Why The U.S. Is Losing Ground In The Critical Global Lithium Market

In June, the Energy Institute released the 2024 Statistical Review of World Energy. The Review provides a comprehensive picture of supply and demand for major energy sources on a country-level basis. Each year, I write a series of articles covering the Review’s findings.

Today’s article will be the last in the series, as I discuss global trends in lithium production.

Overview

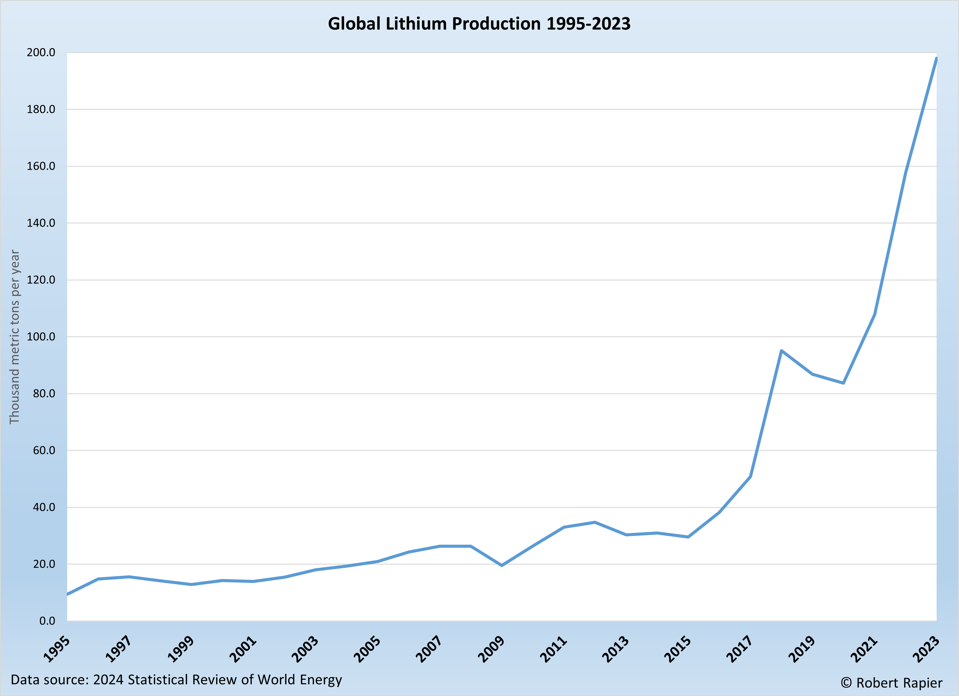

The global production of lithium has seen remarkable growth, rising from 9.5 thousand metric tons in 1995 to 198 thousand metric tons in 2023. This growth reflects a surge in demand driven by lithium’s essential role in batteries for electric vehicles and energy storage.

Global Lithium Production 1995 to 2023. Robert Rapier

Australia has emerged as the world’s dominant producer, significantly increasing its share from 2004 onwards and accounting for 43.4% of global production by 2023. Chile also remains a key player, with production reaching 56.5 thousand tons in 2023, supported by the world’s largest lithium reserves.

China’s production has steadily grown, rising from 2.3 thousand tons in 2008 to 33.0 thousand tons in 2023, aligning with its strategic investments in securing raw materials for its expanding battery manufacturing industry.

Emerging producers like Argentina and Brazil have shown substantial production increases, although they remain smaller contributors compared to the leading countries.

Reported global lithium reserves have expanded, highlighting ongoing exploration and development efforts to meet future demand. Countries such as Brazil and Zimbabwe have exhibited exceptionally high growth rates in recent years, despite starting from a smaller production base.

The Top Producers

In contrast to previous lists, the Review only lists the world’s Top 8 lithium producers, which represent over 98% of the global total.

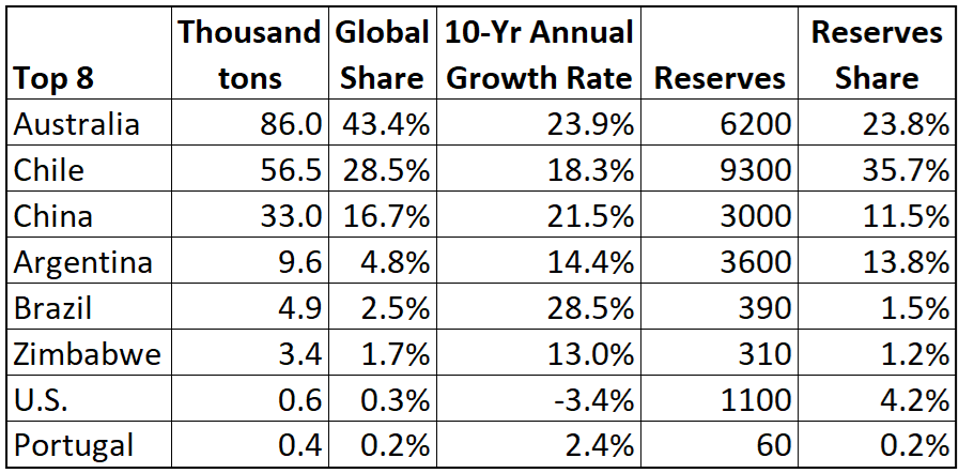

The World’s Top Lithium Producers. Robert Rapier

In addition to being the world’s top lithium producers, Australia also has 23.8% of the world’s proved lithium reserves. The top spot in that category goes to Chile, with 35.7% of the world’s total.

Among the Top 8, only the U.S. has seen a decline in lithium production over the past 10 years. The U.S. also has the lowest lithium production relative to the size of its reserves of any company in the table.

The data shows that the U.S. is a minor player in the global lithium market. Given the expected importance of lithium in the decades ahead, the U.S. risks a situation analogous to its historical dependence on OPEC for petroleum.

This potential dependence on foreign sources — especially China — for such a critical resource, particularly given lithium’s importance in batteries for electric vehicles and energy storage, could pose strategic and economic risks. The U.S. may need to consider additional measures for developing domestic production capabilities or securing stable supply chains with key foreign producers to mitigate potential vulnerabilities in its lithium supply.

Conclusions

Overall, the data underscores a strong and growing global demand for lithium, with Australia and Chile leading the market while China has also made significant strides.

The U.S., however, remains a minor player, raising concerns about its reliance on foreign sources for this critical resource. As the demand for lithium continues to grow, driven by the expanding electric vehicle and energy storage industries, the U.S. faces potential strategic and economic risks.

More By This Author:

Renewable Energy Reaches New HeightsFrom Fukushima To SMRs: How Nuclear Power Is Evolving Globally

Why Oil Prices Have Dropped

Follow Robert Rapier on Twitter, more