Two Trades To Watch: FTSE, Oil - Friday, Nov. 18

Image Source: Pixabay

FTSE rises after retail sales surprise. Oil is set for large losses this week.

FTSE rises after retail sales surprise

The FTSE is heading higher after a modest decline yesterday. The market reaction to the Budget was very tame compared to the Truss/ Kwarteng min-budget. This could be because many of the measures had been pre-released, meaning there were few surprises.

Today the index is rising after consumer confidence improved and retail sales rebounded from September’s decline.

GFK consumer confidence rose to -44, up from -47 in a sign of relief after Truss’ government and as Rishi Sunak works to stabilize the economy.

Retail sales also rose to 0.6% MoM, a partial rebound from the -1.5% decline in September when shops closed for the Queen’s funeral.

Still, the outlook remains weak as inflation sits in double digits and taxes and interest rates rise.

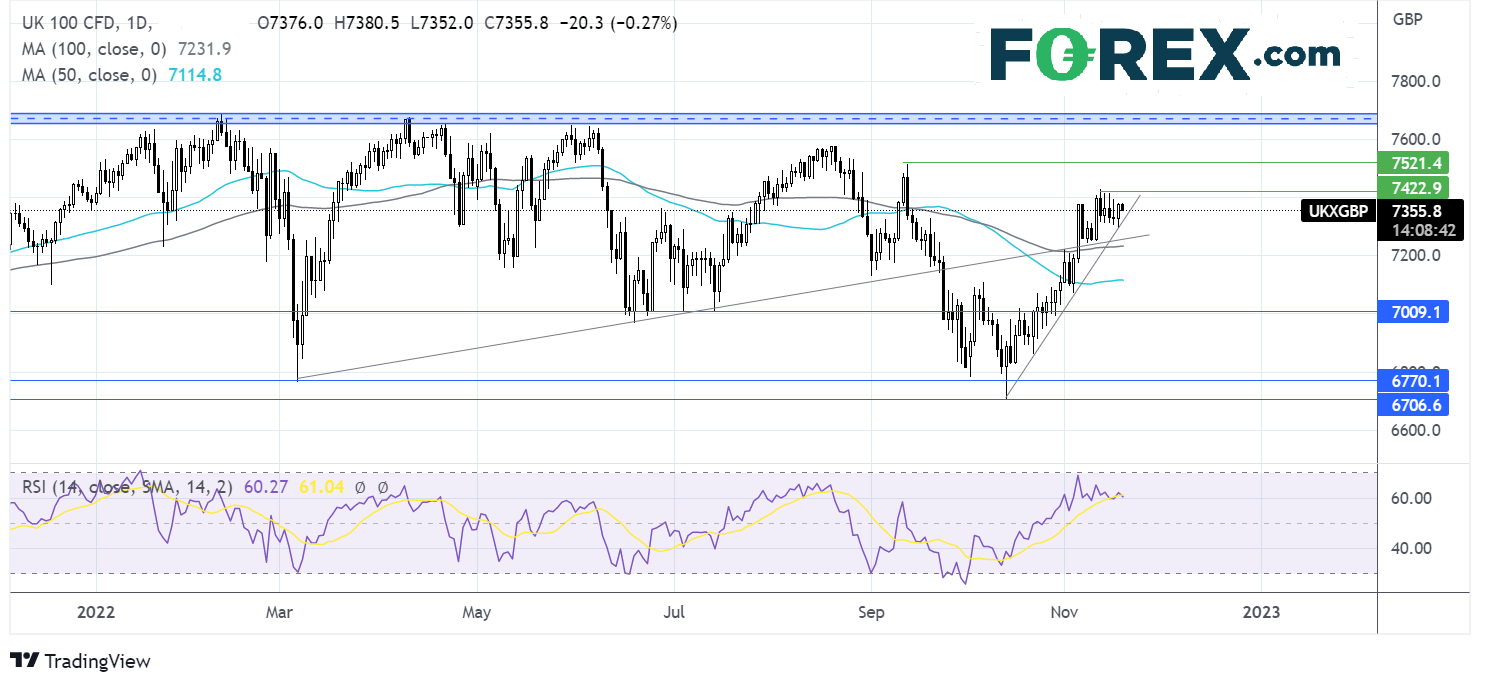

Where next for the FTSE?

The FTSE trades above a steep rising trendline dating back to mid-October. The price ran into resistance at 7430 and is consolidating around 7360. The RSI supports further gains.

Buyers will look for a rise over 7430 to extend the bullish trend to 7515, the September high.

Meanwhile, sellers will look for a move below 7300, the weekly low, and the rising trendline support. A fall below here could expose the 100 sma at 7230 and the rising trendline support dating back to March.

(Click on image to enlarge)

Oil is set for large losses this week

Oil prices are rebounding modestly after steep losses in the previous session. Still, oil is on track to lose almost 8% across the week after booking 4% losses in the week before.

Concerns over rising COVID cases in China, fears of a recession in the US, and downwardly revised oil demand growth have all worked to pull oil prices lower.

Pressures on oil prices are unlikely to ease anytime soon, given the deteriorating macroeconomic picture.

Meanwhile, in China, COVID cases rose to 25,353, up from 23,276. Policy moves surrounding the zero-COVID strategy will be watched.

The Baker Hughes rig count data will be released later today.

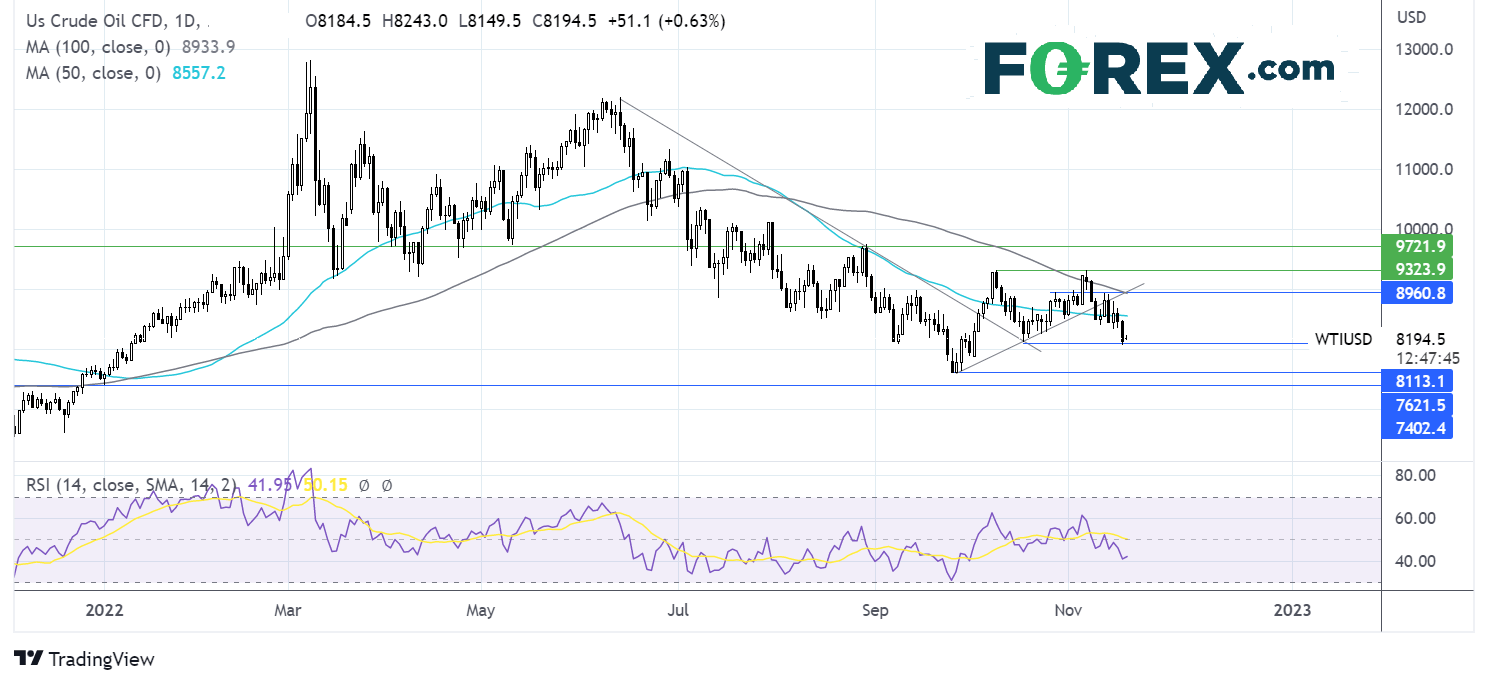

Where next for oil prices?

After oil hit resistance at 93.40, the price rebounded lower below the 100 sma, rising trendline support and the 50 sma. The RSI is below 50 and supports further downside.

Sellers could look for a break below 80.80, the weekly low, opening the door to 80.00 psychological level and 76.50, the 2022 low.

Buyers could look for a rise over the 50 sma at 85.60, with a rise over here exposing the 100 sma at 89.75 before bringing 93.40, the November high, into play.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: GBP/USD, EUR/USD - Thursday, Nov. 17

Two Trades To Watch: EUR/GBP, USD/CAD - Wednesday, Nov. 16

Two Trades To Watch; GBP/USD, DAX

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more