Two Trades To Watch: EUR/USD, Oil - Monday, Nov. 27

Image Source: Pixabay

EUR/USD rises at the start of a key week for data

- Eurozone & US inflation data is due

- Today ECB President Christine Lagarde speaks

- EUR/USD needs to rise above 1.0965 to extend gains to 1.10

EUR/USD is edging higher, attempting to push above the 1.0950 level, adding to last week's gains as investors look ahead to a key week for data. Inflation figures from both the eurozone and the US will be released.

Today, attention will be on ECB president Christine Lagarde, who is due to speak. She is unlikely to change her steer on inflation after reiterating on Friday that the fight against inflation is still not over.

Inflation figures for the eurozone region will be released on Wednesday and Thursday and could provide further clues about the ECB interest rate trajectory. Hotter-than-expected inflation could see the market push back ECB rate cuts bets into H2 2024.

Data last week suggested that the downturn in the eurozone economy could be slowing after PMI data surprised to the upside, contracting at a slower pace. German Ifo business climate data moved higher for a second straight month.

ECB officials have maintained a cautious stance regarding the region's outlook as inflation remains above the ECB's 2% target and as rates are at a record high. The ECB has indicated that their preferred path is to leave rates unchanged until inflation is back to the target level.

Meanwhile, the US dollar is trading around a two-and-a-half-month low as the market is increasingly convinced that the next move from the US central bank will be to cut interest rates.

According to the CME Group FedWatch tool, the market is pricing in a 44% probability of a rate cut in May. The FOMC minutes released last week were slightly more hawkish than expected, and jobless claims and the services PMI came in ahead of expectations, highlighting the resilience of the US economy. Inflation data this week will provide more clues about when the Fed could cut rates.

Today, attention will be on US home sales today, which are expected to rise 4% after rising 12.3% and the previous month.

EUR/USD forecast – technical analysis

After breaking above the 200 SMA and breaking out of the rising channel, EUR/USD consolidated, capped on the upside by 1.0965, the November high, and by 1.0850, last week’s low. The RSI is approaching overbought territory so buyers should be cautious.

Buyers will look for a rise over 1.0965 and 1.10, the psychological level. A rise above here brings 1.1065 the August 10 high into focus.

Sellers need to break below the 200 SMA at 1.0810 to gain control and bring 1.0750 November 7 high into focus.

(Click on image to enlarge)

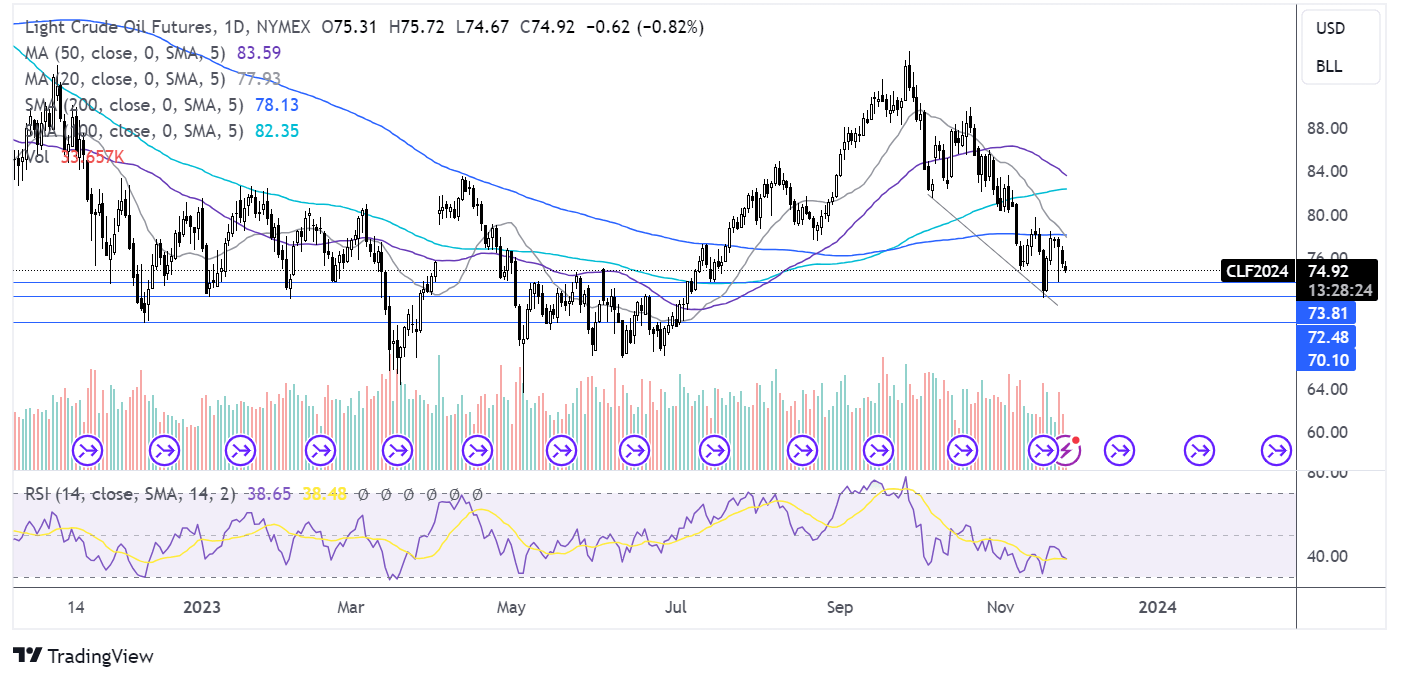

Oil slips with the focus on OPEC+ meeting

- OPEC+ delayed the meeting until November 30th

- Doubts rise over whether they will cut supply

- Oil bears look to test 73.80 last week's low

Oil prices are sliding lower on Monday after falling last week for a second straight week as the market focuses on the OPEC+ meeting on Thursday.

The meeting was delayed to November 30th from November 26 due to reports that there were disagreements over planned production cuts. As a result, the market is questioning how much further the group of oil-producing nations will be able to cut oil supply.

Saudi Arabia and Russia, the two top producers in OPEC+, are widely expected to extend their ongoing supply reduction or potentially deepen the supply cut amid growing fears that high global interest rates and deteriorating economic conditions will hurt global oil demand.

However, production in some OPEC+ member states has been increasing in recent months, particularly some African nations that plan to increase output further.

Meanwhile, non-OPEC oil production is at a record high, which, coupled with rising Chinese stockpiles, means the oil market is not as tight as initially thought, pulling prices lower.

Oil markets are expected to be cautious ahead of a key week for data, including eurozone and US inflation, Chinese PMI and US GDP data.

Oil forecast – technical analysis

Oil failed at the 200 sma and rebounded lower. The price has fallen below 75.00 and is looking towards 73.80, last week’s low. A break below here brings 72.15, the November low into focus, with a break below here creating a lower low and bringing 70.00 into target.

On the upside, any recover needs to rise above the 200 sma at 78.00.

(Click on image to enlarge)

More By This Author:

S&P 500 Forecast: S&P 500 Drifts On Black Friday

Two Trades To Watch: DAX, USD/JPY Forecast - Friday, Nov. 24

Two Trades To Watch: EUR/USD, Oil - Thursday, Nov. 23

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more