Weekly Market Pulse: Has Inflation Really Peaked?

Image Source: Pexels

Stocks, REITs, and bonds all rallied last week on the back of what was interpreted as good news on inflation. The CPI report was better than expected, with the overall level flat from September to October. Core inflation, less food and energy, was also better than expected at up 0.2%. Producer prices, reported the day after CPI were even better, coming in at a -0.5% pace month to month. The year-over-year change in PPI turned negative in March and it still is at -3.6% year over year. That is positive for corporate margins and also probably lessens the urgency of price hikes at the consumer level.

Import and export prices were also down on the month and are both down year over year, -2.0% and -4.9% respectively. A lot of that is from energy, as it was in the CPI, but the drop is pretty widespread. Through all of these reports, the common theme is one of moderating prices and it is welcome. And if it continues, markets are going to love it because lower inflation and lower interest rates solve a lot of the problems people are worried about. With lower rates, unrealized losses on banks’ bond holdings fall, real estate refinancing gets easier and values recover and of course, lower rates mean higher multiples can be justified on stocks. And it might even allow the Fed to be pre-emptive, to cut rates before any serious downside in economic growth.

So, we like lower inflation and lower interest rates. If we could stabilize NGDP growth around 5% and from that get 2.5% real growth and 2.5% inflation, I don’t think anyone would complain too loudly about that even if the Fed’s target is 2% inflation. If we could get 3% real growth and 2% inflation, I’m pretty sure Jerome Powell would drop the mic and walk off the proverbial stage. I sure would.

But since it is my job to worry, I will. I’ve written two long-form articles over the last 13 months making the argument that we are in a new inflationary regime (The Times They Are A-Changin’ and Dawn of A New Era) and I haven’t changed my opinion. If anything, the events of the last year reinforce my belief that, while we may be seeing a cyclical peak in inflation now, a secular, long-term peak is still far away. Inflation will come back and if history is any guide it will be higher in the next cycle than this one.

I’ve laid out in those previous pieces a number of reasons I think inflation will be making a comeback and that interest rates are in a new long-term uptrend. But for today, I just want to focus on one piece – industrial policy. The new infatuation with industrial policy did not, contrary to popular belief, start with the Biden administration but rather with the Trump administration. Trade policy is very much part of industrial policy and Trump made it okay to be protectionist again. The Biden administration was happy to continue the Trump administration’s tariffs and other trade policies.

The Biden administration has, however, made industrial policy the centerpiece of its economic planning with the CHIPs Act and the Inflation Reduction Act, both of which directly intervene in the market to choose particular industries for subsidy and/or tax relief. Trade policy under the Trump administration did some of this by choosing particular products or industries on which to impose tariffs. Steel tariffs favored steel producers over steel consumers, for example. And of course, retaliatory tariffs don’t usually hit the same product so the overall impact is to spread the pain across multiple industries.

One of the most pernicious effects of government intervention in the economy is the increase in corruption. Thousands of companies sought exemptions from the tariffs imposed by the Trump administration. If you believe the review of these requests and the granting of exceptions wasn’t political I’ve got a bridge to sell you. And it will be no different with the Biden administration’s more direct interventions in the semiconductor and renewable energy industries. How can you justify restricting government assistance to a couple of industries when so many others can also claim to be critical to national security or saving the environment? Who’s going to succeed in their lobbying? One might start with a list of campaign contributors to whichever party is in charge.

What these policies do is restrict the supply side of the economy while stoking demand. The impact of tariffs is direct and the intended consequence, the goal is higher prices to support the domestic industry. But it has other effects too in that it misdirects resources to politically favored industries and away from others that would likely produce higher returns. Tariffs by themselves cause relative price changes but when accompanied by large government deficits – as they have been under the Trump and Biden administrations – they can certainly be inflationary.

The direct interventions by the Biden administration with the CHIPs Act and the Inflation Reduction Act also restrict the supply side of the economy by wasting scarce capital on politically directed projects. We are already seeing significant problems with these industrial policies:

The CHIPs Act and the IRA direct trillions of dollars to be spent in two industries favored by the Biden administration. Taiwan Semiconductor can’t find workers to build its plant in Arizona and they are not the only company finding it hard to meet the requirements of these politically motivated investments. Intel has complained of delays in funding and many companies are finding the work requirements onerous and hard to comply with. The cost of the plants will be higher than otherwise because they have to meet the requirements of the Davis-Bacon Act.

The effect of all these policies, which will be reflected in excessive government spending and large deficits, will be inflation. For now, these projects create economic activity so it looks like economic growth. But mere activity is not what helps us achieve higher levels of growth or improved living standards. That comes from productive activity, investment that makes our economy more efficient. One can make a national security argument for investing in semiconductors and many have but if that’s the argument you want to make you better be prepared to continue to subsidize the industry. And you need to acknowledge that it will not make us more productive. US companies will pay more for chips or the government will subsidize the producers to keep prices competitive.

There is no such argument for green energy. It is not a national security matter and it isn’t more efficient than current methods of producing electricity or transportation. It diverts resources to industries that are not now competitive without subsidies and limits investment in more efficient means of producing power. That is not a recipe for long-term economic growth.

For some reason, these types of economic interventions have become popular again despite their repeated failure in the past. The only group that benefits from government directed investment are the politicians who get to direct the flow of funds and their cronies who find themselves on the other end of that fire hose. The direct cost is high but the cost in lost opportunities may be enormous.

Environment

(Click on image to enlarge)

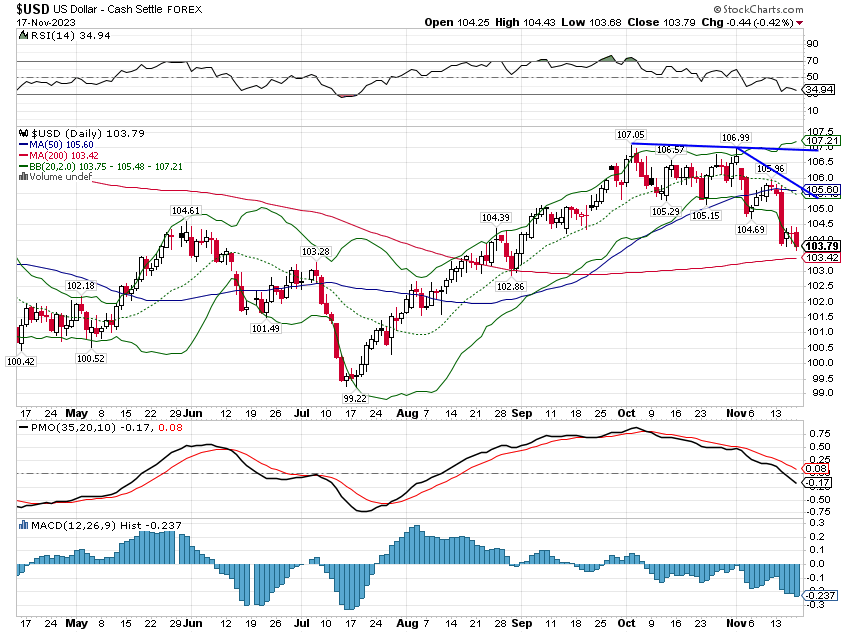

The short-term trends of the 10 year Treasury note rate and the US dollar have changed to negative. They aren’t strongly negative – more neutral to negative – but it is hard to continue calling either trend up. What does that mean? Not much from the viewpoint of the dollar; we are already partially positioned for a negative dollar trend because the dollar peaked over a year ago. If the intermediate or long term trends changed, that might warrant a more significant allocation change. The intermediate trend could already be called neutral but with the index up 16% since the low at the beginning of 2016 it can’t be called negative yet.

(Click on image to enlarge)

The 10 year note yield has turned negative short term but it is a very short-term trend. A break under the August high would probably make me feel stronger about it but for now, there is no need to make any changes. The long-term trends haven’t changed with intermediate up and with rates today at levels that also prevailed in 2004, I don’t see how that could be called anything but neutral. To break the intermediate-term uptrend would require the rate to fall below 4% which is certainly possible but doesn’t seem imminent.

(Click on image to enlarge)

These intermediate level trends tend to persist and because of that, they are hard to break. What that really means is that trends in the economy are hard to break and that’s why we track these things so closely. We can’t predict the future but we can track the present and refer to historical data to see what assets perform well in the current environment. We know what assets have performed well when the dollar was falling and we’re anticipating that somewhat in our portfolios right now. We know what assets have performed well when rates were rising or falling and we can incorporate that into our asset allocation as well.

But tactical choices are not all or nothing. The dollar shifting to a short-term downtrend doesn’t mean you should only own things that do well when the dollar is falling. Small changes in the trend warrant small changes – if any – in your portfolio. So, what performs well when the dollar is falling? Here are some easy ones:

That is just based on yearly returns back to 1971 (the dollar was fixed to gold prior to that) so it isn’t a lot of data but it’s what we have to work with. And it doesn’t take a lot of thought to figure out why those things do well when the dollar is falling. And remember too that these are based on averages; there are weak dollar years when these were not the best-performing assets. Another reason not to go all in on tactical changes.

Markets

Stocks and REITs have been hampered by rising interest rates for the last two years so any hint that rates have peaked or are coming down are welcomed. Except if they fall too far because the economy is suddenly bad and headed for recession. So, yes, lower rates are good but only to some point, beyond which lower rates will be bad news for stocks.

Things were so exuberant last week that it didn’t even matter whether you owned growth or value stocks, they all went up. There is still though a pronounced divergence between value and growth over the last 2 years with Large Cap Value up 10.5% and Large Cap Growth down 12.3%. I think people forget this when they talk about how well growth stocks have done this year. Value continues to outperform over the trailing 3 year period as well.

Commodities brought up the rear last week but still managed to close positive despite energy being down. Gold was up more than general commodities(+2.4%) but a small drop in inflation expectations (nominal yields fell more than real yields) probably held it back.

By the way, as I said a couple of weeks ago, there is now a lot of chatter about crude oil slipping into contango. For those who always see the glass half full (or in some cases a quarter full) this means that demand has collapsed, collapsed I tell you! Yeah, not so much. This is much more about the supply side of the equation than the demand side and that is not bad news except for maybe OPEC+ which is having about as much luck controlling the price of the slippery stuff as they did before adding the +.

Sentiment has improved considerably since October when investors were ready to chuck it all for a batch of TBills. It isn’t frothy by any stretch but there is no doubt that the mood has improved. But market sentiment is usually bullish and usually right because the market goes up most of the time. The S&P 500 has been up 73% of the years since 1929 and that win percentage is pretty consistent; it’s up 32 of the last 43 years (which is 74.4%). Given that history, it makes perfect sense for market sentiment to be bullish most of the time.

Bearish sentiment tends to be brief and intense while bullish sentiment tends to persist. So, when markets get overbought and sentiment moves from very negative to positive, you shouldn’t get too worried about it yet. And while I think we may see some weakness soon to work off the overbought condition, I don’t think we should worry too much right now about a big drop.

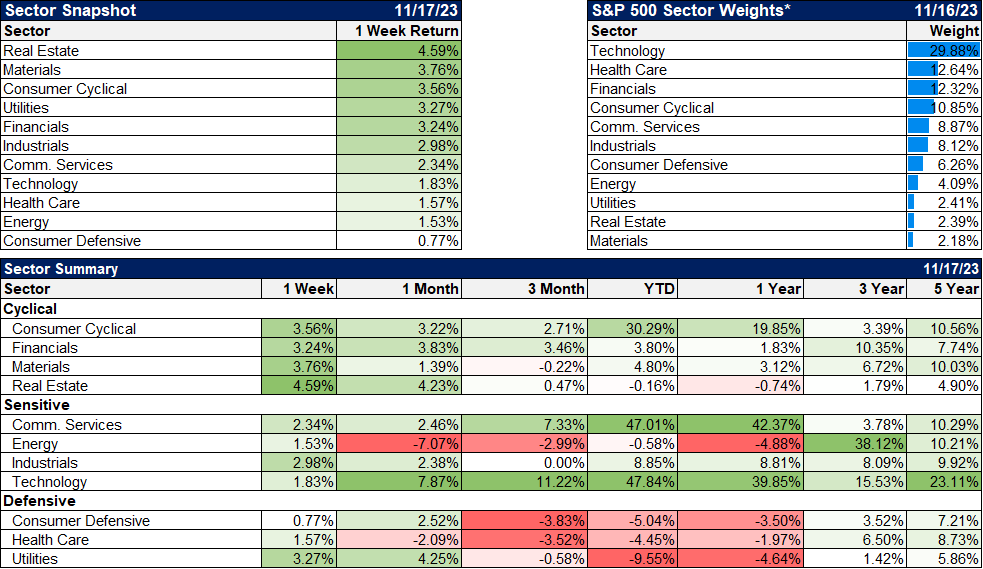

(Click on image to enlarge)

It was a great week for interest rate sensitive sectors from REITs to utilities to financials. Bonds are oversold here though and a countertrend move should be expected so if you want to add to those sectors, patience seems likely to be rewarded.

(Click on image to enlarge)

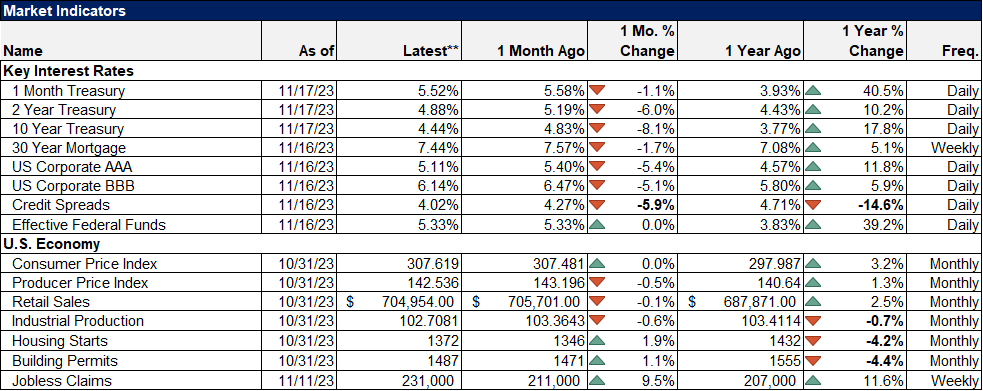

Economics/Market Indicators

The economic data last week was pretty good with the inflation reports center stage. The CPI, PPI, import and export prices all continued to point to moderating inflation. That’s what we have been expecting so it shouldn’t have been a surprise but it apparently caught some off guard. The 10 year rallied 18 basis points with all of that coming in the wake of the CPI report on Monday. I didn’t see much in the other reports of concern; we appear to be growing at about trend for Q4 (around 2%). Of course, we don’t have a lot of Q4 data yet so that could change a lot by the end of the year.

(Click on image to enlarge)

I’ve had a lot of questions recently about the budget deficits and the national debt (I did a video about it which you can see here). I share many of the concerns everyone has about our dysfunctional and profligate federal government. But I am not particularly worried about our ability to finance the debt or even that it will mean higher interest rates. Rapidly growing debt and no plans to get it under control are the proximate reason our credit rating has slid over the last 15 years and that does have a cost. But how much higher are rates because of the credit downgrades? I’ve seen estimates of as much as 40 basis points but that relies on clues from a CDS market that is pretty thinly traded.

But whatever extra we pay in higher interest rates today will pale in comparison to the cost of higher inflation sustained over many years. There are many reasons to believe that our future will include higher inflation from demographics (labor shortage) to a less friendly world to deglobalization to hostility to immigration to excessive government spending. Policies that favor one industry over another, that subsidize one industry while punishing another, will reduce economic growth and increase our political polarization. It is these policies that are most likely to impact the value of the dollar and lead directly to high inflation.

Enjoy the current respite from rapidly rising prices. The inflation rate has come down and that is reason to celebrate – for now. I don’t know how long this period of moderating price increases will last, but the trend of economic policy is not positive for future inflation and hasn’t been for some time.

More By This Author:

Debt, Deficit, And Interest Expense

Weekly Market Pulse: Dark Matter

COVID-19 & The Economy

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more