Why Cocoa Price Volatility May Persist Despite Surplus Forecast

Photo by Pablo Merchán Montes on Unsplash

The cocoa market is expected to return to surplus, pushing prices down from recent peaks.

“While we believe prices have further room to move lower, the market is facing supply risks. In addition, low stocks mean prices will likely remain volatile,” Warren Patterson, head of commodities strategy at ING Group, said in a report.

Cocoa prices have been significantly volatile in the first quarter of this year, with London cocoa trading in an almost GBP 3,400 per ton range.

Implied volatility remains above pre-2024 levels, but has decreased from its 2024 peak.

Cocoa was the best-performing commodity of 2024; however, it has dropped to the second-worst performer this year.

This market decline has caused trading to reach its lowest point since November.

Lower market participation

Although the prospect of a small surplus in the 2024-25 season has alleviated some supply concerns, Patterson says the market will probably remain volatile due to historically tight global inventories following three years of deficit.

Prices are expected to trend lower if these additional supply risks do not materialise, he said.

(Click on image to enlarge)

Source: ING Research

The flattening of the front end of the London market curve, and its move into a small contango, suggests less worry about market tightness, ING Group said in a report.

This is even though any speculative money in the market will probably have been in the nearer term contracts, and liquidation of these longs would naturally put pressure on nearby time spreads.

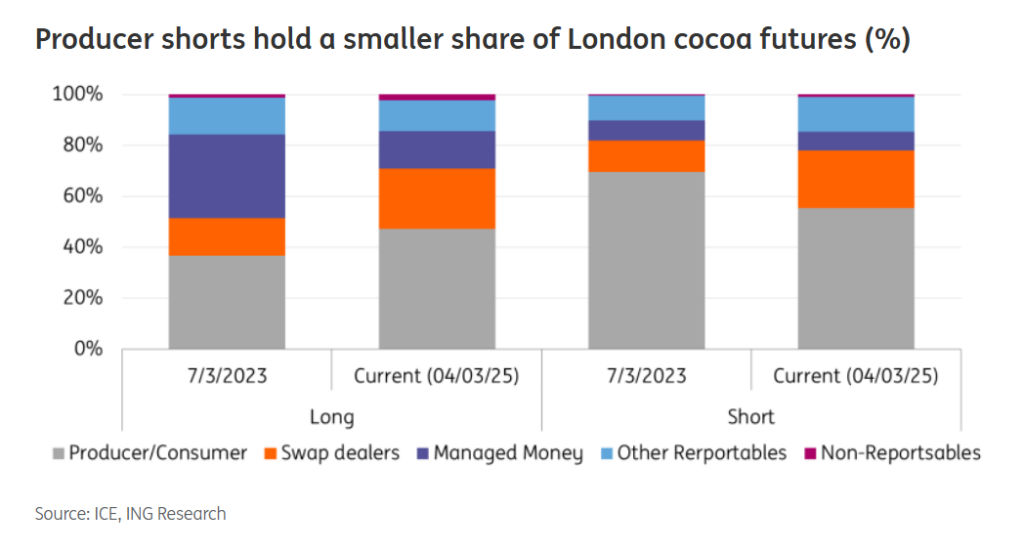

The managed money net long in London cocoa has dropped by more than half since the start of the year, falling from almost 32,000 lots in January to below 13,000 lots currently.

“However, what has also made the market even more volatile is the fact that open interest and traded volumes have been trending lower,” Patterson added.

“A factor behind reduced market participation would be that physical longs are reluctant to hedge (sell futures) given the broader strength we have seen in the market in recent years.”

Furthermore, due to uncertainty surrounding supply, those with physical longs were likely hesitant to hedge too much of their supply, given the risk of being forced to buy back hedges.

Supply dynamics

Weather and crop developments in West Africa have had a greater impact on the market than they typically would due to the current stock tightness.

The spread of brown rot fungal disease was aided by heavy rainfall in September and October.

This was followed by dry harmattan winds, which have raised concerns over the mid-crop and introduced uncertainty into the market.

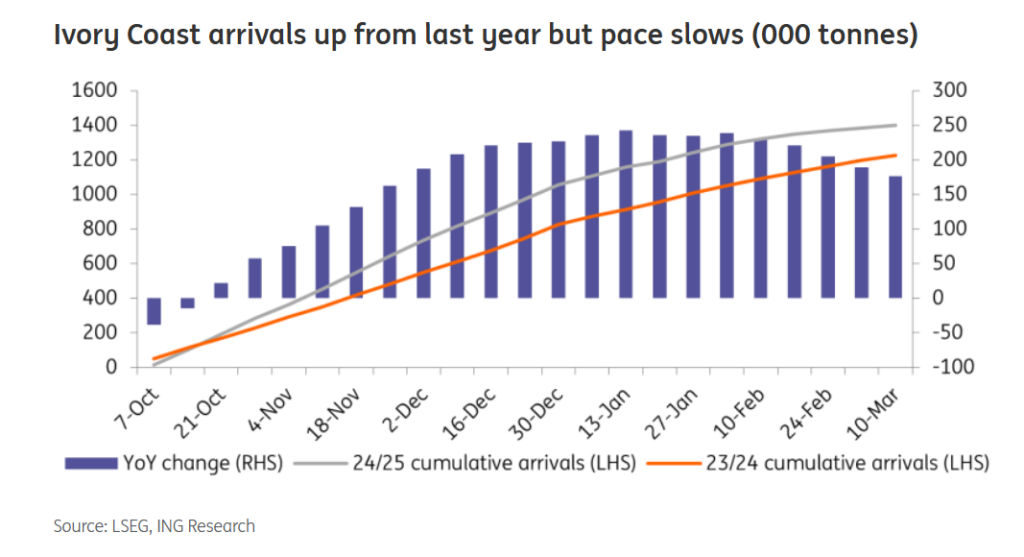

Cocoa arrivals at Ivory Coast ports have increased 14% year-on-year, reaching 1.4 million metric tons, according to ING.

However, the year-on-year growth rate peaked at 34% in late November/early December and has steadily declined throughout the season.

The Ivory Coast’s mid-crop harvest will begin in April, and early estimates indicate it may yield around 300,000 tons.

This figure falls significantly below the historical average of 500,000 tons.

(Click on image to enlarge)

Source: ING Research

Despite this decrease, overall output for the 2024-25 season in the Ivory Coast (including both main and mid-crop harvests) is projected to increase by just under 11% year-over-year, reaching 1.85 million tons.

While this represents growth, it remains below the 2022-23 season’s output of more than 2.2 million tons.

Supply is anticipated to increase by approximately 13% and 12%, respectively, in Ghana and Ecuador. Other large increases in supply are also expected from these countries, Patterson said.

High prices rebalance the market

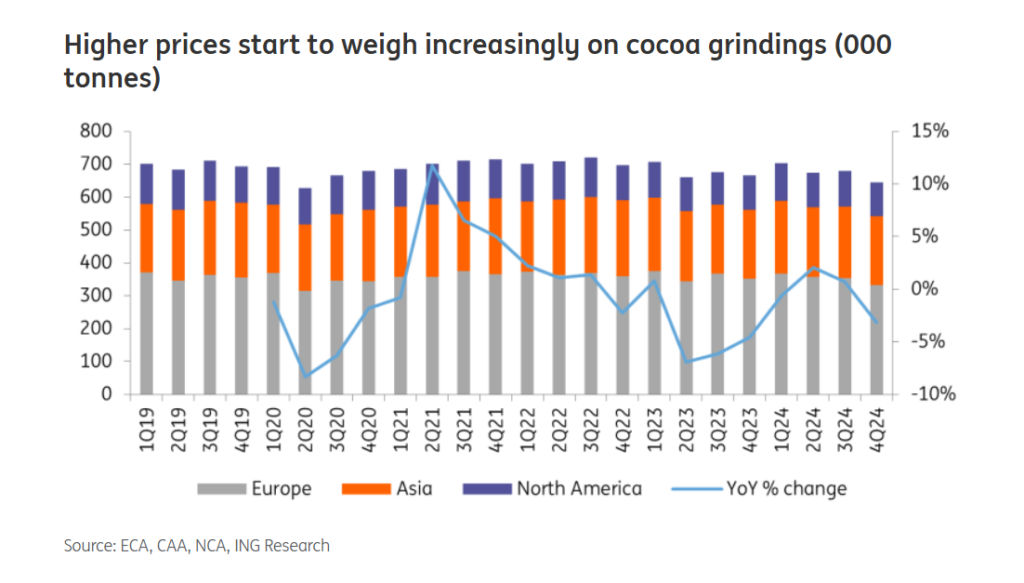

“While higher prices are painful for consumers, they do serve a purpose in trying to rebalance the market through demand destruction,” Patterson said.

The final quarter of 2024 saw the lowest level of grindings since the second quarter of 2020. Year-over-year, grindings in Europe, North America, and Asia decreased by 3.2% in the fourth quarter of 2024, according to ING.

(Click on image to enlarge)

Source: ING Research

The decrease was primarily due to Europe, which saw a 5.4% year-over-year decline in grindings, according to ING.

Full-year figures were down only 0.7% year-over-year, despite weaker grindings in the second half of 2024.

“This reflects the fact that it takes time for higher prices to be passed onto consumers,” Patterson said.

While we need to wait until mid-April to see how grindings performed in the first quarter of this year, it is likely that they remained under pressure.

Global balance shifts to surplus

Although the global cocoa market is projected to have a surplus of 142kt in the 2024-25 season, this figure is uncertain due to the unpredictable nature of the mid-crop’s development.

Additionally, while the International Cocoa Organization (ICCO) anticipates a 5% decrease in demand this season, there’s a possibility that demand may remain higher than expected.

Furthermore, the stocks-to-grinding ratio for cocoa began the 2024-25 season at its lowest point since the 1970s, and cocoa stocks themselves were at their lowest starting level since the 1980s, according to the ING report.

(Click on image to enlarge)

Source: ING Research

More By This Author:

Stocks Tumble Again As Trump’s Tariff Threats Push S&P 500 Into Correction Territory

TLT ETF Forms Rare Bullish Pattern As Outflows Rise

Apple Prevents Opponents From Viewing Key Data In India Antitrust Case

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more