U.S. Shale Revolution Slows Down: The Start Of A Decline?

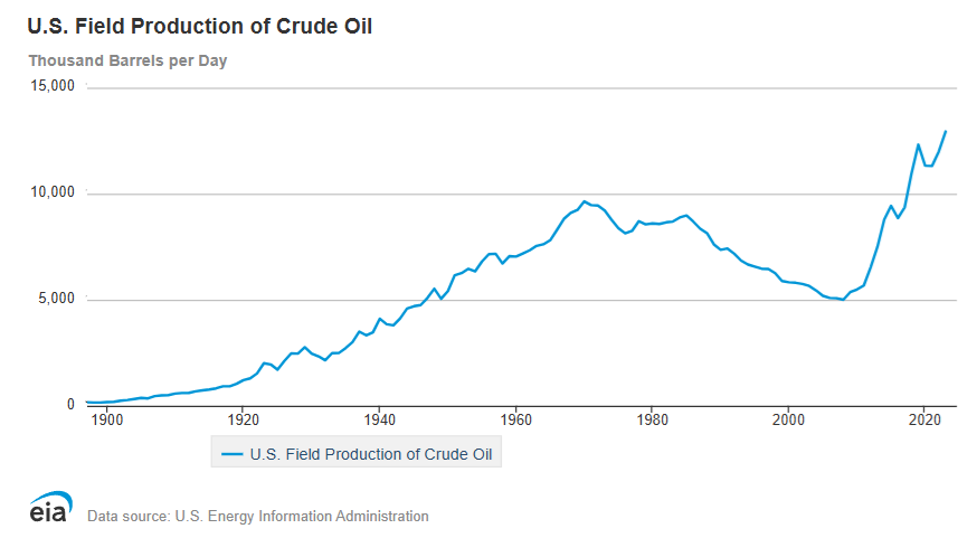

Oil and gas fields, no matter how productive, eventually decline. Before the transformative impact of the shale boom, U.S. oil production had been steadily falling for decades, while natural gas output had plateaued.

The Shale Boom’s Impact on U.S. Production

But the rise of shale drilling changed everything. Beginning in 2006, U.S. natural gas production surged by an impressive 94%, and by 2009, oil production also turned a corner, ultimately soaring by 170%.

U.S. Field Production of Crude Oil. Energy Information Administration

The End of the Surge?

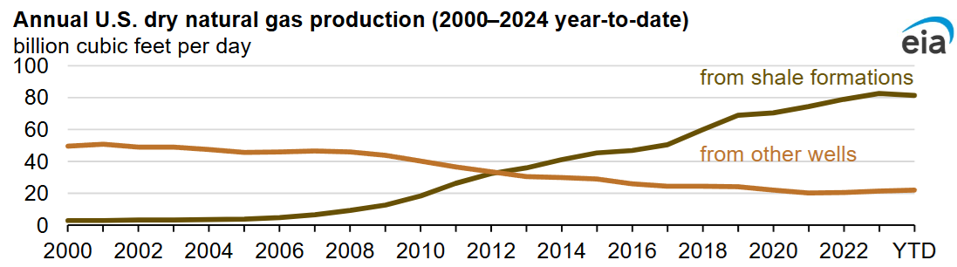

For years, experts have debated how long this shale surge could last. Now, the Energy Information Administration (EIA) has offered a clue: U.S. shale gas production, which accounts for 79% of all dry gas output, dropped slightly in the first nine months of 2024 compared to the previous year. Should this pattern hold, 2024 could mark the first recorded decline in U.S. shale gas production since the EIA began tracking it in 2000.

Annual U.S. Natural Gas Production 2000-2024. Energy Information Administration

Breaking Down the Numbers

Total U.S. shale output dropped by 1% to 81.2 billion cubic feet per day (Bcf/d) from January to September 2024, while other dry gas production increased by 6%, averaging 103.3 Bcf/d overall. The decrease is primarily due to declines in the Haynesville (down 12%) and Utica (down 10%) plays, with only the Permian region showing growth (up 10%).

How Low Prices Are Impacting Production

Falling natural gas prices, which hit record lows in 2024, contributed to production slowdowns, especially in dry gas regions like the Haynesville. Reduced profitability led several operators to shut down wells, and the number of active rigs in the Haynesville, Utica, and Marcellus plays has significantly declined since late 2022.

By September 2024, the Haynesville had only 33 rigs operating—a 53% decrease since January 2023—and the Utica and Marcellus also saw rig count reductions of more than 50% and 36%, respectively.

Fewer Rigs, Lower Output

Higher drilling costs in the Haynesville and Utica, along with reduced demand, have further limited production. In September, Haynesville production was 13.0 Bcf/d, down 14% from its peak in 2023. Meanwhile, the U.S. benchmark Henry Hub natural gas price averaged $2.10 per million British thermal units (MMBtu) in 2024, a 79% drop from 2022’s inflation-adjusted high of $9.39/MMBtu.

What Lies Ahead?

In the latest Short-Term Energy Outlook, the EIA projects that U.S. dry natural gas production will average 103.5 Bcf/d in 2024, a slight decrease from 2023. Looking ahead to 2025, the agency forecasts a modest rebound, with production expected to reach 104.6 Bcf/d.

While the decline in shale production is noteworthy, the potential for future growth remains, contingent on market dynamics and demand.

Conclusion

The shale boom reshaped the U.S. energy industry, but recent declines in production suggest the surge may be slowing. Lower gas prices and a reduced number of active rigs have led to a production dip that raises questions about future growth of U.S. shale.

As production levels stabilize, market watchers will be keen to see how the industry adapts to evolving economic and environmental factors. Whether this is a temporary dip or a sign of a long-term trend, the future of shale gas production will play a crucial role in shaping the U.S. energy market.

More By This Author:

California is Driving Away Its Energy Sector

Is LNG Cleaner Than Coal? A Controversial Study Sparks Debate

Why U.S. Oil Production Is Up 6.5% In 2024

Follow Robert Rapier on Twitter, more