token, raised $28 million in seed funding led by Bitfinex and Hack VC.

1/ We've raised $28M in seed round funding led by Bitfinex and Hack VC to launch @Stable — the first dedicated Layer 1 stablechain optimized for USDT payments. pic.twitter.com/NT4vrzy10I

— Stable (@stable) July 31, 2025

Unlike Ethereum or Solana, which prioritize programmability and composability, Stable is optimized exclusively for payments. Founder Joshua Harding argued that general-purpose blockchains force users into paying high fees in volatile tokens, suffering from long confirmation times, or relying on custodians.

Stable aims to solve this by making transfers free at the protocol level, settling in dollars, and offering predictable costs.

Tether executives believe the timing is perfect. Paolo Ardoino, CEO of Tether and CTO of Bitfinex, pointed to the recent U.S. GENIUS Act, legislation granting regulatory clarity to stablecoin payments.

With this framework, banks and institutions can begin adopting USDT for settlements at scale, and purpose-built blockchains like Stable will be positioned as the infrastructure layer.

Stable isn’t alone. Recently, Circle announced Arc, a dedicated USDC blockchain. Announced in August, the EVM-compatible chain is designed to provide an enterprise-grade foundation for stablecoin payments, FX, and capital markets applications.

Introducing Arc, the home for stablecoin finance.@Arc is an open Layer-1 blockchain purpose-built to drive the next chapter of financial innovation powered by stablecoins.

— Circle (@circle) August 12, 2025

Designed to provide an enterprise-grade foundation for payments, FX, and capital markets, Arc delivers… pic.twitter.com/Z8FHUls1xY

Arc will use USDC as its native gas token and will fully integrate with Circle’s existing platform, while maintaining interoperability with other partner blockchains. This positioning will make the network a high-performance, regulatory-aligned settlement layer.

Plasma, also backed by Bitfinex, raised $24 million earlier this year to build its own stablecoin-focused chain. Stripe, meanwhile, revealed Tempo, a Paradigm-backed stablecoin network.

Tokenization players are joining too, with Securitize building Converge with Ethena, Ondo Finance having its own chain underway, and Dinari working on a tokenized stocks L1 on Avalanche.

Why Are Stablecoin Issuers Building Their Own Settlement Rails?

The pivot toward issuer-built blockchains indicates a desire for control and positioning as much as it does technology. Running a dedicated Layer-1 allows issuers to blend compliance into the protocol, integrate foreign exchange features, and guarantee predictable fees.

It also opens up new business models: instead of paying into someone else’s network, issuers can capture settlement margins directly by issuing their own gas tokens and operating independent fee markets.

The regulatory dimension is equally significant. Purpose-built L1s can embed KYC checks, compliance rules, and tailored governance at the protocol level, which is an increasingly attractive prospect as policymakers in the U.S., Europe, and Asia accelerate digital asset regulations.

However, this shift raises questions for existing chains. Analysts at Coinbase recently noted that Circle’s Arc and Stripe’s Tempo are explicitly targeting high-throughput, low-fee payments, a corner of the market long dominated by Solana.

Ethereum, by contrast, is expected to remain the institutional anchor in the near term, supported by its strong base of institutional users.

Still, analysts caution that replacing trust in established blockchains will take more than raw throughput

More By This Author:

Why Target Stock Is Sinking Despite Earnings Beat – Time To Buy?

Vanguard To Roll Out First Actively Managed Stock ETFs

Did Q2 Earnings Exceed Expectations Or Get Derailed By Tariffs?

Disclaimer: This article is NOT an investment recommendation, please see our disclaimer - Get our 10 ...

more