Two Trades To Watch: USD/JPY, DAX Forecast - Tuesday, Jan. 27

Image Source: Pexels

USD/JPY inches higher as yen strengthening lacks follow-through, Fed 2-day meeting begins

USD/JPY is edging higher on Tuesday with the yen weakening amid concerns about Japan’s fiscal health on the back of Prime Minister Takaichi’s plans for aggressive spending and tax cuts. Furthermore, the market mood is more positive, which is also undermining safe-haven demand for the JPY.

Yesterday’s strengthening of the yen is lacking follow-through for now. However, the downside in the yen could be limited given the willingness of US and Japanese authorities to step in and support the currency and the BoJ’s hawkish stance.

The sharp move in USD/JPY in recent sessions highlights market nervousness over a possible intervention.

PM Takaichi has called a snap election for February 8, aiming to capitalise on her popularity to strengthen her mandate and push ahead with fiscal expansionary policies. Japanese bond yields have soared in recent weeks amid nervousness over Japan's fiscal outlook. That same nervousness had weighed on the yen.

Tokyo CPI data is due late in the week. The BoJ lifted its growth and inflation forecasts in last week’s meeting, keeping more rate hikes on the table.

This is in contrast to the Federal Reserve, which kicks off its two-day meeting today. The Fed is expected to leave rates unchanged at 3.5% to 3.75% after three consecutive rate cuts last year. Attention will be on Fed Chair Powell’s press conference for further clues on the timing of further rate cuts.

The USD has steadied around a 4-month low, weighed down in recent sessions by the “sell America” trade, by Trump's threats of 100% tariffs on Canada and higher tariffs on South Korea, by fears of another US government shutdown, and by speculation of JPY intervention.

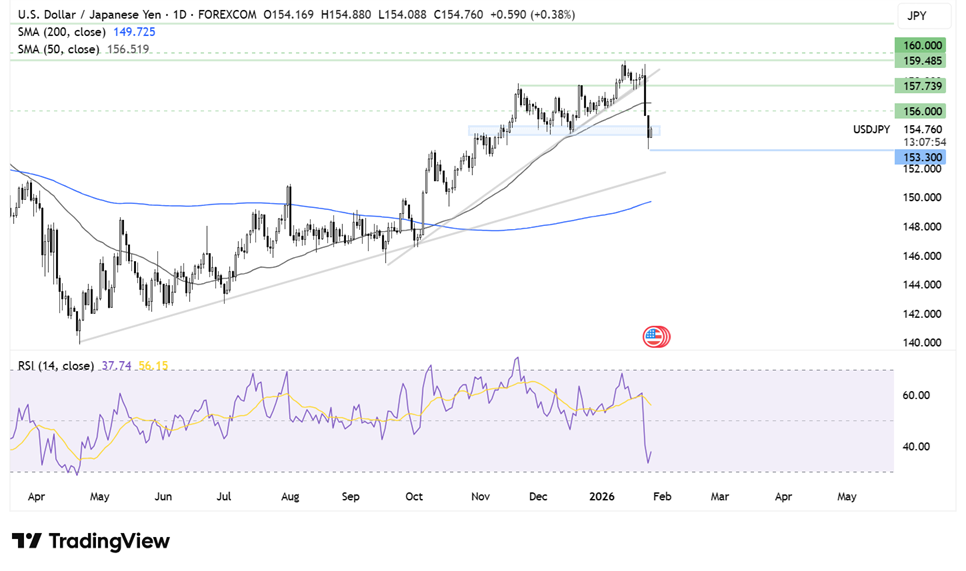

USD/JPY forecast – technical analysis

USD/JPY broke aggressively below its rising trendline dating back to mid-September, and the 50 SMA, falling to a low of 153, before settling above the 154.25 support.

USD/JPY bulls are extending the recovery today towards 155.00. A rise above the 155 puts the pair on a more stable footing and brings 156.00 back into focus ahead of 157.50 as the next key resistance area to watch; this had acted as a support before the sharp selloff.

On the downside, there isn’t that much in the way of support. Should sellers take out the 153.30 low, this exposes the longer-term trendline support around 152.00. A break below here exposes the 200 SMA at 149.75.

(Click on image to enlarge)

DAX rises as EU-India trade deal is agreed

Dax, along with European shares, is seen opening broadly higher on Tuesday, with trade tensions, the upcoming Fed rate decision, and mega cap tech earnings all in focus.

The EU and India have concluded a free trade agreement after almost 20 years of negotiations, and space science seeks to deepen economic ties and offset the impact of Trump's tariff policies.

The deal is expected to double EU goods exports to India by 2032, eliminating or reducing tariffs on almost 97% of those exports. This includes a range of products from automobiles and industrial goods to wine and chocolate. India has agreed to allow up to 250,000 European-made vehicles into the country at preferential duty rates.

Meanwhile, the EU will eliminate or reduce tariffs on almost 100% of goods imported from India over the coming seven years. The deal is set to give India a competitive edge in exporting labour-intensive goods, which have been hit hard by Trump's steep tariffs.

Looking ahead, today also sees the start of the FOMC meeting ahead of tomorrow's rate decision, where investors will be looking for clues on the timing of the Fed's next rate cut. President Trump is expected to nominate a new Federal Reserve chair within the coming days.

In the US, 100 S&P 500 companies are due to release their quarterly earnings results this week. Among these firms, Apple, Meta, Microsoft and Tesla will unveil their latest results.

DAX forecast - technical analysis

After running into resistance at 25,500, the record high, the DAX fell lower, breaking below its near-term rising trendline dating back to mid-November before finding support at 24,350 and settling above the 24,600 support. From here, the price has extended its recovery, and while remaining below the rising trendline, it is tracking the line higher. The long-term uptrend also remains intact.

Buyers, supported by momentum, will look to extend the recovery above 25,500 to fresh record highs.

Immediate support is seen at 24,600, the July and October highs. A close below here opens the door to the 50 SMA at. 24,330.

(Click on image to enlarge)

More By This Author:

Weekly Equities Outlook: Tesla, Microsoft, Apple

Two Trades To Watch: DAX, USD/JPY Forecast - Thursday, Jan. 22

Two Trades To Watch: GBP/USD, JPY/USD Forecast

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more