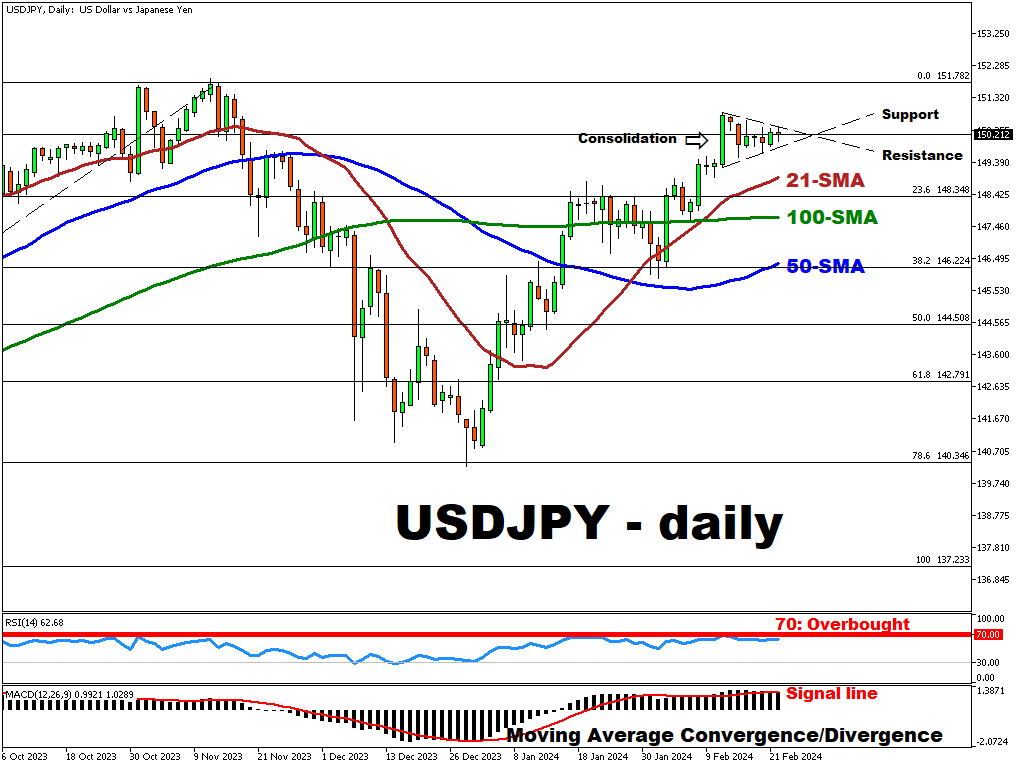

USDJPY Consolidates At 150 Psychological Level

USDJPY's uptrend faces resistance near ~150.00.

While the price sits above all key moving averages (21, 50 and 100-SMAs), indicating a potential bullish momentum, USDJPY is currently encountering hurdles at the ~150.00 psychological level.

Neutral Relative Strength Index (RSI) – 62.23 (<30 – oversold, >70 – overbought) underscores the market’s uncertainty as the currency pair consolidates further.

MACD, now located below the signal suggests the potential weakening of the USDJPY’s uptrend.

On the downside, the key support levels are 148.93 (21-SMA), 148.35 (23.6% Fib), and 146.33 (50-SMA).

To the upside, the key resistance levels are ~150.40 and 151.78 (0.0% Fib).

The short-term outlook may be uncertain. Breaching above ~150.40 could signal further gains towards 151.78. Conversely, a drop below ~149.70 might indicate a deeper correction towards the 21-SMA 148.93.

More By This Author:

S&P 500 Continues To Trade Below $5000 Ahead Of FOMC Minutes And Nvidia EarningsThis Week: NDX Eyes 18k, Traders Anticipate AI Earnings Boost

XAUUSD Is Back Above The $2000 Mark

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more