US Stocks Poised For Breakout As PM Complex Takes A Pause

Image Source: Unsplash

While the PM complex pauses to refresh, the US stock markets that have been pausing since the V-bottom low that formed on April 7th are now coming back to life.

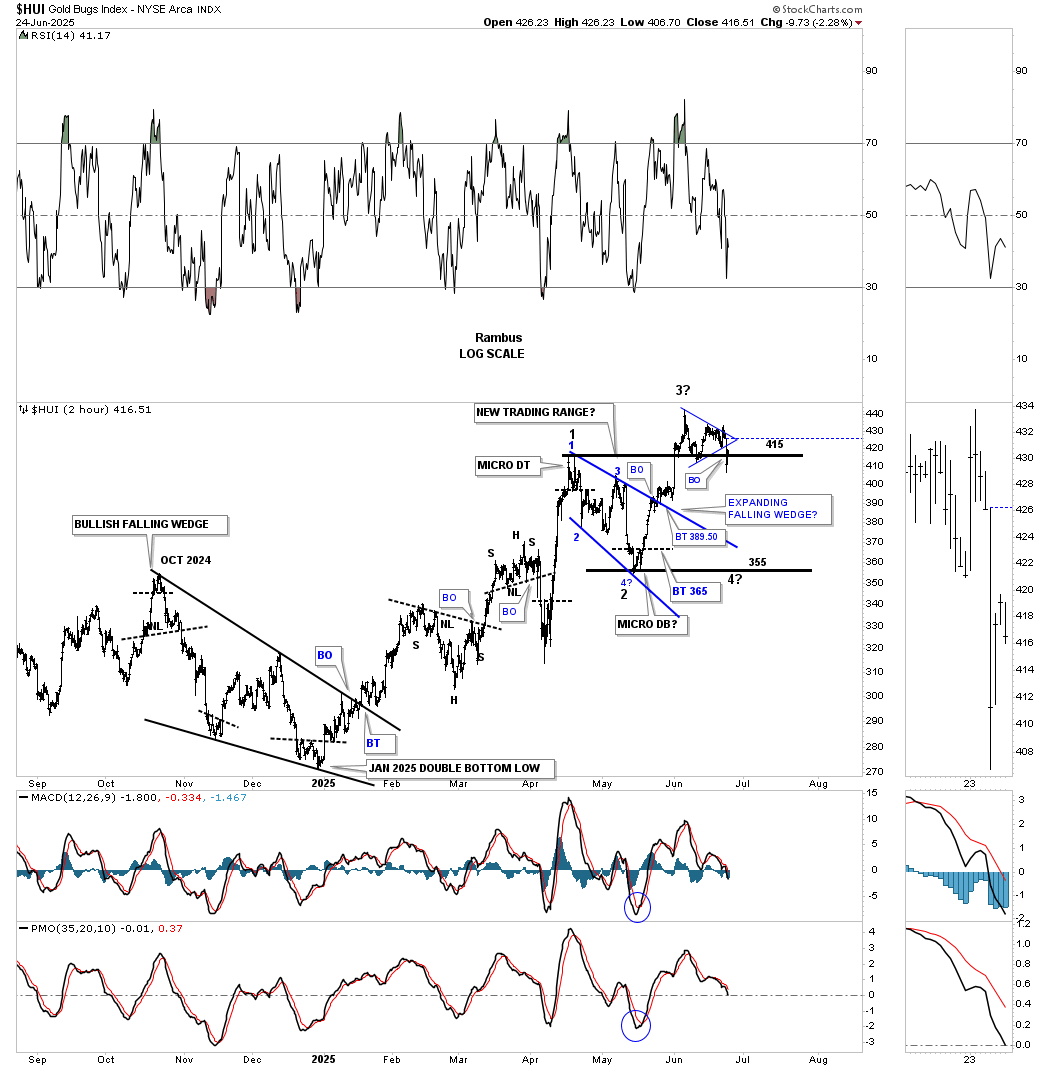

Let’s start with the 2-hour chart for the HUI, which shows the sideways trading range it’s been in since the April 17th high. With the breakout above the high of the blue flag, the price action should have impulsed more strongly to the upside. Today, the 215 area – the top of the possible new trading range – is being tested once again, which is critical that it holds support, or the bigger black trading range will be in play with one more reversal to the downside to put in the all-important 4th reversal point.

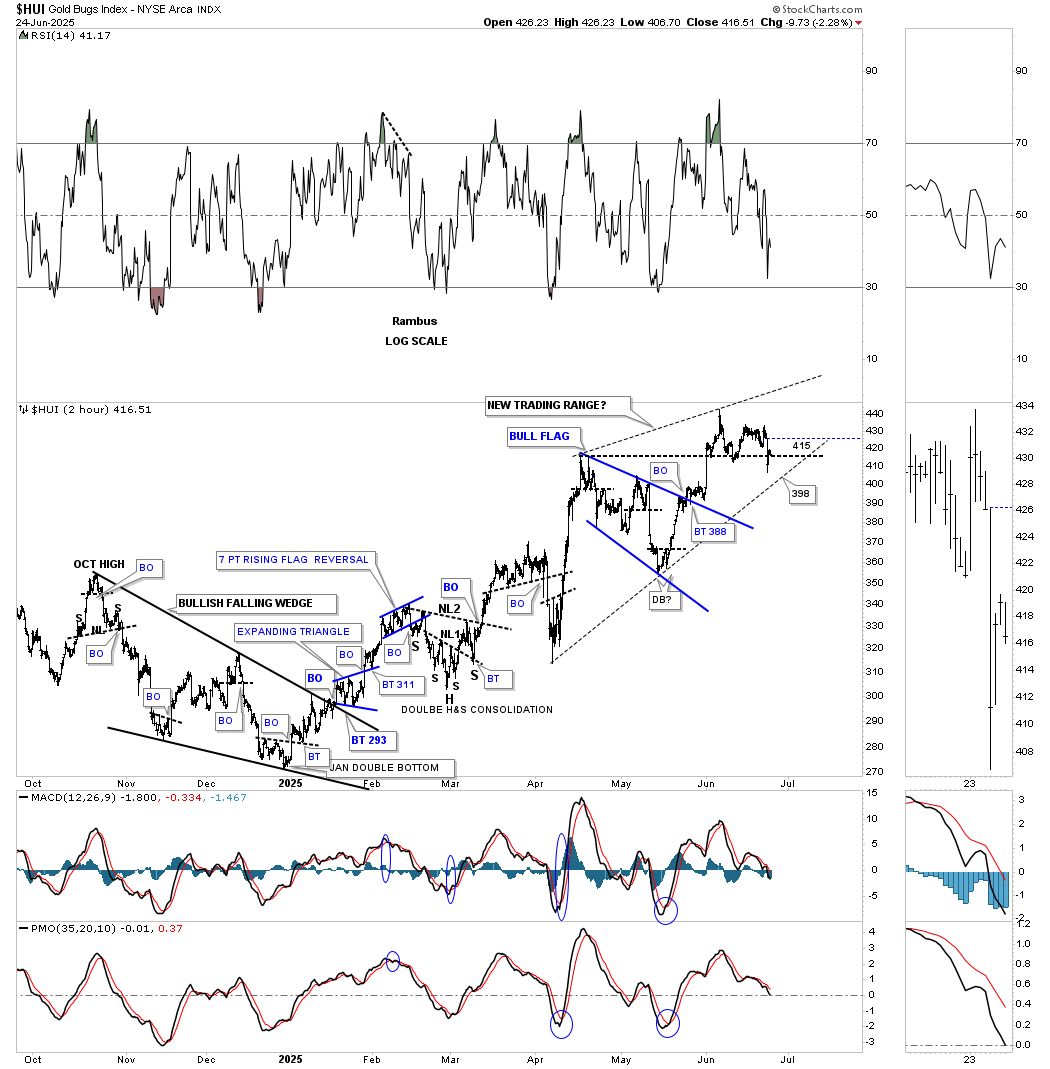

Next is another 2-hour chart that shows a possible small rising wedge if the lower dashed, upward-sloping trendline can hold support.

This is the daily combo chart we’ve been following, which shows the morphing rising wedge. Initially, the upward-sloping dashed line on the HUI showed the top rail of the original rising wedge. As you can see, there was a breakout and then a strong backtest to the original dashed top trendline, which I’ve labeled as reversal point #4. From that low, the HUI moved back up to the original top trendline, where it failed to break through, now labeled as reversal point #5. With the last touch of the top trendline labeled reversal point #5, the rising wedge is complete with four reversal points. The only question is whether we’ll see a 5th and 6th reversal point. What we don’t want to see is a strong breakout below the bottom rail of the October rising wedge.

Today, GLD gapped below its original top trendline, which I suspected may happen as it’s building out its own larger consolidation pattern. SLV, along with a few other indexes, may have completed a small double top, so a backtest to the top trendline may be underway.

More By This Author:

Wednesday Report… A General Update On The MarketsPrecious Metals: Breakout, Backtest, And Bull Run?

Quick Markets Update For Monday, May 19

Disclosure: None. If you'd like more information about the additional free trading education mentioned in ...

more