Gold & Silver Shine, But The Crowd Hasn’t Arrived

.webp)

Photo by Zlaťáky.cz on Unsplash

In several of the past 99 Thoughts, we have pointed to a continuation of the gold and silver rally. And indeed, gold has doubled in the last two years – an impressive run. Historically, however, this is a double-edged signal: the last time the price of gold doubled in this period was in 2011 – shortly before it reached a ten-year high. So, are we at a similar point again?

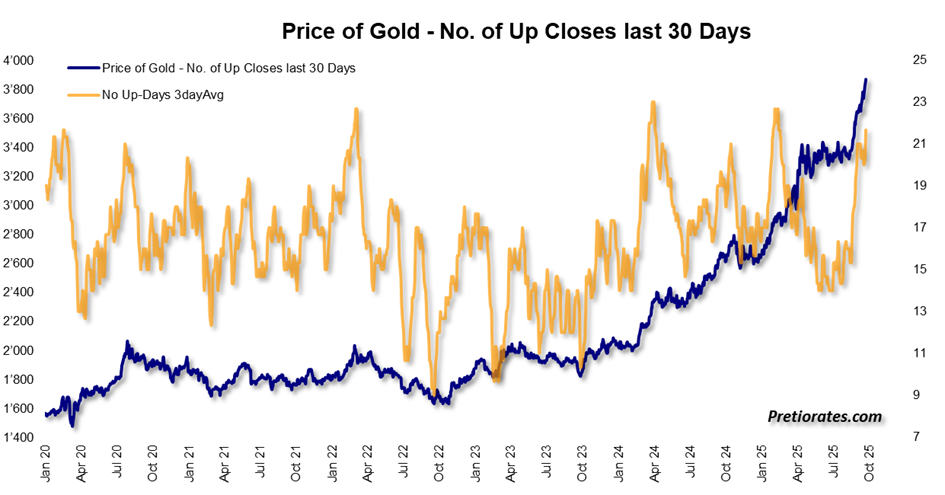

Short-term indicators at least point to overheating. The price of gold has risen on 22 of the last 30 trading days – a rare phenomenon that has only occurred three times in the last four years. However, only once was this followed by a prolonged consolidation.

(Click on image to enlarge)

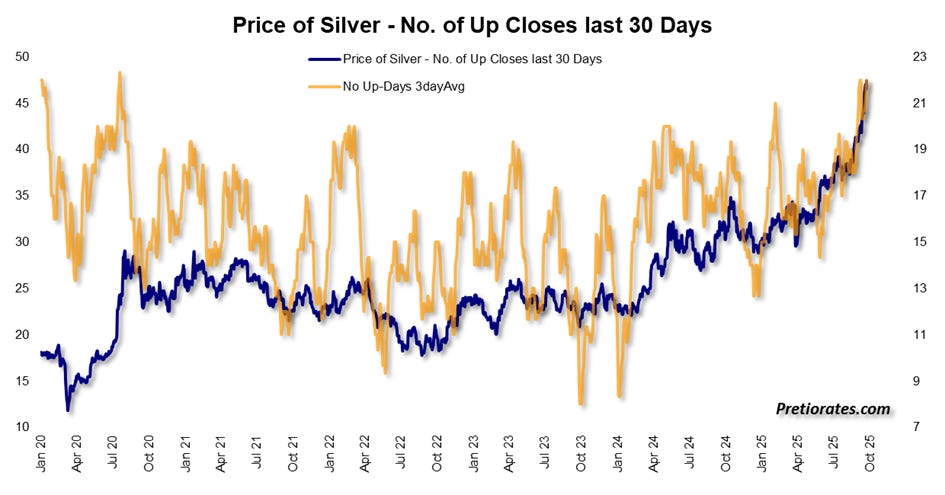

In the case of silver, the price last rose on 22 of 30 trading days in the summer of 2020. This resulted in a prolonged sideways phase.

(Click on image to enlarge)

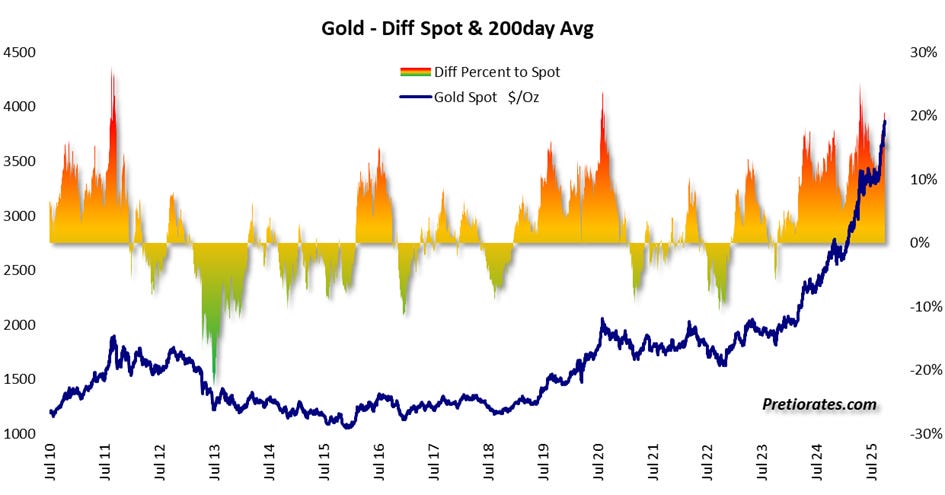

The gap to the 200-day line is now also considerable. However, the historical level at which a correction typically begins has not yet been reached.

(Click on image to enlarge)

And in the case of silver, it is striking that although the recent price rise is dynamic, the difference to the 200-day line is rather moderate compared to the exaggerations of 2011 or 2020.

(Click on image to enlarge)

A look at the futures market provides another piece of the puzzle: although investors in the gold market hold larger net long positions, there is no sign of excesses such as those seen in spring 2016 or fall 2019.

(Click on image to enlarge)

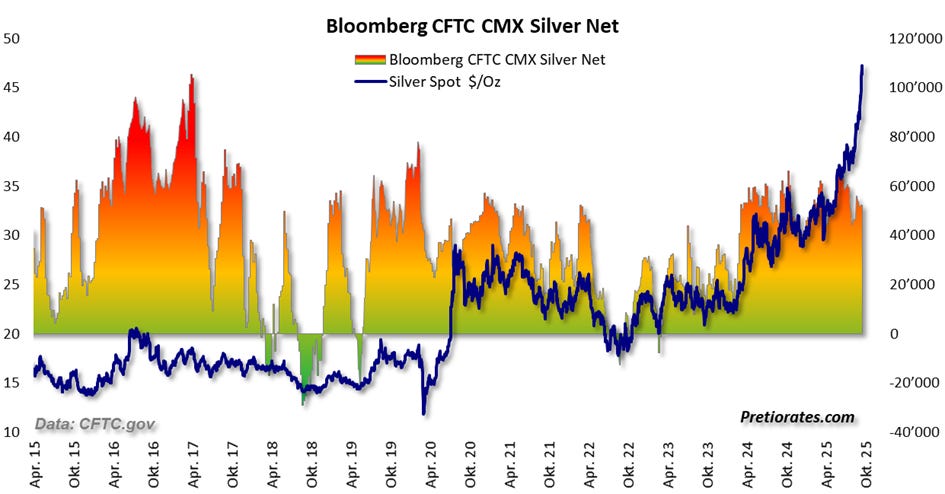

No additional long positions have been built up in the silver market recently either – a clear sign that euphoria has so far failed to materialize.

(Click on image to enlarge)

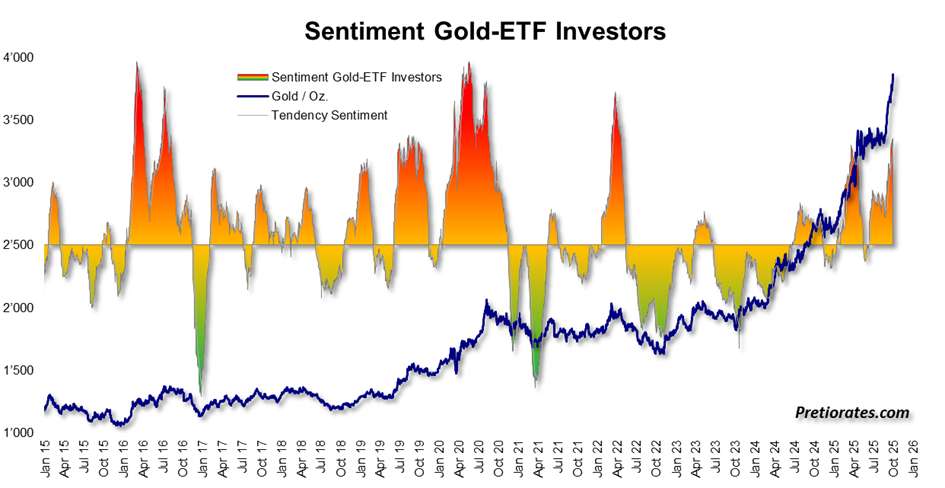

Sentiment in the gold market is obviously positive, but the high sentiment levels of previous bull markets have not yet been reached.

(Click on image to enlarge)

Despite the incredible rally in silver, there is anything but euphoria surrounding its little brother. Major rallies rarely end out of nowhere – they almost always end in euphoria. We are currently a long way from that.

(Click on image to enlarge)

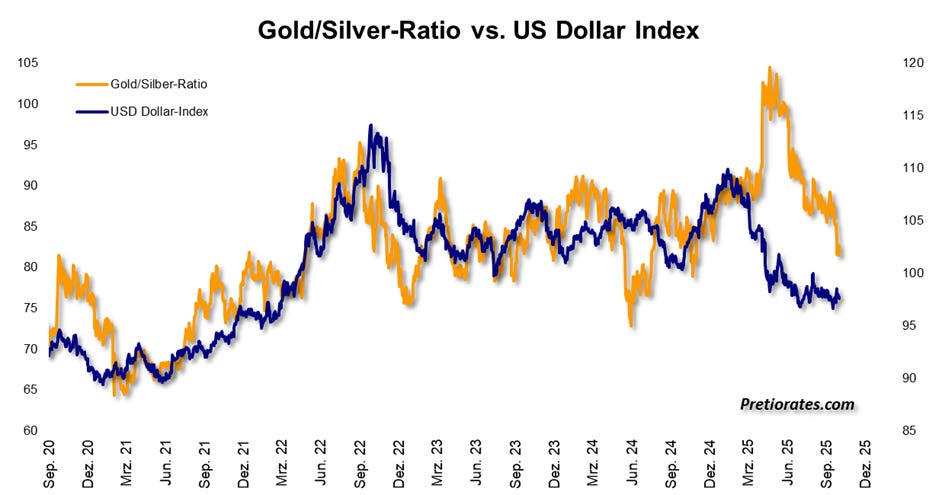

Silver also has potential to catch up. The close correlation between the US dollar and the gold/silver ratio suggests that there is still room for downward movement – possibly to around 75.

(Click on image to enlarge)

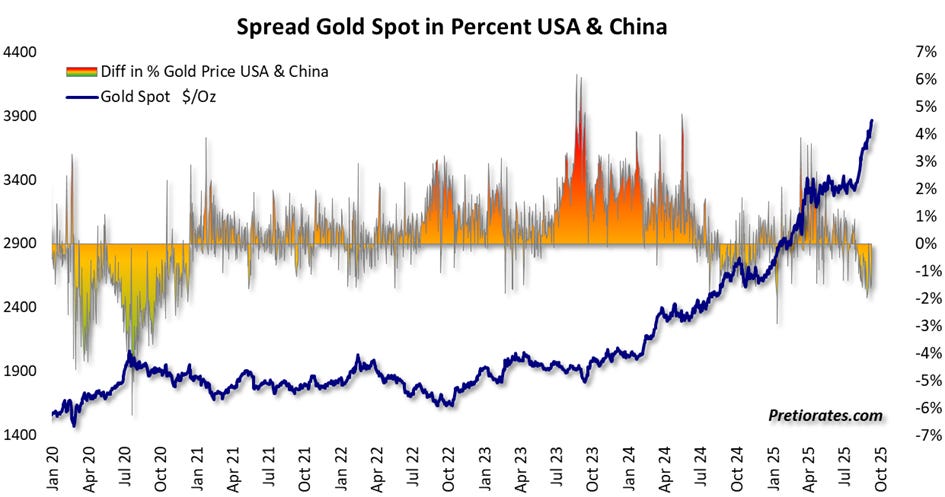

It is also interesting to look at China, where investors have remained surprisingly cautious so far. In Shanghai, gold is now trading at around 1.5% cheaper than on Western trading platforms.

(Click on image to enlarge)

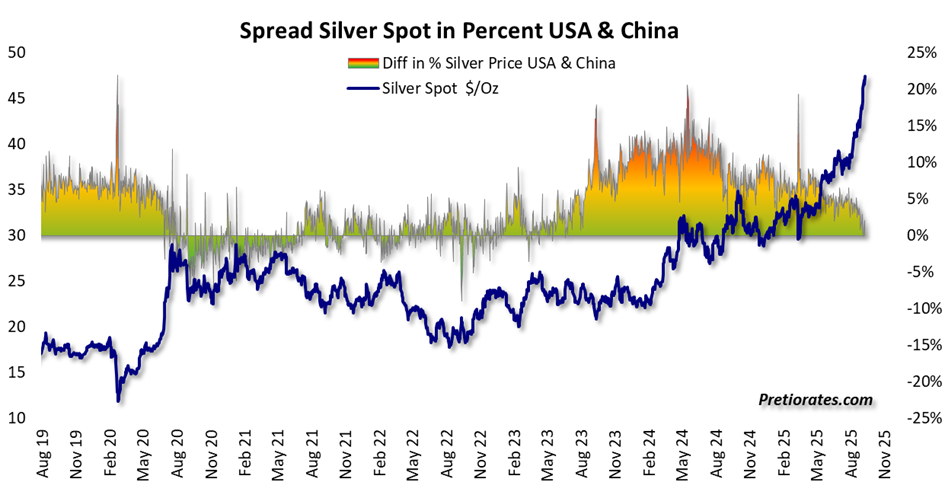

And the 5 to 10% premium that was recently paid for silver there has disappeared.

(Click on image to enlarge)

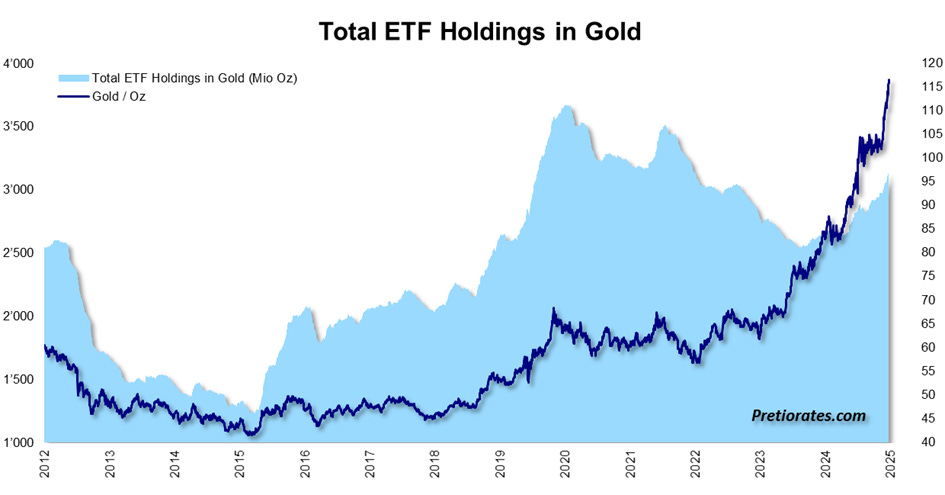

Demand is currently coming from the West – which remains underinvested. Physically backed gold ETFs currently hold around 95 million ounces – significantly less than the record level of 110 million in 2020.

(Click on image to enlarge)

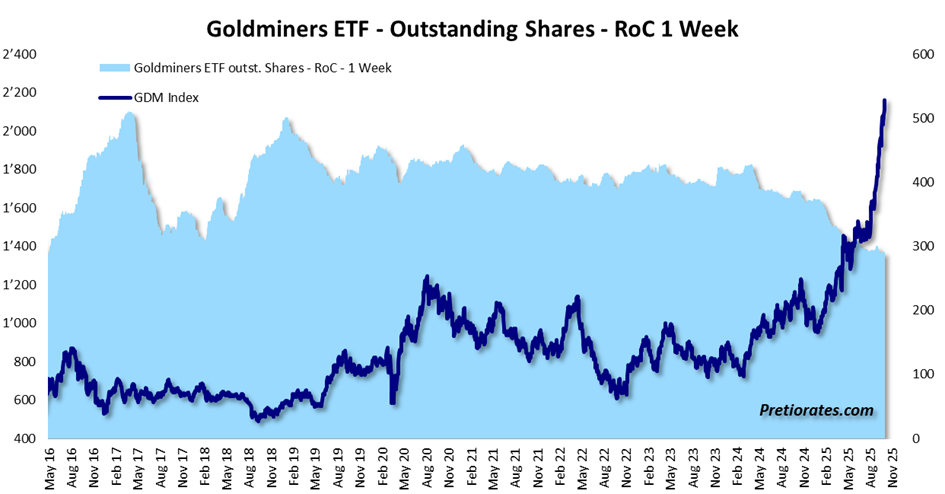

Even more remarkable is the development of mining stocks. Many investors have used the recent price gains to sell, rather than remaining invested in a sector that remains undervalued. The number of outstanding mining ETFs has fallen significantly – an indication that the majority of market participants do not trust this movement.

(Click on image to enlarge)

Bottom line: Yes, there are signs that gold and silver are facing consolidation. But it is equally clear that many investors have simply missed the rally so far and are waiting on the sidelines for more favorable entry points. And these investors are protecting us from a correction: every setback is used by latecomers to enter the market. A pause is therefore more likely than a crash. Those who are invested should not be deterred by this – because the grand finale of this movement is most likely still to come.

More By This Author:

Future In Overdrive, Present On PauseThe Fed's Quarter Pounder With Doubt

It’s A Matter Of Trust...

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more