Where And Why For Gold And Silver

Image Source: Unsplash

For those who thought 2025 was crazy for gold and silver, 2026 is saying, “Hold my beer”.

So far this year, we’ve seen silver reach for the skies and a target of $100 that seemed like a fantasy...or fanatical...just a few weeks ago.

And during that amazing run, gold has been relatively well behaved, advancing steadily but in an unspectacular manner, at least in comparison to silver.

(Click on image to enlarge)

That’s changed over the past few trading sessions. As you can see from the chart above, gold has accelerated to the upside, seemingly taking aim for the magical $5,000 level in the near future. (This chart makes it seem like gold’s down today, but thanks to a surge in overnight markets, it’s actually up over $50 from yesterday.)

Silver’s taking a break today, and a much-needed one at that. But if you take all of these moves, including the PGMs, base metals, and just about every other commodity...it’s obvious that something’s up.

Let’s take a look at just what that could be.

Who’s Buying At These Levels?

I ran across a post on X by a gold bear this morning, and his point was essentially “Who do you know who’s actually buying gold at these prices?”

Well, if your worldview is limited to U.S. retail investors, then everyone you know is more likely to sell gold than buy right now.

But it’s a great big world, and there are plenty of actors on the global stage who think that gold and silver are bargains at these prices.

Of course, we all know about central banks. They’re not very price sensitive, and apparently are steadily buying on a dollar-cost averaging basis at regular intervals. This means that individual banks are probably buying less in terms of tonnage as the price rises.

The good news for gold bulls is that others are stepping in to pick up whatever slack there is in official purchases.

These include investors and institutions in China and India (especially for silver, where the local prices are well above the New York quotes).

And everywhere else around the world, it seems that the “sell America” trade is back on in force, especially given the noise around Greenland. Add in the surge in Japan’s sovereign bond yields, which threatens not only other sovereign yields but every risk market, and you have a powerful recipe for continued gains in monetary metals.

The other metals and commodities are benefiting from strong demand curves running smack-dab into decades of under-investment and strangled supply pipelines. With commodities becoming the latest theme du jour on Wall Street, this trend also seems set to continue.

And in turn, this raises the question....

How Much Further Can We Go?

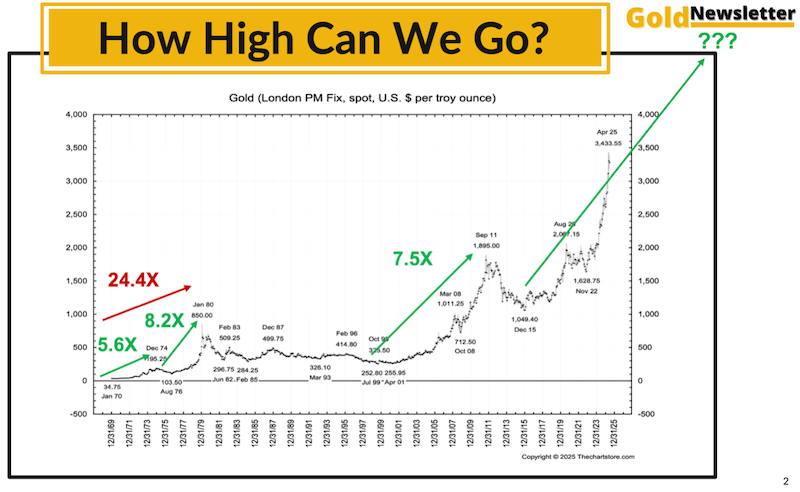

I’ve addressed this question in every presentation I’ve given over the past five years or so, and in those speeches as well as this letter, I’ve featured this slide:

(Click on image to enlarge)

I’ve counted four distinct bull markets since August 15, 1971, when gold began trading as an investible asset, and not the basis of the global financial system. Those four bull markets occurred in the early 1970s, the late 1970s, the 2000s...and today.

In the chart above, I show that gold rose from 5.6 times to 8.2 times, from trough to peak, in each of those previous bull markets. If you count the bottom of this market at around $1,050, then a similar performance this time would put the gold price somewhere between $6,000 and $8,000 gold.

But there’s another possible interpretation....

And that would be if we consider the 1970s as one cohesive bull run, as many analysts do. If that’s the case, then gold rose some 24 times during that period...which would project to a price in the mid-$20,000s at the end of this bull market.

That, in turn, would imply some sort of monetary reset, with gold re-inserted as the foundation for fiat currencies globally. And that’s certainly not out of the question.

It would also imply an interim break in the bull market, and a fairly severe one, like what was experienced in the 1974-1976 timeframe. That’s a possibility that we need to be ready for this time around.

The bottom line is that no one really knows what the future holds for gold, silver, and the rest of the commodity complex. But one thing is clear, and that’s the direction of the trend.

It’s also clear that we want to be on board with this trend, because it’s going a lot higher, albeit with some volatility along the way.

More By This Author:

Silver On Track For Fifth Straight Supply Shortfall And Other Silver NewsIndian Gold Demand Resilient Despite Record Prices

Silver Now Ranks As The Second-Most Valuable Asset In The World