Why Grain Prices Are Exploding Again

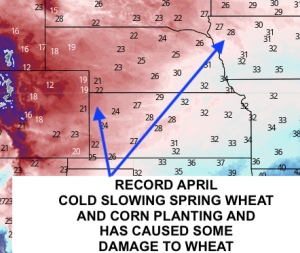

The record cold weather you see across Kansas and the western Plains early this week is indicative of an unusual “Arctic Pig” that has helped set a fire in corn, natural gas, and wheat prices over the last week or so.

In addition, the U.S. dollar has been weakening in response to the U.S. printing more money. A rush to commodities and BITCOIN has been the beneficiary of a global economy looking for some alternative investments.

Take a look at the Teucrium Agricultural ETF (TAGS). It continues to soar due to renewed global weather problems, the weaker dollar, and stellar Chinese demand.

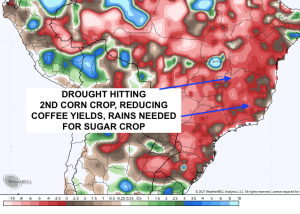

In addition to the record U.S. cold and tight global supplies of grains, I have been watching the return of the Brazilian drought that is hurting the 2nd Brazil corn crop. This is the main reason, as well as U.S. planting delays from cold weather, for corn prices to make new highs. You can see how dry it has been again the last 6 weeks.

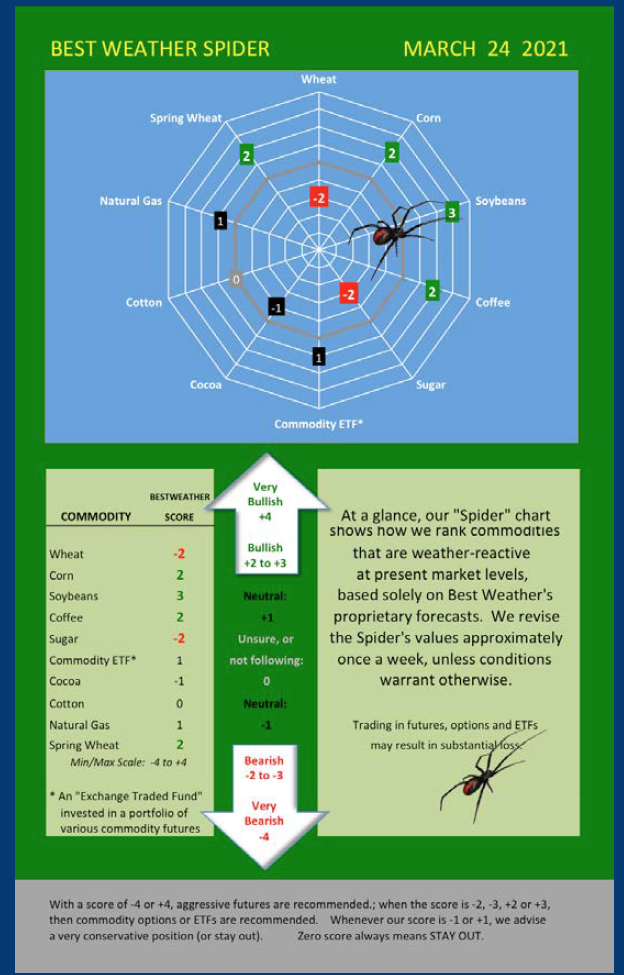

Our best weather spider gives overall market sentiment in many markets. You can see how on March 24th we were bullish some commodities such as coffee, corn and soybeans, and spring wheat, as well as slightly friendly natural gas. What will my index suggest for the month of May? Will it warm up and turn wetter to improve U.S. corn planting weather, as well as for spring wheat?

We invited you to get subscribe or get a free trial to one of our newsletters.

This is an excerpt from James Roemer's premium subscription ...

more