EUR/USD Tumbled In Late Trading, Yet Printed 0.61% Gains For The Week

Image Source: Unsplash

- The EUR/USD currency pair hovered around 1.0900 on Friday after hitting a low of 1.0876.

- US Nonfarm Payrolls numbers were below what was forecast, but they still cemented the case for a 25 bps Fed rate hike.

- ECB’s Knot: Further rate hikes are needed, and there are no rate cuts to be seen in 2023.

The EUR/USD currency pair fell during the North American trading session on Friday, and it retraced towards the 1.0900 figure after a solid US Nonfarm Payrolls report. The euro looked set to finish the week with decent gains of 0.61%, though it ended short of reclaiming the 1.1000 level.

EUR/USD was Clinging to 1.0900 Level on Mixed US Jobs Data

The US economic docket featured March’s jobs report. Payrolls rose below estimates of 240,000 and hit 236,000, but this data triggered a jump in odds for a Federal Reserve 25 bps rate hike. The participation rate jumped to 62.6% from the 62.4% expected reading, and the unemployment rate remained unchanged at 3.6% year-over-year. Average hourly earnings fell to 4.2% on an annual basis, which was beneath consensus.

Therefore, US Treasury bond yields extended their gains, with the 2-year US T-bond yield, the most sensitive to interest rates, climbing 16 basis points. The Fed swaps were repricing the May monetary policy meeting, with odds for a 25 bps rate hike by the Fed seen itching up to 67.0%, compared to the previous day's 49.2%, as shown by the CME FedWatch Tool.

Even though the EU economic docket was absent, Klas Knot, an European Central Bank Governing Council Member, had crossed the wires. Knot commented that the ECB is not done with interest rate hikes, as core inflation remains at 6%, which is three times the ECB’s 2% target.

“The only question is whether you still need to take a further step up by half a percentage point, like the last few times we raised rates, or can you already scale back to smaller increments of a quarter of a percentage point,” he said. When asked about cutting rates towards the year’s end, Knot described such a scenario as “almost impossible.”

Meanwhile, Worldwide Interest Rate Probabilities recently showed the odds for a 25 bps rate hike by the European Central Bank at 90%. Following that, another 25 bps rate increase appears to be expected, along with no movement for Q4.

What to Watch?

The EU’s upcoming docket will feature Retail Sales, Industrial Production, Germany’s inflation, and a round of ECB speakers throughout the week. On the US front, the calendar will feature the Consumer and the Producer Price Index (CPI/PPI) for March, the FOMC’s last meeting minutes, Jobless Claims, and Retail Sales on the data side. The Fed parade will continue during the week.

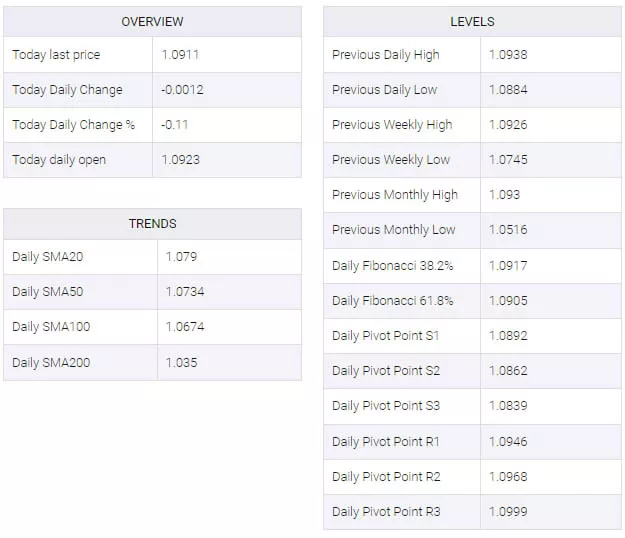

EUR/USD Technical Levels

More By This Author:

EUR/GBP Records Modest Gains Amidst Low Liquidity Conditions On Good FridayUSD/JPY Surges To A 3-Day High On Sluggish US Nonfarm Payrolls Report

USD/JPY: Well-Set For Weekly Loss Near 131.50, Kuroda’s Retirement Speech, US NFP In Focus

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more