The Taylor Swift “Bad Blood” Energy Market (and Sentiment Results)

In previous weeks we discussed being bullish on the general market over the intermediate term, while recognizing and respecting a short term overbought condition that could either be worked off in time (grind sideways) or price (short term pullback) to shake out the late money that missed the rally from Aug/Sept lows.

Our antidote to the dilemma was to trim some of the names that had monster runs off the lows and re-allocate some to laggard sectors that either hadn't participated or were just starting to get money rotating in. Following the 25%+ run off the bottom for biotech (and much more for individual names in the space) we turned our attention to the energy sector in late October.

The theme that came to mind was Taylor Swifts song "Bad Blood" as a metaphor for portfolio managers relationship to the energy sector. Managers have pulled out just shy of $900 billion from the sector since its peak in Summer 2014. The salient lyrics are as follows:

Cause, baby, now weve got bad blood

You know it used to be mad love

So take a look what youve done

Cause, baby, now weve got bad blood, hey!

Now weve got problems

And I dont think we can solve em

You made a really deep cut

And, baby, now weve got bad blood, hey!Remember when you tried to write me off?

Remember when you thought Id take a loss?

Dont you remember? You thought that I would need ya

Follow procedure, remember? Oh, wait, you got amnesia

It was my season for battle wounds

Battle scars, body bumped, bruised

Stabbed in the back; brimstone, fire jumping through

Still, all my life, I got money and power

And you gotta live with the bad blood nowBand-Aids dont fix bullet holes

You say sorry just for show

If you live like that, you live with ghosts

If you love like that, blood runs cold

Listen to Taylor Swifts Bad Blood here

The problem for most money managers is they missed the rebound in 2016 when WTI went down to $26/bbl and many were calling for $10/bbl. One well-known pundit exclaimed that he would never see oil above $44/bbl again in his lifetime. The sentiment was so gloomy that institutions didn't join the party until that summer when the party was already over. By the time they realized it was last call they were too liquored up to leave the party and woke up in a bath tub, alone and with a headache wondering what happened.

Fool me once, that's not fun

As you can see above, by the time most managers realized that Energy (and the leveraged sub-sector Exploration & Production) was the top performing sector for 2016 it was too late. It had moved up over 100% without them and many individual names were up more than that. So once everyone was back in the boat for 2017 the trap door opened and dropped everyone off at the next stop.

Fool me twice, shame on you

Well if that wasn't enough, the sub sector made another run up in 2018. The smart ones said, I'm not going to fall for that again until it made new highs and sucked everyone back in only to serve up a failed breakout and puke everyone out back to reality. The Exploration and Production Sector subsequently tumbled back down to the Great Financial Crisis lows of 2009 (when WTI Crude traded down to $33/bbl), and the 2016 oil patch depression levels (when WTI crude traded down to $26/bbl).

Fool me thrice, shame on me?..

So with WTI Crude trading around $58/bbl, how is the exploration sub-sector trading back down to these levels?

Taylor put it best, "Band-Aids don't fix bullet holes."

Couple this with the fact that if you take the top 30 components of the XOP today (that had comps in 2009), the earnings power has improved >32% over that time period.

Additionally, add in the fact that earnings growth for the sub-sector in 2020 is estimated at 24.59%:

So you have > 55% of combined improvement in earnings power not accounted for in the price. Have we ever seen anything like this before? Yes, try 2003.

The black line is the price of WTI Crude and the red and green bars are the price of the Dow Jones US Exploration and Production Index. The sub-sector had also crashed in 1999-2000 along with the price of oil. It rallied into 2001 sucking everyone back in, puked them out, sucked them back in in early 2002 and puked them out one more time.

Just as everyone began to read from the same hymnal, fool me thrice, shame on me began the biggest secular rally the sector had ever seen fueled by demand from emerging markets. The demography of the emerging markets today (and the continued emergence/expansion of the middle class in those regions) bodes well for another run if not of similar magnitude at least of memorable stature in the coming 3-5 years.

The other similarity that stands out between today and 2003 is in the final shakeout before the secular run, there was a divergence between the price of oil and the E&P stocks (oil was going up while the sector was languishing). After the two fake outs of 2001 and 2002, all managers could think about was:

So take a look what youve done

Cause, baby, now weve got bad blood, hey!

Now weve got problems

And I dont think we can solve em

You made a really deep cut

And, baby, now weve got bad blood, hey!

What else is on managers minds?

Leveraged balance sheets coupled with Wall Street's new found reluctance to lend to the sector because up until now they used the capital to produce with reckless abandon. Wall Street is now demanding capital discipline, cash flow production and return of capital to shareholders before they will open the vault to the wildcatters once again.

As a result, the rig count is down 25% year on year which sets things up for a nice reversal in coming months and years. So why all of the fear? The fear is very simple... DEFAULT. And as in life, what is most feared rarely comes to pass and even if it does to some degree is milder than expected or represents a turning point for the better.

So let's assume the worst

You have to think about the Exploration and Production sub-sector like a portfolio of junk bonds. While 10-15% may default and go bankrupt, the remaining 85-90% will dramatically outperform. That's why it makes sense to own a basket of Exploration and Production stocks at these depression level prices of 2009 (Great Financial Crisis) and 2016 (when WTI Crude traded down to ~$26/bbl), because the 85-90% that make it can be up 100-200% over the next three to five years.

Option one: you could buy the large Integrated names with no defaults that may appreciate 30-50% over the next few years (and probably outperform the S&P 500) or

Option two: You buy a basket of Exploration and Production names or an ETF that covers the sub-sector like XOP (we own it here). The group has ~15% (worst case scenario) default and go bankrupt, but the winners (85% of the basket) appreciate 100% over the next few years. So the safe group yields 30-50% with no defaults, and the risky group yields 85% (after a worst case 15% default/bk scenario).

Which is a better bet?

This is the same concept Michael Milken used to change the world in the 1980s and raise billions of dollars for takeovers.

He simply explained to portfolio managers, I have a basket of junk bonds that yields 15%, but 15% could default in a recession because they are lower-grade companies. You have a basket of investment grade that yields 7% with no defaults. If the worst case scenario happens and 15% default, your net return is still 12.75% (much higher than 7%) and you recover the principal on the losers in liquidation.

That simple pitch financed the construction of modern day Las Vegas and made billionaires like Carl Icahn, Steve Wynn, T. Boone Pickens, Rupert Murdoch, Craig McCaw, John Malone, Ron Perelman and Ted Turner among others. Milken was a billionaire maker like none other, because he understood this simple concept of a basket.

That's the same opportunity that presents itself in the leveraged exploration and production sector today. Everyone fears the imminent defaults when the fact of the matter is they should embrace them. Not only will the 85%+ that make it potentially double or triple over the next 3-5 years, but the 10-15% that default and go bankrupt will clear the market which is duly bullish.

Let's put it another way, what was the last thing anyone wanted to buy in early 2009 during the depths of the Great Financial Crisis? Banks.

Who was buying banks when everyone else was puking them out? Billionaires like David Tepper, Warren Buffett, John Paulson, etc.

In 2009-2010 when single family foreclosures were at their worst, who was buying single family homes by the thousands? Billionaires like Stephen Schwarzman.

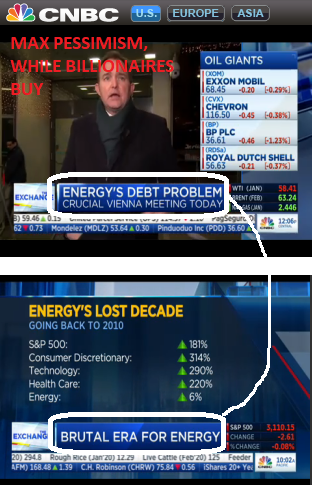

So now that everyone has been dumping their energy holdings, who's buying? Billionaires like Warren Buffett, Jerry Jones, Carl Icahn, Sam Zell, Tom Barrack, Lee Cooperman, Richard Kinder, Harold Hamm, Bill Gross and Kelcy Warren. But what do they know about making money anyway? Quite a bit

Warren Buffett put $10billion in OXY preferred and then added another ~$300M in common stock after the deal: (Investors Business Daily)

Also, when asked about why he (Warren) didn't just buy the whole co. (APC), he said, that might have happened if Anadarko had just come to Berkshire first, implying he's open to buying whole energy companies at these levels (with his $128 billion of cash). Anadarko is a bet on the Permian, but it is more of a long term bet on the price of oil going up over time. You can listen to all of his great points in this video: (CNBC)

Carl Icahn owns $5.5billion in energy stocks as of Q3 2019 (CVI, LNG, OXY, SD): (Carl Icahn Filing)

Grave Dancer Sam Zell is buying up oil assets in CA, CO and TX: (Oil Price)

Tom Barrack is buying oil assets together with Sam Zell: (L.A. Business Journal)

Jerry Jones did a $1 billion investment in Natural Gas through CRK this summer and is now looking to do potentially another $1billion of CHK assets: (World Oil)

Richard Kinder bought $130 million of KMI stock in 2019 alone: (Barrons)

Harold Hamm bought $78.8M of CLR stock with his own money this year: (Yahoo! Finance)

Kelcy Warren bought $45.1 million of common stock in ETP, his biggest-ever purchase: (Yahoo! Finance)

Bill Gross is buying ETP and MPLX and called energy his favorite sector for 2020 (Financial Times)

Lee Cooperman is buying WPX Energy (Investopedia)

Successful people look for opportunities in the difficulty, while unsuccessful people look for difficulties in the opportunity. Or as Warren Buffett likes to say, be fearful when others are greedy and greedy when others are fearful.

So what are the potential catalysts?

1. OPEC meeting. Incentives to extend/deepen cuts for all interested parties.

2. Aramco (small float) IPO and subsequent secondary offerings require valuation to stay up. Valuation is dependent upon the price of oil as a pure play. The future of Saudi Arabia and its political stability depend on the success and ongoing valuation of the stock in coming months and years as they offer more to the public to diversify their income streams.

3. Investors are forcing producers to focus on profit growth OVER production growth which for many means cutting production, generating free cashflow from remaining rigs and returning that cash in the form of buybacks and dividends. Lower levels of production and fewer rigs will start to impact the supply/demand equation for the price of oil further improving profitability in the intermediate term.

4. Shale wells have steep decline rates compared to conventional wells. They gush in the first few months, but by the end of the first year, that production is down 60% or 10x the decline rate of a conventional well. As financing for new shale wells becomes harder to come by and supply declines, cashflows from existing wells will abound and return back to shareholders. Two thirds of US Shale oil comes from wells drilled within the last 18 months. As the pace of new wells declines, price will be the beneficiary (as well as margins on remaining rigs).

5. The Energy Sector is projected to have the higest earnings growth of any sector in the S&P 500 in 2020. Read our earlier note here:

6. And most important is sentiment. As I stated in my previous article above, for a number of factors, portfolio managers wont touch these stocks: environmental, sustainability, political, fundamental, de minimis weighting in S&P 500, etc and maybe the most important reason of all THEY ARE NOT WORKING RIGHT NOW. You would be amazed how quickly that sentiment can change once they start to run (politics be damned).

As for our normal weekly indicators on the general market sentiment and positioning:

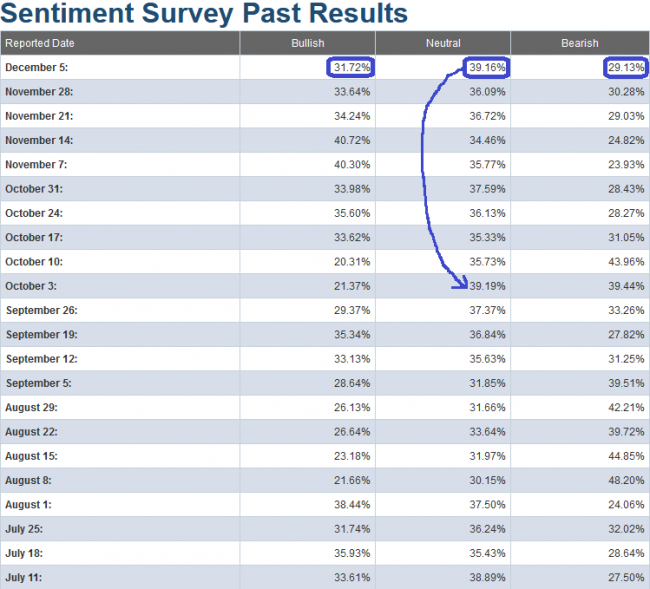

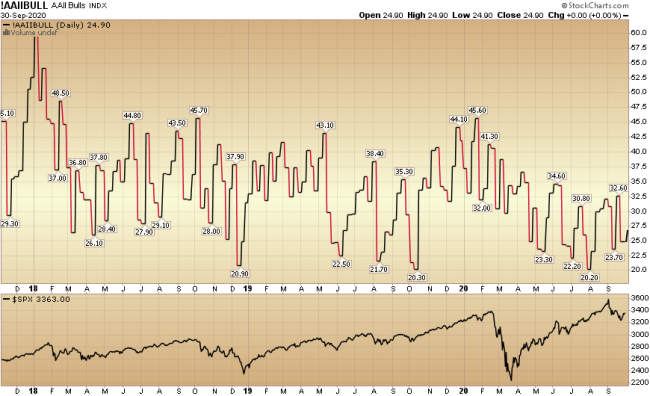

This weeks AAII Sentiment Survey result (Video Explanation) Bullish Percent came in at 31.72%, down from 33.64% last week. Bearish Percent oddly dropped simultaneously to 29.13% from 30.28% last week. Neutrality rose to a level not seen since the pullback bottom on October 3 (39.16%).

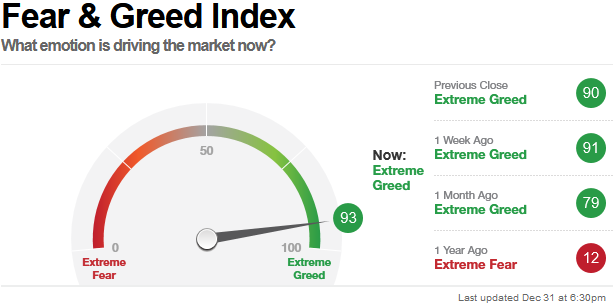

This was confirmed by the CNN Fear and Greed Index which came in 11 points (from 78 last week to 67 this week).

And finally, this week the NAAIM (National Association of Active Investment Managers Index) ticked down modestly on renewed trade war fears (from 78.23% equity exposure down to 76.66%).

As we said last week, each day that goes by without a Phase 1 trade deal signed risks the erosion of 2020 earnings estimates. For now, we are still holding strong at 9.9% earnings growth. What could be a positive surprise is that estimates actually start to improve if a deal is done sooner than later. That is in President Trump's interest, business' interest, Main Street's interest and Wall Street's interest.

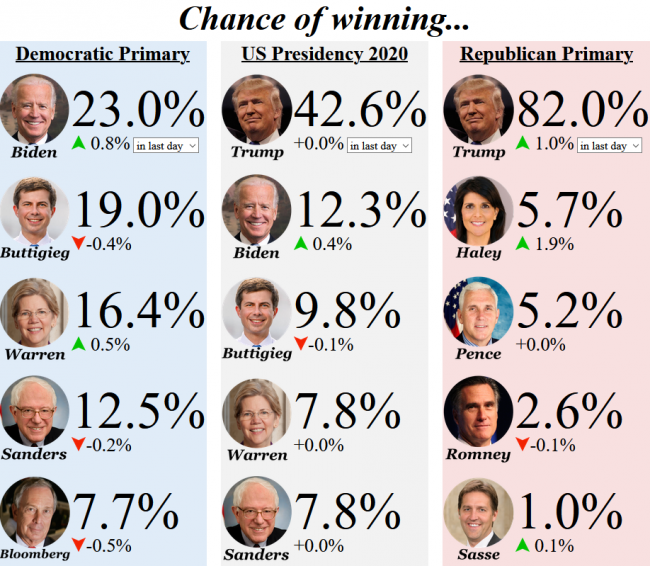

Here is what is in China's interest: Getting a reasonable win-win deal for both sides done before the election (i.e. now). If these odds from ElectionBettingOdds.com hold, I would not want to be in China's shoes after the election if they have missed the opportunity to sign a fair deal now.

With nothing to lose in his second term, President Trump wouldn't likely concede on any points with China which could further devastate their economy and lead to political upheaval. However, completing a fair and mutually beneficial deal now with phase one would put everyone in a good position for both sides to win moving forward.

For better context of this article, please see my recent quotes in the Financial Times today (Weekend Edition) in Jennfier Ablan's (US Markets Editor) Article Big-name US investors take aim at beaten-up energy sector here or here.

You can also watch our weekly VideoCast - Episode 6 - that explains the Energy Sector thesis here.

Disclaimer: Not investment advice. For educational purposes only: Learn more at HedgeFundTips.com.

Good article and good song.

Thanks Ayelet. Appreciate it!

Good analysis by the writer: You have to think about the Exploration and Production sub-sector like a portfolio of junk bonds. While 10-15% may default and go bankrupt, the remaining 85-90% will dramatically outperform. That's why it makes sense to own a basket of Exploration and Production stocks at these depression level prices of 2009 (Great Financial Crisis) and 2016 (when WTI Crude traded down to ~$26/bbl), because the 85-90% that make it can be up 100-200% over the next three to five years.

Thanks Barry