Two Trades To Watch: EUR/USD, Oil Forecast - Thursday, April 4

Image Source: Unsplash

EUR/USD rises post-Powell & ahead of the ECB minutes

- Powell said the Fed will still cut this year

- ECB meeting minutes will be released

- EUR/USD rises above the 200 SMA

EUR/USD is heading higher for a third straight day on U.S. dollar weakness after Federal Reserve chair Powell's comments yesterday and ahead of the minutes from the March ECB meeting.

Federal Reserve chair Jerome Powell pulled yields on the US dollar lower after offering mixed signals on US interest rate cuts.

Powell said the Fed would eventually cut interest rates this year, although he offered few clues on the timing and the scale of such cuts. He added that the central bank will need more evidence to show that inflation is moving to the 2% target.

Powell said that recent hotter inflation and stronger-than-expected economic data haven't changed the Fed's outlook for the economy, offering some reassurance to traders that the Fed will still loosen monetary policy.

His comments came after ADP data showed stronger-than-expected job creation, but the US services PMI eased slightly, defying expectations of a rise.

Meanwhile, the euro will be watching the minutes from the March ECB meeting, when President Christine Lagarde left the door open for a June rate cut but suggested that an April move would be too soon.

The minutes from yesterday's inflation data showed that inflation cooled by more than expected 2.4%, although service sector inflation remained sticky at 4%.

Attention will also be paid to the services PMI report, which is expected to confirm the preliminary reading of 51.1. Weaker-than-expected data could limit the EUR’s gains.

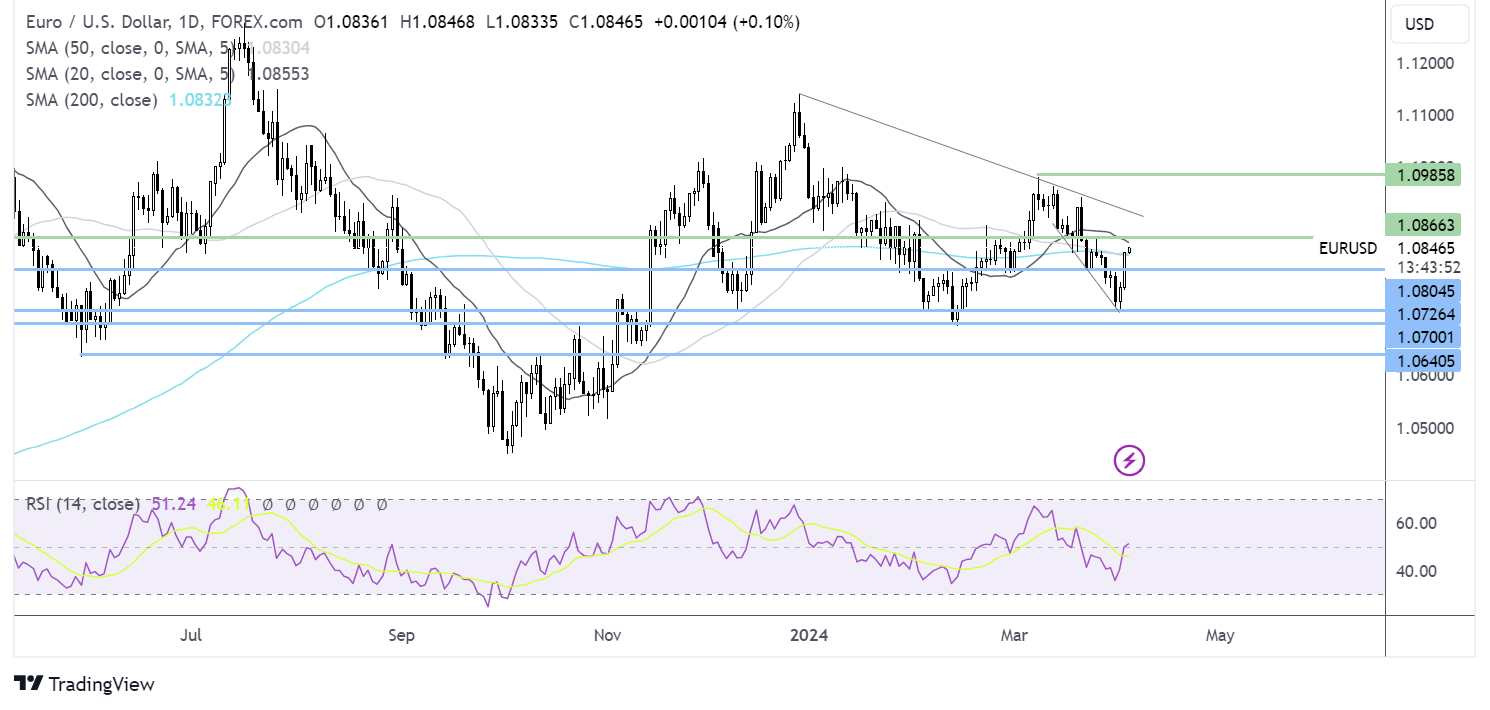

EUR/USD forecast – technical analysis

EUR/USD has extended its rebound from a low of 1.0725, rising above 1.08 and the 200 SMA. The next test for the bulls will be 1.0865, last week’s high. Above here, the falling trendline resistance at 1.0925 comes into play, ahead of 1.0985, the March peak.

On the downside, should sellers regain control, support sits at 1.08 and 1.0725, the April low.

(Click on image to enlarge)

Oil rises on supply concerns & an improving demand outlook

- OPEC+ maintains output cuts

- Geopolitical tension raise supply worries

- The demand outlook improves

- Oil looks to break out of rising channel

Oil prices are rising to a fresh five-month-high, extending gains for a fifth consecutive day amid supply worries as geopolitical tensions in the Middle East worsen and as the demand outlook starts to improve.

OPEC+ ministers voted to maintain production cuts at yesterday's meeting and pressed some members for two more adherence to current output restrictions.

Meanwhile, Middle East tensions raise supply worries concern after Iran threatened retaliation for a strike on its embassy in Damascus and as the Israel-Hamas war shows few signs of de-escalating.

Separately, Ukraine’s attacks on Russian oil refineries mean further supply disruptions with more oil production capacity offline.

On the demand side, optimism surrounding interest rate cuts by the Federal Reserve is supporting the demand outlook. A lower interest rate environment is considered positive for economic growth and, therefore, oil demand.

Meanwhile, data from China this week has also pointed to improving economic conditions in the world's largest importer of oil.

The USD trades at a weekly low. A weaker USD is considered bullish for oil prices as it makes oil cheaper for buyers of other currencies.

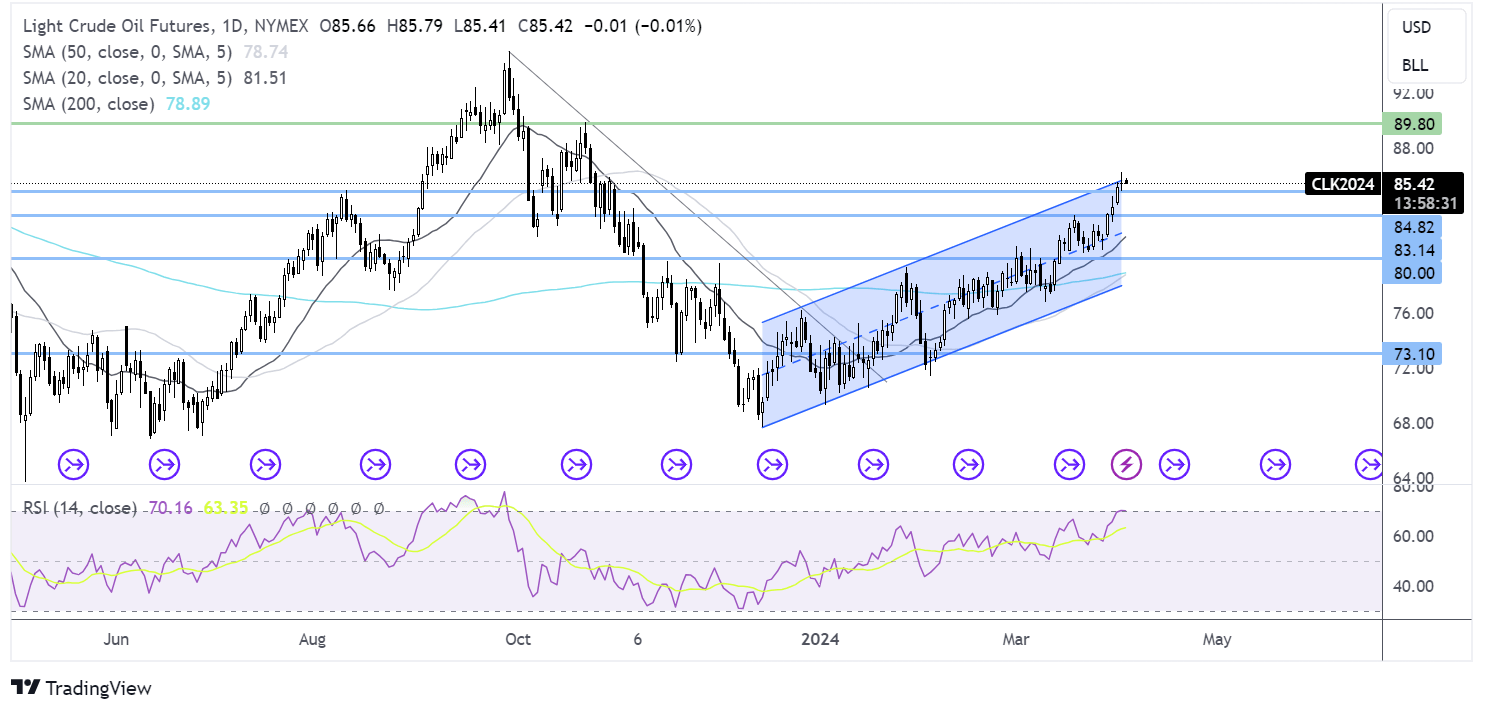

Oil forecast – technical analysis

Oil continues to trade within its rising channel, pushing above 85.00 the August 2023 high and the falling trendline dating back to March 2022. The 50 SMA is also crossing above the 200 SMA in a golden cross bullish signal.

Should buying momentum continue, bulls could look to push the price towards 90.00, the late October high.

On the downside, support can be seen at 85.00; below here, the March high of 83.10 comes into play. Oil would need to fall below 80.00 to negate the near-term uptrend and expose the 200 SMA at 78.90.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: EUR/USD, Oil Forecast - Wednesday, April 3

Two Trades To Watch: EUR/USD, GBP/USD Forecast - Tuesday, April 2

Two Trades To Watch: USD/JPY, FTSE Forecast

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more