Two Trades To Watch: DAX, Oil - Monday, Oct. 31

Image Source: Unsplash

DAX gains after retail sales rebound. Oil falls after weak Chinese manufacturing activity.

DAX gains after retail sales rebound

The DAX is set to open higher, extending solid gains from last week. The German index rose after the ECB hiked rates by 75 basis points but adopted a slightly more dovish stance, as optimism rises that the Fed will soften its hawkish tone after the November meeting and after Q3 GDP defied expectations of a contraction, growing by 0.3%.

German retail sales data was released and highlighted the strength of the German consumer. Sales unexpectedly jumped 0.9% MoM in September after falling -1.4% in August. Expectations had been for a -0.3% decline.

Looking ahead, Eurozone GDP and inflation data are due to be released. Eurozone GDP is expected to rise by 0.2% defying recession fears for another quarter. Inflation, meanwhile, is expected to rise to 10.2% a new record high.

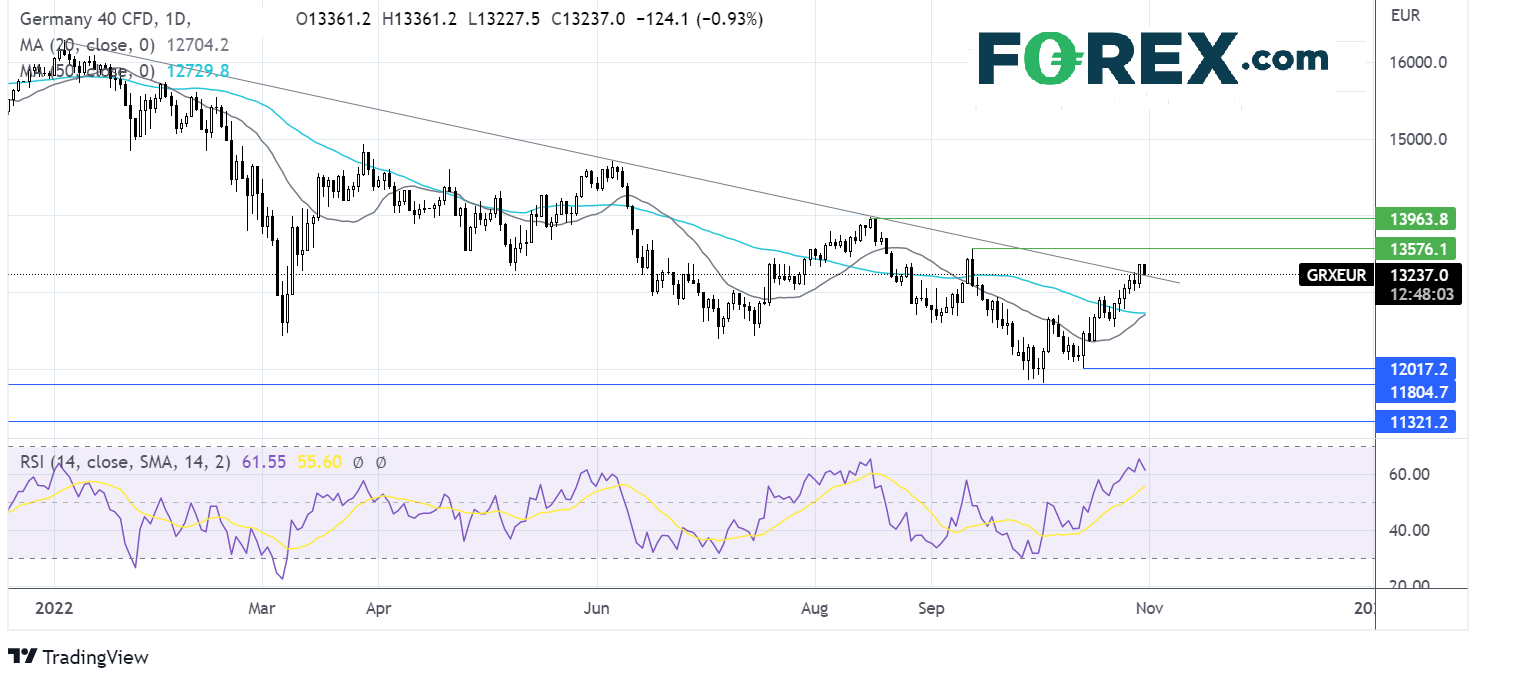

Where next for the DAX?

DAX has recovered from 12000, the October 13 low, recapturing the 20 & 50 sma and rising above the multi-month falling trendline before running into resistance at 13360. The RSI is supportive of further upside, and the 20 sma is about to cross above the 50 sma in a bullish signal.

Buyers will look for a rise over 13360 to extend the bullish trend toward 13575, the September high, and 13975, the August high.

On the flip side, a fall back below the falling trendline resistance turned support could expose the 50 and 20 sma at 12700. A break below here could bring 12000, the October 13 low, back into focus.

(Click on image to enlarge)

Oil falls after weak Chinese manufacturing activity

Oil prices are edging lower after solid gains of over 3% last week. Oil is falling lower after weaker than forecast factory data from China, the world’s largest oil importer.

China’s manufacturing PMI unexpectedly contracted to 49.2 in October, down from 50.1 in September and below forecasts of 50.00. Level 50 separates expansion from contraction.

The weakness comes after COVID lockdown disruptions increase and point to a sluggish start to the final quarter of the year. Widening COVID curbs are unnerving investors further, suggesting that the Q3 rebound in activity could be short-lived.

Strict COVID lockdowns are dampening economic growth and business activity, hurting oil demand. China’s crude oil imports fell 4.3% across the first nine months of the year, the first annual drop in 8 years.

Looking ahead, OPEC is expected to release its outlook report today.

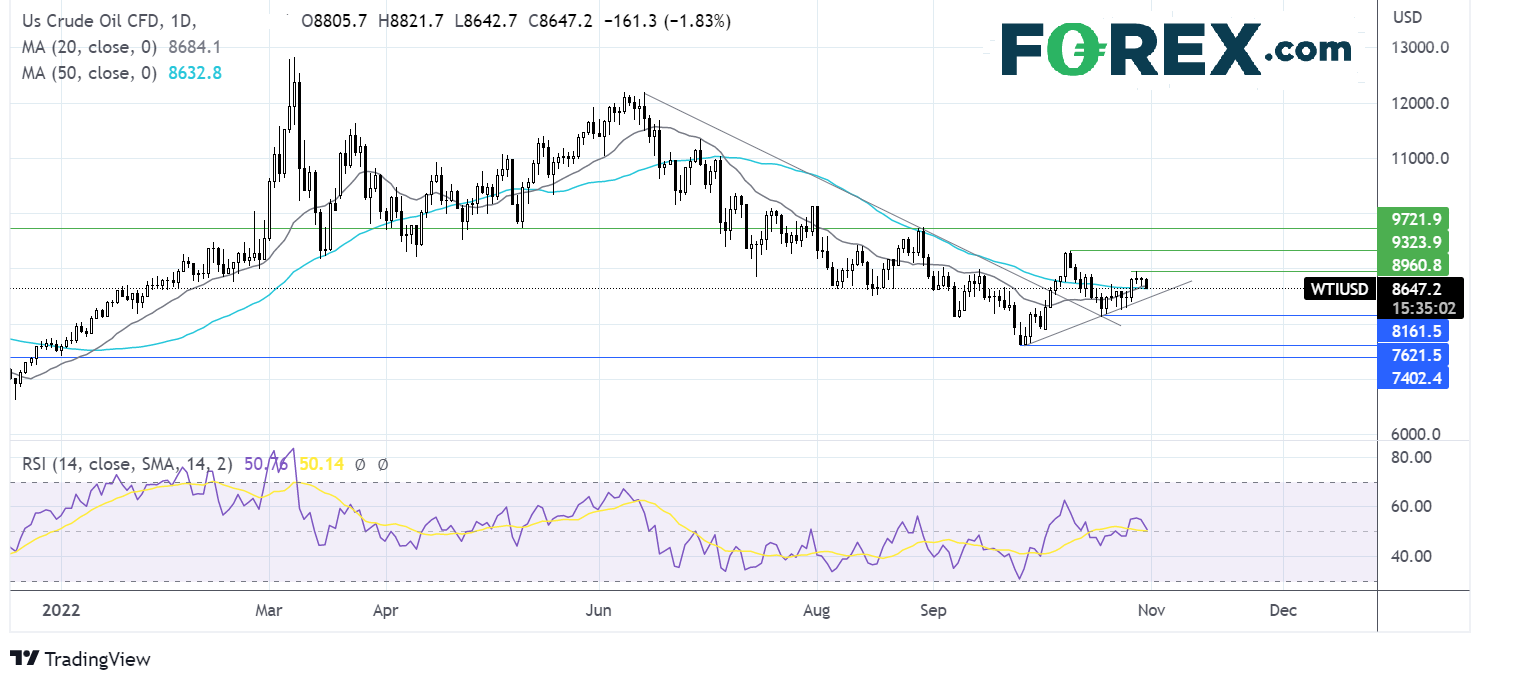

Where next for oil prices?

Oil prices trade above the multi-week rising trendline before running into resistance at 89.50 last week. The price is testing the 20 & 50 sma at 86.50 and the RSI is neutral, providing few clues.

Should buyers successfully defend the 20 & 50 sma, buyers will look to rise above 89.60 to create a higher high and bring 97.50 the August high into focus.

Should the bears break below the smas and the rising trendline support at 84.40, then the October 18 low at 81.10 comes into focus. A fall below here creates a lower low.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: DAX, USD/JPY - Friday, Oct. 28

Two Trades To Watch: EUR/USD, DAX - Thursday, Oct. 27

Two Trades To Watch: USD/CAD, Gold - Wednesday, Oct. 26

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more