Two Trades To Watch: Gold, FTSE 100 Forecast - Wednesday, Jan. 28

Image Source: Pixabay

Gold rises to another record high as the USD drops ahead of the Fed rate decision

Gold is extending its strong bullish trend, hitting a fresh record high above 5300, supported by a weaker U.S. dollar and ongoing geopolitical tensions. The market is also looking ahead to the Federal Reserve's interest rate decision later today.

The US dollar has fallen to a four-year low, with losses accelerating after President Trump said that he was not concerned about a drop in the USD. His words took the US dollar to its lowest level since February 2022. A weaker dollar is making gold more attractive to investors, particularly those seeking safe havens. Typically, the U.S. dollar is a safe haven, but this hasn't been the case all this year.

Apart from U.S. dollar weakness, ongoing geopolitical tensions are also another factor supporting the gold rally. While President Trump backed off threats to take Greenland and withdrew threats of tariffs on Europe, he has warned that Canada could face 100% tariffs if it signs a trade deal with China. Geopolitical tensions between the US and Iran are also elevated, which is supporting safe-haven flows.

Attention will now turn to the Federal Reserve's interest rate decision later today. The Fed is expected to leave interest rates unchanged at 3.5% to 3.75% after cutting rates at the previous three meetings at the end of last year.

With no cut expected, the focus will be firmly on Federal Reserve chair Jerome Powell's press conference. Any hawkish signals could limit losses in the US dollar and weigh on gold prices. However, a dovish bias could extend gold's rally further.

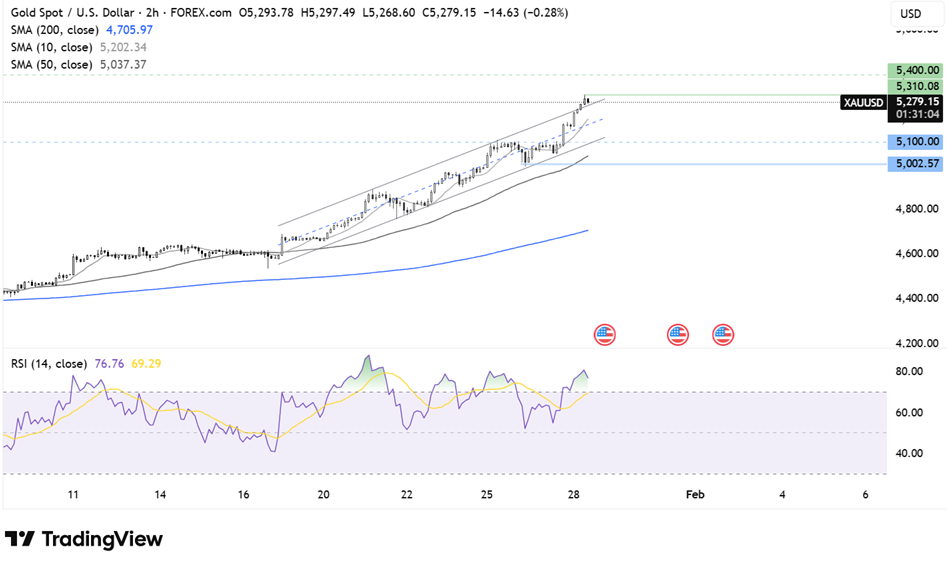

XAU/USD forecast – technical analysis

Gold has traded higher, forming a series of highs and lows. XAU/USD has broken out of its rising channel, extending gains to fresh record highs at 5300. Investors are ignoring deeply overbought conditions, with bulls firmly in control.

With blue skies above, buyers will look to extend gains beyond the 5310 record high towards 5350 and 5400 round numbers.

The price remains at risk of being overstretched. Immediate support at 5270, the upper band of the rising channel, is being tested. Below here, 5200, the 10 SMA comes into focus ahead of 5100.

(Click on image to enlarge)

FTSE 100 slips as pound hits a 4-year high

The FTSE is inching lower, and European shares remain subdued amid a cautious undertone ahead of the Federal Reserve interest rate decision later today and earnings from major tech companies.

Meta, Microsoft, and Tesla will report later today, whilst Apple will report tomorrow.

Precious metal miners, such as Fresnillo and Endeavour, rally as gold prices keep rising amid the plunging dollar. Endeavour is up 4%; Fresnillo is increasing 2%. Broader miners are also advancing, with Anglo American up 3%, tracking gains in industrial metals.

Energy stocks are pushing higher, with Shell and BP gaining over 1% amid rising oil prices, as increased tensions between the US and Iran raise supply concerns.

However, U.S. dollar weakness also pushed the pound to levels not seen since September 2021, above 1.37. The stronger pound puts a dampener on the FTSE 100, as it puts pressure on multinationals' overseas earnings, which make up 80% of the index.

Burberry is experiencing a notable decline after results from the French luxury group LVHM.

The UK economic calendar is quiet. Attention will turn to the Fed rate decision and US earnings, which could influence broader risk sentiment.

FTSE 100 forecast – technical analysis

On the 4-hour chart, the FTSE trades above its rising trendline dating back to late December last year. The price reached a record high of 10,250 before easing to 10,050, finding support on the trendline. While the price has recorded higher lows from here, it has failed to make a higher high, running into resistance at 10,225. Momentum is fading as the RSI points lower.

Support is being tested at 10,170, the 50 SMA below here, 10,155. The rising trendline support comes into focus. A break below 10,050, the January 20 low, creates a lower low.

Should momentum recover, buyers will look to extend gains above 10,225 to bring 10,255 and fresh record highs into focus.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: USD/JPY, DAX Forecast - Tuesday, Jan. 27

Weekly Equities Outlook: Tesla, Microsoft, Apple

Two Trades To Watch: DAX, USD/JPY Forecast - Thursday, Jan. 22

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more