WTI Holds 'Beirut Instability Premium' After Bigger-Than-Expected Crude Draw

Oil prices ended higher today as stimulus hopes ebbed and flowed - more flowing than ebbing into the close - and the massive explosion in Beirut sparked fears of yet more instability in the region.

“Tensions are high and that just kind of puts a fine point on it,” said John Kilduff, a partner at Again Capital LLC. “Looks like there’s gonna be a draw in crude oil again, so we got that support as well.”

But after last week's big surprise crude draw, analysts are expecting another significant draw...

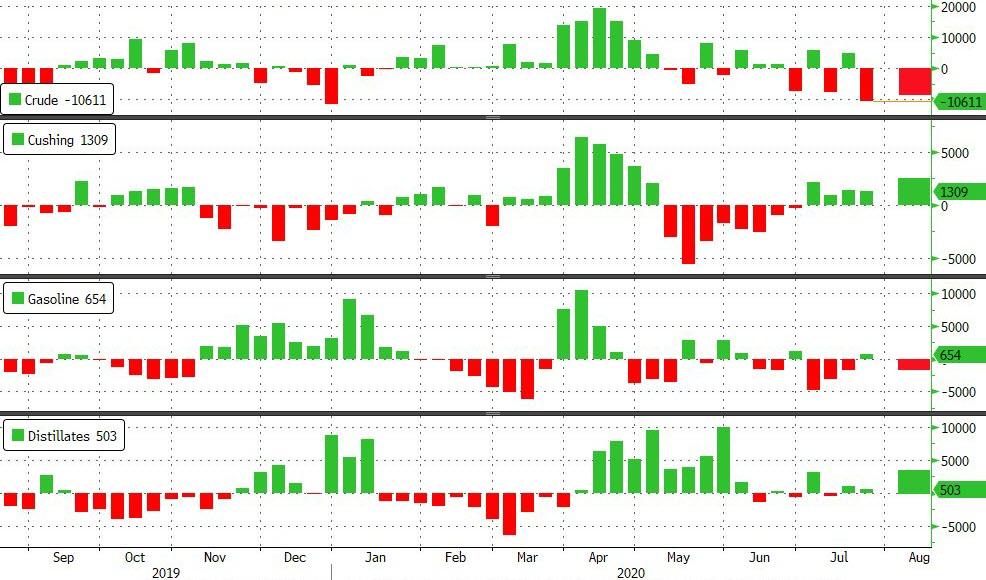

API

- Crude -8.587mm (-3.35mm exp)

- Cushing +1.63mm

- Gasoline -1.748mm (-1.3mm exp)

- Distillates +3.824mm (+100k exp)

And for the second week in a row, crude saw a major inventory draw (and bigger than expected gasoline draw). Distillates continue to build however as flying habits (among other things) remain subdued to say the least...

(Click on image to enlarge)

Source: Bloomberg

WTI was hovering around $41.50 ahead of the API data and modestly extended gains after the print...

(Click on image to enlarge)

Ahead of tomorrow's official EIA data, "oil again rejected the sub-$40-a-barrel area as talk starts to circulate that we could see a significant draw down in U.S. crude oil inventory," said Phil Flynn, analyst at Price Futures Group, in a note.

"The whisper numbers are becoming louder as a historic drop in U.S. oil production, as well as a plunge in U.S. oil imports, could set the stage for another historical crude oil supply draw."

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

I'd generally consider this wishful thinking although any spike in oil is a good thing for all players usually. Wait for the news and the reaction to it. For some any oil price shock couldn't come sooner because they will not likely survive until the next upturn.

Inevitably the unstable Middle East will crimp the supply chain. In such a case the world is currently much better prepared for this than usual with lots of reserves.

The Middle East will always be a wild card. I wonder what it would take to have true stability there. Do you think the explosion in Lebanon was just an accident?