Weekly Market Pulse: What’s Your Risk Tolerance?

While it seems obvious that the future should feature a lower dollar and gold continuing to outperform stocks, that is far from assured. That is the consensus view and while the crowd can be right for a long time, its clairvoyance is inversely proportional to its size. The more consensus the consensus becomes, the less likely it is to happen. I think the right question to be asking right now is what might change to produce a different outcome, something that bucks the consensus? I’ll leave that for a future commentary.

Me, last week

I don’t often quote myself because it seems…tawdry somehow. On the other hand, finding anyone skeptical of the recent gold rally is a tall task so I went with someone I know well. On the third hand, I’m always skeptical of the consensus and a stopped clock is right twice a day. Truth be told, when I mention something that bucks the consensus and it turns out to be right – however briefly – it’s just luck. And that quote above doesn’t really say anything except being long gold is (was?) pretty popular and that it might not keep outperforming stocks. Still, it was a timely observation, at least for last Friday.

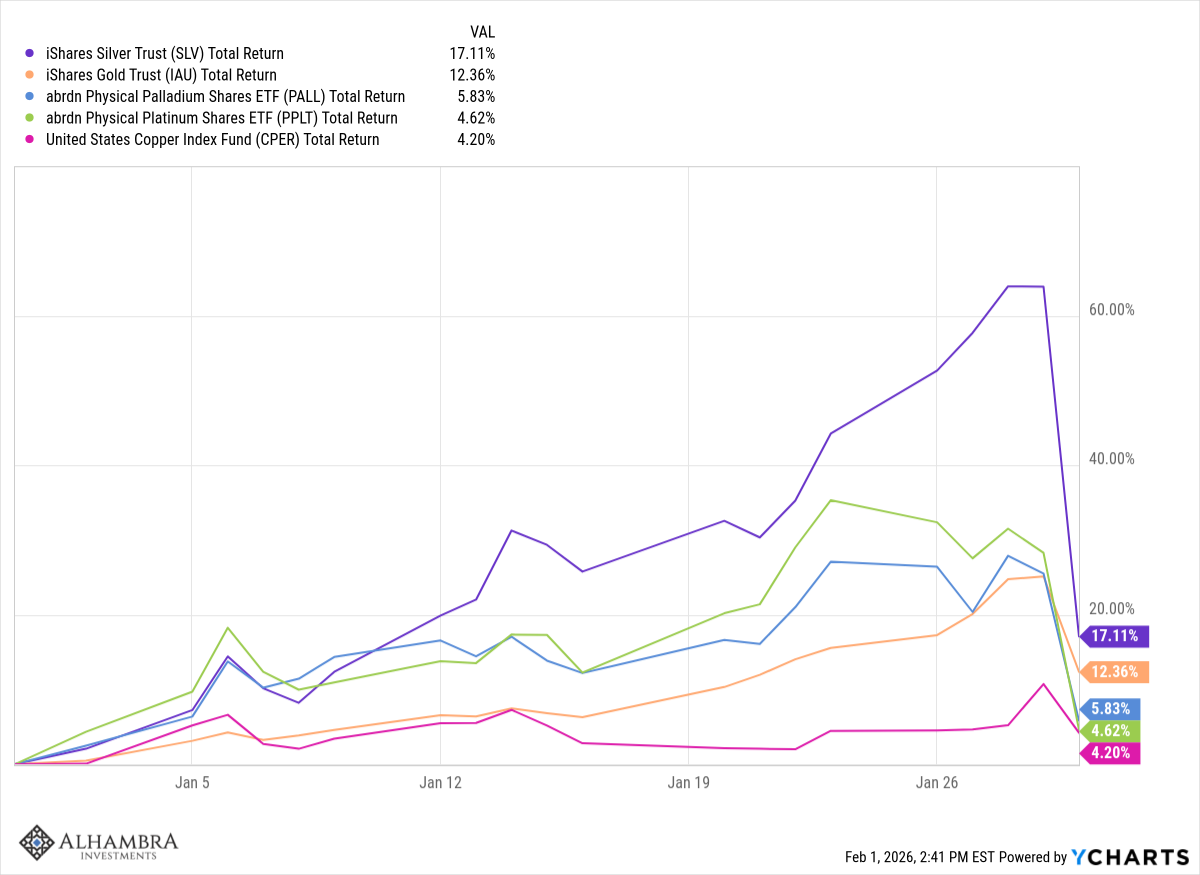

In case you missed it, gold* fell over 10% last Friday and that was the good news from the metals. Silver swan dived 28.5%, platinum 18.4%, palladium 15.7%, copper 6%; it was a bloodbath correction of an uptrend that has been in place for months, dating back to the middle of last year.

The trigger for the selloff was, apparently, the appointment, by President Trump, of Kevin Warsh as the next chairman of the Federal Reserve. Why would that trigger such a large selloff? The theory floated by the media is that Mr. Warsh is a monetary “hawk”, presumably one that will not be as amenable to cutting rates as some of the other candidates. To which I say….really? To believe that you have to believe that after all of Trump’s haranguing of Jerome Powell, after trying to fire Lisa Cook from the board, after appointing the obsequious Stephen Miran to the board, after siccing the DOJ on Powell, that he appointed a guy who isn’t going to at least try to do what he wants? Anyone putting forth this excuse for analysis is just talking through their hat.

In any case, the head of the FOMC is just one vote; Warsh can’t cut rates all by himself. Markets, other than the ones for precious and industrial metals, didn’t buy the Warsh excuse. Expected changes in Fed policy barely budged last week; the next rate cut is tentatively (49.5% probability of a cut) expected in June. Last week the probability was 46%. If that cut happens, it would bring the rate down to 3.25%-3.50%; the probability of getting to 3.0% – 3.25% by the end of the year is just 33.2%. The odds were 32.2% last week.

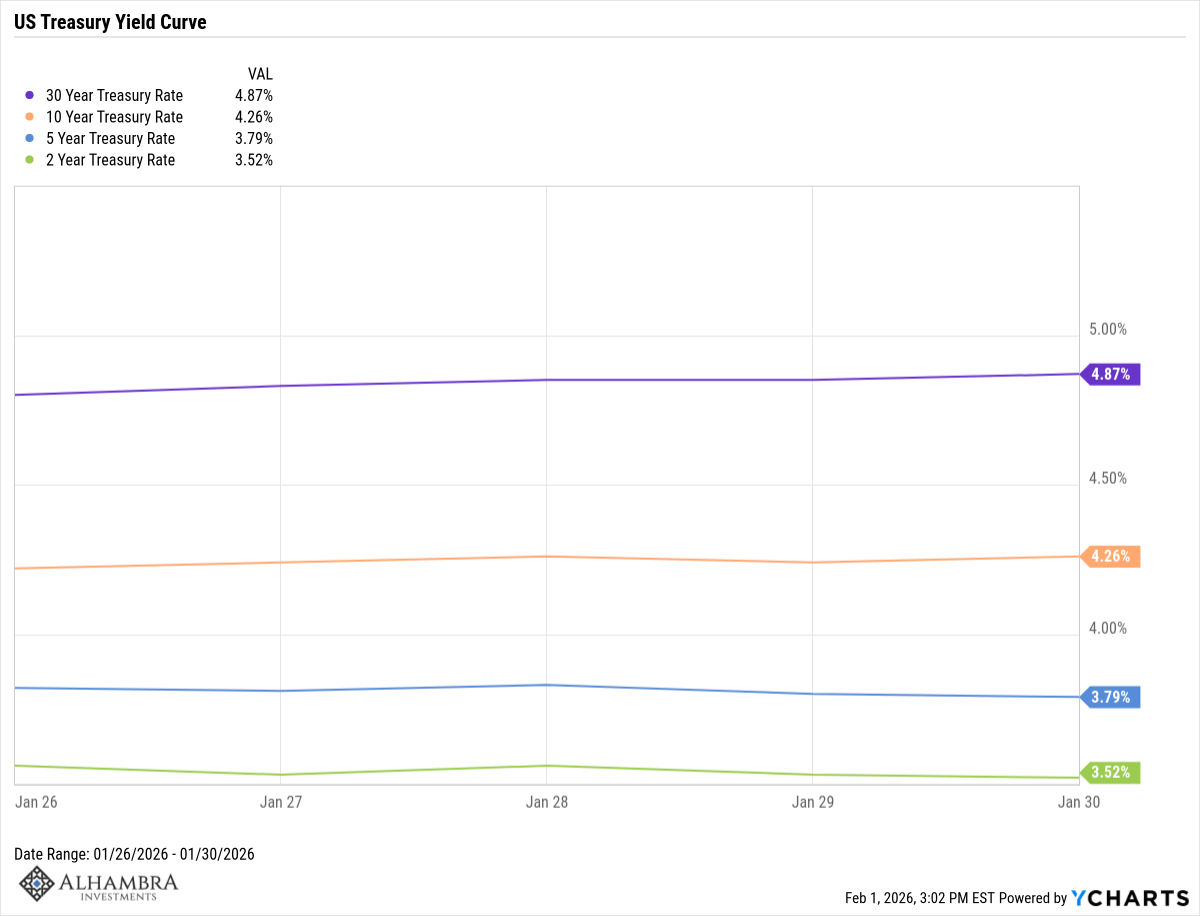

If we move over to the Treasury market we find that the 10-year Treasury yield rose 1.4 basis points, the 5-year fell less than 1 basis point and the 2-year Treasury (the note maturity most sensitive to Fed policy) fell – brace yourself – 2.8 basis points. These markets should be the most sensitive to future Fed policy and they responded with a collective shrug. The currency markets also yawned; the dollar index rose 0.9% and ended at 97.14, but that’s considerably lower than just two weeks ago when it closed at nearly 99.5.

Selected Treasury Rates – 1 week

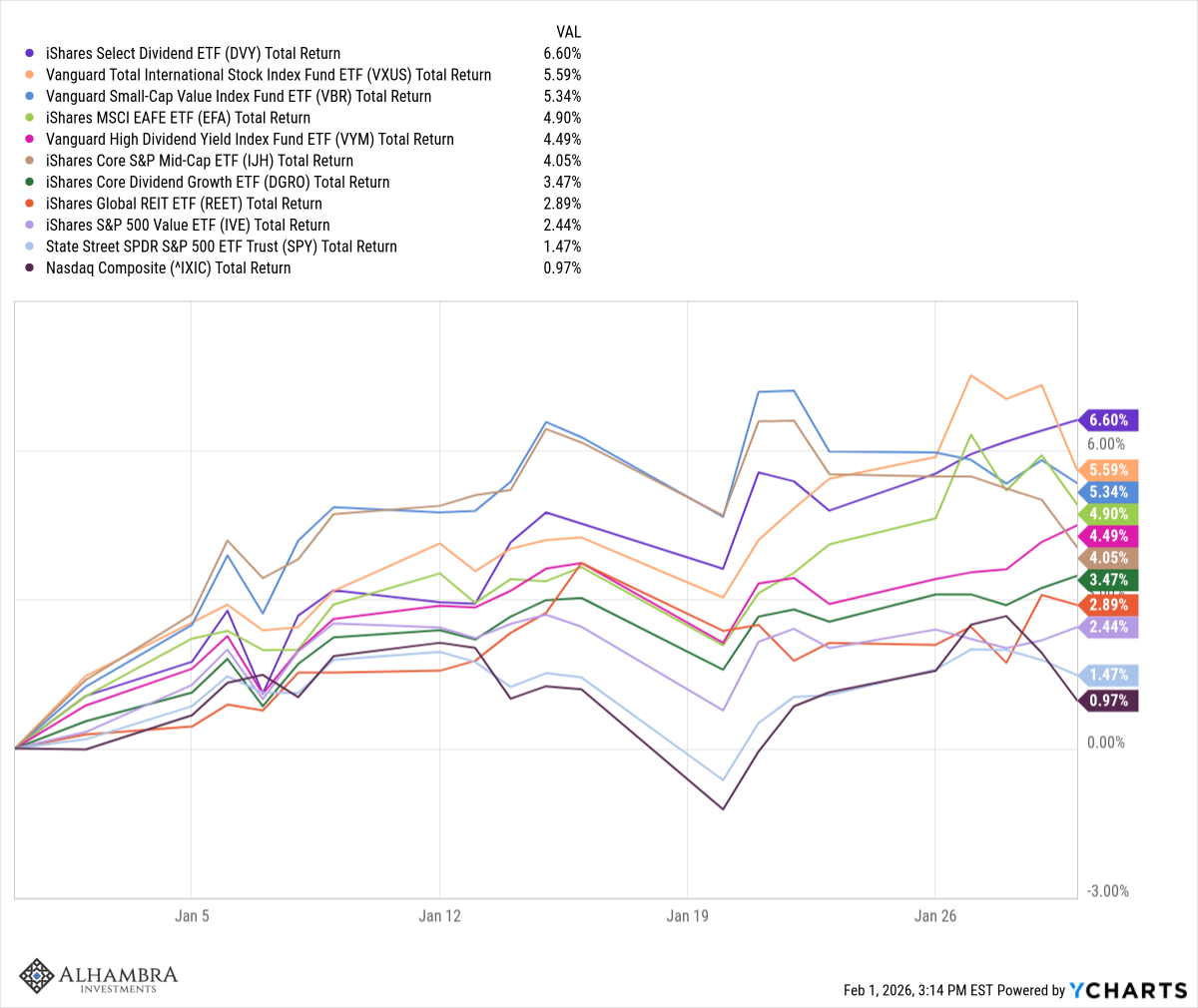

Stocks were also generally lower on Friday, but the moves were pretty modest and far from uniform. The S&P 500 fell 0.4% but large value, dividend growth, high dividend, and REITs all closed the day higher. International stocks were down more than the US on Friday but a lot of that was from the rise in the dollar and they are still way ahead year-to-date. In fact, most everything is doing better than the S&P 500 and the NASDAQ so far this year.

Selected Equity ETFs YTD

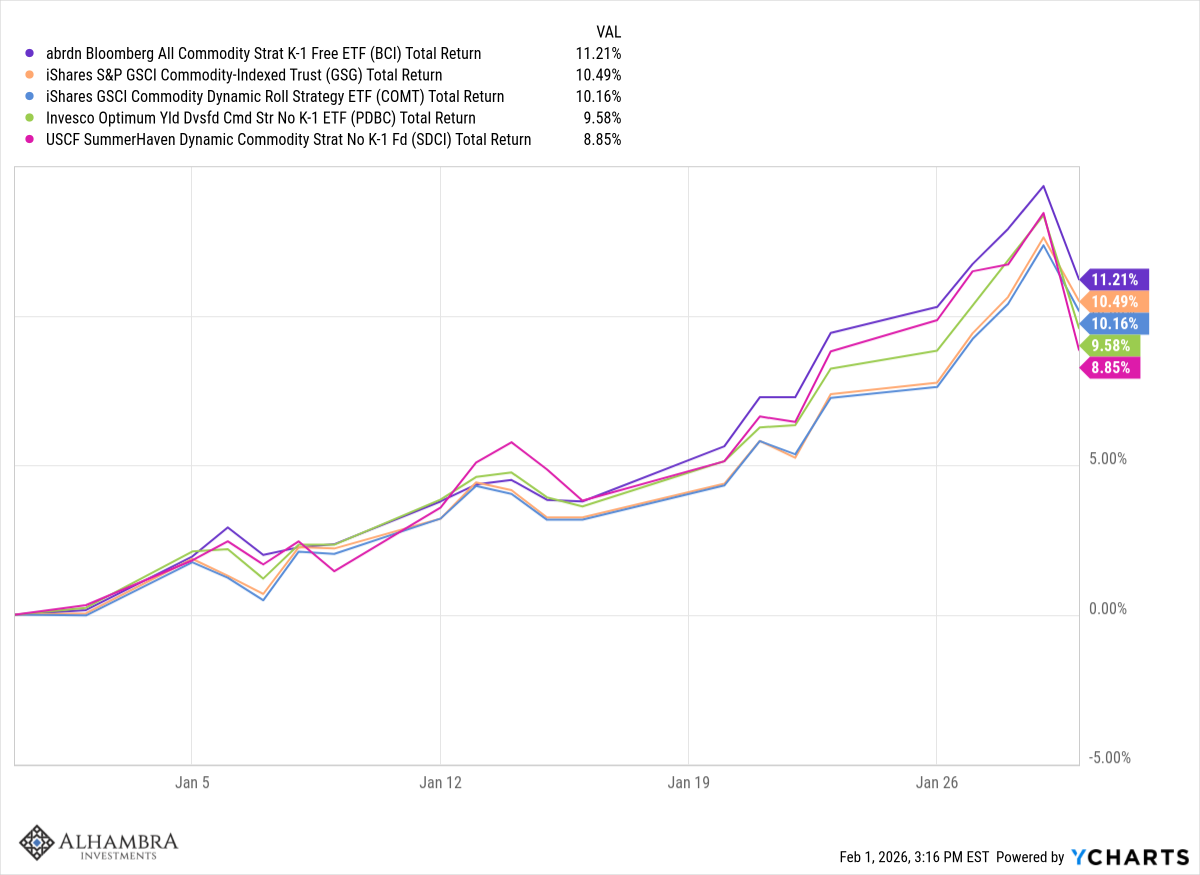

The general commodity indexes were also down but are still up high single digits to low double digits (depending on what index you choose).

General commodity ETFs YTD

The appointment of Kevin Warsh may have meant something to metals traders – a jumpy, nervous sort I might add – but it didn’t mean much to anyone else. Which is as it should be, by the way. The Chairman of the Federal Reserve and indeed, the Fed itself, has a lot less control over the economy than almost everyone imagines. Even if Trump had made an even worse choice by appointing Kevin Hassett it shouldn’t and probably wouldn’t make much difference. The other members of the FOMC are not required to take the Chairman seriously.

The month of January didn’t end on a positive note for metals traders but for diversified investors it was a great month. There is a great lesson to be learned from the metals action Friday – position size matters. A lot. We own gold, platinum, palladium and some general commodity indexes for our clients but Friday was really just another day for us. We have a strategic allocation to gold and general commodities (meaning we always have an allocation to these assets) in our portfolios for each risk tolerance we consider. We sometimes make tactical changes to this allocation depending on market conditions and we did so early last June when we reduced our allocation to gold in favor of an allocation to platinum and palladium.

That change entails a series of decisions, each of which holds risk. First, there is the risk that gold continues to outperform the other two metals and our portfolio performs worse than it would have if we made no change. Second, the mere act of swapping gold for platinum and palladium raises the risk of the overall portfolio. Why? Platinum and palladium have higher volatility – standard deviation of monthly returns – than gold. That means that if we want to keep the risk of the overall portfolio the same as before the change, we need to reduce risk in some other asset. That is a third risk, namely that other thing we choose to reduce also outperforms the two new assets.

As it turns out, in this case, we made good decisions: platinum and palladium have outperformed gold since the switch and they also outperformed the other asset we reduced. But that doesn’t mean we’ve done nothing since we made the switch. Once the tactical change was made, we had to manage it. While we usually make tactical changes based on what we think are long-term shifts, commodities, because of their volatility, require more active management; commodities are not buy and hold investments. To keep our risk level fairly constant and to maintain the strategic allocation to precious metals, we had to sell as prices rose.

We sold in several tranches over the last 8 months, the last only a week before last Friday’s great metal massacre. This active management of the position size means we’ve already recouped roughly 80% of the original capital we put at risk. The fundamentals of these two metals haven’t changed and we think the bull market in metals – and commodities more generally – likely has years to go so we want the exposure. But we want it on our terms and within our – and our clients’ – risk tolerance.

Of course, things don’t always turn out so swimmingly. Making tactical changes, as noted above, requires an investor to make a series of choices, all of which he must get correct, for the tactical change to pay off. That’s why you need a good strategic plan (allocation) and you need to keep the tactical changes to a minimum. You also need to make the changes in a risk-neutral manner if possible. Your risk tolerance doesn’t change just because you think one precious metal will outperform another.

Gold and other commodities can be good diversification tools, assets that can add return and reduce the overall volatility of your portfolio. But commodities are also the assets that disprove the idea that if a little is good a lot must be great. All things in moderation, especially commodities.

One last note: Risk tolerance is a very hard thing to measure but it doesn’t change just because the market rose – or fell. It is human nature to want to get more aggressive when things are going well. It’s also human nature to curl up in a ball when things are not going well. But if you maintain an even keel, if you can keep your portfolio risk aligned with your emotional risk tolerance, you’ll be selling after things have gone up and buying after things have gone down. Last I checked that was the aim of this game we call investing. If you found yourself wondering why you owned so much gold or the other metals last Friday, you probably need to spend some time thinking about the nature of risk.

*All metal returns are from the ETFs that represent these commodities.

More By This Author:

Weekly Market Pulse: Maybe We Need Our Golden FettersWeekly Market Pulse: Central Planning Gone Awry

Monthly Macro Monitor: No Change

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more