We Forecast Gold’s High For ’26 At 5546

5546 is our forecast Gold high for 2026. When we set upon such an annual analysis for this year, we admittedly felt a bit snarky in perhaps selecting the year’s high as “the opening tick”, which yesterday (Friday) was 4340. After all, Gold is — at present — overvalued. But it did trade well up early in the session to as high as 4415 before giving back most of that gain in settling the first trading day of 2026 at 4342.

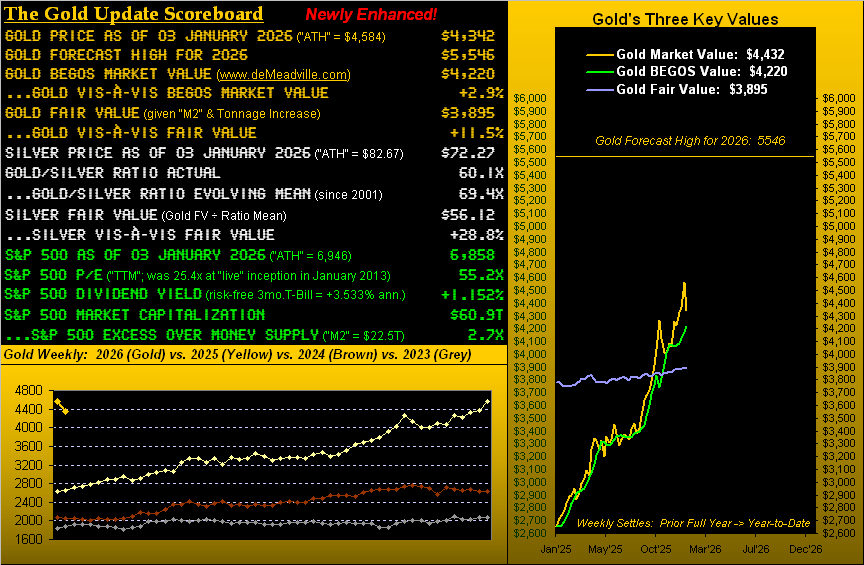

Regardless, per the above newly-enhanced Gold Scoreboard, we peg the price as overvalued both by Fair Value (+11.5%) and BEGOS Market Value (+2.9%). In such respect, the notion of Gold thus opening on what would turn out to be its high for the entire year did have a modicum of plausibility.

However, plausibility is hardly reality. Gold is in play … Big Time! As you regular readers well know, 2025 was the year of the newly minted Gold expert. Much of that upon which we’ve expounded these past 16 years was suddenly discovered by the many perceptive pawns proliferating this ongoing Investing Age of Stoopid. To wit, Gold’s COMEX contract volume in 2025 exceeded 50 million, the largest since 2020’s onset of COVID, which put Gold into panic mode.

Moreover, despite Gold’s overvaluation by both Fair Value and BEGOS, the price’s trend has not only been up, but on balance soaring. In settling 2025 at 4332, Gold’s 2625-4584 low-to-high range for the year was a percentage span of +74.7%, far and away the broadest of the 25-year century-to-date; (second-most was 2009’s +53.2% run from 802-1228).

“So mmb, if it’s overvalued, why is your 5546 forecast so much higher than here?”

Squire, the herd push into Gold — and into Silver as well — is sufficiently substantial that ’tis not going to suddenly stop. Further, we have to think that 2026 shall see significant issues to work in Gold’s favour, albeit as a valued re-publisher of The Gold Update recently wrote to us (hat-tip GoldSeek.com): “What a year! If we have another similar year, then we have serious problems taking place…”

For example, geopolitical issues abound (consequential Gold price spikes, short-lived as they may be). But hardly seeing a resolution are RUS/UKR, ISR/PSE and the portending state of PRC/TWN.

“Also, now this morning, USA/VEN and there’s also USA/IRN, huh, mmb?”

To coin a radio phrase, Squire, “The hits just keep on comin’!” and these all are sensitive situations which can swiftly induce higher Gold.

Remember, too, the recent StateSide government “shutdown”? Gold therein did quite well: having settled at 3888 the day before the “shutdown” commenced on 01 October, the price three weeks hence on 20 October had gained +13.1% to a fresh record high at 4398. And now there’s “talk” of another “shutdown” beginning on 31 January. How many more missing metrics for the Economic Barometer would that elicit? Such total actually ticked up yesterday from 36 to 37 upon the U.S. Census Bureau’s not issuing Construction Spending for a third consecutive month. To reprise the late, great football coach Vince Lombardi: “What da hell’s goin’ on out ‘dere?”

‘Course, a currency debasing event axiomatically would pump Gold higher still as Fair Value would accelerate. The U.S. estimated federal spending in 2025 was $7.01T on generated income of $5.23T. Indeed, the federal government’s average two-week spend is essentially the same as a full year’s increase in Gold tonnage, marked-to-market.

As well, our upgraded Scoreboard shows the market capitalization of the S&P 500 as 2.7x greater than the liquid money supply to support it. That wouldn’t end well: “Jeepers, Mabel, the broker gave us more IOUs for our stock sales!” … “Just relax, Beano, the Fed said it’ll make us whole.”

As well as toward Gold 5546, there’s much ado about making the 5000 milestone. So, as overvalued as the yellow metal presently is, let’s repeat that which we herein wrote a week ago toward still higher Gold: “…far be it from us to stand in the way of the ‘bigger fish to fry’ global financial stability concerns…”

“And how did you come up with 5546, mmb?”

‘Twas fairly straightforward, Squire. We merely calculated Gold’s “expected yearly trading range” (on a percentage basis) and — assuming this year that price trades higher than it falls — out popped 5546. Relative to last year (as noted, Gold’s low-to-high range having spanned +74.7%), the math actually suggests less than half that range in 2026, the potential low coming in at 4136, (just in case you’re scoring at home), although a return sub-4000 wouldn’t surprise us a wit.

Now, as this is effectively our month/quarter/year-end edition of The Gold Update, ’tis time to present the attendant graphics, starting with the final BEGOS Markets’ Standings 2025, starring as sterling as ever, Sweet Sister Silver. Her having reached as high as 82.67 was nearly triple her 2024 settle away back at 29.29, en route to closing 2025 at 70.98:

Next to our two-year-over-year views, beginning with Gold’s weekly bars and parabolic trends. Obviously, we cannot rule out the inevitable flip of the blue-dotted Long trend to Short. But for the present, the “flip-to-Short” level is 4080, i.e. below the year’s potential low we just mused on 4136. That noted, barring a swift Gold plunge, we’re about two weeks away from the blue dots accelerating up beyond 4136:

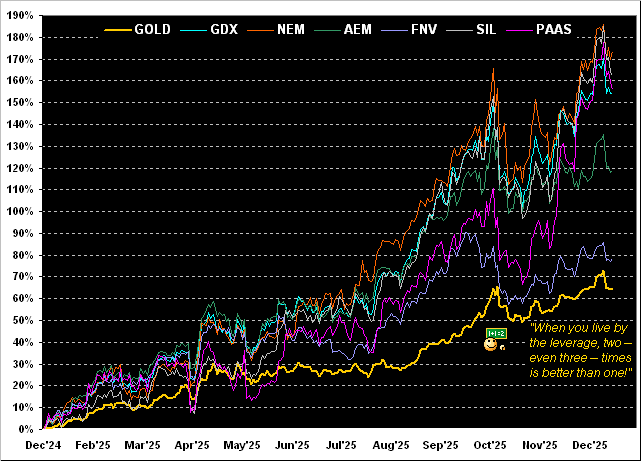

And in the second such view, we present the most noble precious metals equities. The expression “Live by the leverage, die by the leverage” is exemplary in this case. For even as Gold itself year-over-year is now +65%, we’ve Franco-Nevada (FNV) +78%, Agnico Eagle Mines (AEM) +119%, the VanEck Vectors Gold Miners exchange-traded fund (GDX) +154%, Pan American Silver (PAAS) +156%, the Global X Silver Miners exchange-traded fund (SIL) +163%, and Newmont (NEM) +174%. “Wow!” and “Beyond Wow!”

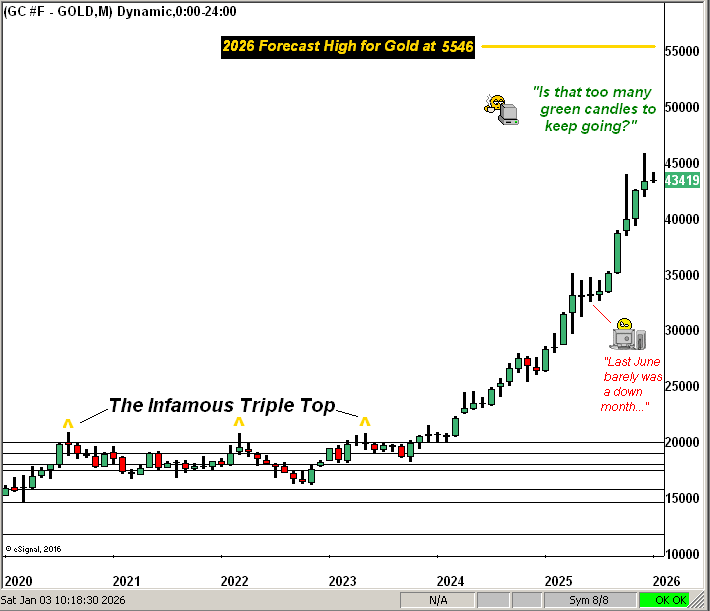

Maintaining the end-of-month tradition, next we’ve Gold’s Structure; however, we’ve reduced the overall time scale from starting in 2010 to instead starting from 2020. All those sedimentary-level names have been removed, although the horizontal lines are still there for reference. But barring the yellow metal breaking below “The Infamous Triple Top” in price’s initial attempts to stay above 2000, we don’t anticipate Gold returning so low. Even last year, the only month in which a candle closed below its open was June. So ’tis fair to say — despite our forecast 5546 — ‘twould be prudent to anticipate a bit of red en route:

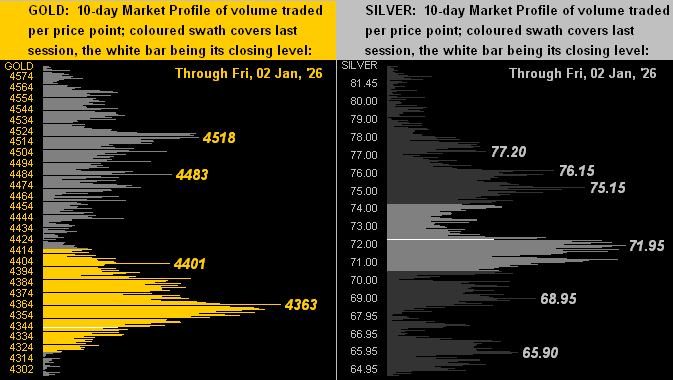

Zooming back in near-term, here are the precious metals’ 10-day Market Profiles for Gold on the left and for Silver on the right. Note that the yellow metal in opening the year has slid below its most volume-dominant support (now resistance) as labelled at 4363. As for the white metal, she’s begun the year in flirting with either side of her dominant 71.95 level:

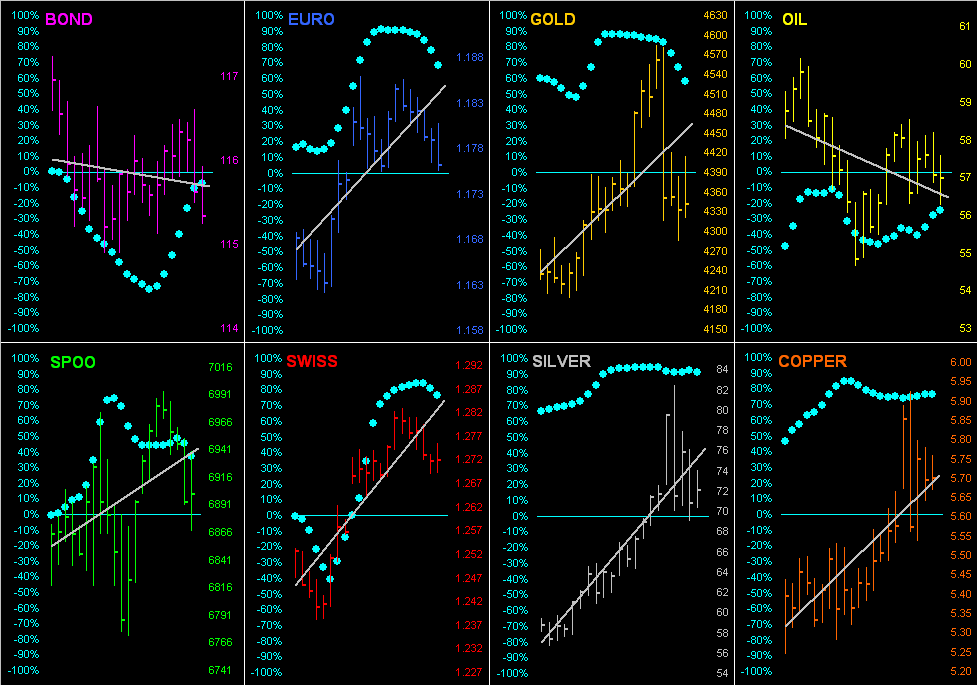

Now to the last 21 trading days (one month) for all eight BEGOS Markets, featuring the baby blue dots of regression trend consistency. Save for the Bond and Oil downtrends, the other six components are positively slanted, albeit the “Baby Blues” for the Euro, Swiss Franc and Gold are all dropping from having been above their key +80% levels, suggestive of lower prices (which already we’ve been seeing); those for Silver and Copper, too, may begin to break down as the ensuing week unfolds:

All of which brings us to the Econ Baro. Just a wee three metrics made it into the Baro this past week … but their respective results were large: the Chicago Purchasing Managers’ Index leapt from 36.6 in November to 43.5 for December; November’s Pending Home Sales improved from a +2.4% gain in October to +3.3%; and Initial Jobless Claims (admittedly for Christmas week) dropped from 215k to 199k. Thus, the Baro remains positively pointed even as rate cuts are expected to be announced:

However, that raises the question of a barrier to Gold 5546: for if the Fed were not to cut… on verra…

In summary, yes, Gold is — for the present– overvalued (and certainly so is Silver … again see the opening Scoreboard). But hardly would we sell here. More prudently, should Gold as the months unfold, break below Fair Value (currently 3895), ’tis an opportunity to buy “mohrrrr….”

Either way, we’ll wrap it here with this observation: if Gold is overvalued, then the S&P 500 is massively so. Per our final 2025 Prescient Commentary from last Wednesday morning, we wrote: “The S&P 500 — which a year ago closed with its ‘live’ P/E at 46.1x — now finds it at 55.1x.” As depicted earlier in the BEGOS Markets’ Standings, the S&P sported a +16.4% gain for 2025; in turn, its Price/Earnings ratio increased (finishing the year at 54.6x) by +18.4%. For you, WestPalmBeachers down there, that means relative to share prices, earnings growth for the Index as a whole wasn’t there! “Whoopsie…”

More By This Author:

Merry MetalsGold Sinks Slightly As Silver Skirts Sixty

Gold’s New Short Trend Shoved Aside; Silver’s Rise To All-Time Highs