Why Did The Gold Price Nosedive After The June Fed Meeting

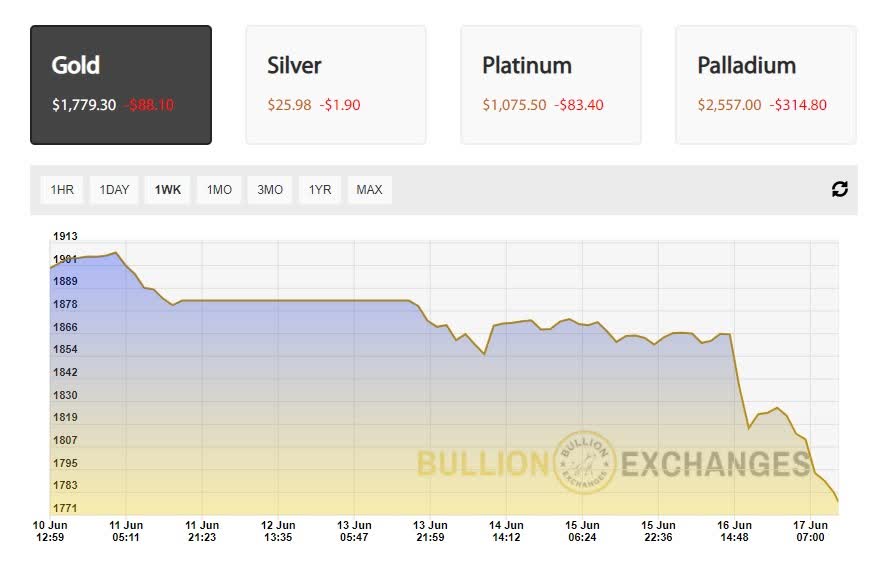

The Fed is now discussing raising interest rates as early as 2023, revising their previous stance to keep rates around 0 until 2024. From the meeting yesterday, it appears that there might be two possible hikes in 2023. Consequently, the gold price, spot price of silver, and other precious metals nosedive and continue to sink today.

What Happened: Changing Rates

Changes in interest rates can be both positive and negative. The upside to increasing interest rates is brought on by the fact that there is increased spending. Lower rates can encourage people to borrow, take on loans, and invest. However, when rates are low, spending can rapidly expand over time. This reveals the underlying inflation. So, increasing interest rates discourages rapid spending as it slows the rate at which money is trading until inflation returns to a more sustainable level.

But how does this affect the gold price?

Inflation is something that contributes greatly to the spot price of silver and gold. As people worry about the buying power of their fiat currency, they want to hedge it with something safe, like precious metals. The Fed announced the move towards a hawkish monetary policy, which means they are strategizing about tackling inflation. Basically, this is not a positive outlook for physical gold and silver, and people may be running back to cash.

This announcement is not yet official. Some speculate that the Fed is testing the market reaction. That being said, the dollar is up higher, weighing significantly on the current price of gold and silver.

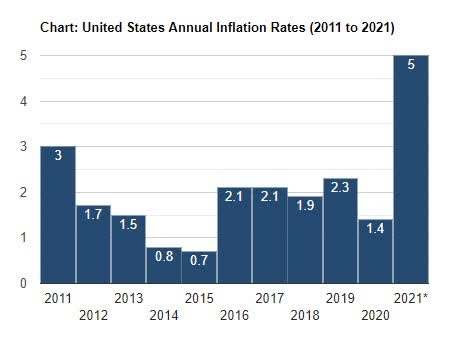

Inflation

Inflation is on the rise, but apparently not at a rate the Fed deems problematic. The prediction for inflation is now 3.4% in 2021 as a whole. But, this is still up 1% higher than their previous estimate earlier this year. Recent reporting reveals that inflation is currently running hotter than 3.4%. And yet, Fed Chairman Powell responded by saying that current numbers are "transitory." His dismissal of current inflation rates had markets optimistic yesterday as they ran away from their hedges. The USDI reached a 2-month high overnight. Additionally, bond and note yields rose, which tend to trade inversely with the gold price.

Source: US Inflation Calculator

Kelly Evans of CNBC mentioned in her afternoon newsletter today that both the stock market and the gold price are now down. So, perhaps the Fed may have been too hawkish. Even though they barely lifted its rate-hike forecast, she concludes that the market seems to be more worried about deflation than inflation. Or if the Fed did nothing, then this would have “goosed the inflation trades” and reinforced price-pressure-problems and more.

Basically, it’s an uncertain situation right now, which offers great buying opportunities for investors.

Jobs Report and the Gold Price

Weekly jobless claims, however, rose 37,000 to 412,000 this week. This is from last week’s estimate of 375,000 claims, which is worse than expected. Originally, consensus forecast thought claims would only rise to 360,000.

On the other hand, the four-week moving average for new claims fell to 395,000. This number shed 8,000 claims from last week. Interestingly, this average is considered a more reliable measurement of the labor market because it lessens weekly volatility. Interestingly, this is actually the lowest level for the average since March 14, 2020. Back at the start of the pandemic, it was 225,500.

That being said, continuing jobless claims were 3.518 million people at the start of June. This amount was up 1,000 people from the end of May.

Have Gold and Silver Peaked for 2021?

The Federal Reserve maintains that rising inflation is “transitory” at this time. Does this mean that the sudden spike in inflation will suddenly fall? Not even the Fed knows for sure, but again, their estimate is a 3.4% inflation rate for 2021 as a whole.

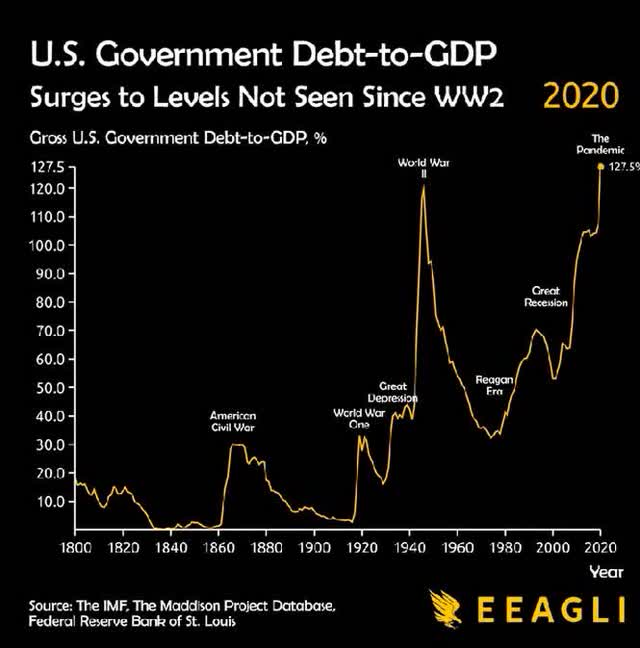

Powell also indicated yesterday that the reopening economy’s dynamics are “raising the possibility that inflation could turn out to be higher and more persistent than we anticipate.” The sharp economic rebound sees the GDP 7% in 2021. And yet, the unemployment estimate remains at 4.5%.

It is worth noting that the US’s current economic expansion rate nearly matches that of World War II. However, this growth is combined with inflation, which may or may not be here to stay.

Source: Reddit

The gold price recently enjoyed a steady climb, peaking at $1,917 per oz on the first day of June. Since then, it turned slowly downward, crossing under $1,900 and crashing underneath $1,800 suddenly before the NY-open today. Similarly, the spot price of silver gradually grew, keeping above $28 several times throughout the month until now. Silver is trading under $26 as of this writing.

Does that mean this crash is permanent? Last August, the gold price reached a record high of over $2,040 an oz before falling through the rest of the year. It is not yet clear if gold and silver reached their respected zeniths yet. But, the current price of gold and silver offers more opportunities for investors to buy in while the prices are low.

Disclaimer: This article is not meant to serve as professional economic advice. Any action you take upon the information from this article and website is strictly at your own risk.

This was a good read. I own CEF and some PHYS and find difficult to figure out why they change value the way they do.