Warning Of A Possible Top In Some Commodities

September and October are often down months in the stock market, especially following years of at least a 10-15% positive return. The stronger dollar on worries about COVID-19 again, possible Fed tightening and the situation in Afghanistan are all reasons for caution in multiple markets.

Many folks are asking me if gold (GLD) or silver (SLV) is a good hedge if the stock market goes into the tank. I personally do not think that any major rally in gold prices will ensue anytime soon.

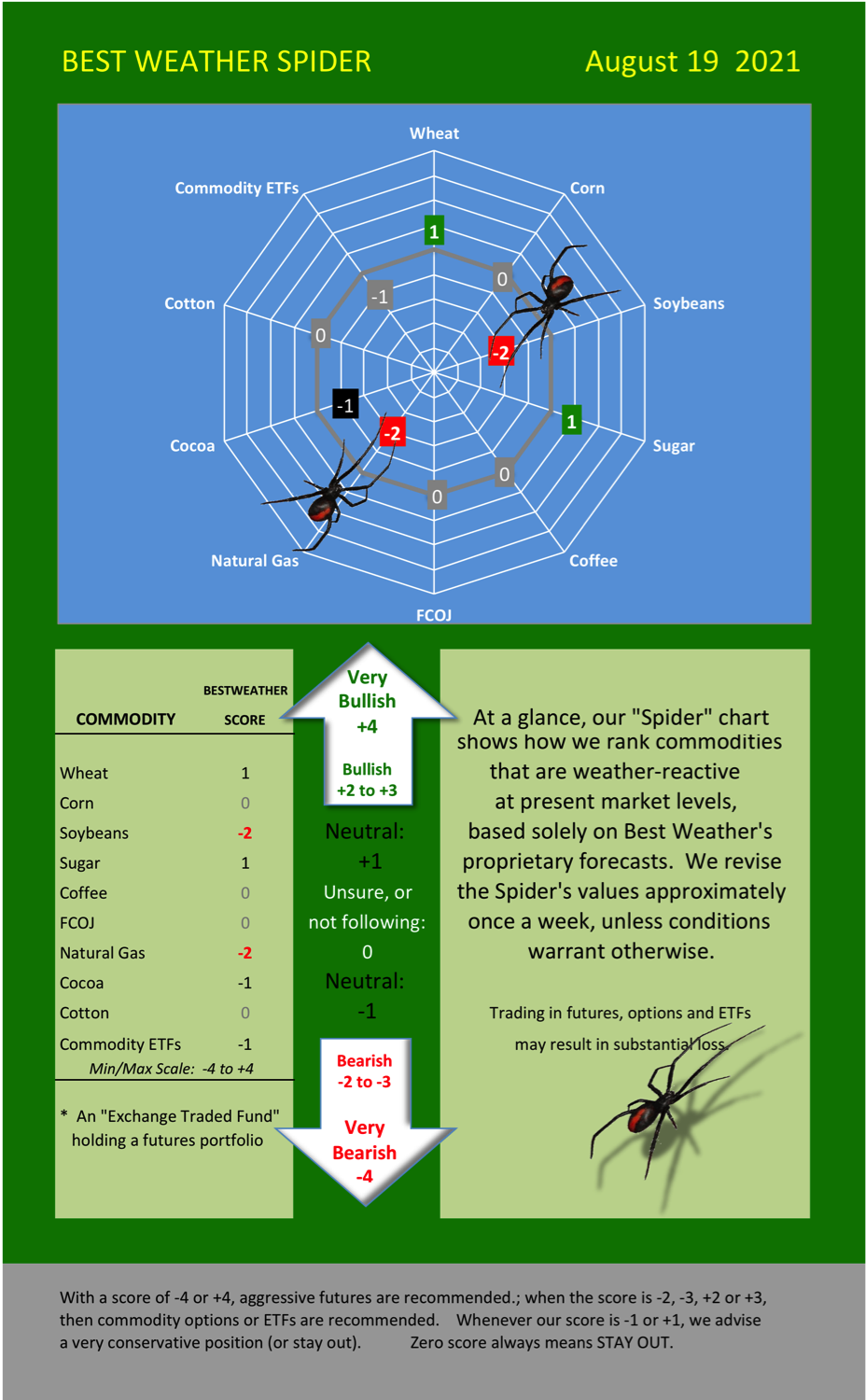

I focus mostly on agricultural and weather-related energy commodities, such as natural gas (UNG). Following my bullish attitude all summer long in natural gas on extreme U.S. heat and strong LNG exports. I became bearish this market last week above $4.00. The spider below show this and how my bullish attitude in several markets has been tamed

My Best Weather spider and some excerpts from my most recent newsletter are discussed below.

In the case of natural gas, for example, unless we have a major Gulf Coast hurricane and or extreme hot late summer weather, natural gas prices often fall. See the comment I recently made before the price collapse in natural gas based on the negative Arctic Oscillation Index (AO) and some cooler risks heading deeper into August. However, selling in the hole now is not advised. What will the winter be like? I am doing multiple studies for clients with regards to La Nina Modoki, the historic fires out west, etc.

My Best Weather spider had a +3 wildly bullish scale in spring wheat since late June. However, most recently, we lowered our sentiment to neutral to slightly bullish wheat (+1), since we already had the rally I expected on lower crops in Russia, Canada, and the northern Plains from drought. Another excerpt from my recent newsletter is below.

(BELOW) EXCERPT FROM WEATHER WEALTH NEWSLETTER. WEDNESDAY 8/18

(ABOVE) EXCERPT FROM WEATHER WEALTH NEWSLETTER. WEDNESDAY 8/18

I do not see the drought in Russia easing at all. This could help the wheat (WEAT) market rally again later. The key to the wheat market will also be how planting and crop conditions fare for 2022 and La Nina Modoki will play some interesting tricks on global weather and crop production next year.

One of the biggest weather markets this last year was coffee (JO). We were lucky enough to catch almost the entire move up the last few months, but presently, rains are forecasted for Brazil later this month, and the stronger dollar has created profit-taking. It is important to remember that often in commodities when spec traders are leaning too heavily long or short in a particular market, that prices can often reverse on a dime when fundamentals change.

CONCLUSION:

How does one invest in commodities given the current environment of geopolitical and economic uncertainty? It is important to be nimble, use conservative option strategies and commodity ETFs, which offer much less risk than standard futures? Given La Nina Modoki and many speculators washed out in some commodities, it is possible in the weeks ahead my weather spider will turn more bullish m markets such as wheat, coffee, sugar, and a few others. When the spider is in the +3 to +4 category, one trades futures, when it is +2, options or commodity ETFs and when were are at 0 or a +1 do nothing.

Finally, while my Best Weather Spider only advises in the crude oil market come winter when one can use spreads in the crude complex to trade heating oil, etc., without a new OPEC Agreement and given COVID demand worries and the EU and China making stronger plans to cut carbon emissions, any rally back above $75 in crude the next few months is highly unlikely.

Mr. Roemer offers the only commodity newsletter in the world that teaches expert, novice, and stock/eff traders how the power of weather can help you capitalize in trading agricultural and energy ...

more

Don't we have to be at a top, for this to be a possibility top?

We have been in the top in some commodities, at least for the next few months (such as corn and soybeans, and coffee). Not sure which markets you are referring too

Which ones aren't faring as well?

Grains bearish and possibly coffee and cocoa on changing weather and COVID worries. I suggest going to my website bestweatherinc.com. It could help you and you will find my newsletters interesting. Thank You

Jim