AUD/USD Bears Stay Hopeful Of Breaking 0.6800, RBA Minutes, US Retail Sales Eyed

Image Source: Unsplash

AUD/USD languishes near 0.6820 after a downbeat week-start and a failure to defend the corrective bounce as traders await the Reserve Bank of Australia’s (RBA) latest monetary policy meeting minutes on early Tuesday. It’s worth noting that the Aussie pair’s latest weakness could be linked to the market’s fears of economic slowdown in China, as well as the US Dollar’s consolidation of the previous weekly loss, despite the latest retreat of the greenback. Also, concerns about the RBA’s inability to lift the interest rates further, as well as economic fears surrounding Canberra, weigh on the risk-barometer pair ahead of the key data/events.

On Monday, China’s headline statistics confirmed the market’s fears that Australia’s biggest customer is facing economic headwinds, which in turn joined the US-China chatters to flag fears surrounding Beijing and exert downside pressure on the AUD/USD.

That said, China’s second quarter (Q2) 2023 Gross Domestic Product (GDP) rose past the previous readings of 4.5% to 6.3% but eased below the analysts’ estimations of 7.3%. Further, the Industrial Production growth jumped to 4.4% YoY in June, compared to the 2.7% expected and 3.5% prior. However, the Retail Sales slumped to 3.1% from 12.7% prior and 3.2% market consensus. It should be noted that China’s June survey-based Jobless Rate for 24-year-olds jumped to a record high of 21.3%.

Elsewhere, US Treasury Secretary Janet Yellen said during a Bloomberg interview that the US is looking carefully at outbound investment controls on China while adding, “But they would be focused on a few sectors." The policymaker also clarified that these would not be broad controls that would have a fundamental impact on the investment climate in China. During the weekend, US Treasury Secretary Yellen spoke at a meeting of Group of 20 (G20) finance ministers and central bankers in India while saying, “I am eager to build on the groundwork that we laid in Beijing to mobilize further action.” Hence, the US-China tension is back in the spotlight but the pace of pessimism appears slow and mixed.

It’s worth mentioning that Australian Treasurer Jim Chalmers flagged economic fears for the Pacific major and exerted downside pressure on the AUD/USD.

Alternatively, softer prints of the New York (NY) Empire State Manufacturing Index for July, to 1.1 from 6.6 prior and 0.0 market forecasts, joined the market’s risk-on mood, to allow the AUD/USD bears to take a breather.

While portraying the mood, Wall Street closed with minor gains whereas the US Treasury bond yields remained pressured.

Looking ahead, the RBA Minutes will be observed to gauge the catalysts behind the pause in a rate hike trajectory and predict the future moves of the Australian central bank, which in turn can help the AUD/USD bears in case of posting dovish remarks. It should be observed that the incoming RBA Governor Michele Bullock isn’t known as a hawk and hence downbeat RBA Minutes and the aforementioned pessimism can allow her to keep the easy money policy on the table.

Elsewhere, US Retail Sales for June, expected to rise to 0.5% versus 0.3% prior, can help the US Dollar to grind higher amid the Fed policymaker’s blackout ahead of late July’s Federal Open Market Committee (FOMC) Monetary Policy Meeting.

Technical analysis

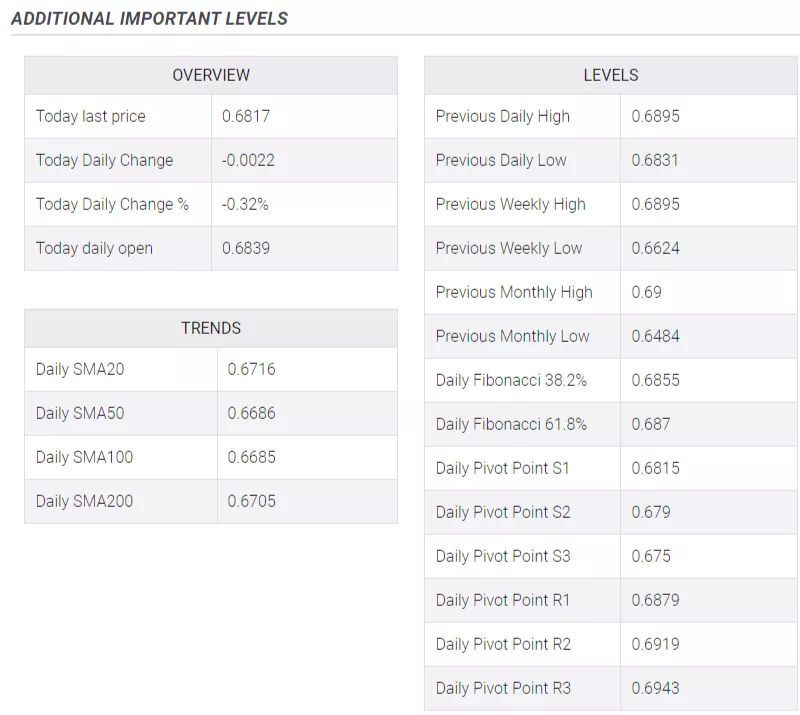

A clear U-turn from the 0.6900 mark directs AUD/USD bears toward a one-week-old rising support line surrounding 0.6765, a break of which will highlight the 200-DMA level of 0.6710 as the key challenge for the bears before retaking control.

More By This Author:

Dollar Suffers Worst Weekly Loss Since November, Still VulnerableEUR/USD Price Analysis: Enough from the bulls and will the bears make their move?

AUD/USD Retreats From 0.6900 Neighborhood, Bullish Potential Seems Intact

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more