Two Trades To Watch: Gold, DAX - Wednesday, Nov. 2

Image Source: Pixabay

Gold holds steady ahead of the Fed rate decision. DAX rises with manufacturing PMI data due.

Gold holds steady ahead of the Fed rate decision

Gold is trading around $1650 as all eyes turn to the Federal Reserve interest rate decision later today. While a 75 basis point hike is almost entirely priced in for today, what comes next is what is likely to drive the markets.

While stocks have risen across October, partly on optimism that the Fed could adopt a less hawkish approach to rate hikes from December, Gold failed to follow those gains, instead falling -1.6% in October.

Data raises questions over whether the Fed will even reveal a dovish pivot given core CPI is still rising, Q3 GDP came in stronger than forecast, non-farm payrolls held over 200k, and JOLTS job vacancies showed that there are still 10.7 million positions to be filled.

Should the Fed hint at a slower pace of hikes from December, non-yielding Gold could rise. However, signs that the Fed will keep hiking aggressively into next year could send USD higher and the USD-denominated gold lower.

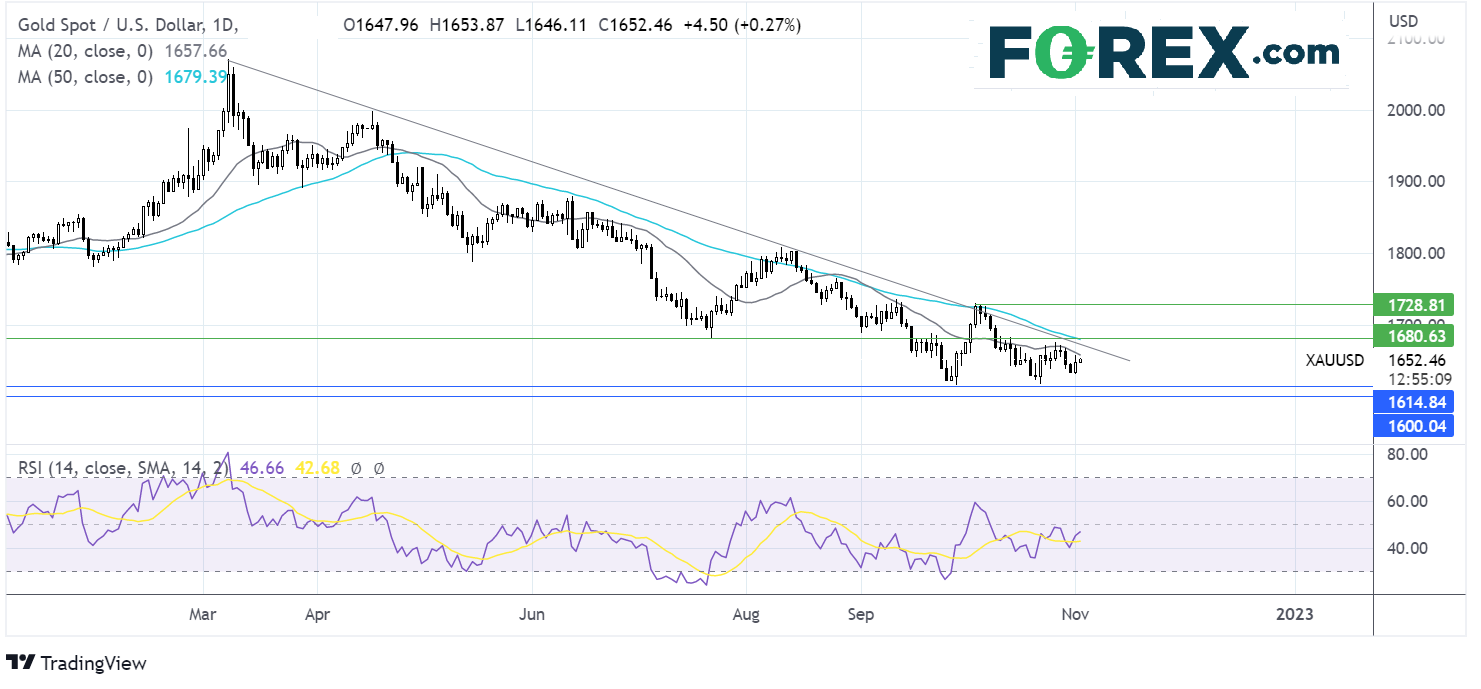

Where next for gold prices?

Gold trades below its multi-month descending trendline, 20 & 50 sma, after failing to push above the 20 sma last week.

A hawkish-sounding Fed could see gold test 1630, the weekly low, and bring 1617, the October low, into focus. A break below here opens the door to 1600 round number.

A dovish signal from the Fed could help it rise over the 20 sma at 1660 to expose the 50 sma and falling trendline resistance at 1676. A break above here brings 1700 round number to focus and 1730 the October high.

(Click on image to enlarge)

DAX rises with manufacturing PMI data due

After rising 0.6% in the previous session, the DAX is extending gains for a second straight session. Strong gains in Asia, amid optimism that China could be considering ending its zero-COVID strategy, in addition to cautious optimism ahead of the Fed meeting, are helping lift the DAX.

Attention will be on manufacturing PMI data which is expected to confirm the initial reading of 45.7, down from 47.8, a 29-month low. Rising energy costs and weak demand are hitting the sector. The data will likely confirm that the German economy is heading for a recession.

German unemployment is expected to hold steady at 5.5% in October.

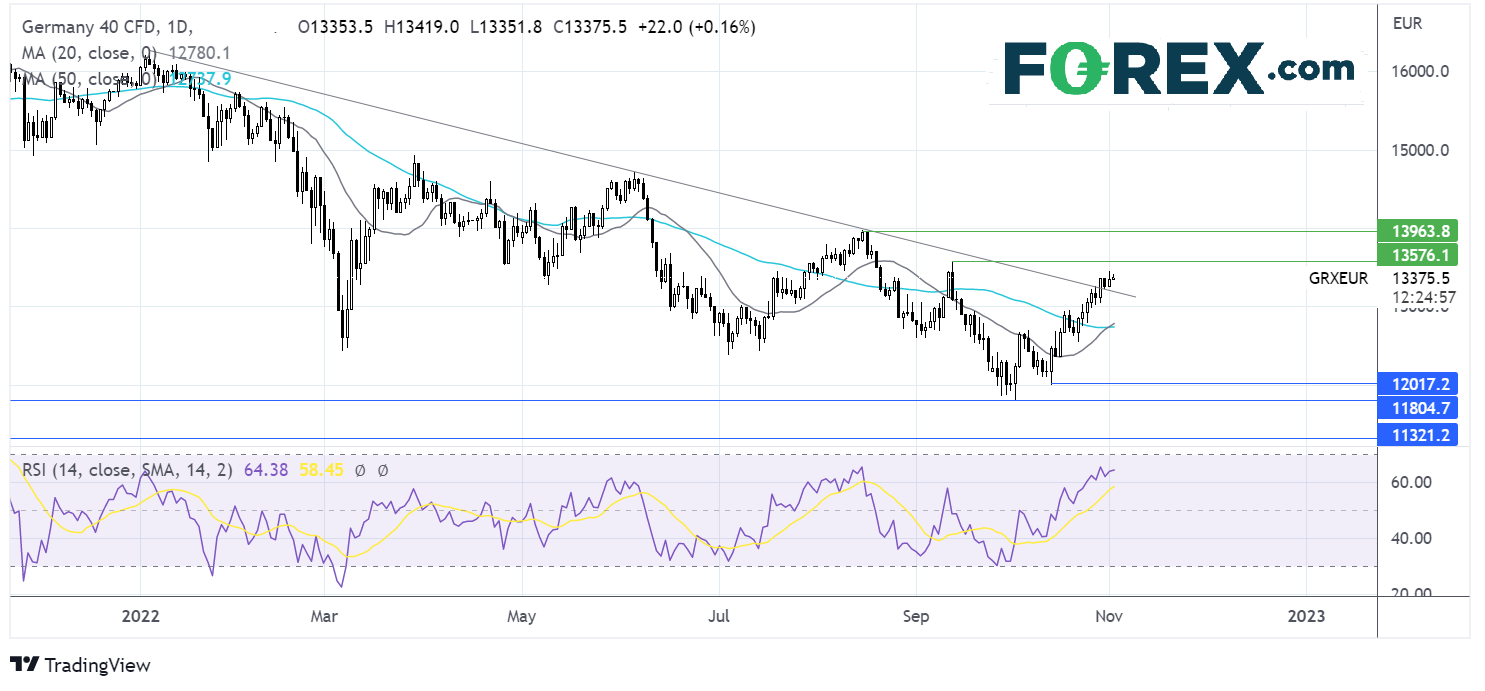

Where next for the DAX?

The DAX has broken above the multi-month falling trendline and is heading towards 13570, the September 12 high. The RSI supports further upside, and the 20 sma is crossing above the 50 sma in a bullish signal. Buyers could look for a break over 13570 to bring 13965, the August high, into focus.

On the flip side, a break below the trendline resistance turned support at 13200 could open the door to 12740, the 20 & 50 sma, ahead of 12050 the October 13 low.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: GBP/USD, FTSE - Tuesday, Nov. 1

Two Trades To Watch: DAX, Oil - Monday, Oct. 31

Two Trades To Watch: DAX, USD/JPY - Friday, Oct. 28

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more