The Weekender: AI’s Conveyor, Gold’s Anchor

Image Source: Pixabay

The Show That Never Ends

It was a week the markets marched on like a caravan in the desert—unmoved by shifting sands of politics, guided instead by a mirage of AI-fueled optimism and the glitter of gold in the distance. Equity traders barely flinched at the U.S. government shutdown, shrugging off Washington’s theatre even as it blinded the usual BLS navigational stars. Instead, they followed the siren song of technology, and when in doubt, clutched the timeless hedge of gold.

More telling is the rhythm: 114 sessions without a 5% pullback, a one-way march higher that feels less like a stock market and more like a conveyor belt—endlessly moving forward, powered by AI. Or, to borrow from Emerson, Lake & Palmer, “Welcome back my friends to the show that never ends.”. Every deal, every partnership, every capex promise is taken as fresh oxygen, and the tape inhales greedily. It’s reminiscent of prior booms—such as railroads, dot-coms, and smartphones—where enthusiasm for the future raced well ahead of what the present could deliver.

Yet beneath the surface, the Fed and macro purists are flying blind. The shutdown has left policymakers and traders without the usual maps: no NFP, no reliable BLS compass. What they do have is noise. ADP flashed a 32,000-job loss—its worst in over two years—sending shivers through the macro crowd, but private alternatives like Revelio Labs told a very different story, suggesting a gain of 60,000. This tug-of-war between data sets is no mere sideshow; it shapes the narrative of whether the Fed is cutting rates into a manageable slowdown or stumbling into a possible recession. For now, the balance tips in favour of the former. The labour market is cooling, but not collapsing, and that alone is enough for traders to maintain faith in the “insurance cut” narrative.

Meanwhile, volatility has drained from every corner of the market, with the VIX receding as if investors believe the script is already written: slower growth, easier policy, AI as a growth driver, and gold as a safety net. Gold has surged more than 40% this year, its third straight double-digit gain, and sits on track for $4,000 by mid-2026 if Goldman’s arithmetic holds. Its bid is split between conviction buyers—central banks, ETFs, speculators—whose steady flows act like a rudder, and opportunistic households in emerging markets who step in at perceived bargains, setting the floor and ceiling. Every 100 tonnes bought pushes the price nearly 2% higher, a mechanical translation of belief into price.

So, where does this leave us? In a market that is both euphoric and oddly fragile. The AI boom has made equities feel invincible, but it also risks becoming the only story that matters, blinding traders to every other signal. Gold, on the other hand, is telling a different story: that hedging against uncertainty still commands a premium, and that behind the AI headlines lurks an uncomfortable truth—the Fed is navigating without traditional instruments, and traders are relying on autopilot.

The Weekender closes with a paradox. Equities are riding the momentum that feels unstoppable, even as the economic instruments flicker unreliably. Gold glitters brighter with each data delay, and the Fed watches an economy running near 4% growth with little job creation, scratching its head in the dark. For now, the market doesn’t care. Ain’t nothing going on but AI—and the quiet, steady hum of gold beneath it.

The Dollar Pauses, Traders Drift Toward the AI Parade

The FX market right now feels like a deserted carnival after the lights have been shut off—empty rides swaying in the wind, ticket booths unmanned, traders wandering with nothing to do but watch another show across town. That show, of course, is the AI spectacle. Even in the land of currencies, where yield spreads, carry trades, and data beats usually call the tune, the orchestra has gone quiet. Instead, traders are glued to the neon glow of megacap tech, where AI is the only headline in town.

Volatility—the lifeblood of FX desks—is draining away like a river dammed upstream. With the U.S. government shuttered and critical data like nonfarm payrolls delayed, markets are trading half-blind, deprived of their usual compass points. Interest-rate volatility, the grand conductor that normally sets the tempo across asset classes, has taken a holiday. Rates traders are convinced the Fed will slip in a couple more cuts this year and another half-point in 2026, and with that conviction comes calm seas. For FX, that means traders default to the only reliable trade left: carry.

The Turkish lira remains the favorite ride at this carnival of calm, a high-yield roller coaster that investors still line up for despite its creaks. Egypt’s pound is also pulling in thrill seekers—so much so that even after a 100bp cut, it’s still climbing the hill. Hungary’s forint keeps drawing carry tourists too, with inflows humming as long as volatility stays flatlined. When the lights go out, yield is all that matters.

Meanwhile, the DXY has stalled near 97.80, the equivalent of a boxer frozen mid-ring, waiting for the bell to sound. The ISM nudged the dollar weaker, but no one’s betting it’ll be a knockout blow without. Even the Fed’s speaking circuit, from John Williams to Miran the uber-dove, felt more like a chamber recital than a symphony—background music to the real headline act.

Across the Pacific, the yen remains the one currency that could break this monotony. Japan’s LDP leadership race could crown Takaichi, who tilts more yen-bearish than Koizumi, but under the surface, the market still thinks the yen is too cheap.

With roughly a 60% chance of a BoJ hike already priced, the LDP leadership result will likely push those odds sharply higher toward 80% or slash them closer to 30%. Either way, that sets the stage for some real chop at the Monday Wellington open. But let’s be honest: most retail traders won’t get near that action. Unless you’ve got institutional access, you’ll be stuck on the sidelines until the retail shops flip their lights on around 5 PM EST — by then, you’re trading the leftovers, not the feast.

So, the weekend plot twists: OPEC+ and their chess game with supply, and Japan’s political shuffle. The Saudis may attempt to flood the market, reclaiming market share with increased output. Lower oil is almost always a thorn in the dollar’s side, but the real question is whether traders will treat OPEC’s barrels as paper or cargoes.

Hovering over all this, however, is Sam Altman and the machine he’s built. OpenAI, valued at $500 billion, has become the lodestar of global capital. The irony is rich: FX traders, the original “macro futurists,” are now stuck watching the AI rocket ship blast off without them. Instead of parsing sticky inflation versus softening labor markets, they’re watching the birth of another trillion-dollar tech colossus.

So here we are: currencies pacing in the hallway, waiting for the data doors to reopen, while the AI parade roars outside. Traders can’t trade what isn’t moving, so they’ve joined the crowd. Ain’t nothing going on but AI—and until the tape finds fresh volatility, that’s the only show worth watching.

Trader View: Don’t Fight it Yet

The market feels like a run-first football team, pounding the ball up the middle in slow, grinding drives—no trick plays, no long bombs, just relentless yardage that keeps the bears on defense and chained to their own goal line After another week of global gains, the bulls remain firmly in control, and the message on the tape is simple: don’t fight it yet. Not willing to fight it—at least, not now.

Equities across regions continue to march higher in a “ smashmouth offence ” style. The S&P grinds to fresh peaks, the Eurostoxx 50 has broken through its first-quarter ceiling on surging volume, and Asia has delivered clean breakouts in the KOSPI and Nikkei. This isn’t a rally confined to a single theater; it’s global, with both developed and emerging markets pulling their weight. For all the challenges around tariffs, politics, or data droughts, the bulls clearly still hold the high ground.

The composition of this surge might puzzle some—low-quality names are taking their share of leadership, and it has been six months since we’ve seen a serious selloff—but it’s not especially mysterious. Rates are being cut, GDP is tracking near 3.8%, financial conditions are supportive, and equities are basking at the highs. Markets rarely need a more complex recipe.

At the macro level, growth resilience is the foundation stone. The Atlanta Fed’s tracker has Q3 GDP humming at 3.8%, and surprise indices are breaking out to highs not seen since January. This is the sort of durability that defies hand-wringing recession talk. Tariff shocks, like the earlier monetary shocks of 2022–23, have landed unevenly, but not with the uniform recessionary signatures that usually herald a downturn. Each month without those signals edges the downside narrative closer to expiration.

Despite some paring back of implied cuts, the market has barely blinked. Real yields may be off the lows, yet secular growth names carry on unfazed. October’s policy meeting is essentially running on autopilot, and equities seem to know it. That, in itself, is revealing: the tape is less concerned with the micro-ticks of Fed guidance than with the larger fact that policy is easing against a backdrop of solid growth.

Quarter-end typically means supply pressure, and buybacks should have been quieter in recent weeks. Yet the S&P never buckled. Long-only funds have stepped back into the bid, retail inflows remain steady, and the options market has been a frenzy—call volumes exploding in a way that drives the “spot up, vol up” feedback loop. Even when it looks like the tank is low, new demand refills it.

The speculative corners of tech continue to rip. The basket of non-profitable tech names is up another 7% this week, more than doubling since April. It’s the kind of move that makes collars feel tight, but not tight enough to fight against. Add to this the constant drumbeat of AI headlines—SK Hynix, Samsung, Oracle, Nebius cloud, and the Stargate project—and you get a sense of insatiable demand chasing scarce supply. Whether this ends with overcapacity or write-downs will take time to know, but for now the market is banking on an accelerating revenue cycle.

As the Nikkei sits on dead highs heading into elections, old market hands can’t help but remember Koizumi père and the boom years of Japanese bank stocks in the early 2000s. The backdrop may be different today, but the echoes of past surges remind us how quickly confidence and capital can pile in once Japan starts trending.

Nearly two-thirds of SPX options volume is now in same-day (0DTE) contracts. In 2025, these have become more than speculative toys; they’re part of the professional risk-management arsenal. Traders are arming themselves with gamma slingshots to hedge exposures or amplify momentum, and liquidity is ample. It changes how markets digest news—instant hedging, instant speculation, instant reversals.

Investor sentiment has surged to highs not seen since last December, and optimism is now threaded through nearly every asset class. AI remains the gravitational force, with positioning in the Mag 7 stretched to its most extreme since mid-2024. Infrastructure names are still the preferred way to play the theme, while robotics and quantum remain second-tier trades. Momentum itself has converged with AI—meaning the two flows feed each other, amplifying the upside but also planting the seeds for sharper reversals.

High valuations? Forgotten. Talk of bubbles? Muted. The cost of being on the sidelines outweighs fear of froth. Long-only demand is climbing, retail inflows are sticky, and net-long positioning in both developed and emerging market equities sits at multi-year highs. The whole setup has the same texture as 2017: low vol, turbocharged momentum, and no obvious catalyst to stop it. Which, ironically, is what raises the risk of sudden unwinds.

Not every chart is breaking out. The middle-income consumer basket has been stuck in the mud for five months. Housing affordability is a growing crisis—the price-to-income ratio has blown past the 2000s peak, mortgage burdens are historically high, and rent-to-income ratios are at levels not seen since 1980. Constraints are structural: restrictive zoning, dwindling urban land, and declining construction productivity. Even well-meaning reforms have historically delivered only incremental relief.

This imbalance sits as a counterweight to the euphoria. It’s the reminder that, for all the AI glitter and index breakouts, large parts of the real economy remain shackled. That divergence—between market exuberance and consumer strain—could yet become a narrative fulcrum in 2026.

So where does it leave us? With a market that keeps climbing walls of worry, where every pullback is bought, where AI fever eclipses macro gloom, and where even weak data is explained away as noise. The tape is telling traders not to resist, not yet.

But it is also a market where momentum and positioning are stretched, where volatility is too cheap, where consumer affordability is flashing red, and where the very resilience that powers this rally could also fuel its eventual unraveling.

For now, the path of least resistance is still up. The bulls own the high ground, the Fed is easing, AI demand is insatiable, and money continues to flow. You may not love the complexion of the rally, and you may doubt its duration, but the discipline is the same: don’t fight it—at least, not yet.

China’s War on Involution: When the Factory Floor Turns on Itself

China’s economy has long been an engine that roared louder than any other, but recently that engine has been stuck in a feedback loop—revving without traction, producing more and more output while profitability spins out. That cycle, known in Mandarin as nei juan—or involution—has become the defining buzzword of 2025. It’s the paradox of an economy eating itself alive through cutthroat competition: factories producing beyond demand, companies slashing prices until the floor caves in, and industries locked in battles where everyone loses.

The fallout has been brutal. The GDP deflator contracted 1.2% year-on-year in Q2, the ninth consecutive drop, signaling broad economy-wide price declines. That isn’t just a deflator print—it’s a flashing red warning that corporate profits, government tax coffers, and labor incomes are all being bled by deflationary pressures. Involution has moved beyond an abstract phrase; it has become a structural headwind.

Enter Beijing’s anti-involution campaign, a rare and deliberate attempt to slam the brakes on excess. But unlike prior supply-side reforms that targeted old economy steel mills and coal mines dominated by state-owned enterprises, this campaign zeroes in on the “new economy”: EVs, solar, e-commerce, semiconductors—the very sectors China has promoted as pillars of its independence from foreign technology. And unlike the blunt force supply cuts of 2015, this approach leans more on discipline than demolition.

So far, the toolkit has been mostly rhetoric, asking companies to show restraint on output and pricing. The one substantive legal shift has been the October 1st amendment to the Anti-Unfair Competition Law, effectively outlawing price wars. Think of it as Beijing trying to referee a knife fight by declaring knives illegal—an ambitious rule when every player is already cut and bleeding.

The contradiction is stark. Xi’s doctrine of “new quality productive forces” emphasizes technological self-reliance, but those same green and tech industries are precisely where the most intense overcapacity is unfolding. Worse, they are dominated by privately held firms, not state champions. The state can order a coal mine to idle, but telling dozens of aggressive EV startups to stop undercutting each other is a different beast altogether.

There may be faint signs the effort is gaining traction. Industrial profits jumped 20.4% in August, though largely on a low base (-17.8% last year). Year-to-date, profits are up only 0.9%. Fixed asset investment in manufacturing fell 2.1% in July and August, a sharp reversal from +9.3% in Q1. At first glance, that looks like the campaign is biting, but zoom in and the picture muddies: the auto sector, ground zero for price wars, still posted robust investment growth of +14.2%. That suggests confidence hasn’t cracked, and involution remains alive and well.

The most reliable barometer may ultimately be producer prices. The PPI for all industrial products fell 2.9% in August, a stark reminder that inventories remain heavy and pricing power weak. If the campaign succeeds, PPI should stabilize and turn higher, signaling that excess capacity is being reined in. Until then, China’s anti-involution drive looks less like a clean reform effort and more like a high-wire act—an attempt to restore discipline in industries where survival instincts have already taken hold.

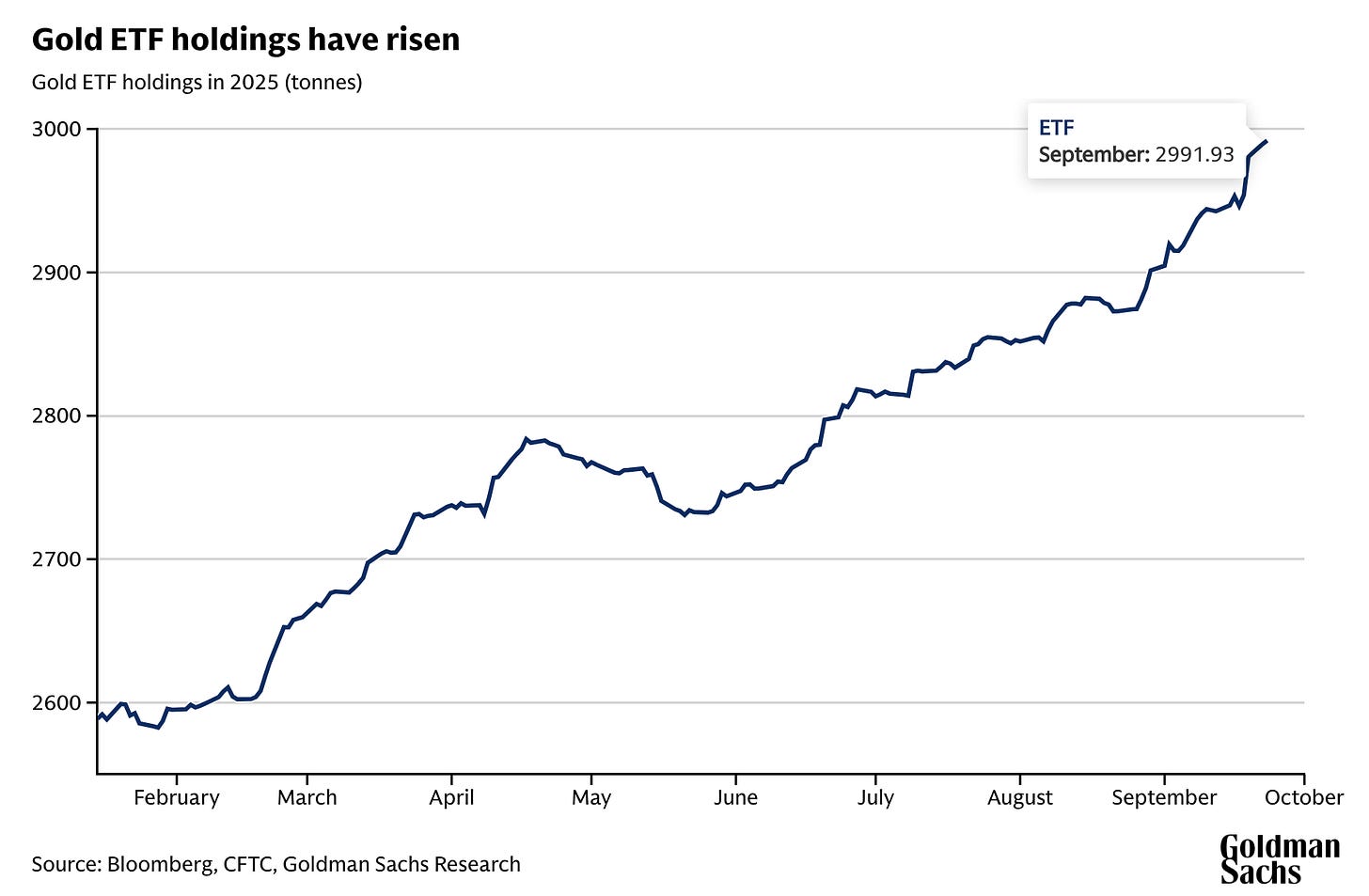

Chart of the Week: Gold Forecast to Break Record Highs

Goldman Sachs Research is now calling for bullion to stretch another leg higher, pencilling in a 6% gain through mid-2026. In their latest note (Sept. 24), analyst Lina Thomas points out that fresh demand from central banks and ETF inflows — the same heavy hands that have been driving the tape all year — remain the backbone of this rally.

The numbers tell their own story: gold is already up more than 40% in 2025 and is barreling toward a third straight year of double-digit gains. Goldman’s team sees the metal reaching $4,000 per troy ounce by the middle of next year, built on two structural pillars: official sector demand and a Fed pivot that continues to ease financial conditions. For traders, that’s the script — gold no longer trades just as a hedge; it trades as an asset in its own right, with central banks as the ultimate whale on the bid. However, I think $4,000 might be too conservative a call, given that the market is underpricing some massive tail risk in the European Eastern War Zone.

(Click on image to enlarge)

Goldman Sachs Research breaks down the market into two distinct buyer camps, and the contrast is everything. On one side you’ve got the conviction buyers — the whales who show up regardless of price. Think central banks hoarding reserves, ETF managers adding metal to back their flows, and speculative funds with a thesis that gold belongs higher. These are the players who don’t blink at price action. They buy because it fits their macro map, and their flows dictate the direction of travel. Goldman’s rule of thumb: every 100 tonnes of net purchases from these conviction players adds about 1.7% to the gold price. That’s gravity in motion.

On the other side sit the opportunistic buyers — households across emerging markets, the traditional jewelry demand, and local savers looking for a deal. They’re not chasing charts; they’re bargain hunters and profit-takers. When gold dips, they step in to catch the knife; when it surges, they sell into the rally. They’re the ones who build the floor on the way down and nail the ceiling on the way up.

In other words, conviction buyers draw the long-term lines on the chart, while opportunistic buyers scribble the short-term noise. Together they form the push and pull of the gold market’s heartbeat — structural demand from the top down, tactical flows from the bottom up.

Running Update: Training Harder, Not Smarter

Jake Barraclough, better known as “Ran To Japan” on YouTube, has been ringing in my ears lately. Unlike most YouTube influencers dishing out cookie-cutter advice—ignoring that no two runners are alike—Jake takes a different approach. He’s not the most naturally gifted pro, yet as a Brooks-sponsored marathoner, he’s chasing a sub-2:10 by training the old-school way: harder, not smarter, logging an astonishing 1,000 km a month.

That resonated. I’m not the most gifted recreational runner myself, but his message cut through: maybe the secret isn’t chasing data, Garmin metrics, or training fads. Maybe it’s just putting in the miles, letting the numbers come to you, rather than hunting them down.

So here we are, October. I’ve decided to follow that path—training harder, doubling or even tripling my monthly average this year. My goal is to cover over 200 km this month, which translates to roughly 7 km per day. It doesn’t sound like much compared to Jake’s workload, but for me it’s a meaningful push, especially since my training load these days sits at the lower end of my five-year range.

Four consecutive daily runs are in the books, 40 km + logged, and yes, I’m feeling it today. Still, it’s been good to put together something resembling a long run this week. The only metric I’m keeping a close eye on is heart rate, trying to hover around LT1 n. Everything else? Just miles on the road, day after day.

More By This Author:

Shutdown Theater, Market Masquerade

Shutdown Theater, Melt-Up Reality

Best September In 15 Years — But The Market’s Balance Beam Is Narrow