The Quiet Stories In The Base Metals Complex

Image Source: Pixabay

While precious metals are staging a breathtaking rally, other commodities are almost completely overshadowed. Attention is focused at most on the price of copper, which has become a geopolitical pawn due to Donald Trump’s import tariffs. Industry insiders from the mining sector, on the other hand, are rubbing their hands with glee at the surge in uranium prices. Both metals play a key role in the infrastructure of the high-tech industry: copper in electronics, uranium as an energy source for gigantic data centers.

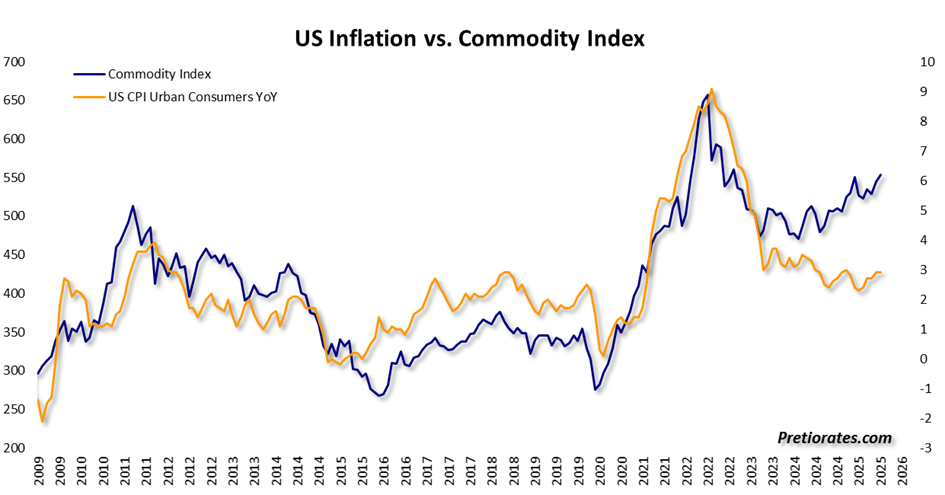

Although uranium is not included in the Bloomberg Commodity Index, it has performed remarkably well over the past five years. The lion’s share of the index’s growth is attributable to gold and silver, which together account for over a quarter of the index. Various agricultural commodities also rose sharply, while oil, gas, and most industrial metals performed rather poorly. Thanks to precious metals, the index surprisingly broke away from its close correlation with inflation—it is currently high compared to the consumer price index (CPI), unless the CPI suddenly kicks into high gear.

(Click on image to enlarge)

The close link between oil prices and the CPI remains striking. However, there is currently no sign of mispricing that would offer an attractive entry opportunity.

(Click on image to enlarge)

Looking ahead, there is little cause for hope: comparing the oil price with expected inflation, there are no signs of a reversal in the trend in the near future. On the contrary, falling inflation expectations tend to point to a further decline in oil prices.

(Click on image to enlarge)

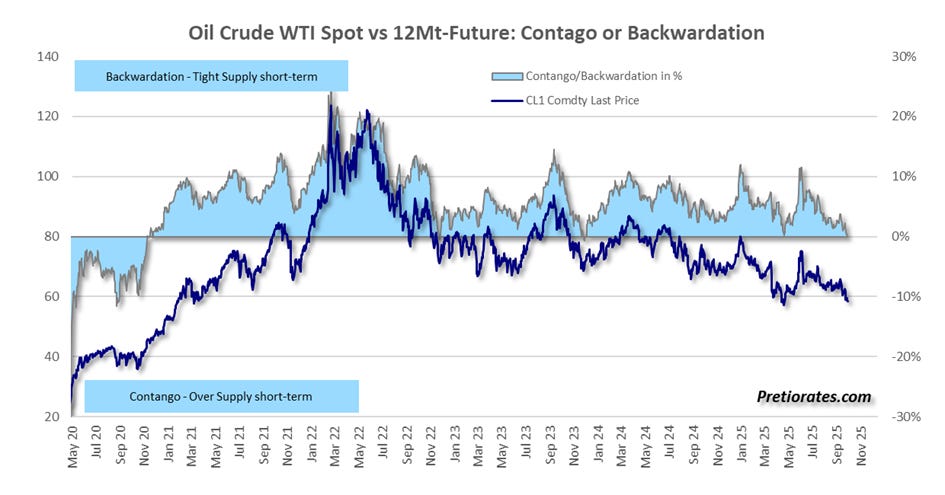

The futures market reveals a similar picture. In a so-called contango situation, prices for later delivery dates are usually above current spot prices – a sign of sufficient supply in the spot market. But for four years now, the opposite has been true: backwardation, where the spot price is above the futures price, reflecting a tight market for immediately available oil. The OPEC+ production cuts caused this situation, but did not lead to rising prices. As the production cuts are now being phased out again, backwardation seems to be coming to an end – which, based on experience, is not a good omen for the oil price.

(Click on image to enlarge)

In addition, the so-called ‘non-commercials’, i.e., funds and investment houses without physical oil interests, currently hold fewer long positions in crude oil futures than they have in over a decade. However, this lack of interest could turn out to be a classic contraindicator – in the past, phases of indifference often marked the low points of a cycle.

(Click on image to enlarge)

The price of copper is currently attracting much more attention, not least because of the discussion about US import tariffs. The prospect of tariffs drove up inventories on the US commodities exchange in the short term, as importers rushed to ship materials to the US. When the tariffs failed to materialize, the price collapsed abruptly. But since then, it has been rising again: More and more investors are realizing that available copper reserves will probably not be sufficient to meet global demand and, in particular, the energy hunger of global data centers.

(Click on image to enlarge)

The situation is quite different for nickel. After the price shock three years ago—when delivery obligations could no longer be met in futures trading—things have been quiet there ever since. Indonesia flooded the world market with cheap nickel, creating a historic oversupply. The price decline was correspondingly severe, and the forward curve slipped deep into contango. But smart investors are already sensing an opportunity: international pressure on Indonesia is growing, and the reckless exploitation of nature and resources is unlikely to continue indefinitely. As soon as the Indonesian government places greater emphasis on sustainability again, supply will stall. The nickel price – and with it the shares of mining companies – could take off strongly with this long-term outlook.

(Click on image to enlarge)

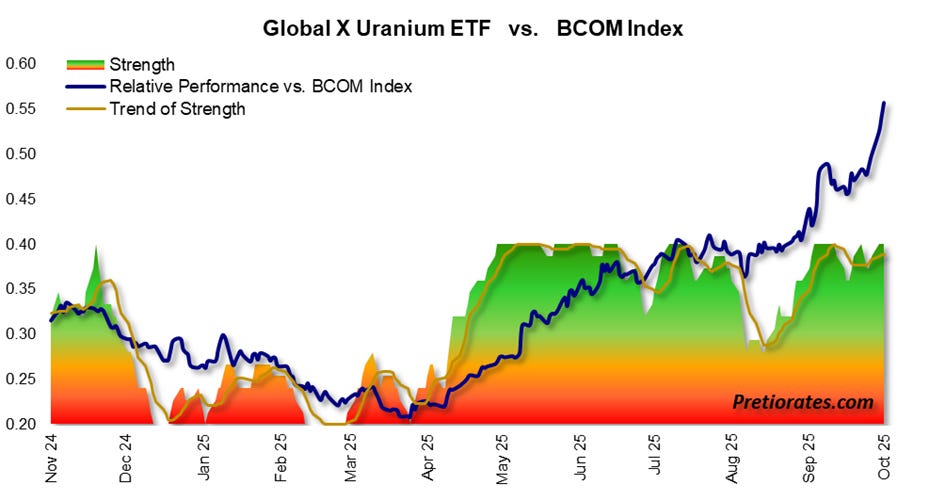

Uranium, one of the heaviest metals of all, remained a niche topic for a long time. But the plans of tech giants to build energy-hungry data centers around the world have changed that. With Russian supplies now off limits, the price has skyrocketed. For nuclear power plants, however, this is of secondary importance: fuel costs account for only around five percent of total costs – but they are by no means dispensable. Uranium significantly outperformed the Commodity Index.

(Click on image to enlarge)

Despite the recent price rally, uranium currently appears to be inexpensive again. Historically, the Sprott Uranium Trust has always offered attractive entry opportunities when its discount to the market price grew too large.

(Click on image to enlarge)

Individual metals therefore offer interesting niches for investors. The broad commodity basket, on the other hand, remains hampered by China’s growth slump and the subdued global economy. A look at the ratio of the Bloomberg Commodity Index to the price of gold underscores this: Whenever the ratio hits significant lows, attractive entry opportunities arise. There is no sign of this at present. Until that changes, it is worth keeping a close eye on the special situations mentioned above – because that is where the fire is smoldering, while the rest of the commodity market continues to slumber in the background.

(Click on image to enlarge)

More By This Author:

Gold Shines And Silver Rocks

Gold & Silver Shine, But The Crowd Hasn’t Arrived

Future In Overdrive, Present On Pause

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more