Wood Versus Wood

Screen capture from Thursday's episode of Bloomberg TV's "What'd You Miss".

Wood Versus Wood

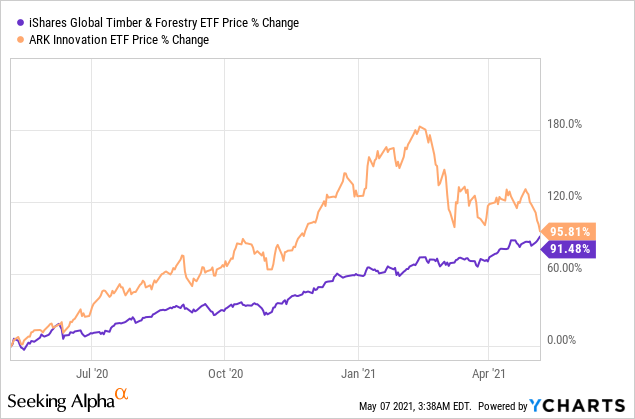

On Bloomberg TV's market wrap-up show Thursday, "What'd You Miss", anchor Joe Wiesenthal presented the chart above comparing the performance over the last year of the iShares Global Timber & Forestry ETF (WOOD) to Cathie Wood's flagship Ark Innovation ETF (ARKK). Here's an easier to read version of that chart.

As you can see, the lines are close to intersecting, as WOOD continues its steady march higher, while ARKK continues to roll over from its high earlier this year.

Where Both ETFs Go From Here

We thought it might be interesting to scan for optimal hedges on both ETFs, not just to see how much it would cost to hedge them, but to see what we could infer about their respective prospects over the rest of the year. We used our hedging app to do so in the video below.

In a nutshell, here's what we found:

- The timber ETF is much cheaper to hedge using optimal, or least expensive put options, suggesting option market participants see less risk of it declining significantly this year than the Ark Innovation Fund.

- When scanning for optimal collars to hedge both ETFs, ARKK was less expensive to hedge than WOOD, given the higher bids on out-of-the-money call options on the tech ETF. That suggests options market participants see a higher chance of ARKK posting >20% gains over rest of the year than WOOD doing so.

We looked at options expiring closest to six months out for both ETFs, but if you're considering adding either to your portfolio and your time horizon is different, you can of course use a similar approach with closer or further out options expiration dates.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more