WTI Failed To Rally Despite Inventory Decrease In The United States

Image Source: Pixabay

Western Texas Intermediate (WTI), the US crude oil benchmark, retreated from weekly highs and reached $74.32 in the early New York session. Inventories in the United States (US) dropped, though it failed to underpin WTI’s price. At the time of typing, WTI exchanges hands at $73.08 PB.

US EIA announced that inventories dropped, but WTI remains down

Traders’ sentiment is positive, as shown by US equities climbing. The US Energy Information Administration (EIA) revealed that inventories in the last week fell as refineries ramped up operations once the maintenance period ended. US crude oil imports fell to their lowest level since March 2021.

Delving into the data, crude oil stockpiles dropped by 7.5 million barrels in the week to March 24 to 473.7 million barrels, vs. estimates of 92,000 barrels rise.

Although there was an oil shortage, WTI failed to capitalize as the greenback recovered some ground. The US Dollar Index (DXY), which track’s the value of the American Dollar (USD) against a basket of six currencies, is up 0.31%, at 102.745. That makes oil prices more expensive for international buyers.

After an arbitrage decision, the Norwegian oil firm DNO began shutting down production in Kurdistan’s fields.

WTI Technical analysis

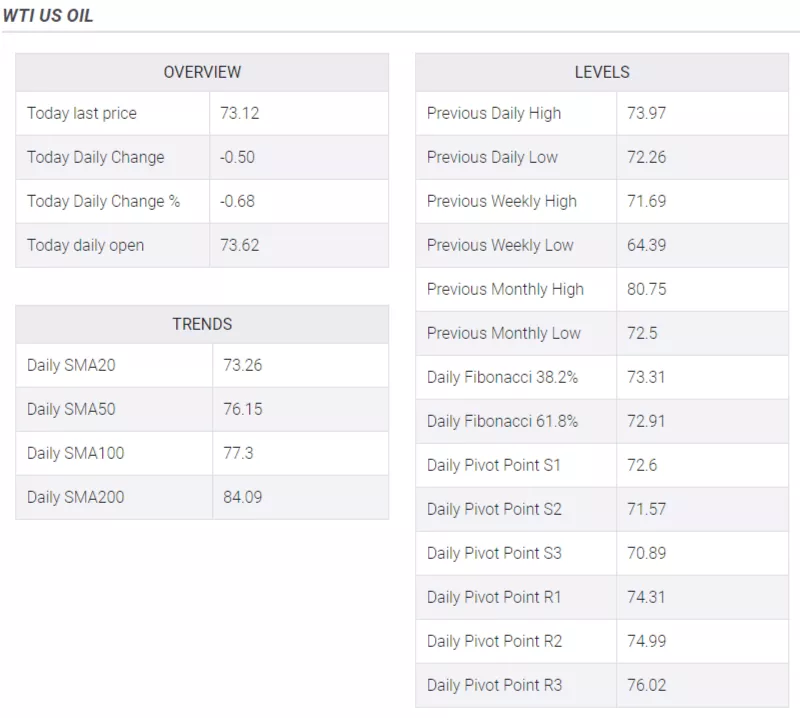

After recovering from trading nearby the YTD lows, WTI is consolidating within the 20 and 50-day Exponential Moving Averages (EMAs), at $72.45-$74.85. For a bullish continuation, WTI needs to crack $75.00, with upside risks at around the 100-day EMA At $77.90. On the other hand, WTI’s would re-test the YTD lows at 64.41, once it broke below $72.00 PB.

More By This Author:

USD/CAD Stages A Modest Recovery From Multi-Week Low, Upside Potential Seems Limited

WTI Crude Oil Surges Above $73.50 Amid Supply Concerns And Risk-On Sentiment

USD/CHF Price Analysis: Rebounds From Weekly Lows And Approaches 0.9200

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more