Trading Cocoa: A Fresh Price Collapse Amid Conflicting Narratives

Almost a month ago, I celebrated a major breakout for iPath Bloomberg Cocoa SubTR ETN (NIB) by declaring a confirmed bottom. That bottom still holds but unfortunately NIB has persistently declined since then. NIB is down 15.2% from the time of that post.

The iPath Bloomberg Cocoa SubTR ETN (NIB) erased two months of gains in one month. A major breakout turned into another big breakdown with the previous all-time low looking like a pivot again. Source: FreeStockCharts.com

At the time of my last post, the International Cocoa Organization (ICCO) seemed cautiously optimistic about the prospect for prices. Demand also seemed to be responding to low prices. From there, a story for cocoa evolved that includes a healthy mix of conflicting supply/demand narratives. In this post, I briefly review the various catalysts and justify my strategy to re-accumulate a short-term trading position to augment my core NIB position. NIB continues to trade with more volatility than the underlying fundamentals, so I am betting on periodic relief rallies when selling panics subside.

Bullish Olam, Bearish Barry Callebaut

As NIB traded down toward support at its 50-day moving average (DMA), Olam (OLMIF), the world’s 3rd largest cocoa processor, issued a bullish outlook for cocoa that echoed my own expectations. In “Global Chocolate Binge Has Olam Predicting Smaller Cocoa Surplus,” Bloomberg wrote on November 24th about drivers supporting prices in the cocoa market using commentary from Olam as the centerpiece.

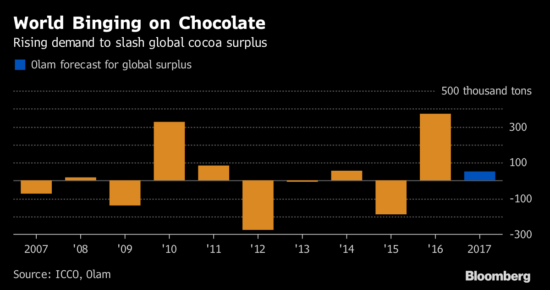

Olam called the demand for chocolate “tremendous.” The company also doubted that Ivory Coast could deliver the same kind of bumper crop as it did the previous season. As a result, the company projected a sharply lower surplus for the 2017/18 season.

The 2016 cocoa surplus sticks out as a tremendous outlier if Olam’s forecast of a small surplus pans out. Source: Bloomberg

Olam went on to explain how traders may be underestimating the demand for chocolate because “traditional data” do not include sales from online businesses, artisan shops, and bakeries. Moreover, the current surplus cocoa includes low quality cocoa damaged by a reduction in fat content and an increase in free-fatty-acid levels.

This commentary from Olam pointed to a market with a near-term price floor. Yet, chocolate-maker Barry Callebaut (BYCBF) provided a distinctly different impression.

In a recent earnings call, Barry Callebaut surprisingly claimed that chocolate demand is not growing in Asia and Europe. I concluded differently from recent data, especially in Asia where grindings soared 12.9% in the third quarter. Barry Callebaut also fears that health conscious North Americans and Europeans will start to spurn chocolate. Again, this conclusion is surprising given the rising popularity of dark chocolate as a healthier alternative to milk chocolate.

So while traders are clearly tuned into the bearish voices, I am much more inclined to take note of Olam’s observations and claims.

The International Cocoa Organization (ICCO)

The International Cocoa Organization (ICCO) added to a more bullish tone on the market with its market report for October trading. The ICCO claimed that poor weather conditions were responsible for the general uptrend in price for the month: “The bullish trend in the cocoa nearby contract prices was supported by unfavorable weather conditions that led to concerns of floods, the outbreak of black pod disease and the spread of brown rot disease which consequently could negatively impact the main crop output.” Just as I did, the ICCO also pointed to strong grindings from Europe.

Finally, the ICCO described a slow start for the current growing season:

“News agency reports indicate that the 2017/2018 cocoa season took off slowly in West Africa since production was stressed by fulsome rain. Indeed, as at 19 November 2017, total cocoa beans arrivals at ports in Côte d’Ivoire had reached around 346,000 tonnes since the start of the cocoa season on 1 October, down nearly by 9% from the 382,000 tonnes produced in the same period of the previous season.”

Agrimoney cited ICCO’s caution about the cocoa growing season, particularly in the Ivory Coast. Heavy rainfall is helping to spread tree diseases. Poor revenues in the previous growing season discouraged farmers from properly investing in their farms: “the majority of farmers could not afford fertilizers, insecticides and investment in good husbandry practices during the period leading up to the start of the 2017-18 season.”

Indeed, I think poor farming revenue could pose a threat to future crop production – whether it is farmers or taxpayers (through government subsidies) who bear the brunt of persistently low cocoa prices. In other words, the longer cocoa prices remain depressed, the more vulnerable the crops become. Prices inevitably must go higher again and under these circumstances could soar substantially when they do.

Efforts underway to preserve Ghanaian production capacity

Insufficient money for maintenance is a real issue. Ghana apparently needs more than $1B to secure its cocoa future. In particular, the Ghana Cocoa Board needs to add $750M to a $600M loan from the African Development bank for building warehouses, to improve storage and distribution facilities, and to replace over 988,000 acres of cocoa tress in the next 5 to 8 years. The Board recently warned that “about a fifth of Ghana’s cocoa tree stock is affected by swollen shoot disease, a virus which reduces yields and kills a plant within three to four years, while another quarter are old and unproductive.” The board is obviously confident in its ability to tackle the issue as it claims that the coming rehabilitation will increase the size of future harvests and will not impact the 850,000 tons of production forecast for the 2017/2018 season. Still, imagine what could happen to the price of cocoa if anything goes awry with these efforts.

Rosy outlooks drive prices down

Starting December 1st, I finally took note of the rosy weather forecasts that were driving market expectations for another year of over-sized cocoa surpluses. Reuters explained that cocoa fell to a two month low because of “favorable crop conditions in Ivory Coast and a pick-up in the pace of port arrivals in the world’s top grower…” A stronger British pound (FXB) also took on some of the blame. Three days later, forex and technical levels took the blame for a continued sell-off.

While the trend has been very volatile, the British pound has trended up against the U.S. dollar all year. Source: FreeStockCharts.com

Another day of selling brought more descriptions of favorable crop conditions. On December 5th, Reuters even tracked down a dealer to provide this dire quote: “I don’t really see any reason to buy at the moment. I think the crop is going pretty well and we’ve a huge surplus from the previous season.” Ironically, Reuters also pointed out that cocoa prices were at their most “oversold” levels since April.

Narratives are contagious. Currently, traders are re-infected with bearish and gloomy outlooks from what they see immediately in front of them.

JSG Commodities weighs in

Finally, on December 7th, JSG Commodities provided its assessment to an industry group after the close of trading. JSG projected a 2017/2018 surplus of 88,450 tons, almost 40,000 tons more than Olam’s forecast and a near-term trading range for the price of cocoa. Some of the forecast comes from a belief that the Ivory Coast is on pace to match last year’s production. JSG also believes it will take a lot more time for demand in emerging markets to increase significantly.

While I interpreted this commentary as bearish, cocoa prices managed to rally the next day. The resulting 1.8% gain for NIB was its first positive print in 7 trading days.

Parting Thoughts

The 2017/2018 season is in its early stages and forecasts can easily swing given the uncertainties of weather patterns. Moreover, the market commentary lacks some conviction and seems easily swayed by the latest daily events. Reuters provided a great example with its explanation for Friday’s rally: “Dealers said the market was underpinned by rising demand and an expected decline in production in the 2017/18 season which should lead to a smaller global surplus.” That assessment is a sharp and rapid turn-around from the commentary just used to explain the declines over the last two weeks!

As bearish and bullish narratives compete for mindshare, the price of cocoa may get caught up in a new trading range. I shelved my hope and expectation for an on-going breakout and am now looking to play a new trading range. I was a bit early in accumulating a trading position, but I see further downside risk to be relatively small compared to the opportunity ahead.

Be careful out there!

Full disclosure: long NIB

Follow Dr. Duru’s commentary on financial markets via more

Thanks for all the information, I have been closely following the cocoa market over the last few weeks. The global surplus clearly is diminishing next year and weather experts say La Nina typically brings heavy rain to West Africa which should support cocoa prices. Personally I believe $NIB will test its all time lows but will not head any lower, the long term decline in cocoa has bottomed out. I look forward to buying in!

Come on in. The water's great...or at least it should be in due time! :)

If we retest all-time lows on NIB, I will be ready to back up the truck...