WTI Price Analysis: Testing The $80 Level On Broad US Dollar

Crude oil prices are down on Monday as a risk-off mood underpins the American currency. The black gold stands a few cents above an intraday low of $79.71 a barrel and is nearing its latest range's base.

OPEC+ oil output cut

Early April, the Organization of the Oil Exporting Countries and Allies (OPEC+) surprised market players by announcing a cut in their oil output of around 1.16 million barrels per day, pushing West Texas Intermediate (WTI) roughly 5.5% higher on April 3, leaving a $4 unfilled gap. WTI has been consolidating between $79 and $81.80 since the announcement, unable to find fresh directional impetus.

Higher energy prices have been partially responsible for skyrocketing inflation, and OPEC+'s decision came as a complete shock and revived concerns not only about price pressure but also about economic growth.

Technical Outlook

(Click on image to enlarge)

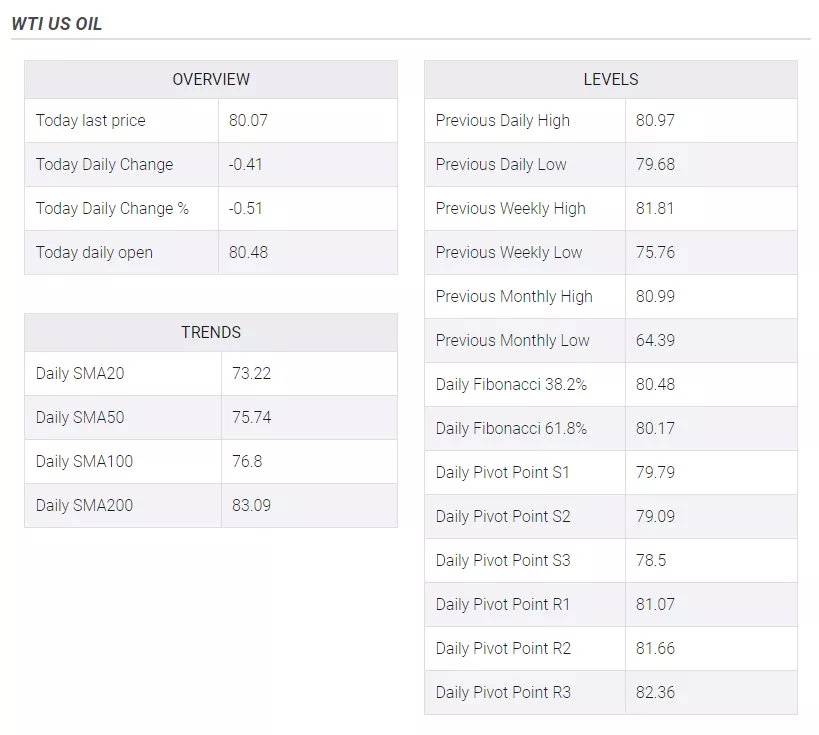

The United States crude oil consolidative phase gives no signs of changing in the near term. Technical indicators are flat in intraday charts, with modest downward slopes, which only reflect the absence of buying interest but fell short of supporting a steeper decline.

The base of the range comes as a strong static support level, with a break below $79.00 favoring a downward extension towards the $75.60 area, where the pair closed on March 31. On the other hand, the pair could accelerate its advance towards $82.65, this year's high, once above the aforementioned $81.80.

More By This Author:

USD/CAD Trades With Modest Losses Below 1.3500 Amid Bullish Oil Prices, Subdued USD

US Dollar Index Builds On The Post-NFP Positive Move, Lacks Bullish Conviction

EUR/USD Tumbled In Late Trading, Yet Printed 0.61% Gains For The Week

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more