WTI Crude Oil Prices Surge On Supply Cuts, Weaker USD Ahead Of US Inflation Report

Western Texas Intermediate (WTI), the US crude oil benchmark, advances sharply more than 1.70% or $1.30 per barrel on Tuesday, spurred by supply cuts established by Saudi Arabia and Russia, while China’s woes about a global economic slowdown, cushions WTI’s rise. At the time of writing, WTI is trading at $74.50 after hitting a daily low of $73.03.

China’s dampened demand and Saudi-Russia output cut boosted Oil prices

During the North American session, the 1.5 million barrel crude oil output cut by Saudia Arabia and Russia is one of the main reasons for Oil’s jump. That, alongside a weaker US Dollar (USD), amid a light economic calendar in the United States (US), is lifting WTI prices across the board.

However, Oil traders must be aware that on Wednesday, a hot June Consumer Price Index (CPI) report in the US could suggest that further tightening is needed to curb stickier inflation, which could pave the way for more US Federal Reserve (Fed) rate increases. Consequently, that can underpin US Treasury bond yields and the US Dollar, refraining WTI traders from opening fresh bets on the oil price rise.

Meanwhile, the International Energy Agency (IEA) stands firm that oil demand from China and developed countries, mixed with the latest supply cuts, would keep the Oil market tight during the second half of 2023.

According to Reuters, sources told that “top buyer China again requested less supply from the world’s biggest oil exporter, Saudi Aramco.”

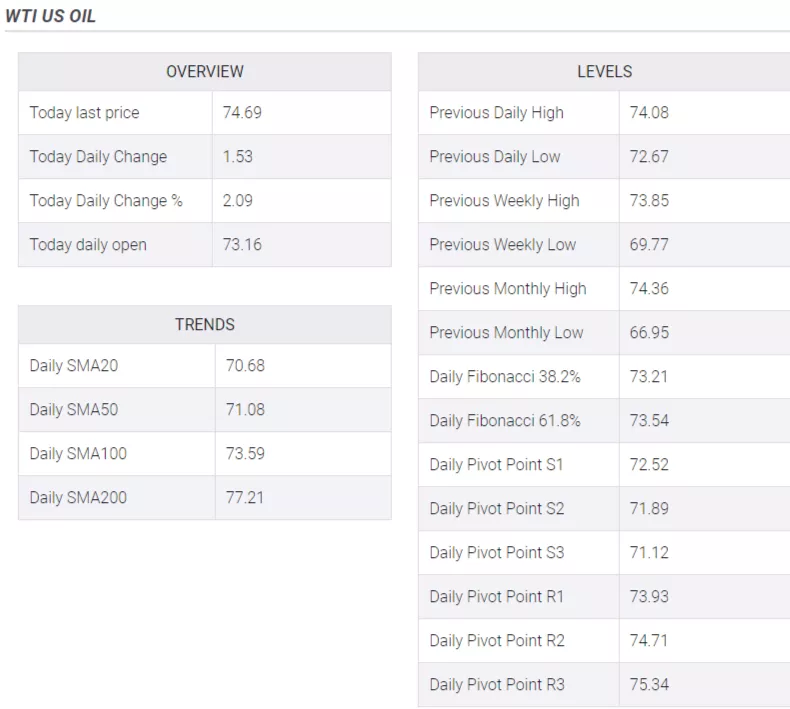

WTI Price Analysis: Technical outlook

(Click on image to enlarge)

From a technical perspective, WTI buyers reclaiming the 100-day Exponential Moving Average (EMA) at $73.06 has established a floor in the near term. Still, WTI prices remain capped by the June 5 daily high of $74.92; if surpassed, that could pave the way to the psychological $76.00 figure before testing the 200-day EMA at $77.35. Conversely, if WTI does not deliver a daily close above the 100-day EMA, that could expose WTI to a fall below $73.00 and extend its losses toward the 50-day EMA at $71.87.

More By This Author:

GBP/JPY Retreats From 181.70 As UK’s Labor Market Report Misses Estimates

EUR/JPY Price Analysis: Japanese Yields Continue To Boost The JPY

S&P 500 Forecast: Bank Earnings Back In Focus As Index Readies For CPI

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more