Why Are Speculators Betting Big On US Corn And Cattle Markets?

Speculators have taken super-bullish positions in both US corn and cattle due to strong demand, despite dwindling inventories.

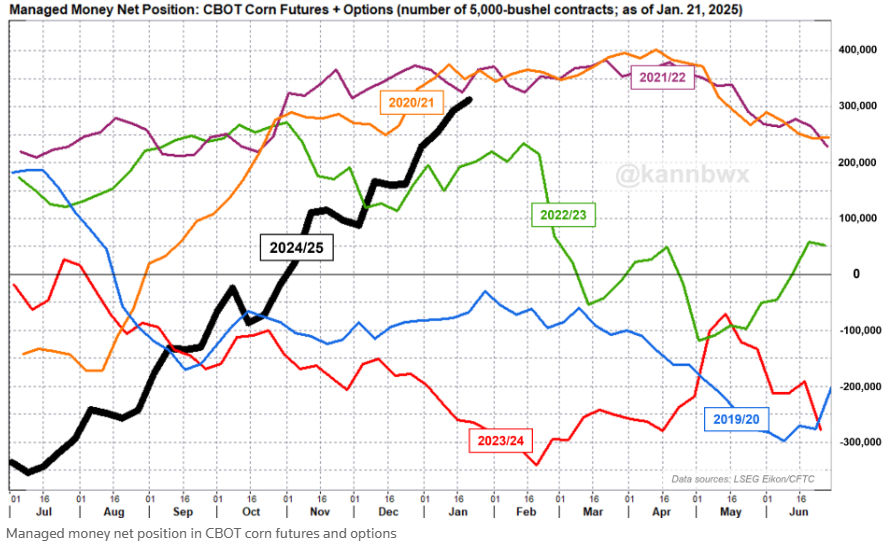

Money managers have increased their net long position in Chicago Board of Trade (CBOT) corn futures and options to 311,678 contracts in the week ending January 21, up from 292,228 contracts the previous week.

Open interest in corn futures and options jumps

Open interest in corn futures and options jumped 19% in the two weeks ending January 21, reaching their highest point since June 2021.

This surge pushed investors to their most optimistic corn outlook since May 2022, according to the report.

In the week ending January 21, speculators in the “other” category significantly increased their net long position by over 21,000 gross corn longs.

This marks the largest weekly addition in almost four years, Reuters said.

Meanwhile, CBOT corn net long positions exceeding 300,000 futures and options contracts have only been held by money managers in 10% of the weeks since mid-2006, when records began, according to the report.

(Click on image to enlarge)

Source: Reuters

Historical analysis suggests that their bullish outlook is likely to continue until at least late March.

The most-active corn futures reached a 15-month high on Thursday, but have eased slightly in the last three sessions.

This may indicate that their latest position could be the high point for now, the report said.

Argentina’s decision to reduce export taxes

CBOT March corn prices experienced a decline on Friday, triggered by Argentina’s surprising decision to reduce export taxes.

This move has the potential to stimulate sales and shipments of key Argentine agricultural products, including corn, wheat, soybeans, and soy products.

The increased availability of Argentine corn in the global market, due to the export tax cuts, exerted downward pressure on CBOT corn prices.

Despite the recent drop, it’s important to note that CBOT March corn had been trading within a technically overbought zone for approximately two weeks before the Argentine announcement.

This suggests that the market may have been due for a correction, and the export tax cuts simply acted as a catalyst for the price decline.

The overbought condition indicates that prices had risen too far and too fast, potentially creating an unsustainable market situation.

The unexpected nature of Argentina’s export tax cuts added to the market’s volatility.

Traders and investors were caught off guard by the policy change, leading to a rapid reassessment of market fundamentals and price expectations.

The potential for increased Argentine corn exports, coupled with the pre-existing overbought condition, created a bearish sentiment in the market, driving prices lower.

Cattle futures exceeded 200 cents per pound

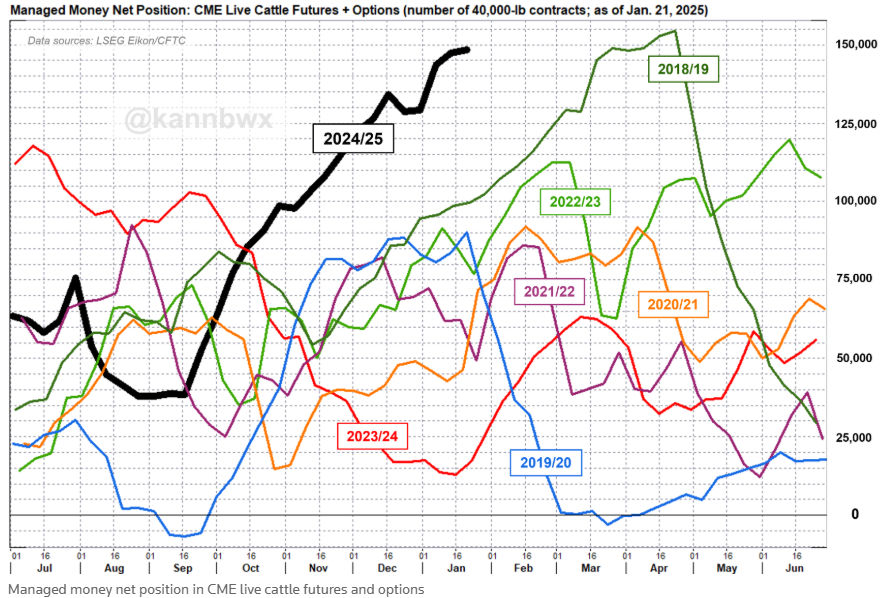

CME live cattle futures exceeded 200 cents per pound for the first time, possibly driving speculators to establish a record net-long position in the last couple of days.

The surge is fueled by tight supplies and strong consumer beef demand, which have also pushed US cash prices to extreme highs.

In the week ending January 21, money managers boosted their net long position in CME live cattle futures and options by slightly more than 1,000 contracts to 148,466 contracts.

This is still below the all-time high of 154,550 contracts reached in April 2019.

A US Department of Agriculture report on Friday may have further fueled the bullish trend in the live cattle market, which saw CME April live cattle gain an additional 3% over three sessions.

(Click on image to enlarge)

Source: Reuters

The agency reported a 3% year-on-year decrease in December placements of US cattle in feedlots, contrary to analysts’ expectations of no change.

The tight cattle supply was exacerbated by the cold temperatures in mid-January. However, the end of the month is expected to be much warmer than average, providing some relief. The extreme cold may have also damaged some US wheat areas.

U.S. corn export sales and shipments remain strong, and traders will continue to monitor them this week.

However, Monday’s export inspection data may be disappointing due to rare snow on the US Gulf Coast, which likely slowed loadings last week.

More By This Author:

Gold Prices Ease After Last Week’s Steep Climb; Copper Falls On Dollar StrengthUSD/CAD Forecast: BoC, Fed And The Carry Trade Opportunity

Is It Safe To Buy These High-Yielding S&P 500 Stocks?

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more