Weekly Market Pulse: Maybe We Need Our Golden Fetters

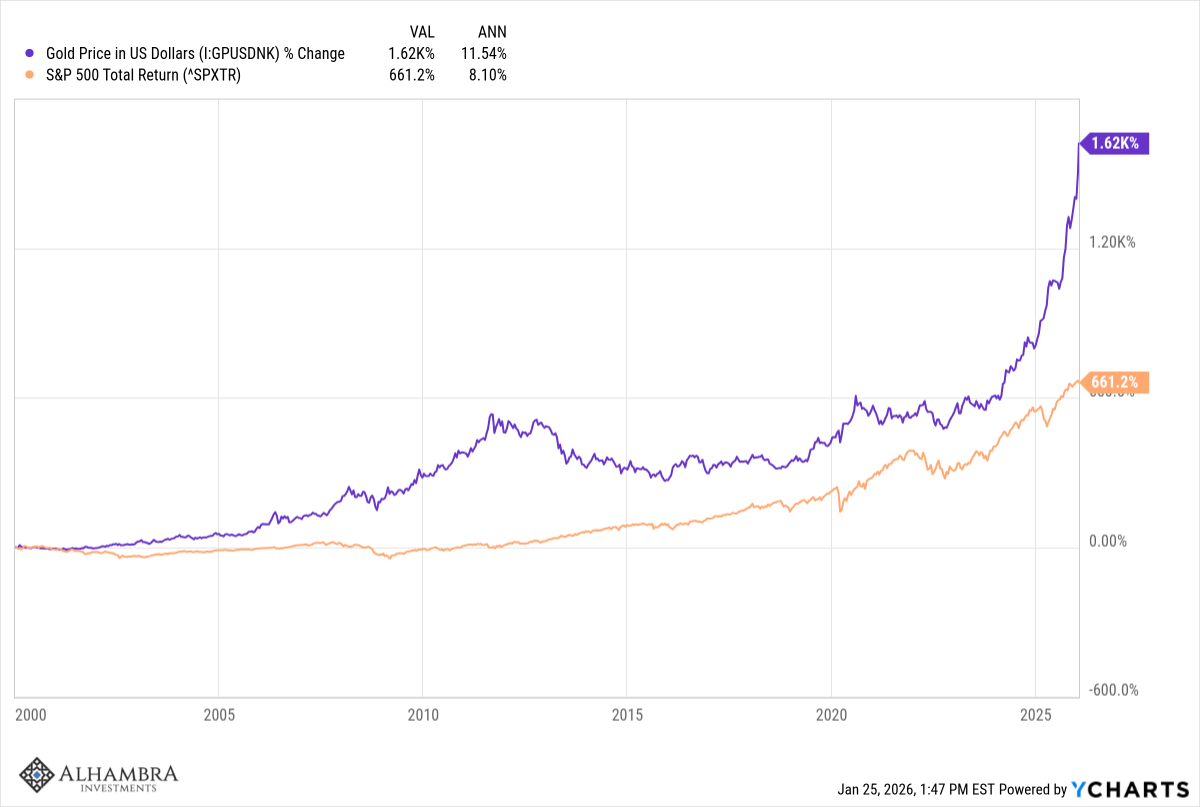

This is, in my opinion, the most interesting chart in all of finance. This shows the return from gold versus the total return of the S&P 500 since 1/1/2000. As you can see, gold’s return has exceeded that of stocks by almost 3 to 1; it isn’t even close. If you had bought gold at the turn of the century, at no point over the next 25 years would you have been better off having bought the S&P 500 instead. There were periods of outperformance by stocks so you could have done better if you were able to trade those inflection points, but for buy and hold investors, the 21st century has, so far, been the Golden Century. Is gold trying to tell us something or is it just the latest object of speculation in a society increasingly addicted to gambling?

Think about this for a minute…an inert metal with limited industrial uses, has, over the last 25 years, produced a better total return than ownership of, supposedly, the best companies in the United States. Think of all the innovations provided by the leading US companies over the last 25 years. In 2000 we didn’t have:

- Smart phones – the first Blackberry phone came out in 2002 and the iPhone followed in 2007

- Widespread availability of Wi-Fi

- 3G, 4G or 5G cellular networks

- Social media – Facebook 2004 and Youtube 2005

- CRISPR technology

- Human genome mapping project completed in 2003

- mRNA vaccines

- Generative AI, large language models

- Alphafold

- Blockchain and Bitcoin

- Reusable rockets – SpaceX

- Widespread use of EVs

- Self driving auto technology

- USB flashdrive

Of course, corporate America has also provided us with some things that weren’t all that beneficial. Most of them, to my way of thinking, are just symptoms of the same malady affecting gold – inflation, a cheapening of the dollar.

- Subprime mortgages, liar loans, etc.

- Credit default swaps on those subprime mortgage securities

- The creation of “investment grade” securities from a bundle of junk mortgages courtesy of the ratings agencies

- Bernie Madoff

- Wirecard fraud

- FTX and Sam Bankman-Fried

- NFTs of cartoon apes selling for millions of dollars

- Social media

- Blockchain and cryptocurrencies

- Theranos fraud

- The opioid crisis

- Boeing building planes with self-removable doors

- Wells Fargo opening millions of fraudulent bank and credit card accounts whether you wanted one or not

- 100s of other forms of fraud and speculation that have happened over the last 25 years

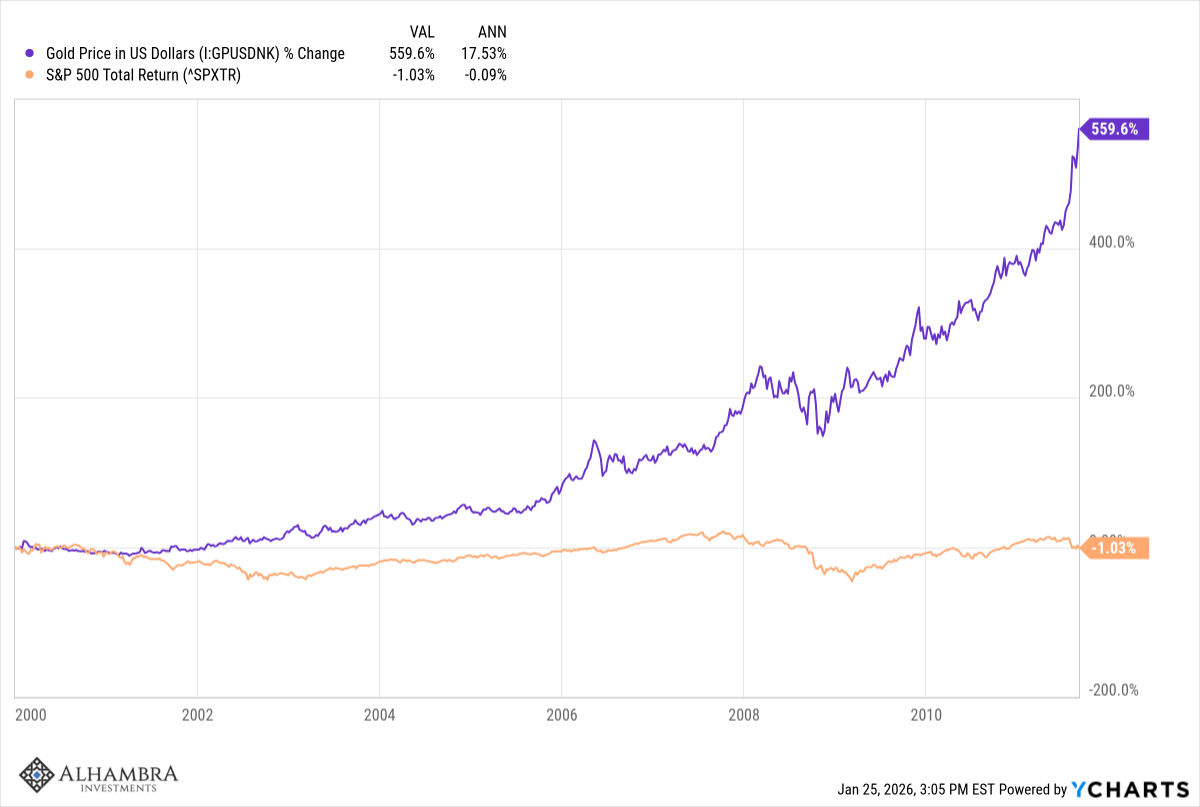

The outperformance of gold over the 25 years can be broken up into distinct periods of outperformance and underperformance. First period of outperformance was from 2000-2011, the aftermath of the dot com boom. This period was marked by very loose monetary policy and the real estate boom that led to the 2008 financial crisis. It was also a period marked by financial fraud and massive leverage for speculative purposes. The dollar index mostly fell during this period as well, making the rise in gold logical.

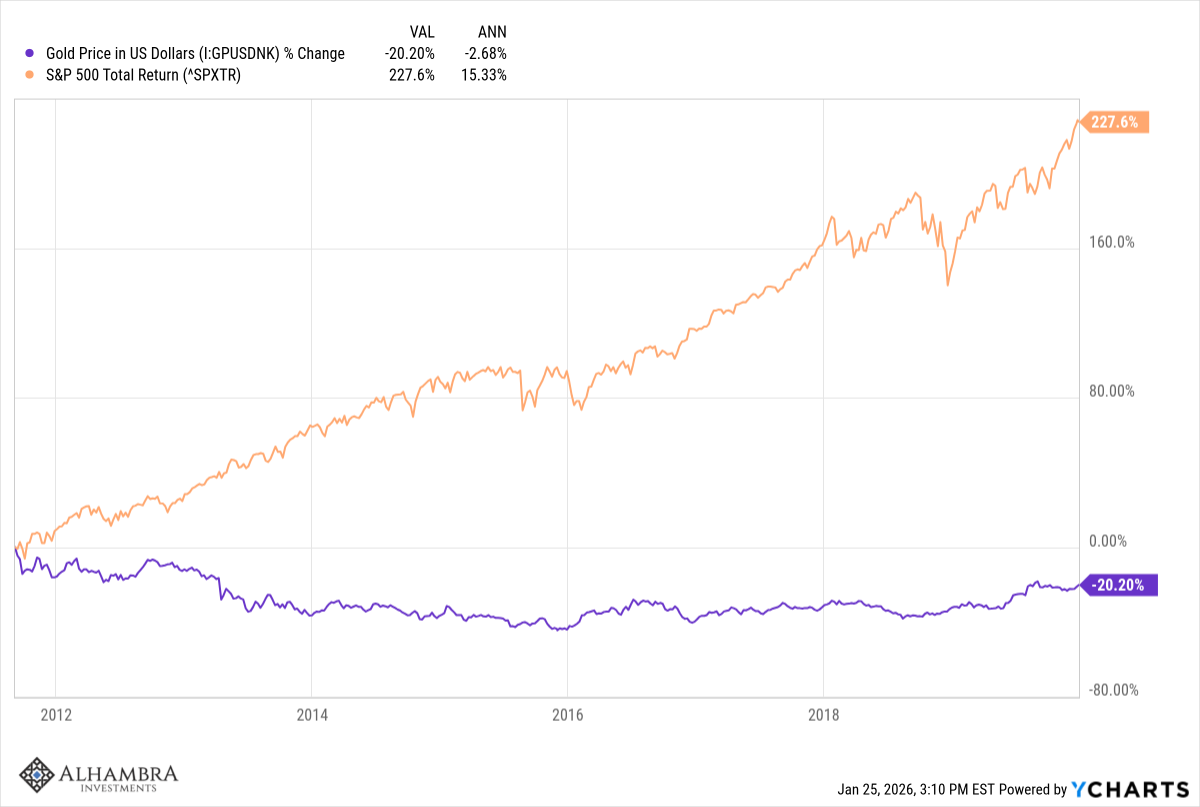

The second period is from the 2011 peak to the end of the 2010s. While most people think of this period as one of loose monetary policy because of the advent of Quantitative Easing, the fact is that QE wasn’t inflationary and one can make a very good case that it was in fact deflationary. This was a more conservative era financially as the financial crisis impacted the public’s view of speculation and debt more generally.

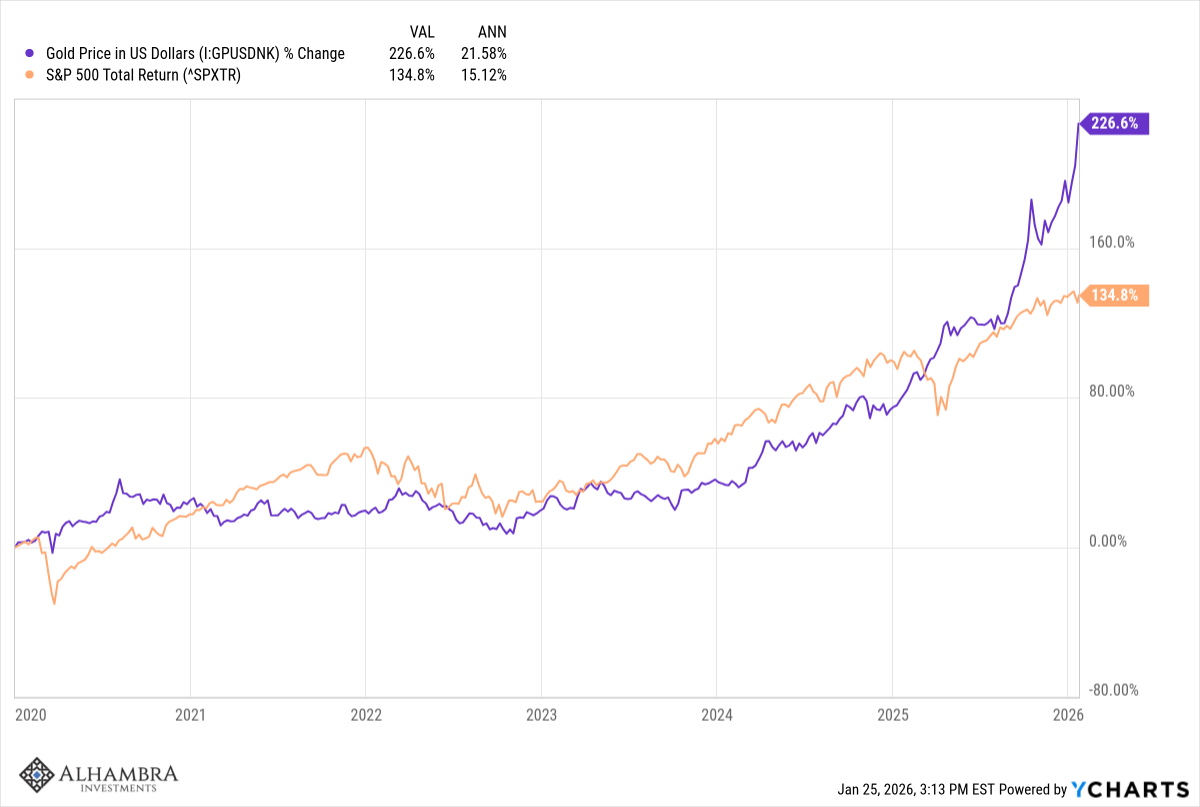

Finally, there is the period since the end of 2019, another period of loose – very loose – monetary policy. This COVID era has become known as the Golden Age of Fraud, starting with the PPP loans during COVID before moving to the meme stock and SPAC craze of 2021, the NFT fad (remember the Bored Ape Yacht Club?), the massive increase in options trading including the emergence of “zero days to expiration” option contracts and the growth of gambling on sports and now almost anything else. YOLO – you only live once – is the motto for the Millennial and Gen-Z generations.

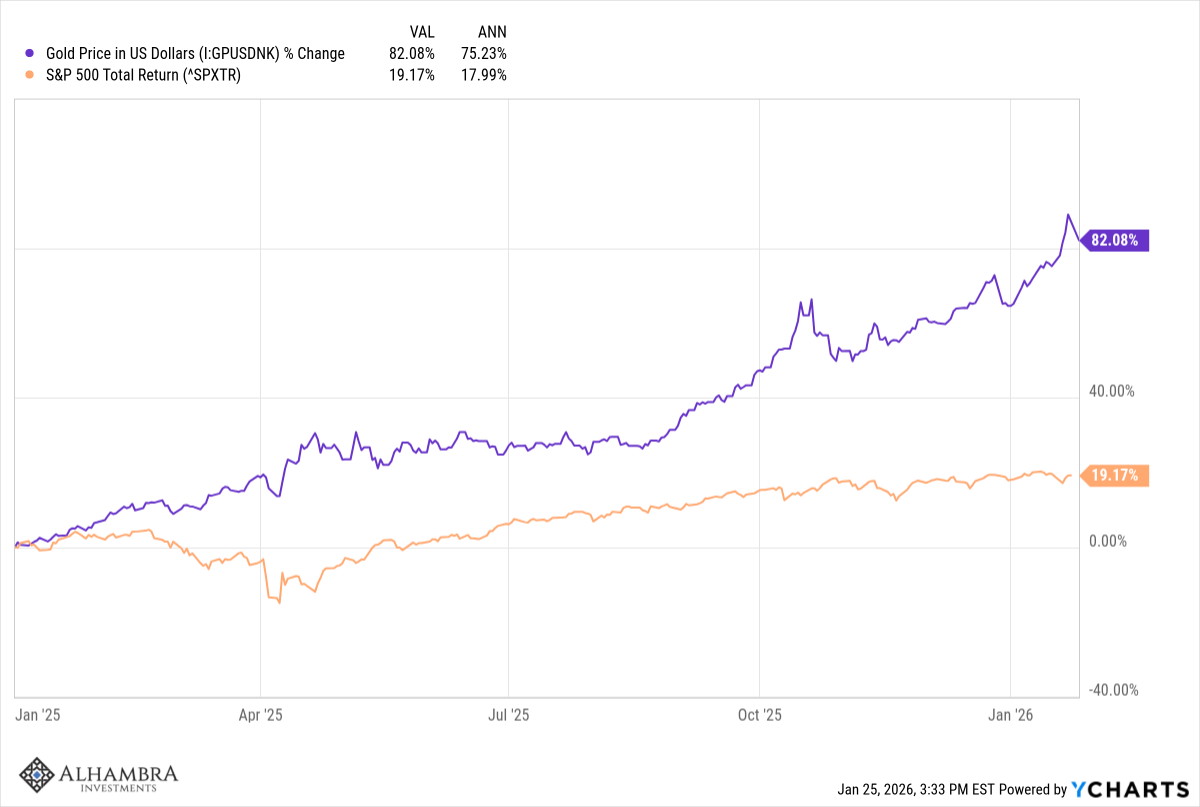

You’ll notice too that gold’s performance has accelerated dramatically over the last year, the second term of President Trump:

There has been a lot of debate about what the rise in the price of gold means but I don’t think there is really one explanation. It is certainly not coincidence that the periods of gold outperformance have come during periods of loose monetary policy, first in the post dot com boom period and today in the post-COVID period. Gold has acted as a check on monetary excess for thousands of years and it doesn’t appear that has changed, even though gold no longer plays a role in official monetary matters. It seems unlikely – in the extreme – that gold rising from $250 an ounce in late 1999 to $5000 today has nothing to do with monetary policy. The speculation and financial fraud associated with the 2000-2009 and the 2020 to present periods cannot be coincidence either; rampant speculation requires money and in both periods there was plenty of it. If you cheapen money people do foolish things with it.

The other factor that drives the price of gold is uncertainty and we’ve had plenty of that. The period after the dot com boom and the 2008 crisis certainly qualify as periods of extreme uncertainty as does the post-COVID era. It probably isn’t coincidence that gold peaked around the most intense part of the Euro crisis around 2011. There was deep concern during this time that the PIIGS (Portugal, Italy, Ireland, Greece and Spain) would default and end the Euro experiment. Mario Draghi gave his “whatever it takes” speech in 2012 which effectively ended the crisis. Gold spent the rest of the decade doing little, with the 2011 high not exceeded until 2020.

The first year of Trump 2.0 has produced massive uncertainty in multiple arenas, from trade to immigration to geopolitics. The uncertainty produced by the Trump administration is global, persistent and unpredictable so gold making new highs isn’t surprising. As for monetary policy, while it doesn’t seem excessively loose right now, markets look ahead and President Trump has made it clear he wants lower interest rates (although I suspect he’ll be disappointed with the results).

One last thing to consider is the official value of the dollar. Inflation is not, as most people define it, a general rise in the price level. Inflation is about the purchasing power of money, in our case the value of the dollar; the change in prices is the effect. The long term correlation between the price of gold and the dollar is about -0.7, a strong inverse relationship – dollar falls, gold rises. What that means in practical terms is that the dollar is the dominant factor driving the price of gold. What’s interesting is that the traditional relationship is not holding right now; gold has been rising as the dollar has stayed fairly stable. There have been periods of positive (or less negative) correlation before but they have always been followed by a return to the strong inverse relationship.

There is a similar anomaly in the correlation between stocks and gold which over the long term has averaged about 0; there is no correlation between the two. That’s the main reason to include gold in a portfolio; by providing returns that aren’t correlated with stocks, gold can reduce the volatility of your portfolio and raise long term returns. Recently the correlation between stocks and gold has been strongly positive, reaching as high as 0.8 at times. Like the dollar and gold, this correlation is likely to revert to its long term average.

How that happens is the key question. While it seems obvious that the future should feature a lower dollar and gold continuing to outperform stocks, that is far from assured. That is the consensus view and while the crowd can be right for a long time, its clairvoyance is inversely proportional to its size. The more consensus the consensus becomes, the less likely it is to happen. I think the right question to be asking right now is what might change to produce a different outcome, something that bucks the consensus? I’ll leave that for a future commentary.

More By This Author:

Weekly Market Pulse: Central Planning Gone Awry

Monthly Macro Monitor: No Change

Weekly Market Pulse: A Lot To Be Thankful For

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more