Why Does The Fed Has A Tough Nut To Crack With Gold Investors?

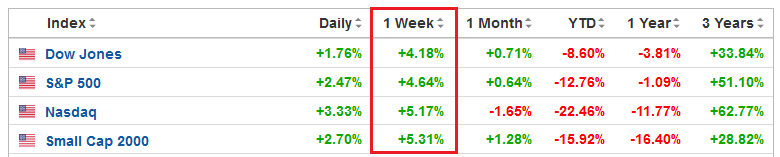

After exiting our profitable long position in the GDXJ ETF, the focus is now squarely on the short side. However, with recession fears decelerating and optimism returning to Wall Street, the bulls are brimming with confidence.

Please see below:

Source: Investing.com

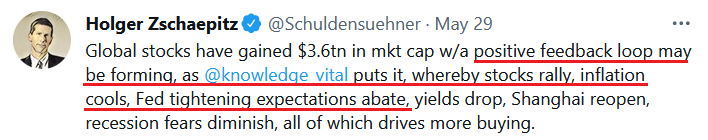

Despite that, I've been warning since 2021 that investors underestimate inflation's wrath. Furthermore, they still don't see the connection between higher asset prices and inflation. For example:

Yet, I warned on Apr. 6 that higher asset prices are antithetical to the Fed’s 2% inflation goal. In a nutshell: the more the bull gores, the more inflation bites. I wrote:

Please remember that the Fed needs to slow the U.S. economy to calm inflation, and rising asset prices are mutually exclusive to this goal. Therefore, officials should keep hammering the financial markets until investors finally get the message.

Moreover, with the Fed in inflation-fighting mode and reformed doves warning that the U.S. economy “could teeter” as the drama unfolds, the reality is that there is no easy solution to the Fed’s problem. To calm inflation, it has to kill demand. If that occurs, investors should suffer a severe crisis of confidence.

To that point, while U.S. stock indices rallied sharply last week, guess what else participated in the festivities.

Source: Investing.com

To explain, the table above tallies the performance of commodities over various time periods. If you analyze the vertical red rectangle, notice how most commodities rallied alongside equities. As a result, the thesis was on full display.

When economic optimism elicits rallies on Wall Street, that same optimism uplifts commodities. Therefore, if the Fed tries to appease investors and passively attack inflation, it will only spur more inflation.

As such, the idea of a “positive feedback loop” where ‘stocks rally, inflation cools, [and] Fed tightening expectations abate” is extremely unrealistic. In fact, it’s the exact opposite. The only bullish outcome is if economically-sensitive commodities collapse on their own. Then, input inflation would subside and eventually cool output inflation, and the Fed could turn dovish.

However, the central bank has been awaiting this outcome for two years. Thus, my comments from Apr. 6 remain critical. If investors continue to bid up stock prices, the follow-through from commodities will only intensify the pricing pressures in the coming months. Therefore, investors are flying blind once again.

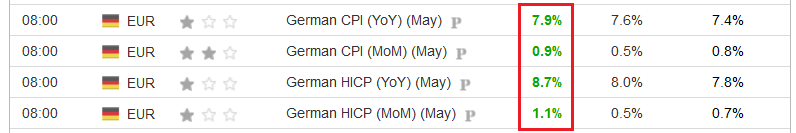

To that point, I’ve long warned that investors underestimated the demand side of the inflation equation. Moreover, with German inflation outperforming across the board on May 30, the pricing pressures remain profound. For context, Germany is the Eurozone’s largest economy, and May’s data laps April’s results, which accounted for the inflationary impact of Russia’s invasion of Ukraine.

Please see below:

Source: Investing.com

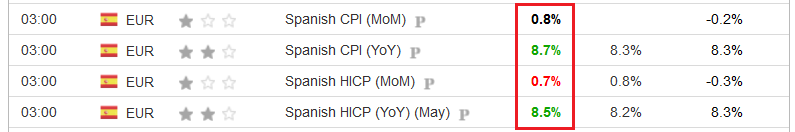

Also, it was a similar story in Spain – the Eurozone’s fourth-largest economy. For context, the middle figures are economists’ consensus estimates:

Source: Investing.com

More importantly, with demand more resilient in the U.S. than in other parts of the developed world, the misguided supply-side theory lacks fundamental credibility.

Please see below:

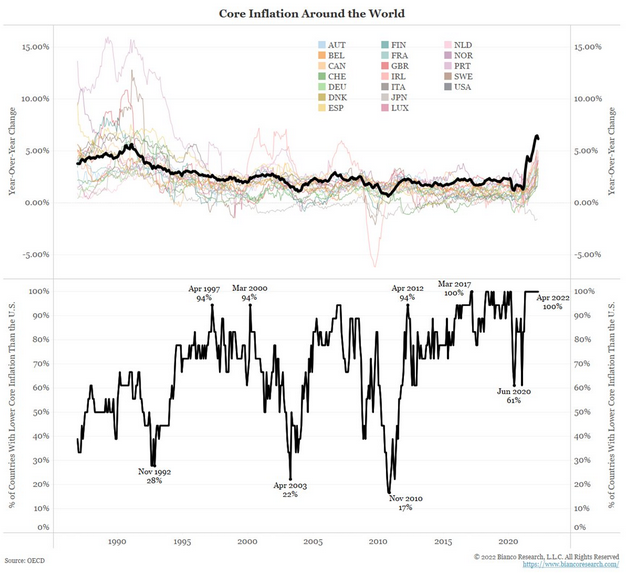

To explain, the chart at the top half tracks core inflation across various countries. For context, core inflation excludes the inflationary impacts of food and energy, so investors can’t blame the Russia/Ukraine conflict.

If you analyze the black line, you can see that the U.S. has the highest core inflation in the developed world. Moreover, if supply constraints were the main culprit, core inflation would be nearly identical across regions. Thus, with the U.S. showcasing more excess demand due to unprecedented stimulus, the Fed has a serious problem.

The Big Picture

Likewise, the black line at the bottom half of the chart plots the data in percentiles. If you focus your attention on the right side of the chart, you can see that U.S. core inflation is in the 100th percentile. Therefore, 100% of developed countries have lower core inflation, and investors underestimate the medium-term implications.

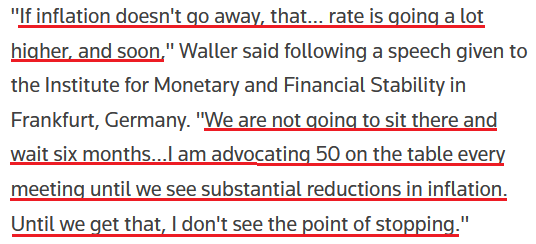

Speaking of which, Fed Governor Christopher Waller said on May 30: “I support tightening policy by another 50 basis points for several meetings. In particular, I am not taking 50 basis-point hikes off the table until I see inflation coming down closer to our 2% target (…).”

“By the end of this year, I support having the policy rate at a level above neutral. If the data suggest that inflation is stubbornly high, I am prepared to do more.”

He added:

“Markets expect about 2.5 percentage points of tightening this year. This expectation represents a significant degree of policy tightening, consistent with the FOMC’s commitment to getting inflation back under control and if we need to do more, we will.”

Therefore, with each optimistic week on Wall Street making the Fed’s job more difficult, the ‘buy the dip’ crowd doesn’t realize they’re digging their own graves.

Please see below:

Source: Reuters

In addition, I noted on May 26 that prospective drawdowns of the S&P 500 and the PMs are unintended (but necessary) consequences of the Fed’s war with inflation. I wrote:

It's important to remember that Fed officials' primary objective is to calm inflation. They don't want to crash the stock, bond, or commodities markets; the latter outcomes are simply collateral damage from what must be done to curb the pricing pressures. To explain, I wrote on Dec. 23:

The Fed’s only hawkish goal is to calm inflation. When inflation was running hot and most Americans bought into the “transitory” narrative, Fed officials exuded confidence. However, when consumer confidence sank to a 10-year low and inflation became political, the Fed changed its tune. As a result, Powell wants to reduce inflation while tightening as little as possible (3% to 4% inflation may be considered acceptable in 2022).

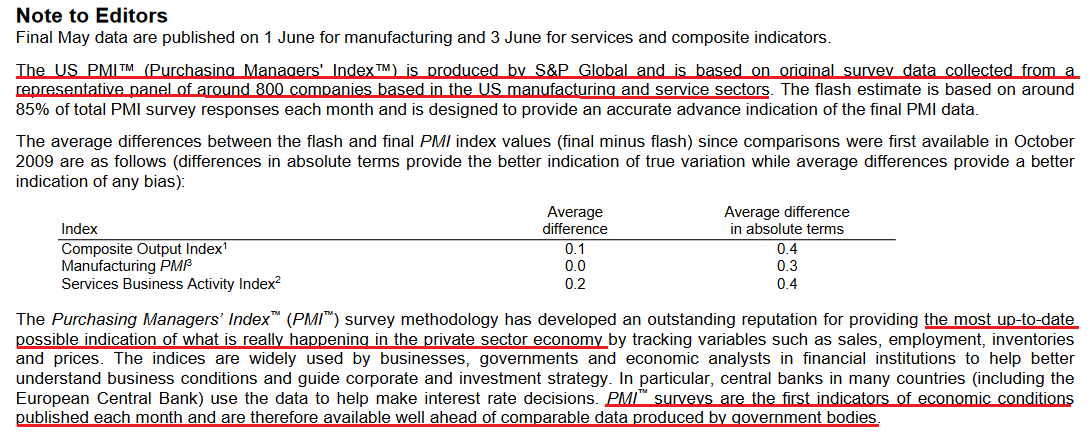

In contrast, the weekly performance of most commodities shows that inflation is still running away from the Fed. Likewise, I noted previously that S&P Global’s input (all-time high) and output (second-highest on record) price indexes accelerated in May. Moreover, it’s important to understand the significance of PMI data that covers the entire U.S. S&P Global states:

Source: S&P Global

Therefore, S&P Global’s results are collected from “around 800 companies” and are leading indicators of future government data. As a result, this mythical “positive feedback loop” exists only in investors’ minds, not in fundamental reality.

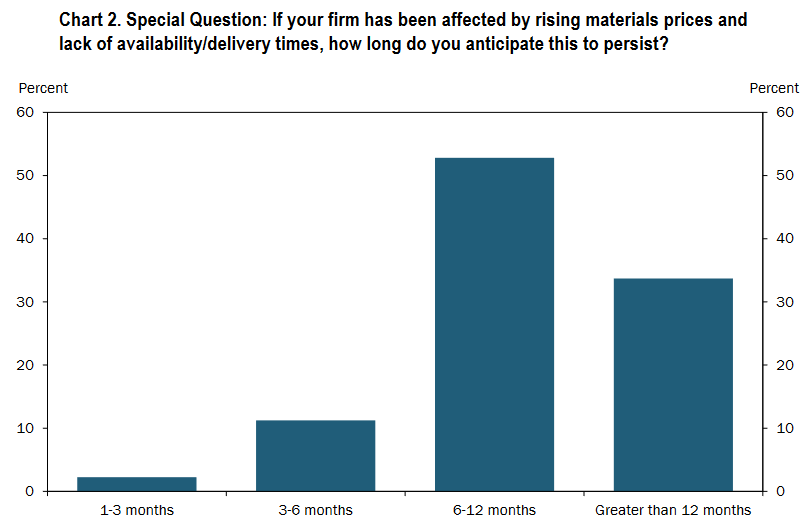

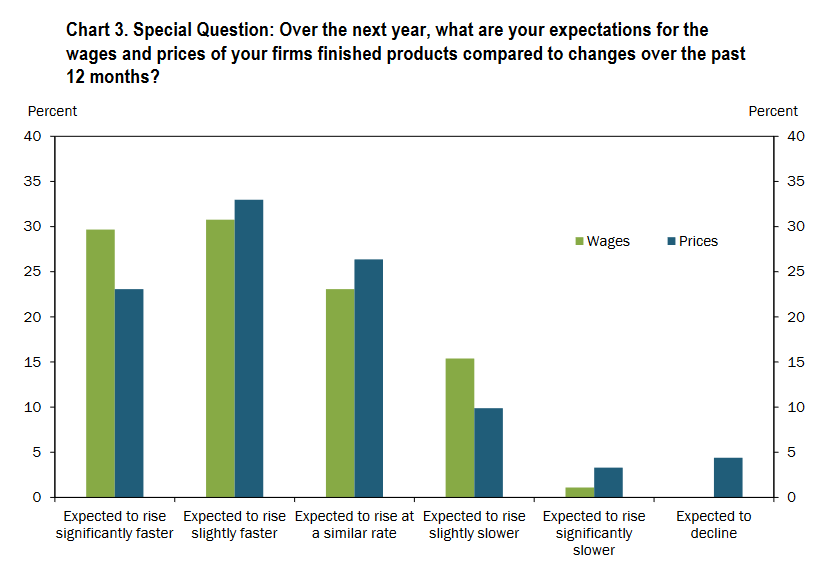

Second, the Kansas City Fed released its Tenth District Manufacturing Activity Survey on May 26. Now, this is a regional report, so it’s less relevant than S&P Global’s data. Moreover, while the KC Fed’s prices paid and received indexes “modestly declined from last month,” the results showed:

“In May, 92% of firms reported being affected by rising materials prices and lack of availability/delivery times and 87% anticipated this to persist for at least 6 months or longer.”

Please see below:

Source: KC Fed

Also:

“Over 59% of firms expected wages and prices to rise slightly or significantly faster compared with a year ago. A significant share of firms reported the expectation for prices to rise at a similar rate.”

Please see below:

Source: KC Fed

Thus, with most respondents expecting prices and wages to rise in line or faster than the 5% to 6% realized in 2021, they’re nowhere near the Fed’s 2% target. Furthermore, since no respondents expect wages to decline over the next 12 months, how can U.S. consumers be on their deathbed when their salaries are increasing?

Similarly, the data jives with the wage sentiment expressed in The Conference Board’s U.S. CEO Conference survey released on May 18:

Source: The Conference Board

Even more revealing, please read some of the anecdotal comments from the KC Fed’s survey:

Source: KC Fed

The bottom line? While investors are prone to conjuring up unrealistic narratives, the latest takes the cake. For example, a retail apocalypse two weeks ago meant a recession was imminent. Then, after strong retail earnings flipped the script, all was forgotten. Now, the ‘new narrative’ is that stocks can rise while inflation declines and the post-GFC script is alive and well. However, the reality is that what’s bullish for stocks is also bullish for economically-sensitive commodities. As a result, higher asset prices elicit more inflation and a more hawkish Fed.

In conclusion, the PMs rallied on May 30, as optimism bloomed on Wall Street. However, I noted on Apr. 27 that while investors will likely remain in ‘buy the dip’ mode until the very end, lower highs and lower lows should confront the S&P 500 and the PMs over the next few months. Moreover, nothing has changed. The Fed has a profound problem, and solving its inflation crisis should result in more pain over the medium term.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more