WTI Price Analysis: Prints A Fresh Nine-Day Low At $67.60 As Global Recession Fears Deepen

West Texas Intermediate (WTI), futures on NYMEX, have refreshed a nine-day low at $67.60 as investors are expecting further decline in the global demand for oil due to the continuation of policy-tightening by central banks.

In the battle against stubborn inflation, central banks are sharpening their quantitative measures by hiking interest rates whose consequences are weighing on global economic prospects.

The US Dollar Index (DXY) is in a corrective mode after printing an intraday high at 103.17. The USD index has dropped to near 102.80, however, the upside bias is still solid amid the risk-aversion theme. Going forward, global PMI figures will provide further guidance for the oil price.

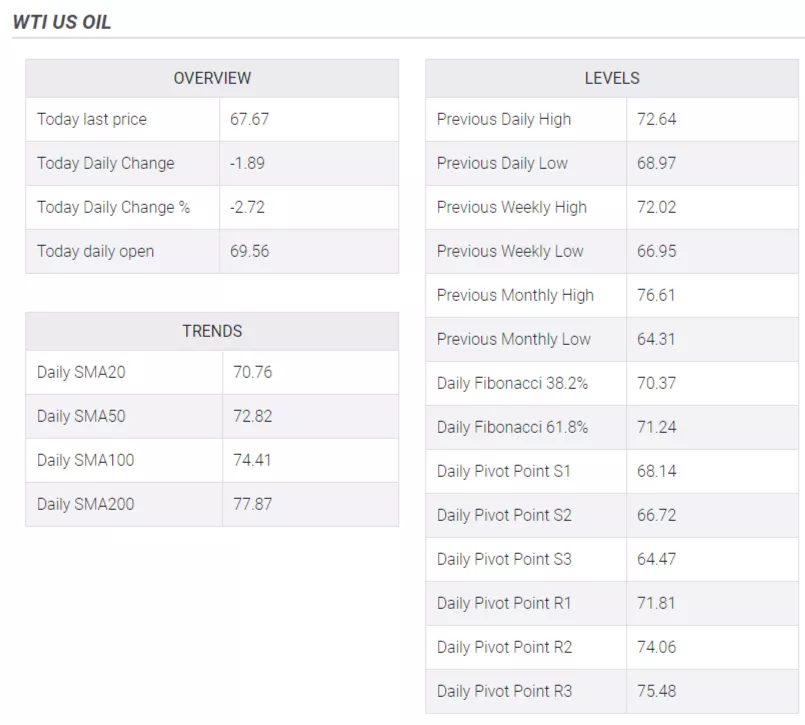

Oil prices are consolidating in a range of $66.95-74.70 for one-and-a-half months on a daily scale. Broader rangebound performance indicates a sheer contraction in volatility but is followed by a breakout in the same. The 50-period Exponential Moving Average (EMA) at $72.20 has been acting as a stiff barricade for the oil bulls.

The Relative Strength Index (RSI) (14) is on the verge of slipping into the bearish range of 20.00-40.00. An occurrence of the same would trigger the bearish momentum.

A downside move below May 31 low at $67.12 will drag the asset toward the $65.00 support followed by the ultimate support around $64.31.

In an alternate scenario, a solid recovery above May 24 high at $74.70 will drive the asset toward April 28 high at $76.84. Further recovery above the latter would expose the oil price to April 26 high at $77.86.

WTI daily chart

(Click on image to enlarge)

-638231239538322521.png)

More By This Author:

GBP/USD Looks Vulnerable Above 1.2700 Despite Fed-BoE Policy Divergence Narrows

WTI Plummets Due To Global Rate Hike Fears, Worldwide Economic Slowdowns Woes

USD/CHF Rebound Swiftly From 0.8900 Mark After SNB’s Expected 25 Bps Rate Hike

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more