The Weekender: Bad News No Longer Tastes Like Comfort Food For Wall Street

Image Source: Unsplash

When Bad News Becomes Simply Bad

The market strutted into Friday thinking it was at a celebration and stumbled out looking like it had been blindsided at the bar. Fresh intraday highs across the S&P, Nasdaq, and Dow evaporated into losses by the bell as the August payrolls report revealed just how fragile the labour market really is. Twenty-two thousand jobs created—when seventy-five thousand were expected—isn’t a slowdown, it’s a near stall. The unemployment rate ticked up to 4.3%, and the June revision showed outright job losses. The combination has traders prompting the Fed to consider multiple rate cuts this year, starting this month, with three now priced in before year-end, and open talk of a fifty-basis-point cut on the table.

Equities reflected the tension. Tech managed to buoy the week, but Friday was a pump-and-dump session as traders wrestled with whether weaker data means salvation or sickness. Bonds, bullion, and Bitcoin had no such hesitation; they surged on the dovish repricing curve. Oil was the casualty, sliding to three-month lows under the twin weights of OPEC+ supply hikes and the consumer demand warning embedded in payrolls. Gold, by contrast, sprinted to a new nominal record at $3,600, brushing its inflation-adjusted 1980 peak. The divergence is stark—oil in gold terms has never been cheaper outside the COVID collapse.

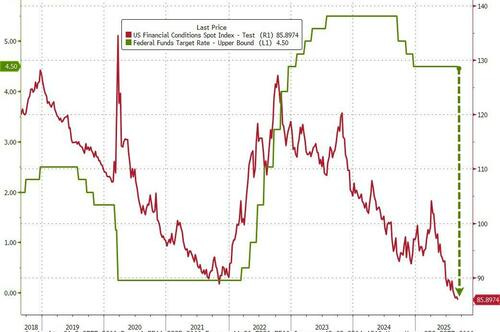

What makes this even more surreal is that financial conditions, by Goldman’s measure, are already the loosest on record. Powell is being asked to open a tap when the basin is already flooded.

Yet, the real risk isn’t about liquidity anymore; it’s about whether labour weakness leaks into corporate earnings and credit spreads, igniting a vicious circle where easy policy is drowned out by tightening risk premia.

Inflation has been shoved off the stage, and jobs data now takes the spotlight. August CPI will likely print a headline of 2.9% with core at 3.1%, a print that could provide more stock market pain if the long end of the curve surges, but the short end of the rates markets and the Fed alike will look past tariff price pressure noise when job creation has a faint pulse.

That said, traders should brace for some whipsaw in Treasuries. The 10-year has broken lower, with the assault on 4% looking increasingly likely. But don’t mistake that for a one-way street. It feels more like an overshoot to the downside, a sharp adjustment born of weak payrolls and dovish repricing. Once the dust settles, higher inflation prints lurking in the pipeline will come back to haunt the long end, forcing yields to back up hard. In other words, enjoy the dip while it lasts—this move carries the seeds of its own reversal.

The Sahm Rule hasn’t fired yet, but the trigger is close. A three-tenths rise in joblessness this year leaves little cushion. With an -800k payroll benchmark revision looming, the safety margin may not survive September. If unemployment continues creeping higher, the “not yet recession” narrative will be hard to sustain.

Powell is cornered. A September cut is all but certain, but whether it arrives in time to arrest labour deterioration is another matter. Once layoffs harden, liquidity injections are more painkillers than a cure. The market’s strange logic—cheering bad news as good because it forces Fed action—can only last until bad becomes too bad. Friday’s tape was the dress rehearsal: bonds, bullion, and Bitcoin feasting, equities hesitating, oil in retreat. Comfort food for now, but one step away from a market that discovers it has lost its appetite entirely.

Gold’s Ascent: When Trust in the Fed Cracks, the Metal Shines

Gold has never been about yield, it has always been about belief. Strip away the glitter and you are left with a blunt store of value that demands no institutional trust, no central banker’s promise, no bondholder’s coupon. In a world where Washington sharpens its knives against its own central bank, that simplicity becomes priceless.

This year’s surge—up 35%, smashing through $3,500 an ounce—hasn’t been a random melt-up. It’s the collective market mind recalibrating to the idea that the U.S. Federal Reserve, once the unimpeachable referee of monetary stability, could become just another political pawn. Every attack on the Fed isn’t just noise; it’s erosion of the foundation upon which the dollar’s reserve status has stood for decades.

The mechanics are straightforward but devastating. A Fed stripped of its independence is one more likely to ease when discipline is required, to inflate when restraint is demanded. That threatens the long-dated Treasury complex, raises the long-term inflation path, and chips away at the dollar’s global preeminence. If even a sliver of the enormous private Treasury holdings were to bleed into bullion—just one percent of that mountain—the repricing would catapult gold toward $5,000. Not in fantasy, but in math.

This isn’t just a speculative hedge fund game. Central banks, from Beijing to Brasília, have already shifted allocation, buying gold with an urgency not seen since the Cold War. They’ve watched sanctions weaponize the dollar and know the only true “neutral asset” is yellow metal stacked in their vaults. The private sector is following suit. Portfolio managers who once counted on long bonds to ballast equity risk are discovering that duration no longer diversifies in a world of fiscal overhang and political interference. Reliable insurance has become scarce, and gold is filling the void.

Markets have a long memory. They know that when political actors muscle into monetary space, currencies wobble and inflation expectations creep higher. They know that dollar strength isn’t eternal, and that every empire’s coin eventually debases. Against that backdrop, gold is not a barbarous relic—it is the last line of defense.

The base case may be $4,000 by mid-2026. But markets are not linear. Confidence breaks slowly, then suddenly. If trust in the Fed truly unravels, the trajectory won’t be incremental; it will be parabolic.

In that world, gold isn’t just an asset. It becomes the litmus test of what investors believe money itself is worth.

Gold’s Gamma Inferno: The Fire Traders Can’t Contain

Gold isn’t just rising—it’s ripping through the ceiling like a trader’s blotter set alight. What began as a measured breakout has morphed into a self-feeding inferno, where overbought is no longer a warning but an invitation. The tape is pure momentum now, and momentum has no conscience.

At the start of the year, gold was pinned in, tracing a tired triangle pattern as if waiting for the 100-day moving average to decide its fate. That breakout felt significant at the time, but this latest charge carries the same DNA—only with more fuel and fewer doubters. Once the beast broke free, every short hedge became tinder.

The real accelerant is gamma. Dealers are trapped. The push through $3,500 tightened the rope, with a brief pause at $3,550 before the noose snapped tighter again at $3,600. Guess what? Yes, the virtuous gold gamma loops start again. The higher gold ticks, the more dealers must chase, dynamically hedging to cover their exposure. This is the cruel symmetry of short gamma—it destabilizes in both directions, but right now the street is being forced to fuel the rally rather than cap it.

Volatility has jumped, yet gold’s options surface still trades cheap relative to the move. August call spreads have ballooned in value, and traders nimble enough to roll into higher strikes are finding fat pickings. The irony: the storm looks obvious in hindsight, but vol remains just inexpensive enough to lure fresh speculators into the bonfire.

The other prop under gold’s surge is a dollar that can’t find its footing. The correlation is as old as the tape: a soft dollar lubricates gold’s climb. The inverted DXY chart makes the relationship painfully clear—greenback weakness is pouring accelerant on this blaze.

The rotation between bitcoin and gold has once again tilted to the tangible. Digital assets may flash, but when capital gets nervous, it wants something it can literally touch. The handover is real, and history shows these switches can last far longer than most traders’ patience.

The tail-risk math is shocking but simple. Gold ETFs are still just a sliver compared with Treasuries—barely 1%. If even 1% of privately held U.S. Treasuries were reallocated into bullion, gold wouldn’t just touch $4,500, it could scream toward $5,000. The central banks are already making the pivot. If private capital joins them in earnest, the supply of available metal will look like a drought-stricken reservoir.

This isn’t a polite rally. It’s a gamma squeeze turned bonfire, lit by dealers, fanned by a weak dollar, and legitimized by the gravitational pull of diversification flows. Traders know overbought can persist longer than cash margins, and right now, the market is teaching that lesson all over again. Gold isn’t just unstoppable—it’s rewriting the script on what unstoppable means.

Chart of the Week

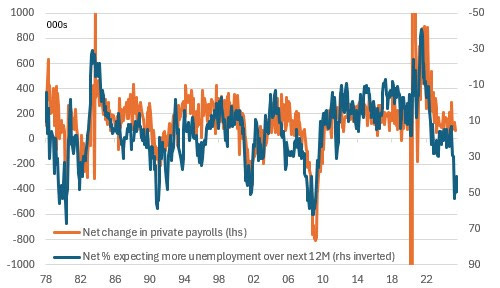

Households fear jobs will be lost.

Households are already bracing for job losses, even if the official data still insists on a “cooling, not collapsing” labor market. The University of Michigan’s confidence survey tells the real story. Buried inside is a question on unemployment expectations, and the answers should make policymakers sweat: 62% of Americans believe unemployment will rise over the next year, while only 13% expect it to fall. That nets to nearly half the population leaning bearish on jobs, a reading that has only been worse four times in the past half-century.

Households often feel the tremors long before the statisticians. They see the quiet hiring freezes, the whispered cutbacks, the colleague quietly shown the door. That front-line intuition builds into the survey before it bleeds into the payrolls data. Which means the market’s unease is not just about the last 22k print—it’s about the sense that the ground is shifting beneath workers’ feet. The signal here is clear: the risk of outright employment declines later this year is no longer theoretical, it’s becoming the base case in the minds of consumers themselves.

From Briefcases to Black Boxes: The Fed’s Judgment Is Still the Only Currency

There was a time when the whole Street leaned on a camera zoom. Alan Greenspan stepping out of his car, leather briefcase swinging. If it bulged, we whispered “tightening.” If it looked thin, we bet on a pass. Ridiculous, in hindsight—but that’s how the game was played. Traders turned into amateur tailors, measuring the folds of a bag instead of the folds in the yield curve.

That ritual was never about the briefcase itself—it was about the mystery. The Fed spoke rarely, forecasts came out only twice a year, and so any prop, no matter how absurd, filled the void. Markets wanted signals, and in the absence of transparency, they invented them.

Now flip the calendar forward a quarter century and the briefcase era looks like a sepia photograph. Today, there’s no mystery left. Every macro release is instantly scrubbed, digested, and coded into the market’s bloodstream. Algorithms read the data before most traders finish blinking. Implied probabilities shift in Fed funds futures before Powell even finds his podium. We live in a world of models priced to perfection, where every whisper of a forecast is mechanically mapped into rates curves and cross-asset spreads.

But here’s the paradox: all the precision in the world doesn’t make the Fed mechanical. Judgment still rules. The black boxes may tell you the odds, but they can’t tell you what the committee chooses to do when growth and inflation collide in opposite quadrants. No model can weigh political pressure against credibility, or financial stability risk against academic theory. Those are choices humans make. And they’re messy.

That’s why the most difficult moments for markets are the grey zone cases—the split signals—rapid growth with tame inflation, or sluggish growth with stubborn prices. A formula says one thing; instinct and fear say another. Do you lean hawk and protect the currency of credibility? Or do you lean dove and protect the currency of growth? Algorithms can’t resolve that; they can only price both possibilities and whipsaw when the humans decide.

The irony is that in the briefcase era, the guessing was crude but honest—we knew we didn’t know. Today, the veneer of perfection makes us think we’ve solved the riddle, when in fact we’re still in the same business: trying to read judgment calls through imperfect data. The props have changed, but the uncertainty is the same.

The Fed’s briefcase has become a server rack; the superstition has become code. But whether we’re staring at leather or at latency, the punchline doesn’t change: monetary policy is never arithmetic, it’s interpretation. The outcomes are still made in real time by people weighing risk, not by numbers spitting out an answer. And that’s what keeps markets forever hunting—the realization that the heart of the system is still human, no matter how mechanical the machinery appears.

Running Update

Running has to be one of the cruelest pursuits out there—or in my case, hobbies. On a good day I’d slot myself somewhere at the higher end of “intermediate” on that beginner–intermediate–advanced scale. After four straight weeks of grinding it out on tempo and threshold runs, spicing things up with the occasional VO₂ max effort, I finally decided to back off and slip into base-run mode this week. Funny thing is, those base runs are now about a minute faster per kilometer than they were last year—but still not close to the peak shape I carried in 2022.

And yet, despite dialing the pace back by a solid 90 seconds per kilometer over 8–10K, I still managed to tweak my left hamstring. How on earth does that happen? Running’s sense of irony never fails. So here I am, sidelined into recovery since Monday. The silver lining is the leg feels good again today. The tricky part is fighting the urge to lace up too early. I know if I head out while I’m too pumped up, I risk making it worse. But if I can hold the line today, tomorrow looks like the day I get back on the road.

More By This Author:

Wall Street Dances On The Edge Of A Jobs Cliff

The September Scaries Return: Bonds Crack The Whip, Stocks Feel The Sting

Calm Before The Ambush: September Seasonal Scaries