WTI Price Analysis: WTI Recovers And Rises Back Above $75.00 Following U.S. Retail Sales

The West Texas Intermediate (WTI) price cleared almost all of Monday’s losses and jumped towards $75.70. Following weak Retail Sales data from the US, rising Wall Street indexes and lower US yields signal that markets expect a less aggressive Federal Reserve (Fed) past July. This should lead to lower interest rates eventually and a weaker US Dollar, and since WTI is priced and traded in USD, translate into lower Oil prices.

The US Census Bureau revealed that Retail Sales in the US expanded in June by 0.2%, lower than the 0.5% expected and the previous 0.5%, and the sales excluding the Automobile sector increased 0.2%, failing to live up to the expectations of 0.3%. On the positive hand, the Retail Sales Control Group, which represents the total industry sales used to prepare the Personal Consumer Expenditures (PCE) estimates for most goods, expanded by 0.6% in June, while markets expected a 0.3% decline.

US Treasury yields are declining as a reaction, indicating that markets expect a less aggressive Fed. The 2-year yield fell to 4.70%, while the 5 and 10-year rates to 3.95% and 3.75%, respectively, decreased by more than 0.50%. In that sense, the expectations of lower rates, which tends to be associated with a stronger economy and a weaker Buck, allowed Oil prices to rise. That being said, regarding Federal Reserve bets, according to the CME FedWatch Tool, investors have practically priced in 25 basis points (bps) hike in the upcoming July 26 meeting, while the probability of a hike in 2023 has dropped to around 20% due to the latest set of data which has weakened the USD over the last sessions.

On the downside, the sluggish economic situation of China, the world’s biggest Oil importer, may limit WTI’s upside. On Monday, it was reported that the Chinese Gross Domestic Product (GDP) and Retail Sales expanded but below expectations, so weaker Chinese Oil demand may apply selling pressure to the Black Gold.

For the rest of the session, investors will closely watch American Petroleum Institute (API) weekly Crude Oil stocks.

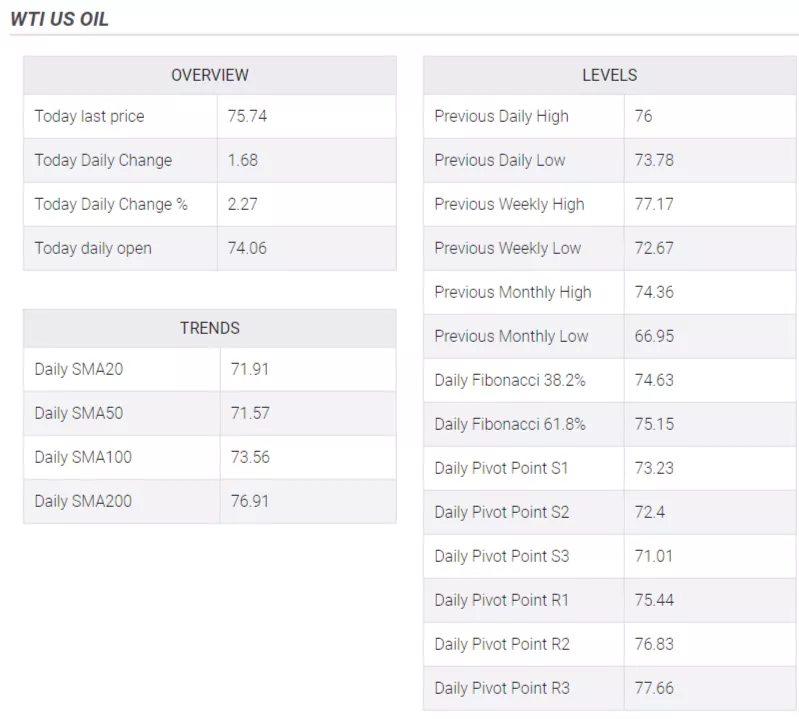

WTI Levels to watch

According to the daily chart, the technical outlook is neutral to bearish despite daily gains. The Relative Strength Index (RSI) stands with a flat slope above its midline, while the Moving Average Convergence Divergence (MACD) prints lower green bars indicating bullish exhaustion.

Support Levels: $73.55 (100-day SMA), $72.80, $71.90 (20-day SMA).

Resistance Levels:$76.00, $77.00,$77.30 (200-day SMA).

WTI Daily chart

(Click on image to enlarge)

-638252976315962254.png)

More By This Author:

AUD/USD Flirts With Daily Low Around 0.6800 Mark, Weaker USD To Help Limit Losses

AUD/USD Bears Stay Hopeful Of Breaking 0.6800, RBA Minutes, US Retail Sales Eyed

Dollar Suffers Worst Weekly Loss Since November, Still Vulnerable

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more