What These Key Gold Ratios Are Suggesting For The Gold Price In 2023

Video Length: 00:04:22

The true performance of the 2022 gold price

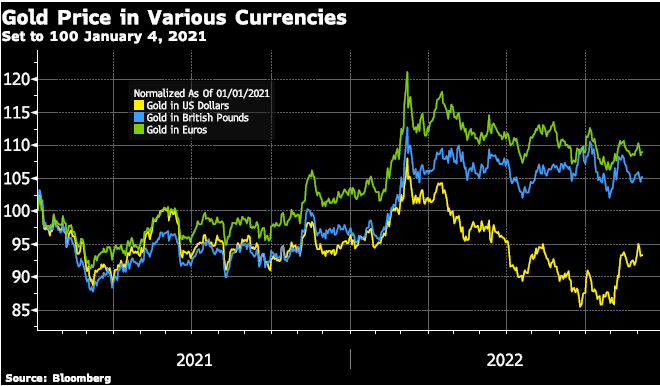

Gold and silver prices have been rising since early November. After setting a high for the year in early March, soon after Russia invaded Ukraine, gold was on a declining trend in US dollar terms until early November. In other currencies, gold has fared better and trended sideways since May. For the majority of the year, gold and silver prices faced stiff headwinds of tightening monetary policy, rapidly rising interest rates, and a surging US dollar.

Gold price In various currencies chart

But with expectations that central banks are set to slow the pace of increases, and the resultant rollover in the US dollar, gold and silver prices have started to climb again. Other asset classes have also turned upward – notably US equity markets. The change in momentum is a good time to provide an update of gold price correlation to other asset classes. (We first introduced many of these charts in our post on July 29, 2021, How Gold Stacks up Against Stocks, Property, Commodities, and Big Macs!)

Gold and equity markets

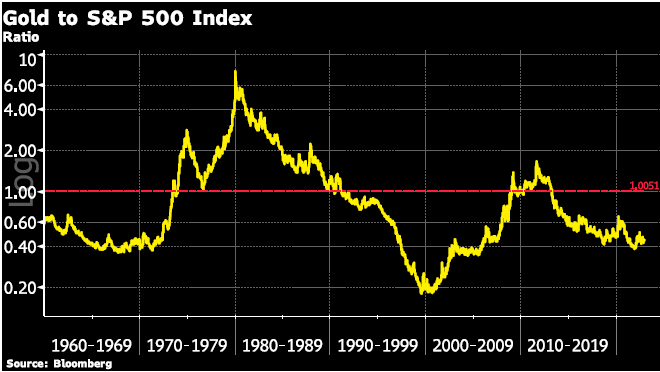

As a reminder, the long-term correlation of the gold price to equity markets is zero, which means that there is not a clear relationship between gold and the S&P 500. In other words, there is not general rule that shows if the S&P 500 increases in a twelve-month span then gold is likely to increase, or decrease.

In shorter time frames the historical experience is different. In certain specific short time frames, such as at the beginning of a recession, gold prices, and the S&P 500 index both decrease. And in times of significant war or geopolitical events, the gold price generally rises, and the S&P 500 declines.

Having said all that; we can see from the below chart a cyclical pattern to gold and the S&P 500 as a ratio. The peaks in the ratio shown below signaled a peak in the gold price and the trough (bottom) of this ratio in 1999-2000 signaled a cyclical peak in the S&P 500. The ratio appears to have formed a bottom in December 2021 when the S&P 500 set its new high and has been increasing since. This indicates that a new high for gold could be on the horizon!

Gold to S&P 500 index chart

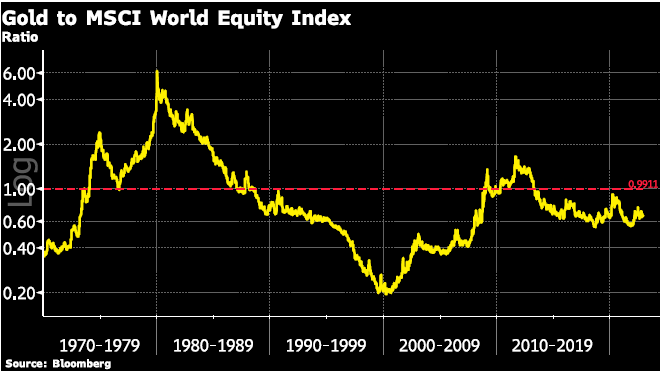

The gold price ratio to the broader MSCI World Equity Index shows a very similar pattern as the ratio between the gold price and the S&P 500.

Gold MSCI World Equity Index Chart

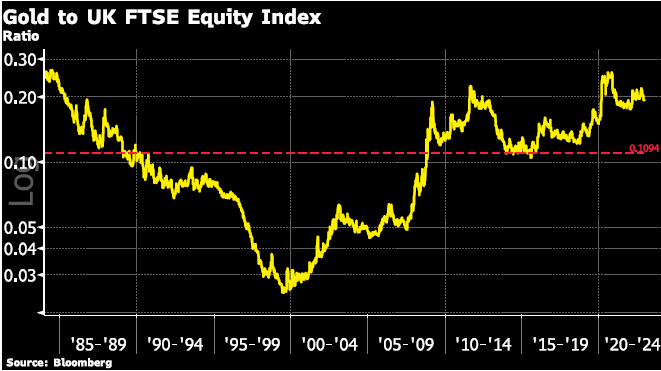

However, taking a look at the gold price in sterling to the UK’s FTSE 100 Index shows a different pattern. Since 2013 the ratio has been moving higher. Two key reasons are that the FTSE had less of a run up from 2020 to the end of 2021 and gold has performed better in Pounds than the US dollar (see the first chart).

Gold to UK FTSE Equity Index Chart

Gold and commodities

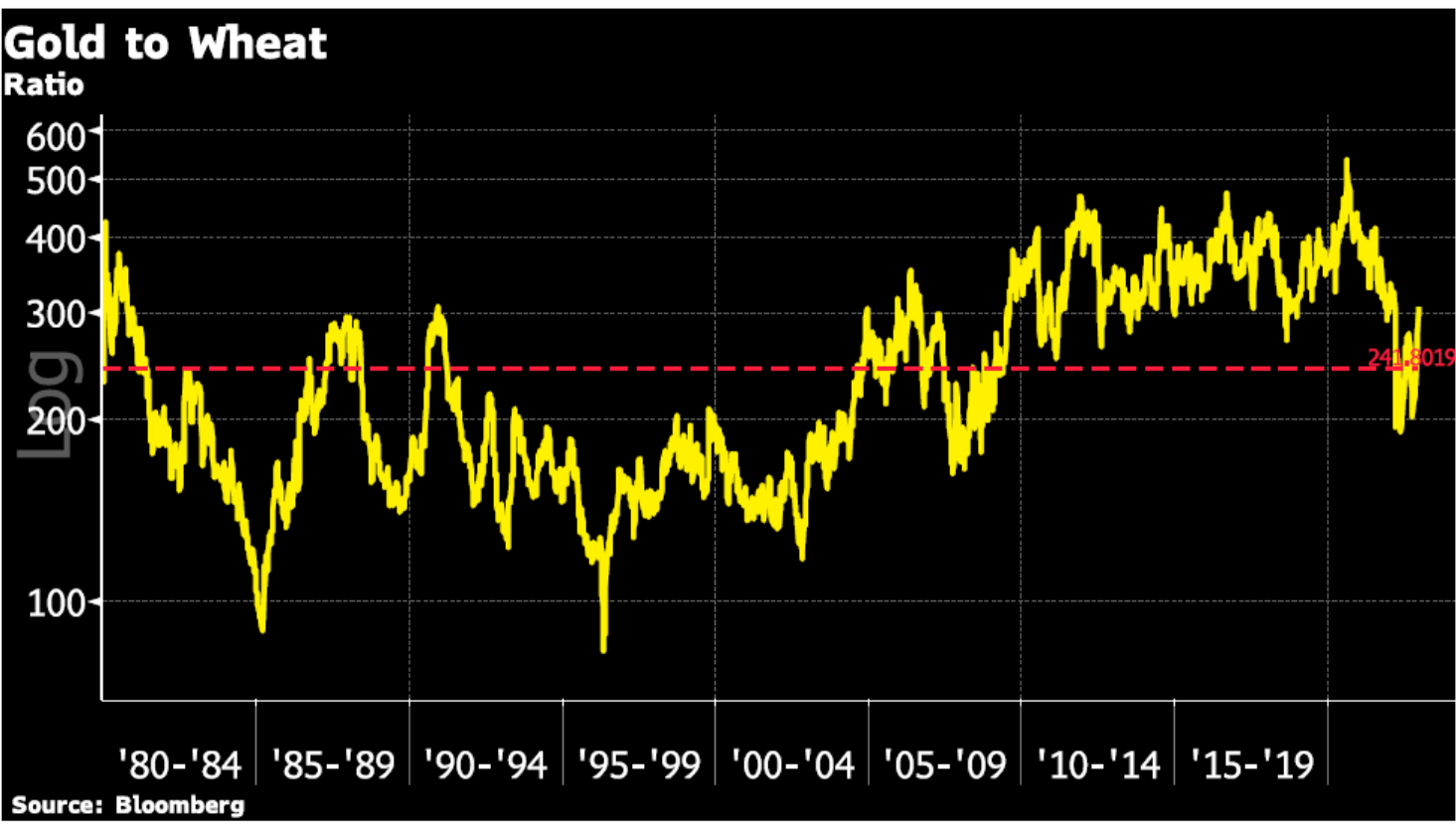

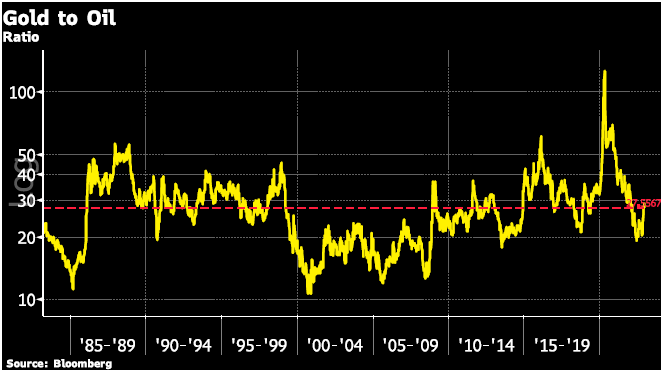

Turning to the gold price ratio to two key commodities, wheat, and oil, we can see from the charts below that the ratio has returned to the average.

The ratio of the gold price to wheat is stable and trading within a rising band from 2010 through 2020. Then higher prices of wheat due to the supply shortage has this ratio back at the longer-term average, however.

(Click on image to enlarge)

Gold to Wheat

The gold price to oil ratio shows that neither commodity has had the upper hand for long. There is not a clear cyclical pattern to the ratio, which makes sense as each has an important role that the other cannot fill, the spikes in oil price are generally oil supply specific.

Gold to Oil Chart

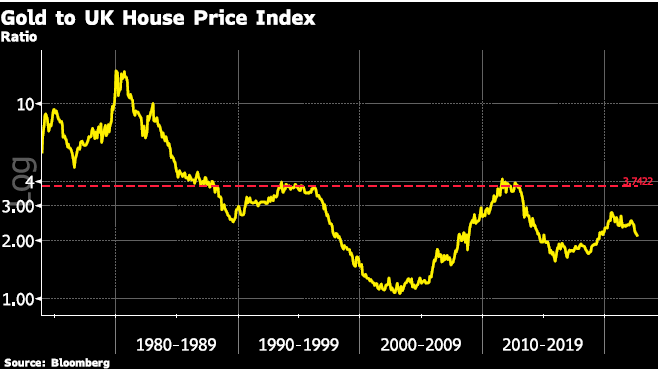

Gold and the housing market

The last ratio is the gold price, again in sterling, to the UK house price index. House prices have been a good store of value. However, the relationship continues to be surprisingly similar to the gold price ratio with the S&P 500 and MSCI indices.

Gold to House Price Index Chart

Why should the gold-to-housing relationship have more in common with gold-to-stocks than with gold to oil? Our answer is leverage. As we see stocks and housing are far easier to own with borrowed money [or newly printed money] than is a barrel of oil. Said another way; stocks and housing are connected by virtue of how they both benefit from lower interest rates and both do poorly in rising interest rate environments.

Invest in gold to protect yourself in 2023

Gold, like oil, is far more outside the financial leverage system which has overrun all of us since 1971. Stay away from other people’s leverage since it could drag your investments down with them. Physical metals are a great way to insulate yourself from risky bets made by other people.

More By This Author:

Gold’s Role In The International System

What The World Cup Can Tell Us About Inflation

The Bitcoin Is ‘As-Good-As-Gold’ Myth Is Over

Disclosure: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation ...

more