Week Ahead: The Market That Refuses To Blink

Image Source: Pexels

There’s something almost supernatural about the calm on Wall Street these days. With Washington locked in yet another budget standoff and the data lights flickering out across the dashboard, the market just keeps gliding forward — like a pilot flying through cloud cover, trusting the instruments even as they start to fail. The S&P 500 sits near record highs, the bulls are still charging, and even a government shutdown can’t seem to stir much panic. But make no mistake — this isn’t a serene sky. It’s a pressure front building. Beneath the surface, traders are starting to question how long this suspension of disbelief can last before someone pulls the wrong lever.

The federal government is officially closed for business, and the first casualty is clarity. No jobs report, no trade data, no inflation prints — the lifeblood of Fed forecasting is missing in action. Economists are now reduced to reading tea leaves, parsing the ADP survey (which printed an ugly 32,000 decline in September), and cross-referencing the Fed’s Beige Book anecdotes like medieval scholars trying to divine omens from the stars.

The irony is thick: markets claim to crave data, but when it’s gone, they simply trade on hope. “No news is good news” has become the mantra — a logic that only holds until the next shock. In this vacuum, the shutdown paradoxically tightens the feedback loop. The Fed will be flying blind into October, relying on stale prints and anecdotals. A 25bp rate cut is already priced for the next meeting, and a second one by year-end. But what happens beyond that — into 2026 — depends on whether the data void feeds complacency or confusion.

The calendar, at least, is on the bulls’ side. The fourth quarter has long been their hunting ground, with average S&P 500 gains of nearly 3% and the highest frequency of positive returns of any quarter since 1928. That’s not just seasonality — it’s behavioural muscle memory.

Despite the lack of data, market internals still point to resilience. Analysts now expect S&P 500 earnings to grow 8.8% year-on-year in Q3, up from 8% forecasted just a few months ago. It’s a reminder that as much as politics grabs the headlines, profits still write the story. The market’s message is simple: growth may be uneven, but it’s not gone. The corporate machine keeps humming, and that alone gives traders permission to stay long risk. The bulls’ logic — twisted as it sounds — is that the absence of tier one news is itself bullish. Without new Tier One data, the burden of proof shifts to the stock bears.

The market’s latest waltz feels like a “misheard” nursery rhyme — rickety-dickety dock, the data fell off the clock. Traders are treating bad news as good again, clapping along to the same tired rhythm that’s kept this bull on its feet for the past year. It’s the Pavlovian reflex of modern markets: weakness means easing, easing means liquidity, and liquidity means the party goes on.

There’s also an underlying sense that the Fed has already done enough. Two more cuts are widely expected before year-end, and with labor data showing mild weakness, the market sees these as insurance cuts — not panic moves. That gives equities a “Goldilocks” narrative to cling to: a soft-landing story that still feels intact, even if the plane’s instruments have gone dark.

Still, not all is as tranquil as it seems. The absence of government data means private surveys and sentiment gauges like the University of Michigan index will take on exaggerated importance. The Beige Book anecdotes will be treated like holy scripture, and every corporate earnings call will double as an economic briefing. Levi Strauss and Delta Air Lines report this week — two bellwether names that will act as early thermometers for consumption and travel trends. With data paralysis in Washington, it’s up to Main Street to tell Wall Street what’s real.

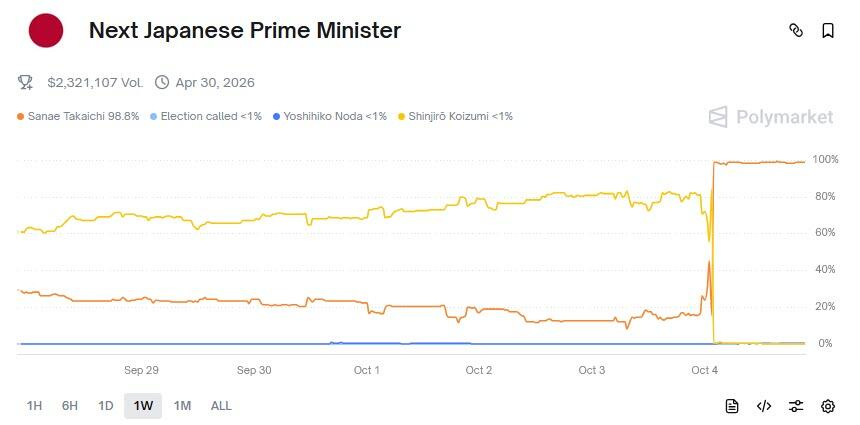

Meanwhile, the policy fog thickens abroad. Japan is preparing for its own political reboot as Sanae Takaichi, a hardline conservative and staunch China hawk, becomes the country’s first female prime minister. Her ascent — unexpected by everyone— is shaking up Tokyo’s corridors of power and injecting fresh energy into the yen trade.

“Virtually no one—including media, political analysts, opposition parties, and even LDP insiders—had expected this result” - Goldman Sachs

And

The First time Polymarket Bettors Have Been Dead Wrong

(Click on image to enlarge)

The market is already sniffing a familiar script: a reflationary fiscal push, a patient central bank, and a weaker currency. Traders are betting that under Takaichi’s watch, the Bank of Japan will slow its normalization path, sending USD/JPY gliding toward 150 — perhaps even through it. A weaker yen would buoy Nikkei futures but could rekindle old diplomatic tensions with Washington, especially if Trump uses his October Asia visit to revive FX revaluation rhetoric.

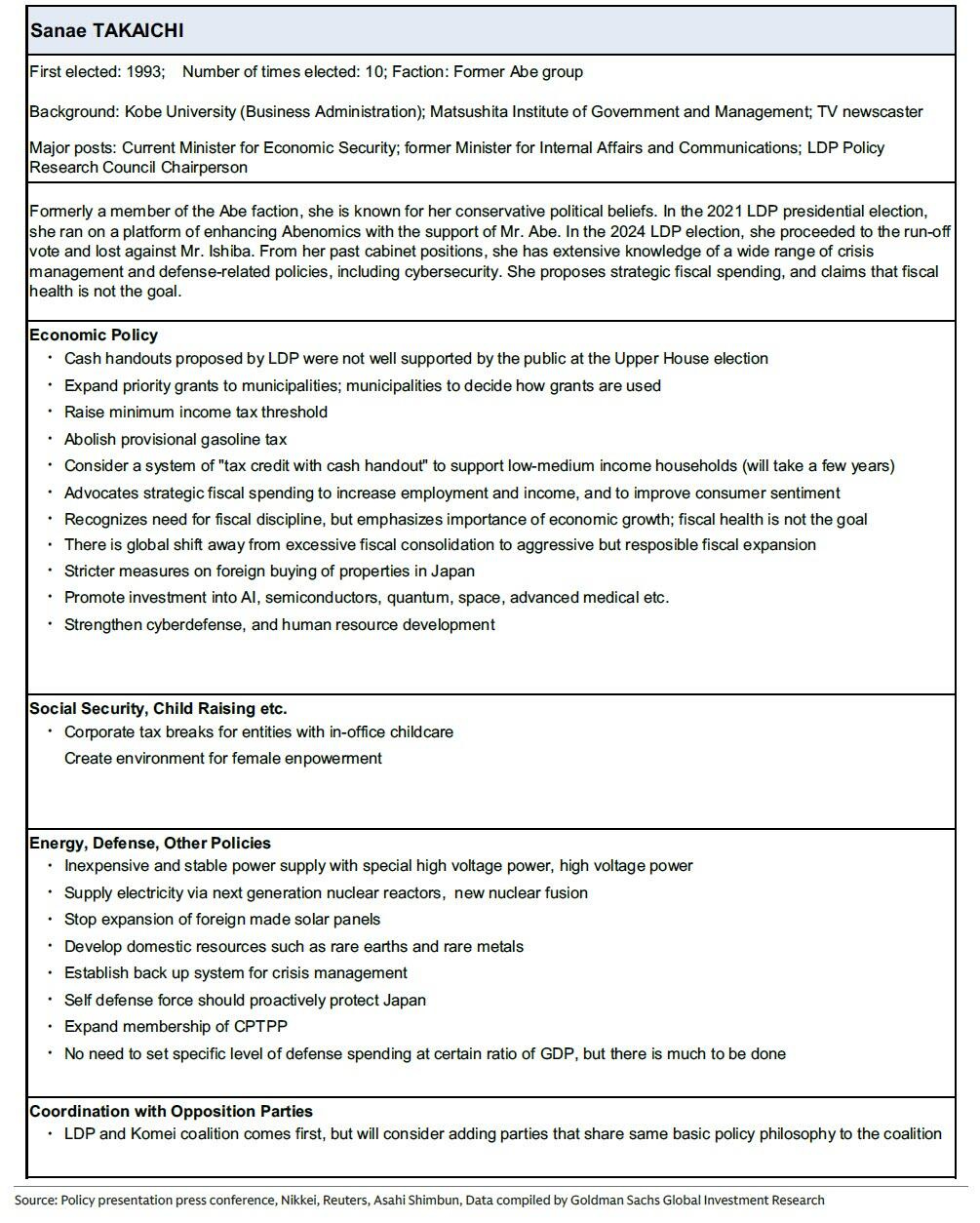

Goldman Sachs Takaichi Cheat Sheet

(Click on image to enlarge)

The energy markets, too, are performing their own version of political theater. The real story isn’t the headline quota — it’s the delivery. OPEC+ keeps promising staged increases as it unwinds its production cuts, but since April, only about three-quarters of those barrels have actually materialized. The rest exist purely in press releases. The cartel’s problem is structural: Nigeria, Angola, and Iraq are still stuck repaying their past overproduction through “compensation cuts,” while most others are pumping flat-out. Only Saudi Arabia and the UAE have genuine spare capacity left, and even they are treading carefully, unwilling to flood the market and crater prices they’ve spent a year defending.

That’s why each new quota announcement has begun to feel more like market theater than supply policy. The headlines scream “OPEC to boost output,” but the physical flows rarely change. Traders know the difference, but they still have to price the illusion. Every leak out of Vienna sends algo desks chasing shadows — Reuters reports a glut-in-the-making, OPEC counters to protect the narrative, and prices whip around in a tug-of-war between expectation and evidence. In that sense, the oil market now mirrors Washington’s own dysfunction — an elaborate stage show where policy pronouncements move faster than reality. On paper, OPEC+ could easily announce another big hike; in practice, the barrels may never show up. It leaves traders in the same bind equity investors face with the U.S. shutdown — navigating a hall of mirrors where perception, rather than fundamentals, drives the tape. And just like the S&P 500’s unblinking march through political fog, crude prices continue to drift on faith rather than flow, sustained by the belief that someone, somewhere, still has control of the wheel.

Put it all together, and the market resembles a poker table at 2 a.m. — everyone knows the deck is getting thinner, but no one wants to fold while the chips are still moving. Washington’s shutdown drama may dominate headlines, but the real story is the market’s faith in its own inertia. It’s not that traders believe the risks aren’t real — it’s that they believe they can manage them. For now, the tape continues to levitate on muscle memory, AI exuberance, and the oldest instinct in markets: the fear of missing out.

The question isn’t whether the storm clouds are forming — they are. It’s whether anyone still remembers what real volatility feels like.

More By This Author:

The Return Of The Iron Lady: Markets Read Japan’s Political Tea Leaves

The Weekender: AI’s Conveyor, Gold’s Anchor

Shutdown Theater, Market Masquerade