WTI Rises As U.S. Crude Oil Exports Increase Amidst OPEC+ Cuts, Yet Economic Headwinds Loom

Image Source: Pixabay

Western Texas Intermediate (WTI), the US crude oil benchmark, rose on Wednesday after Tuesday’s holiday in the United States (US), keeping prices almost unchanged due to thin volumes amidst US traders’ absence. Hence, WTI is trading at $71.86 per barrel, up by 1.28%, after hitting a daily low of $70.40.

WTI surges on supply tightening measures, but macro-economic factors cast a shadow

Government data revealed that US crude shipments for the week ending June 23 finished at or near record highs with a daily volume of 5.338 million barrels. The week before was 4.543 million, being the June 16 week, while for the week ended June 9, exports were at 3.27 million daily. Therefore, WTI exports have doubled over the last three weeks.

That keeps WTI underpinned, alongside crude oil output cuts by Saudi Arabia and Russia, which extended its 1 million and 500,000 barrels per day cut to August.

Analysts quoted by Reuters said, “The July voluntary cuts and the extension into August should considerably tighten the oil market, but investors will stay on the sidelines until oil inventories show substantial draws.”

The Organization of Petroleum Exporting Countries and its allies, known as OPEC+, gathered at an industry event on Wednesday and commented the cartel will keep its efforts to support a “stable and balanced oil market.”

In the meantime, a global economic slowdown, seen after the release of the Manufacturing and Services PMI, could cap WTI prices. That and higher interest rates in the United States (US) can keep US crude oil prices meandering around the $70.00 per barrel price after June’s Federal Reserve (Fed) meetings showed divisions amongst policy markets pausing on increasing interest rates. It should be noted that a July rate hike is almost certainly, which could boost the greenback, a headwind for US Dollar (USD) denominated commodities.

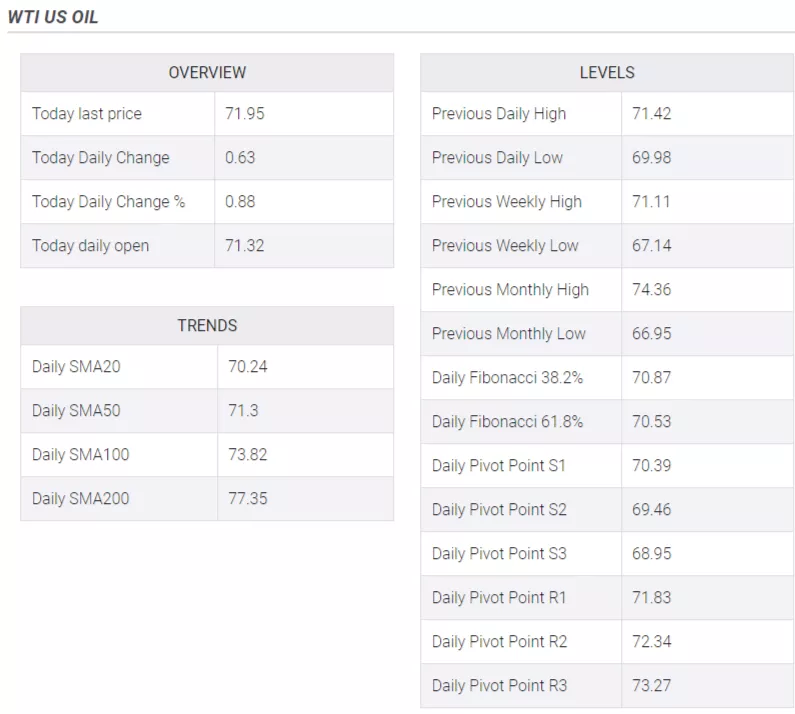

WTI Technical Levels

More By This Author:

GBP/USD Drops Below 1.2700 Post FOMC Minutes Release

Dow Still Angling Toward 35,500 Ahead Of FOMC Minutes, Jobs Report

Pound Sterling Recovers As UK PM Sunak Shows Confidence About Price Stability

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more