WTI Stays Firm At Around $67.60s After Diving To Fresh YTD Lows

Image Source: Unsplash

Western Texas Intermediate (WTI), the US crude oil benchmark, advanced 2.31% on Monday, bolstered by a soft US Dollar (USD) and market sentiment improvement. As Tuesday’s Asian session begins, WTI exchanges hands at $67.68 PB.

Oil prices advanced on an offered US Dollar

Wall Street’s finished the session with gains spurred by risk appetite. Oil price was underpinned by an offered US Dollar, as shown by the US Dollar Index, down 0.54%, at 103.305. Nevertheless, the sentiment would remain fragile ahead of the US Federal Reserve (Fed) monetary policy meeting and the Bank of England’s (BoE) interest rates decision. Any hawkish tilt by central banks could derail traders’ mood and sour sentiment.

In the meantime, the G7 commented that it’s not expected an adjustment to Russia’s oil barrel level at $60.00 this week, as reported by Reuters.

The G7 had planned to reconsider the price limit implemented in December. Still, the officials mentioned that the European Commission informed EU ambassadors over the weekend that there is currently no interest among the G7 to conduct a prompt reassessment. This was supposed to take place in mid-March.

OPEC, Russia, and other producer allies (OPEC+) will hold a ministerial committee meeting on April 3. As per the agreement made in October, the group had decided to reduce their oil production targets by 2 million barrels per day until the end of 2023.

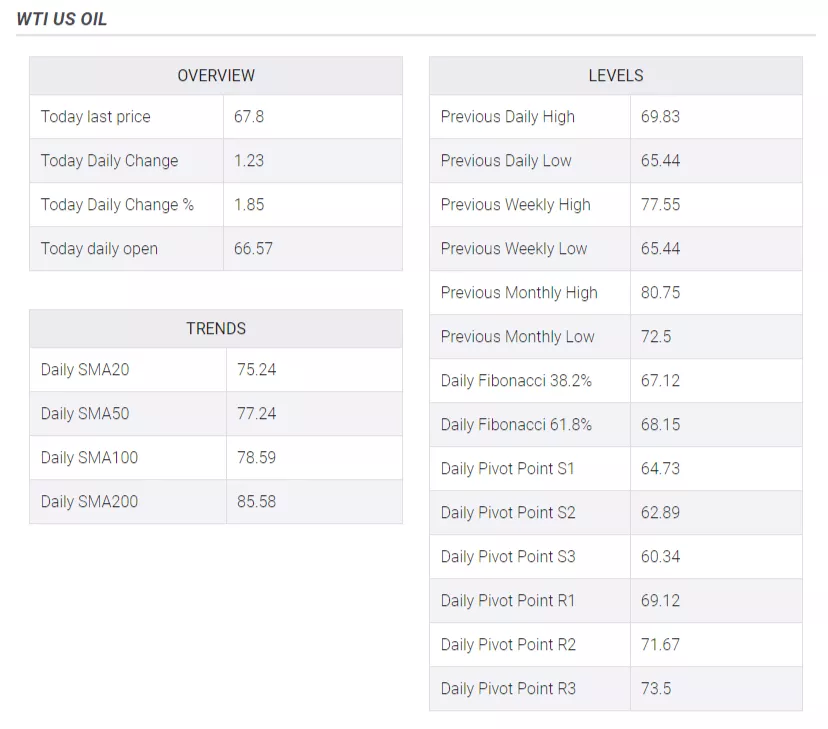

WTI Technical levels

More By This Author:

Gold Price Forecast: XAU/USD Gains More Than 3%, Approaches $2,000

WTI Climbs On Risk-on Impulse, And Saudi-Russia Meeting Eased Fears

WTI Bulls Waiting In The Flanks At Major Support

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more