'Tis The Season: Christmas Shopping For Gold Miners

With the holidays around the corner, not only are retail companies giving discounts, but equities are on sale. This article contains three facts that alone will compel investors to be attracted to the pessimistic, hated, and disgusted mining sector. Mr. Market seems to have drunk too much eggnog.

I. Introduction

When an equity price goes down, the investor with weak nerves sells and tries to salvage what he or she can. But the intelligent investor reexamines his original premise of why he bought that company in the first place. If nothing has changed from the original thesis and the fundamentals are still intact, then the strong investor will not sell, but add to his position.

This is the most important difference between the average investor and the intelligent investor: the intelligent investor has to be strong when everyone is weak. The intelligent investor must lend capital to companies that everyone else is afraid to.

You profit by others' denial of facts. For instance, the mass opinion of Russian ruble devaluation is a social disaster, a political reality, and a speculator's fatality. There is little argument that there is an obvious bias against Russia from American media. In fact, there was recently headline news how Russia was selling its gold holdings. Yet, further investigations showed the contrary. Not only did Russia silence the gold selling rumors, but informed they had actually bought 600,000 more gold ounces. With so much of the focus anti-Russian and anti-ruble, investors are blindly staring at the forest without seeing the trees. Following the OPEC (specifically Saudi Arabia) decision to push down oil prices and Chinese rampant currency swaps and the BRICS (Brazil - Russia - India - China - South Africa) nations forming their own investment banks, the petro-dollar is under heavy stress.

Seize the day and grasp the rare opportunities laid out in front of you.

II. Strong Dollar and Steady Gold Price

Investors have been aware of the strength of the US Dollar lately. As this further adds to the notion of ongoing global currency wars, with countries taking turns devaluing their currencies for the crude expectations of boosting exports, one can rationally expect the Federal Reserve with its disgust towards deflation to eventually begin another round of quantitative easing. But no matter the causation of events or the illogical sequence of how the US dollar got here, a stronger dollar is what investors presently have to work with.

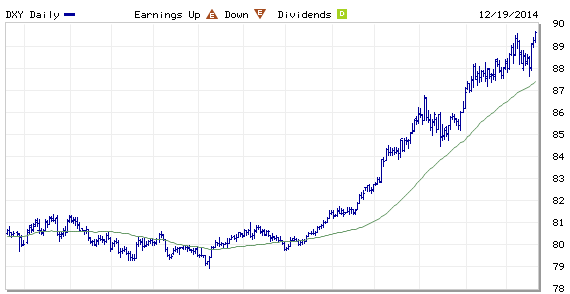

US DOLLAR CHART JANUARY 2014 - DECEMBER 19th 2014

But this has an advantage for gold miners. Usually when the dollar is strong, gold is weak and vice versa. But Investors most likely forget that the mining companies are paid for their production in dollars. And since gold is sitting around the $1,200 mark, a higher gold price plus a strong dollar is a exceptional scenario. The stronger dollar gives gold miners real gains, not just nominal. This means they have more purchasing power to make acquisitions and other value-added moves that promote ultimate shareholder value.

III. Oil Price Decline; Less Energy Costs for Miners

Mining is very capital intensive and to operate the machines all day requires energy. Enter diesel fuel. This specific energy source is needed to power the large machinery, generators, and shoveling.

A Caterpillar (CAT) truck used by mining companies for transportation of earth.

The cost of driving back and forth these very large machines is costly. And according to the U.S. Energy Information Administration, it requires one barrel of crude oil (42 gallons) to conjure 12 gallons of diesel fuel.

"Refineries in the United States produced an average of about 12 gallons of diesel fuel and 19 gallons of gasoline from one barrel (42 gallons) of crude oil in 2013," U.S. Energy Information Administration

One can thus logically and accurately make the claim that lower input costs, such as oil, will transcend into lower costs for the mining companies. With mining companies struggling to control their all-in sustaining costs (AISC), this gives companies a lower overall cost structure and surprises many sell-side analysts once earnings arrive. These lower costs help companies' operating expenses and will strengthen the profit margins of mining companies and also subsidize them if metal prices decline further. However, it is also a double edged sword: Lower costs will bring on marginal mines which will in turn supply more gold, possibly decreasing the price from the added supply. It will take time for this to commence if oil stays low - time will tell.

Oil prices declining could disrupt the entire junk bond market for the US fracking/shale companies that have been piling on cheap debt the past couple years to produce and operate marginal and high cost oil wells, but that's for a different article on another day; it dearly deserves an in-depth study.

The $173 billion in U.S. energy junk bonds make up the biggest portion of the high-yield debt market after the Federal Reserve set low interest rates for years and pushed yield-starved investors toward riskier investments, says Colin Eaton.

IV. Tax Loss Season

DEFINITION OF 'TAX SELLING'

A type of sale whereby an investor sells an asset with a capital loss in order to lower or eliminate the capital gain realized by other investments. Tax selling allows the investor to avoid paying capital gains tax on recently sold or appreciated assets.

With the volatility of the gold mining equities, many investments in the resource sector, as history has shown, become heavily sold towards the end of the year. It is a good time as well for fund managers to reset positions that did not work as expected.

The following chart is from the Casey Research team that had selected the whole energy index on the TSX and took its average for the final trading days. If investors held from a full 30 days of the following year, the entire month of January, the average returns were intriguing:

Three-quarter of the time, the investors made profits. Speculators then can assume with the oversold mining equities that tax loss season, logically, is a key culprit. Investors would be wise to look into the gold/silver mining equities as they are on an even larger discount than before.

This is important: Companies such as Gold Resource Corp (GORO) and Eldorado Gold (EGO) are low-cost producers with minimal dilution, high-grade projects and little-to-no debt. In a lower gold price environment logically the lower cost producers would have an inflow of money coming from the outflows of marginal mining companies. This has not been the case. In fact, both the aforementioned companies have been seeing their stocks drift lower, especially Gold Resource Corp which pays a decent dividend. No bad news has appeared, thus from a rational investment thesis it must be tax loss season selling. This is the time for prudent investors to do their homework, contact the companies they are intrigued with, and decide if any are an excellent buying opportunity with such disgustingly cheap valuations. In other words, ask yourself: Is it "I" who is irrational, or has Mr. Market been negligent towards the overly pessimistic metals and mining sector?

I challenge Mr. Market's irrational conclusion.

V. Conclusion

To summarize: Investors have a strong dollar environment which allows gold companies to increase purchasing power in real terms. Companies will have a reduction in operating expenses, and increasing margins, due to the drastic nearly 50% reduction in oil prices. The historic tax loss selling catalyst throughout November and December has been pushing prices artificially further down. These are all ample reasons for investors to take advantage of such spurious times. The contradictions alone are enough to drive a logical investor mad. Investors should contemplate these questions:

- Shouldn't low cost producers be more attractive? If so, why are their share prices declining?

- Why are mining companies with no negative news having their shares pummeled in the winter months?

- With gold staying steady and the dollar rising, doesn't this make mining companies wealthier in real terms? Indeed it does.

- The massive reduction in oil prices will give the energy dependent mining businesses lower expenses which translates into stronger corporate margins, does it not?

- With the global turmoil increasing and Russia and China calling for a de-dollarized world and Indian gold import restrictions being lifted and more foreign nations requesting their gold holdings back from Fort Knox and the fragile junk bond market in America, shouldn't this be bullish for precious metals? One would think so.

Contrarian investors vs. Mr. Market: Time will tell who was right.

Disclosure: This is my opinion and information is to the best of my knowledge.

well thought out and articulated article. Thanks Adem!