Two Trades To Watch: EUR/USD, Oil Forecast - Wednesday, April 3

Photo by Timothy Newman on Unsplash

EUR/USD looks to eurozone inflation & US services PMI data

Eurozone inflation is forecast to ease to 2.5% YoY, down from 2.6%

US ADP payrolls & US Services PMI in focus

EUR/USD recovers off 1.0725 support

EUR/USD is holding steady after modest gains in the previous session as investors look ahead to a busy day on the economic calendar.

Eurozone inflation is expected to tick lower to 2.5% YoY in March, down from 2.6% in February, as consumer prices in the region continue to ease towards the ECB's 2% target.

The data comes after German inflation cooled to 2.2% yesterday, down from 2.5%, and after the region's manufacturing PMI showed the sector's downturn deepened.

Cooling inflation and signs that the eurozone economy is still struggling will support the view that the ECB will cut interest rates in the June meeting.

Meanwhile, the US dollar is holding steady after falling from a five-month high in the previous session, despite stronger-than-expected data and after mixed messages from Federal Reserve officials.

San Francisco Fed president Mary Daly considered three rate cuts this year a good baseline case; however, Cleveland Fed president Loretta Mester said she still expects rate cuts this year but not anytime soon.

Looking ahead, attention will be on US ISM services PMI, which is expected to rise to 52.7, up from 52.6. The data comes after the manufacturing PMI unexpectedly returned to growth at the start of the week, highlighting the resilience of the US economy.

US ADP private payrolls are also set to be released and are expected to rise to 148k, up from 140k. Fed speakers have highlighted the labor market's strength as an area to watch when considering cutting interest rates.

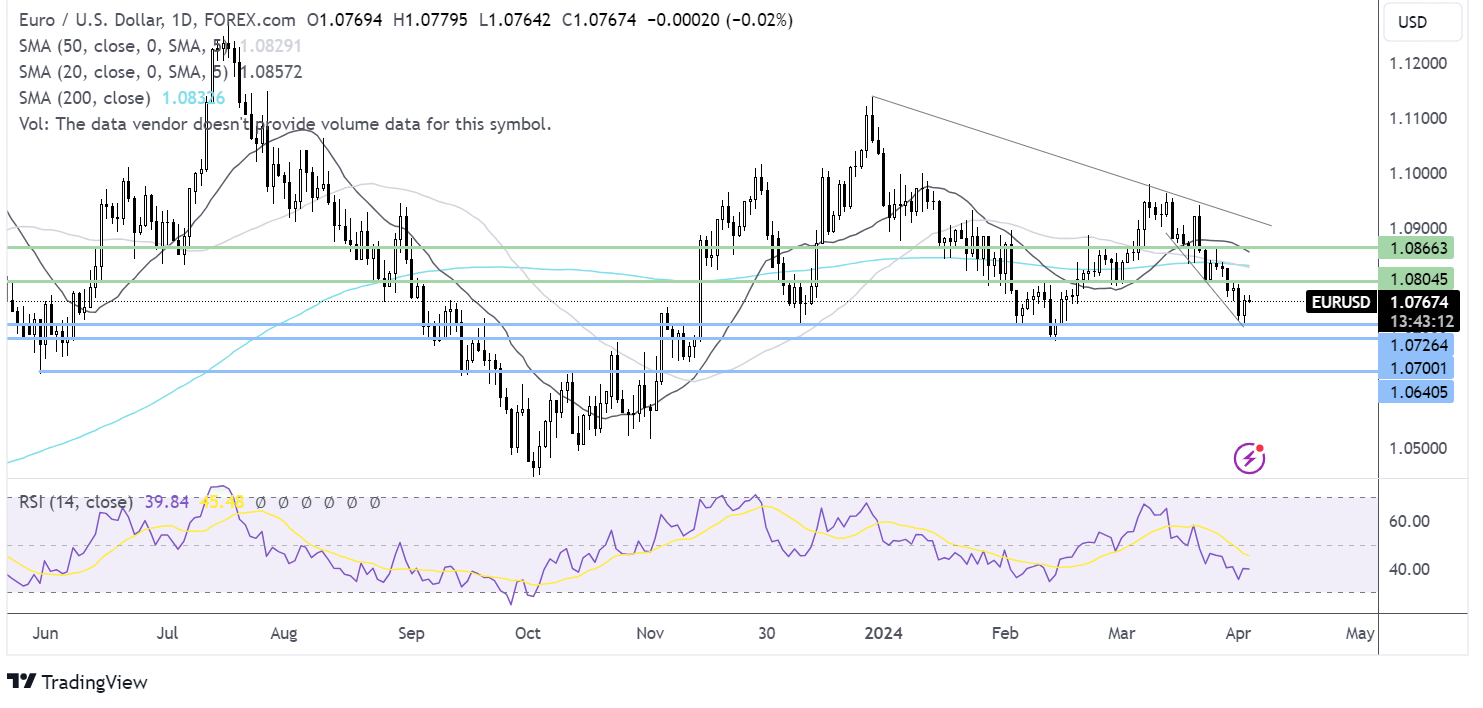

EUR/USD forecast – technical analysis

EUR/USD trended lower across March before hitting support at 1.0725 and recovering higher. Should buyers extend the recovery, resistance can be seen at 1.08 round number. A rise above here exposes the 200 SMA at 1.0835 before bringing 1.0865, last week’s high, into focus.

However, the rebound lacks conviction, so sellers could pull the price back towards 1.0725 and 1.07, the 2024 low. Beyond here, the selloff could extend towards 1.0635, the May 2023 low.

(Click on image to enlarge)

Oil rises to a 5- 5-month high ahead of the OPEC+ meeting

API oil inventories fell by 2 million

No change to oil production policy is expected

Oil rises above 85.00

Oil prices are extending gains to a fresh five-month high as industry data pointed to a drawdown in US crude inventories ahead of today's OPEC+ meeting.

Tuesday's API data showed that inventories fell by over 2 million barrels last week. The data also showed declines in gasoline and distillate stockpiles. Later today, the official EIA stockpile data will be released.

Prices have also risen in recent weeks as Ukraine drone attacks on Russian refineries have threatened to take more of the country's processing capacity offline.

Rising geopolitical tensions in the Middle East have also supported oil prices. Worries that Iran could retaliate against Israel for an attack on Monday that killed high-ranking military personnel and could lead to supply disruptions in the Middle East.

Today, attention will be on the OPEC+ meeting, which is not expected to result in any changes to output policies, even as oil prices rise to their highest level this year.

The oil cartel already extended its voluntary production cuts until mid-year, so the virtual OPEC meeting today will likely reaffirm that. The full ministerial meeting will be held in June.

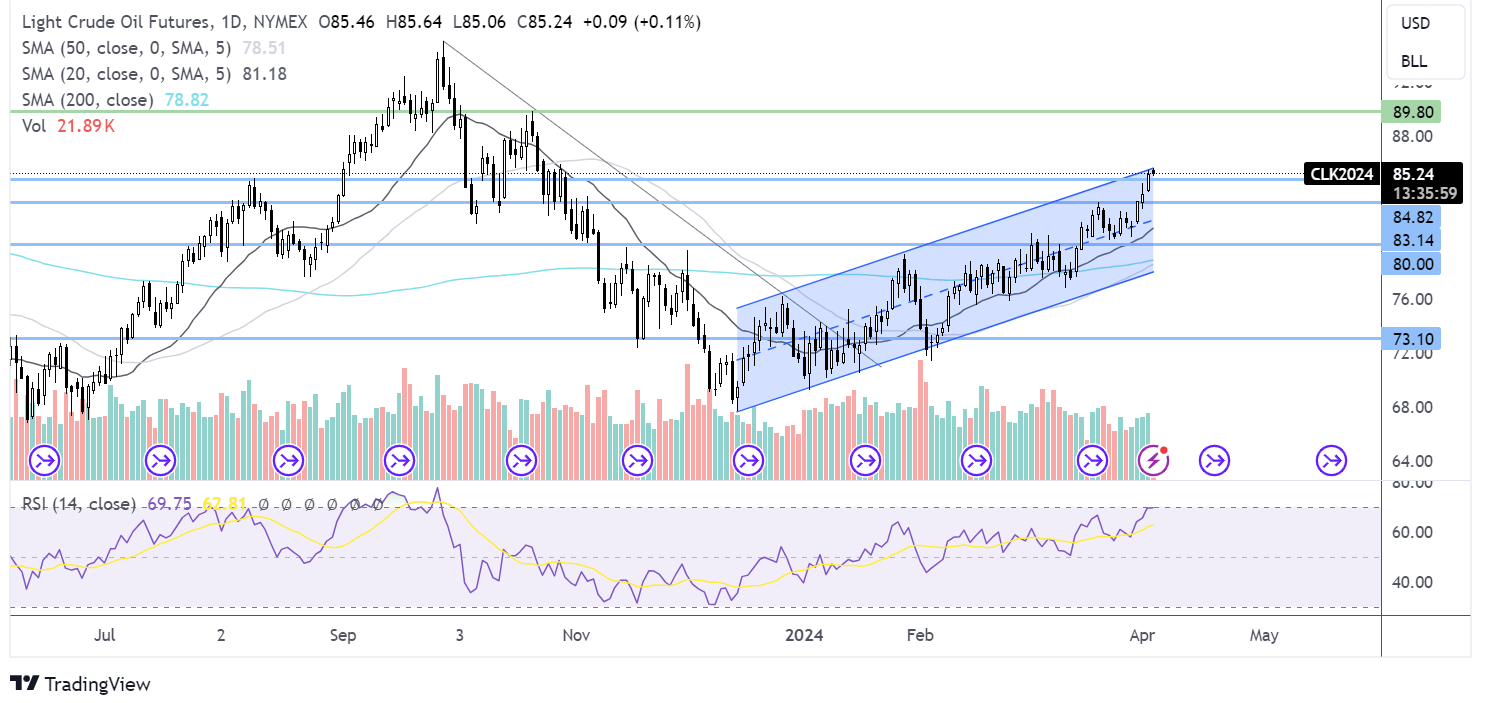

Oil forecast – technical analysis

Oil trades within a rising channel, pushing above 85.00 and testing the upper band of the channel. A breakout could see the price head towards 90.00, the October 2023 high.

On the downside, a break back below 85.00, the August high, could see sellers test support at 83.10 the March high. Below here 80.00 comes into focus.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: EUR/USD, GBP/USD Forecast - Tuesday, April 2

Two Trades To Watch: USD/JPY, FTSE Forecast

Two Trades To Watch: EUR/USD, Oil Forecast - Tuesday, March 26

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more