Wall Street Dances On The Edge Of A Jobs Cliff

Image Source: Unsplash

- Seasonal Scaries Be Damned

- Beijing Tugs the Reins: China’s Market Mania Meets Its First Test

- Are S&P Futures Poised for the Seasonal Ambush?

- Jobs Roulette: What It Would Take for the Fed to Pull the 50bp Trigger

Seasonal Scaries Be Damned

But if truth be told, stock markets rose as the global bond market rout fizzled out, and everything else simply fell into place.

September’s so-called seasonal scaries barely made a dent as the S&P 500 punched through to fresh all-time highs, a move that left even hardened bond vigilantes grumbling in the corner. The immediate driver was a string of labour market data that painted the picture of a slowing—though not yet collapsing—jobs machine, just 24 hours before a payrolls report that could dictate the Fed’s hand. Weekly claims climbed, ADP private payrolls disappointed at 54,000, and Challenger’s survey showed hiring plans hitting the weakest August on record. Markets took that mix as evidence of a gentler landing: the labour market losing steam but not stalling out, keeping the September rate-cut drumbeat alive. Two-year Treasuries lingered near one-year lows in yield, a telltale sign of traders betting the September Fed cut is but a lock.

The backdrop is clear: employers lack appetite for new hires, and the unemployment rate is on course to notch its highest level since 2021 at 4.3%. If Friday confirms that trend with payrolls growing only 75,000—or worse—then the Fed, after holding rates steady this year out of tariff worries, may have no choice but to slice again in two weeks’ time. Powell has already acknowledged the “shifting balance of risks,” while Waller has sharpened the dovish case, warning that labour demand could be on the brink of a sharp decline and openly floating multiple cuts before year-end. The set-up is Goldilocks-delicate: a controlled slowdown gives the Fed cover for insurance cuts and pushes equities higher, but a collapse risks a stagflation narrative that gnaws at confidence and feeds fears the Fed is too far behind the curve.

Politics provides its own tripwires. Tokyo and Paris both simmer with reshuffle risk, keeping the dollar from cleanly rolling over even as Fed bets mount. FX traders remain half-focused on the September 11 CPI print before committing to a full-scale dollar retreat, underscoring how nuance rules the tape. Meanwhile, Trump’s new Fed nominee Stephen Miran stressed independence and the dual duty of preventing both depressions and hyperinflation—language meant to calm, though the Justice Department’s criminal probe into Governor Lisa Cook throws Fed credibility into sharper relief.

Beyond the payrolls, the U.S. service sector surprised on the upside, notching its strongest expansion in six months as orders accelerated. Twelve industries grew, led by information and wholesale trade, a reminder that the biggest slice of the economy is far from flatlining. NY Fed President John Williams echoed the tone, saying cuts will be appropriate “over time,” a phrase carefully vague but consistent with the broader dovish lean.

Commodities told their own story. Oil slid, WTI settling near $64.50 as traders braced for this weekend’s OPEC+ meeting. The market suspects the cartel may pump more barrels into an already heavy market, while CTAs—having hit “buying exhaustion” at $65—are poised to dump up to 40% of their length, a technical tidal wave waiting to crash. U.S. inventories added to the gloom, with crude stockpiles rising 2.4 million barrels and Cushing swelling to its highest since May. Diesel supplies surged, gasoline fell, but the net balance screamed oversupply. With global producers outside OPEC+ also ramping up, and tariffs curbing demand, oil has tumbled 12% this year. Goldman now sees Brent drifting toward the low-$50s in 2026.( I concur )

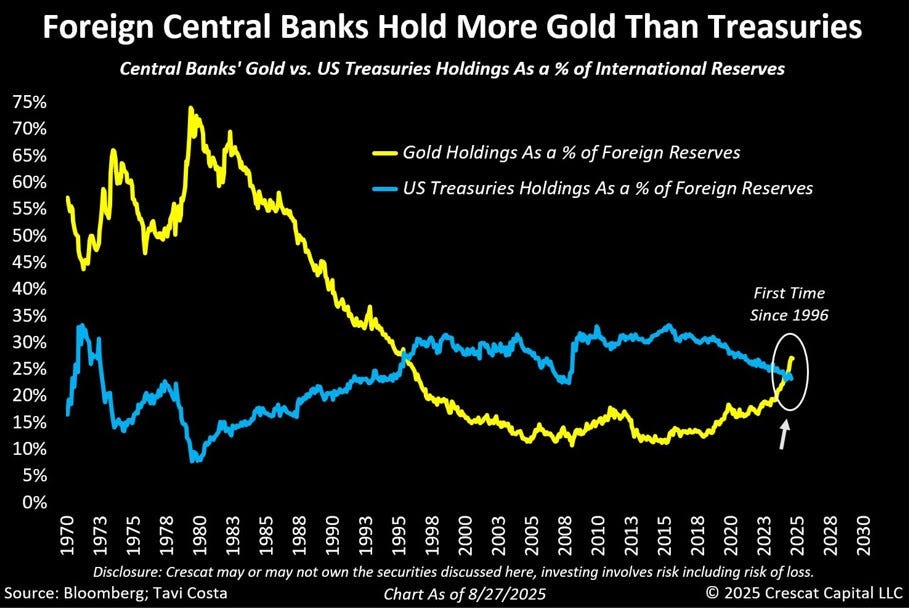

Gold, by contrast, has become the market’s refuge of choice. Central banks are shunning long-dated Treasuries—once untouchable safe assets—in favour of swelling bullion reserves. The divergence is stark: U.S. bonds are still bid, but largely treading water in reserve portfolios, while gold has become the growth asset in central bank vaults. It’s a quiet revolution, a barometer of fading faith in fiscal discipline, inflation control, and geopolitical stability.

Various forms of this chart have been floating around the internet for the past week.

(Click on image to enlarge)

Rates markets, meanwhile, are primed for drama. The 10-year UST is sniffing at 4%, a level that could be tested if payrolls undershoot badly. A print below 50k could drive the push; zero would make it almost inevitable. But any such move risks overshooting: once swap spreads are factored, a 4% yield equates to a 3.5% SOFR, uncomfortably tight against the 3% funds rate floor the market is already discounting. Sustained moves south of that level would require a wholesale rethink of policy—cuts to 2.5% or below—which even doves aren’t yet ready to endorse. Thus, a payroll shock could steepen the curve short-term but would likely reverse as the data fog clears.

Europe adds another layer of intrigue. French 10-year spreads over Bunds eased slightly, but with Bayrou’s government staring at an 86% chance of defeat in Monday’s confidence vote, uncertainty remains sky-high. Macron’s vow to avoid new elections calmed nerves only marginally. Investors remain wary, knowing fiscal consolidation will be watered down and political instability could resurface at any moment. Add in eurozone GDP barely eking out 0.1%, German factory orders, and Italian retail sales, and the continental tape remains fragile.

The bottom line: Wall Street is surfing the edge of a cliff. Equity traders are playing the Goldilocks script, betting on a soft payroll print to hand them another record close. Bond traders smell weakness but know any break toward 4% on the 10-year is probably temporary. Oil is drowning in barrels, gold is basking in newfound central bank devotion, and politics from Paris to Tokyo to Washington add layers of risk. In the end, it all comes down to Friday’s number—75,000 keeps the party going, but too hot or too cold risks breaking the spell. This is not just another jobs report; it’s the fulcrum on which every asset class is now tilting.

Beijing Tugs the Reins: China’s Market Mania Meets Its First Test

China’s stock market has been galloping like a thoroughbred, only to stumble just as the grandstand was beginning to fill. The Shanghai Composite, fresh off a euphoric break above 3,800, has now slipped back under that level—three straight sessions of red ink, the longest losing stretch since May. The selloff is more than a blip; it’s the first crack in the façade of a US$1.2 trillion melt-up that had traders whispering about déjà vu and a speculative frenzy reminiscent of the 2015 “crazy bull.”

China's "NVIDIA" (Cambricon) just crashed 15% overnight. This is what a margin unwind looks like.

(Click on image to enlarge)

The spark came from a well-timed leak: financial regulators “considering” cooling measures, with talk of lifting short-selling bans and tightening curbs on speculative behaviour. In China’s centrally managed theatre, such whispers are rarely accidental. Whether this was a deliberate policy kite or a plant by sidelined players looking for a cheaper entry, the timing was enough to knock momentum off its axis. And yet, the hand of the state was not absent—when selling became disorderly, the so-called National Team stepped in to buy ETFs and steady the tape. Beijing, it seems, wants to scare the horses but not stampede them.

Signs of tightening have been bubbling beneath the surface. Select brokers raised margin requirements, and over 400 mutual funds capped new subscriptions in August. CSRC Chair Wu Qing struck the balancing act at a weekend symposium: pledging “rational, long-term” investing while vowing to preserve “positive momentum.” Translation—Beijing wants discipline without deflation. State-backed funds, though active, kept interventions measured, suggesting the correction remains within comfort levels.

Still, the air came out fastest in the most speculative corners. The STAR50 index, China’s innovation showcase, logged its fourth-worst single-day drop since its launch in 2020. AI infrastructure, semiconductors, even humanoid robots—all the futuristic plays that had become hedge-fund darlings—were hit hardest. Cambricon, often dubbed China’s Nvidia, plunged 14.5%, a brutal retracement that still leaves it up nearly 83% year-to-date. Meanwhile, BYD, the titan of China’s EV revolution, added weight to the gloom, slashing its annual sales target by 16% as competition and demand fatigue set in. Its stock fell another 3%, extending an already painful slide.

Not every corner of the market wilted. Solar names rallied 2.3%, helped by a key polysilicon executive declaring the sector’s downturn over. Still, the day belonged to the sellers. On Goldman’s execution desk, China A-shares were the heaviest net sold in the region—flows more than double the recent average. Long-only funds were the main culprits, dumping consumer names and EVs, while trimming exposure in industrials and tech. Their only refuge? Utilities and healthcare. Hedge funds sold too, though in smaller clips, focusing on healthcare and information tech.

In derivatives, the correction through the 20-day moving average created a push-pull dynamic: profit-taking against fresh dip buying. Futures basis reverted higher, with convexity trades back in vogue as vols caught a bid on the afternoon swoon. Quants have been quietly rotating since mid-August, reshuffling size factors, leaving the spot/futures market thinner and choppier. For traders, the lesson is simple: liquidity is patchy, realized vol is suppressed, but optionality still pays.

Step back from the daily fireworks, and the larger picture is more nuanced. This rally, unlike the runaway mania of 2014–2015, has mostly tracked the contours of China’s economic recovery. Yet cracks are forming—the equity market looks to be outpacing the fundamentals. Upcoming data will be crucial: trade (Sep 8), inflation (Sep 9), and new lending (Sep 12). Any disappointment could confirm that momentum has run ahead of reality.

But don’t confuse a stumble with a collapse. Appetite remains insatiable: turnover in A-shares has topped 2 trillion yuan for 17 straight sessions, an all-time record. Margin balances hit 2.28 trillion yuan, surpassing the 2015 peak that once defined excess. Fund flows confirm it—$4.1 billion poured into China equity funds last week, the biggest since April, even as EM funds remain chronically underweight the market. That underweight, if sentiment holds, is tinder for a sudden rush of global inflows, especially with U.S. and European markets trading near their own highs.

In short, Beijing has no desire to let the market run into mania, nor to let it collapse under its own weight. What we are seeing is the controlled release of steam from a pressure cooker. Whether this proves to be just a healthy pause or the first sign of a broader unwind will depend less on rumors and more on the hard economic data ahead. Until then, traders will be left straddling the line—half saddled for breakout, half braced for buck.

Are S&P Futures Poised for the Seasonal Ambush?

As August closed its books, the tape looked orderly on the surface—S&P 500 grinding higher, breadth tolerable, VIX docile. But beneath that calm veneer, the futures positioning tells a very different story. The sharks have circled.

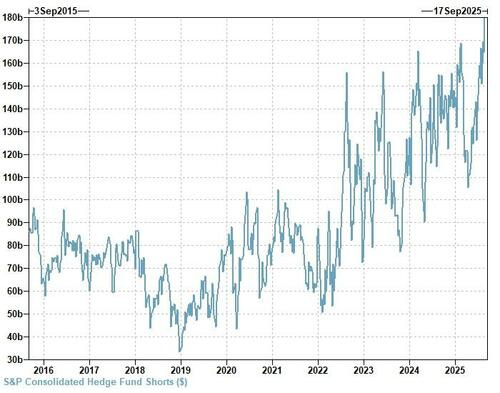

From August 19th to 26th, Non-Dealers dumped $10.5 billion of S&P futures—into a 0.9% price rise. It was the single largest week of selling since June, and it wasn’t spread across the street. Hedge funds alone carried the knife, unloading $17.7 billion. Everyone else—Other, Non-Reportable, even Asset Managers—were either modest buyers or on the sidelines. This was no passive rebalancing; it was discretionary entities putting their chips on the downside.

What jumps off the page is not just the size, but the composition of the flows. Short additions made up 62% of the selling, catapulting hedge fund gross short exposure to a nominal record and a two-year high as a percentage of open interest. In other words, the speculative community has stacked the deck with downside bets just as the calendar flips into September—the market’s bogey month, notorious for bad seasonal juju.

To be clear, some of this surge in open interest is padded by arbitrage flow, the sausage-making that accompanies basis trades and leverage provision. But strip that away, and you’re still left with a meaningful tilt: hedge funds leaning against the tape, not to hedge but to swing.

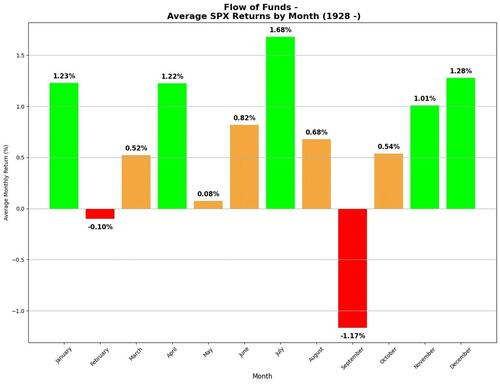

Why now? The seasonal playbook offers a convenient justification. September has been the market’s graveyard more often than not, and with valuations stretched, yields sticky, and macro catalysts—jobs, CPI, tariff politics—looming, discretionary shorts finally have the narrative cover to pull the trigger.

So while the S&P’s surface still reflects calm waters, the futures market is loaded with depth charges. The question is whether these shorts find reinforcement from weak macro data—or if, as so often happens, the market climbs the wall of worry and forces a squeeze. Either way, the stage is set for volatility to reclaim the stage. September rarely passes quietly, and hedge funds are betting it won’t this time.

Jobs Roulette: What It Would Take for the Fed to Pull the 50bp Trigger

The U.S. labor market has become the roulette wheel upon which the Fed’s credibility now spins. At stake is not just September’s policy move, but whether Jerome Powell risks looking political in an election year by repeating last year’s playbook of a jumbo cut on the back of revisions.

This coming Tuesday, September 9, looms large: the Bureau of Labor Statistics will unveil its preliminary benchmark revision of labor market data. A year ago, the shock downward revision of 818k jobs was one of the catalysts that forced Powell’s hand into a 50bp cut—well before November ballots were cast. If this year’s revision proves similar in scale, the Fed Chair could find himself in the same awkward bind: either deliver a cut to match the data, or risk accusations of selective blindness.

We may not even need to wait for Tuesday. Friday’s payrolls could themselves lay the groundwork for a 50bp move. The consensus calls for +75k jobs, tightly bunched between 60k and 100k. Standard Chartered argues that if payrolls come in below 40k, and unemployment rises to 4.4% or higher, the case for a jumbo cut is immediately live. Markets will be hypersensitive because equilibrium job growth has shrunk: with immigration curtailed, 50k–100k new jobs now covers labor force expansion. Anything significantly weaker than that screams slack.

Beyond the headline print, revisions matter. Payroll revisions tend to be procyclical—weak months usually drag prior months lower. A weak August number will almost certainly carry friends with it in the form of downward adjustments. Conversely, to rule out a jumbo cut entirely, payrolls would need to push to 130k or higher with positive revisions. That bar looks high.

The unemployment rate forecast sits at 4.3%. That in itself isn’t enough to guarantee a 50bp cut—it would need to edge up to 4.4% or higher unless NFP collapses. But here lies the trap: the UR has been flatlined between 4.1–4.2% for more than a year, masking real labor force softening. Participation is the dog that isn’t barking. The employment-population ratio has been drifting lower, telling us the labor force is quietly thinning out.

The real controversy lies in how the jobs are being counted. The notorious “birth-death” adjustment has been propping up payrolls well beyond what continuing firms are showing. While job creation from ongoing firms has dwindled to near-zero—down from an average of 450k a month in 2022 to just 14k in the year through July 2025—the birth-death plug has stubbornly stayed near +90k. Compare that to the definitive Quarterly Census of Employment and Wages (QCEW), which shows much weaker new-firm creation. The gap implies the BLS has been overstating job growth by ~70k per month. Hence the widespread expectation of a deep downward benchmark revision next week.

Put differently: a reported +100k payroll print may in reality be closer to +30k; even a headline of +170k would net out to something closer to equilibrium. Standard Chartered reckons true job creation among new firms is running at no more than +20k. The illusion of resilience is being manufactured by statistical smoke.

This all lands in the political season’s lap. Trump benefits from revisions that blame inflated job counts on his predecessor, and Powell will be under immense pressure to acknowledge data reality without looking like he’s playing election referee. That’s the razor’s edge: deny the weakness and risk credibility, or match last year’s precedent with another jumbo cut.

To trigger an immediate 50bp cut this Friday, we’d likely need a one-two punch: NFP below 40k and unemployment at 4.4% or higher. Anything less severe might still justify a 25bp, but the knife-edge narrative belongs to the revisions. If the BLS follows through with a massive downward adjustment next week, Powell may have no choice but to repeat last year’s act. The roulette wheel is spinning, and the Fed’s credibility is the chip sliding across the felt.

More By This Author:

The September Scaries Return: Bonds Crack The Whip, Stocks Feel The Sting

Calm Before The Ambush: September Seasonal Scaries

The Weekender: September’s Cliff, AI Turns To Ballast, China Liquidity Burns Hot, And Gold Stands Tall