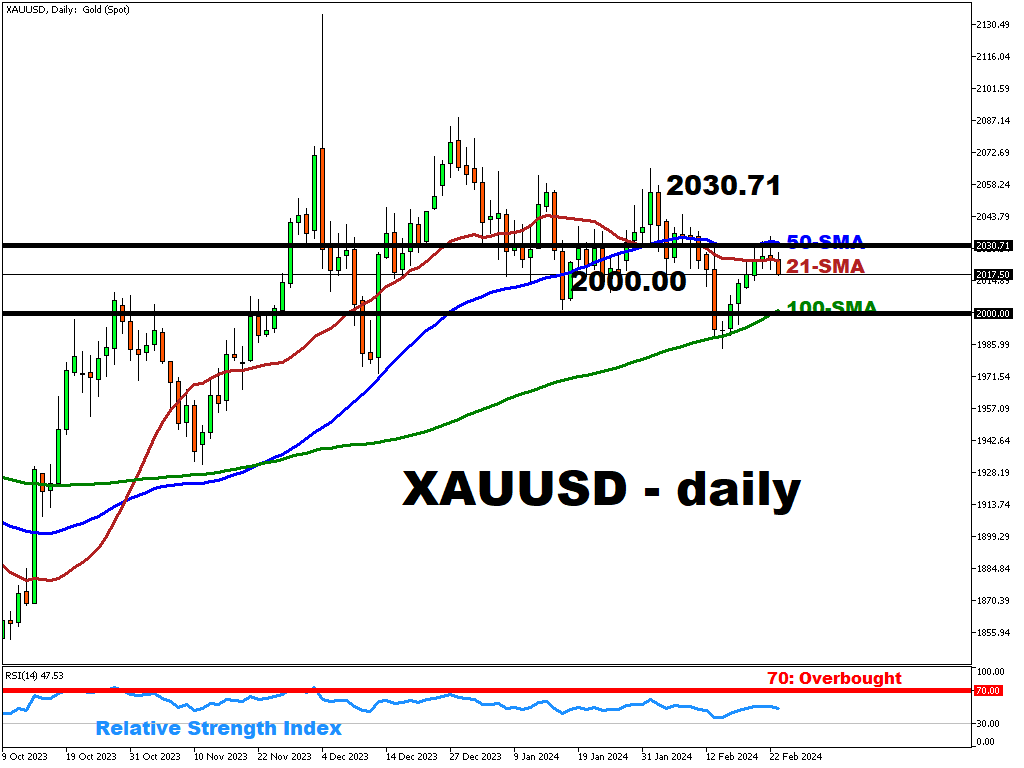

XAUUSD Bulls Struggle Below 21-Period SMA

Gold bulls are struggling to get back above the 21-period simple moving average (SMA) following the lower-than-expected (201K vs 218K forecast) US Initial Jobless Claims reading on Thursday.

A decrease in Jobless Claims suggests a stronger labor market which may contribute to wage pressures and inflation, potentially leading for the interest rates to remain higher for longer.

Last Wednesday’s (21.02.2023) FOMC minutes did not bring any surprises to the markets. Fed did, however, underline that It needed further confirmation that the inflation is clearly going down.

According to the economic forecasts, both total and PCE inflation were expected to lower in 2024 and reach the proximity of 2% target rate by 2026.

The markets are now expecting the Fed to start easing its policy by June (~64.77% probability of a cut on 12.06.2024).

XAUUSD bulls are now looking forward to next week’s US GPD reading, along with the Core PCE Index (the Fed’s preferred way of measuring inflation) and Personal Income/Spending data.

- An uptick in either or both of these macro-economic indicators may translate into zero-yielding bullion moving lower as investors could seek higher returns offered by interest-bearing assets like bonds.

- On the other hand, lower-than-expected readings may contribute to the sooner rate cuts, potentially pushing demand for gold

More By This Author:

USDJPY Consolidates At 150 Psychological Level

S&P 500 Continues To Trade Below $5000 Ahead Of FOMC Minutes And Nvidia Earnings

This Week: NDX Eyes 18k, Traders Anticipate AI Earnings Boost

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more

Means zero.