There's Still Time To Get On The Trade Of The Decade

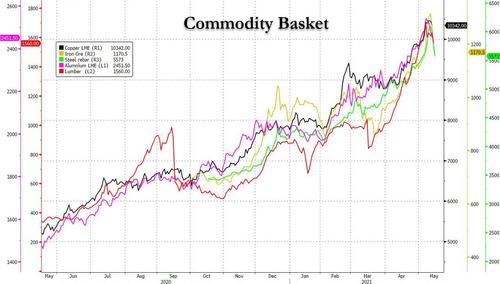

Alongside some observations we made earlier on tech stocks versus commodities, Deutsche Bank credit strategist Jim Reid writes that while inflation and commodities have dominated the financial airways this week, "although commodities prices have been a big part of the current inflation scare, they have actually dipped since the mid-week US CPI shock which has helped markets adjust to the high print."

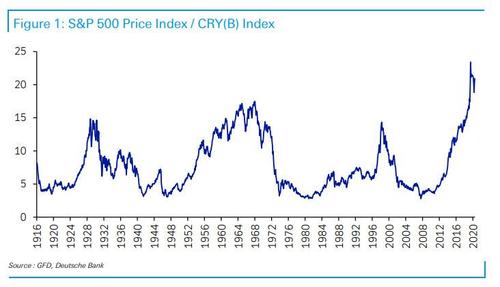

So is the commodities run now over, Reid rhetorically asks? To answer, he updates a chart which he first showed in January (and which he called “Trade of the Decade”) which shows the long-term relationship between the S&P 500 (price only) and a long-term commodity series.

At the start of 2021, this relationship was the most stretched in history. Four and a half months later, and the ratio has moved in favor of commodities. But in the context of long-term history, there hasn't been much change as the S&P 500 has seen a solid 10% YTD gain itself.

As Reid concludes:

"If you think we’re at a secular turning point for hard assets versus financial assets, there is still plenty of time to get on board on a relative basis. Note, though, that history tells us that commodities tend to under-perform inflation over the long-run and equities out-perform. So commodities have never been a great buy and hold investment. However the one major criteria that flips this relationship is inflation. In these periods commodities dramatically out-perform."

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more