Two Trades To Watch: DAX, Gold - Tuesday, Nov. 22

Image Source: Unsplash

DAX falls as China worries persist. Gold rises ahead of Fed speakers.

DAX falls as China worries persist

The DAX close lower yesterday and is extending losses today as worries over rising COVID cases in China continue to undermine confidence. Cases are sitting at a six-month high, sparking concerns about widespread mobility restrictions.

China is a major export market for Germany and, more broadly, the eurozone, so fears of slowing growth in the region negatively impact sentiment.

Looking ahead, eurozone consumer confidence is in focus and is expected to rise again in November to -26 from September’s record low.

The OECD is also due to release its latest economic outlook later today. The Paris-based policy forum has been particularly downbeat about the outlook for Europe, and this is unlikely to have changed.

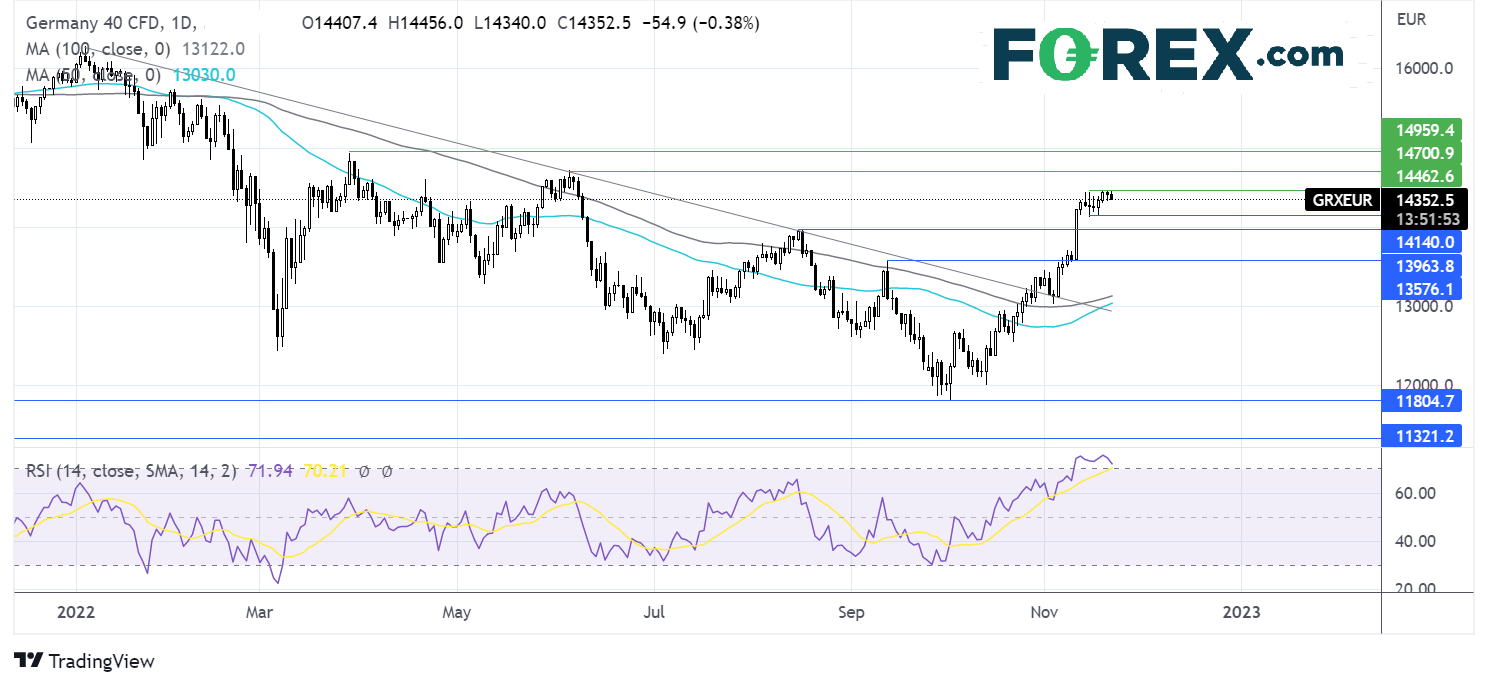

Where next for the DAX?

The DAX continues to consolidate around its 5-month high, just below 14500. The RSI is still in overbought territory so more consolidation could be on the cards. Buyers could look for a rise over 14500 to extend the bullish trend to 14700, the June high, and 14960, the March high.

Sellers could look for a move below 14130, the weekly low, to open the door to 13970 August high, and 13550, the September high.

(Click on image to enlarge)

Gold rises ahead of Fed speakers

Gold is rising to snap a four-day losing streak as the USD pauses for breath and treasury yields ease.

Federal Reserve speakers continue to express their commitment to reining in inflation. However, there is growing support for a slowdown in the pace at which interest rates are hiked.

San Francisco Fed President Mary Daly highlighted the lag time between rate hikes and the real-world impact. Meanwhile, Loretta Mester supported a smaller hike at the December meeting.

Looking ahead, the US economic calendar is quiet. Fed speakers will remain in focus, with investors looking for clues over the future path of rate hikes.

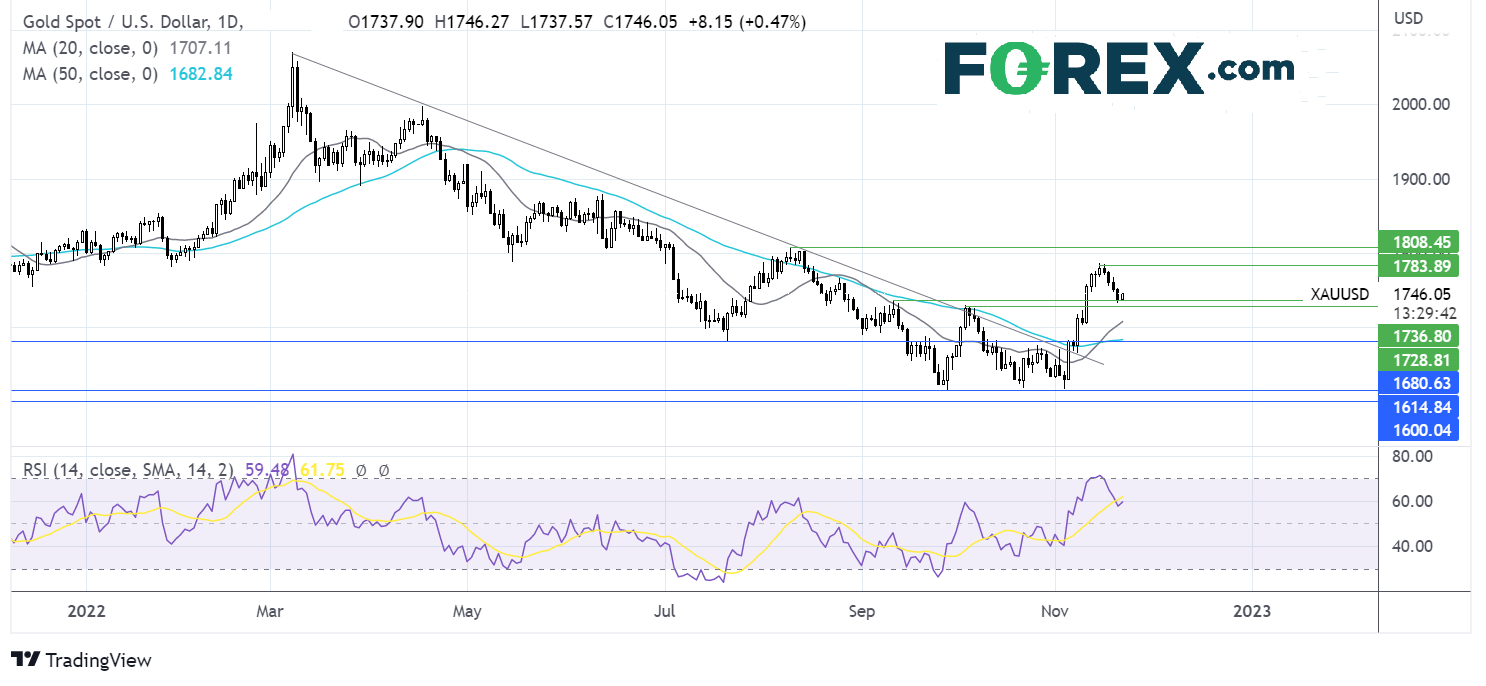

Where next for Gold prices?

Gold saw a bullish breakout at the start of November, which is still in play despite running into resistance at 1785. Gold has since moved lower testing support around 1732 the September high. With the RSI above 50, buyers are still hopeful of further upside. A rise above 1783 is needed o extend the bullish trend.

Sellers would need to break below 1732 and 1727, the October high, to negate the near-term uptrend and expose the 20 sma at 1707. A break below 1676, the 50 sma could see sellers gain momentum.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: EUR/USD, Oil - Monday, Nov. 21

Two Trades To Watch: FTSE, Oil - Friday, Nov. 18

Two Trades To Watch: GBP/USD, EUR/USD - Thursday, Nov. 17

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more