Thoughts For Thursday: Fed Talk And Tech Tremors

Fed signals that it will reduce its bond holdings by up to $95 billion a month and likely raise interest rates by 50 bps, caused tremors in the Nasdaq on Wednesday.

At the close of trading yesterday, as details of the released March FOMC meeting minutes began to sink in, the S&P was down 44 points to close at 4,481, the Dow was down 145 points closing at 34,496 and the Nasdaq Composite fell 315 points to close at 13,889.

Wednesday's top loss holdings were in Travel and Leisure and Technology, with the exception of fixed income, institutional investors trading platform MarketAxess.

Chart: The New York Times

In morning trading S&P market futures are up 11 points, Dow market futures are up 26 points and Nasdaq 100 market futures are up 68 points.

Contributors Chris Turner, Francesco Pesole, Frantisek Taborsky note an Expeditious Fed To Keep Dollar Supported.

"The takeaway from the March Federal Open Market Committee (FOMC) minutes last night was that the Federal Reserve seemed confident enough about growth and the labor market, but that inflation needed to be addressed – and fast. It seems clear that the Fed would have opted to start the cycle with a 50bp hike were it not for the war in Ukraine. Some clarity was also provided on quantitative tightening – i.e. the speed at which the Fed will shrink its balance sheet. Based on the minutes and recent comments from Fed dove Lael Brainard it looks like the Fed will start shrinking its balance sheet after the May meeting, at a rate of $95bn per month. That's nearly twice as quick as was seen during the last balance sheet run down during the 2017-19 cycle. All of the above points to the Fed applying a heavy foot to the brakes, which should be positive for the dollar."

Tuesday we highlighted TM contributor Keith Weiner's piece on the ruble. Today in Oil, The Ruble And Gold Walk Into A Bar… Part II he is back with more storytelling.

"..saying the ruble is linked to oil suggests that something good from oil will rub off on the ruble. If it were voiced clearly, it would sound something like this: “Europe is remitting rubles to buy oil, therefore something and the ruble will somehow go up, someway.” The ruble is not linked to oil. Oil could go up to $1,000 (or down to $10), but it won’t somehow rub off on the ruble."

"Price Fixing Between Rubles and Gold

The present Narrative exploits these notions. They are telling us that, first, Russia is acquiring the requisite gold by this 5,000-ruble bid...Second, they are telling us that 5,000 rubles are the new price floor of gold. Finally, they tell us that the ruble will strengthen—because of the gold which is now backing—i.e. linked—to it. As the ruble goes up, so they assert, 5,000 rubles will be worth more and more in dollar terms. And therefore, the ruble’s rise will drive up gold.

This is a big switcheroo. We went from (1) Russia making a lowball bid on gold to (2) this is the fixed price of gold in Russia's gold-backed ruble gold standard to (3) the gold backing will drive up the ruble all the way to, astonishingly, (4) the ruble will begin to rise under its own steam and drive up the price of gold in dollars(!)

#4 is kind of the opposite of #3. We wonder which is supposed to drive which."

"Taking the absurd to even greater extremes of absurdity, another version of the Narrative sometimes ties it to the gold suppression conspiracy theory. According to this version, London and New York will be “drained” of gold, as Russia has more oil than they have gold to pay for it!

Some say aloud the part that’s supposed to remain silent. They see this as a way to ruin the West entirely. Not just COMEX and LBMA, the West will have to surrender all its gold. Then Russia will have all the gold, control all the cards, and remake the world order as it wishes.

We would worry more about the possibility that our Sun will suddenly go supernova, than about this implausible mechanism to “drain” all our gold.

You aren’t giving Russia your gold, in exchange for oil or gasoline, are you? We didn’t think so."

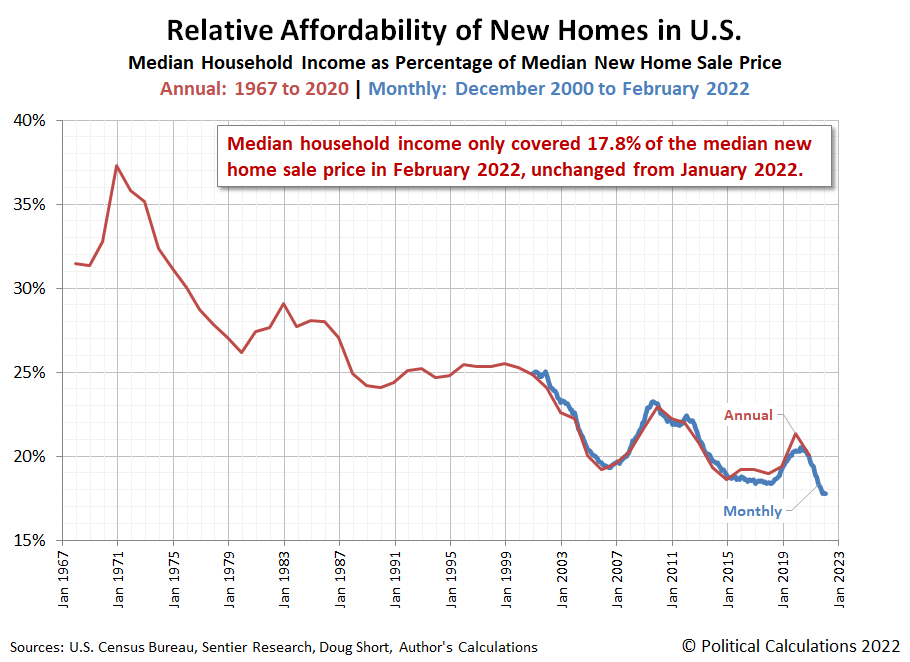

One of the concerns about rising Fed rates is the impact on mortgage rates and the affordability of housing, which has been steadily eroding. TalkMarkets contributor Ironman reports that the Raw Affordability Of New Homes Holds Steady At Record Low.

"The raw affordability of new homes held steady at record low levels in February 2022. While median household income increased, that increase kept pace with the ongoing escalation of new home prices. The following chart confirms that assessment. We find median household income stayed at a record low of 17.8% of the median sale price of a new home in February 2022, effectively tying for the lowest level of affordability by this measure on record."

Ironman writes "The average mortgage payment for a median new home sold in February 2022 represents 29.8% of the income for the median American household."

The article closes with the following chart which visualizes the trailing twelve month averages for both median new home sale prices and median household income.

In an under 40 minute video contributor Ryan Mallory entertains the question Will Jerome Powell Crash The Stock Market!?

"A discussion of whether the stock market is going to crash again, following the Fed Minutes reveals a very hawkish Fed that wants to aggressively raise interest rates. What will be the impact going forward for SPY ETF, QQQ ETF, and IWM ETF?"

To take us out for today TalkMarkets contributor Felix Martinez checks the sweetness of the ketchup in High Dividend 50: Kraft Heinz Co. What follows are excerpts from his lengthy article.

"While The Kraft Heinz Company (KHC) doesn’t have a 5.0%+ yield currently, its dividend yield of 4.1% is still high compared to the low-interest-rate environment and the broader Market.

Source: Company Factsheet

"The company leverages its scale and agility to grow across a portfolio of six consumer-driven product platforms. Some of the company’s well-known brands are Heinz ketchup, Mayo, Lunchable, Oscar Mayer, Jell-o, and Kool-Aid. The company has a total net sales of $26 billion for Fiscal Year (FY)2021, with a market capitalization of $48.9 billion.

"For the 2021 fiscal year, total sales were slightly flat compared to FY2020. Total sales were $26,042 million in FY2021 compared to $26,185 million in FY2020, a decrease of 0.5%. The regional segments saw the same kind of results as the fourth quarter. For the year, the United States region saw sales decrease by 3.1%, from $19,204 million in 2020 to $18,604 million last year. However, the International and Canada region saw sales increase by 6.5% and 6.5%, respectively.

Gross profit for the year was down 5.4%, but operating income saw a significant increase of 62.6% year-over-year. Income also saw a significant increase of 184.5% for 2021 compared to 2020. Thus, diluted EPS was $0.82 compared to $0.29 per share prior year same quarter, or a 182.8% increase. Furthermore, Adjusted EPS was slightly up for the year by 1.7%, from $2.88 per share in FY2020 to a reported $293 per share in FY2021."

"We expect the company to earn $2.62 per share for FY2022. This would represent a decrease of 11% year-over-year compared to FY2021."

"Since the (merged) company was not around during the Great Recession of 2008-2009, we will look at how the company performed during the COVID-19 pandemic.

KHC’s earnings-per-share before and after the COVID-19 pandemic:

- 2018 earnings-per-share of $3.53

- 2019 earnings-per-share of $2.85 (19% decrease)

- 2020 earnings-per-share of $2.88 (1% increase)

- 2021 earnings-per-share of $2.93 (2% increase)"

"Kraft Heinz is a company that is trying to change things around. The company owns some of the well-known brands in the USA. Because of international growth, the company should be able to generate some earnings growth in the long run, but Kraft-Heinz will never turn into a high-growth company. Overall, the company dividend is safe and well suited for investors looking for a safe, high yield company. This stock is not for dividend growth investors who are looking for years of dividend increases from the companies in their portfolios."

Caveat Emptor.

Take care. I'll see you on Tuesday.

Please Support Ukrainian Relief Efforts