Gold Shines And Silver Rocks

Image Source: Pixabay

In our thoughts from last week, we pointed out that precious metals are on their way to reaching a short-term overheated level. This is while most investors are still underinvested, meaning that long-term opportunities remain intact. Our thoughts were clearly well received by our readers: this issue alone has increased our subscriber numbers by a further 5%! We are amazed – and would like to say a big thank you! And if you like our thoughts this week too, we would be delighted to receive another thumbs up!

Over the last few days, Gold has exceeded the $4,000 per ounce mark, and Silver briefly surpassed the magical threshold of $50 today – a new all-time high, even if it was only intraday.

Precious metals are undoubtedly the most emotional of all asset classes. They are bought when the mood is euphoric – as jewelry. And they are bought when uncertainty increases – as insurance. But the biggest rallies always end at the peak of fear. That is when even the last investor realizes that real estate, bonds, and stocks alone are not a panacea. However, we are not quite there yet.

(Click on image to enlarge)

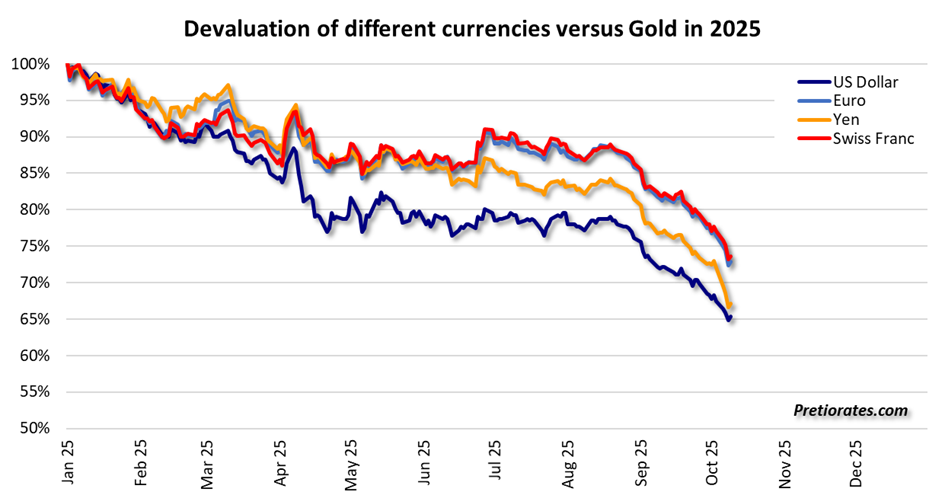

We have explained the pricing of Gold several times. But basically, it reflects the monetary policy of the central bank and the fiscal policy of the government. If these policies are not right, the price of Gold rises relative to the individual currency. But you could also describe it as a devaluation of the individual currency relative to the price of Gold. Many people think of the Venezuelan bolivar or the Turkish lira. But the devaluation of the world’s most important currencies since the beginning of this year is also significant. Unsurprisingly, the US dollar leads the way with a decline of no less than 35%. But the other major currencies have also lost at least 25% against the benchmark Gold...

(Click on image to enlarge)

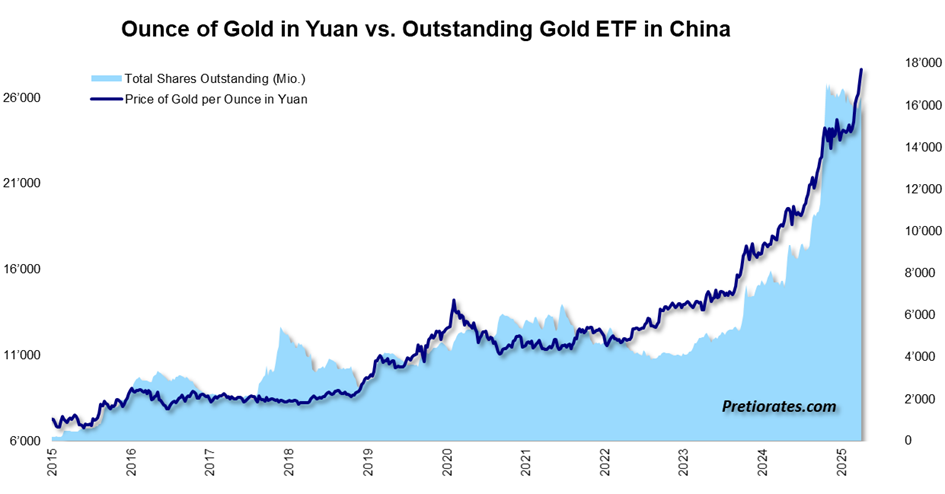

In several issues, we have also pointed out that two centers of power have formed in the global precious metals market: one in Asia, dominated by Shanghai, and one in the West, led by London and New York. In Asia, investors prefer physical Gold – in China and India, mainly in the form of bars and jewelry. In the West, on the other hand, «paper products» or «paper Gold» such as ETFs, certificates, and futures dominate, moving many times the physical volume. Although there are also Gold-backed ETFs in China, the number of outstanding shares has been stagnating for over a year – despite skyrocketing prices.

(Click on image to enlarge)

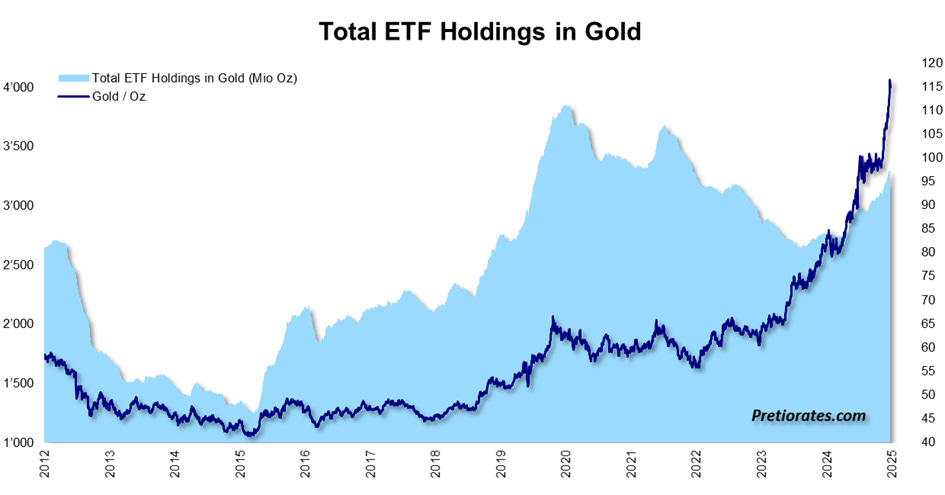

As we described last week, it is now primarily Western investors who are noticeably – or rather, finally – expanding their Gold holdings via ETFs. Nevertheless, Gold exposure in Europe and the US is still below 2020 levels.

(Click on image to enlarge)

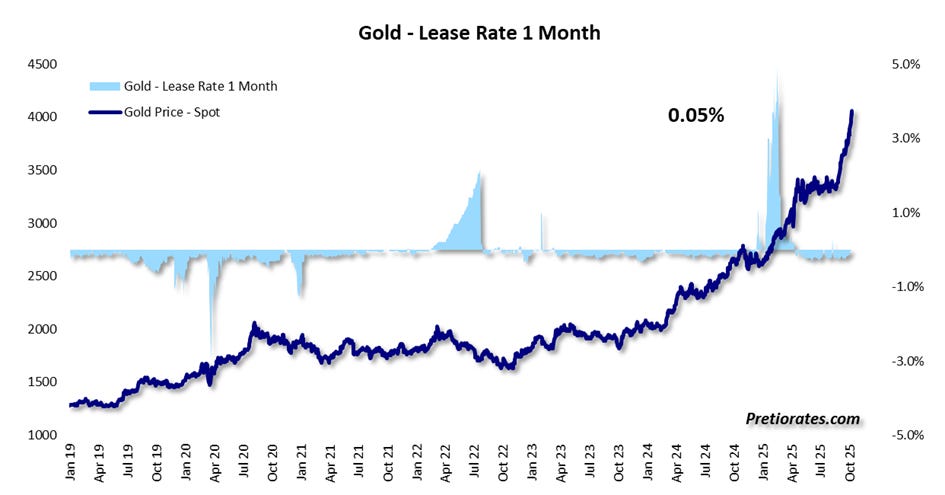

With the rising number of outstanding ETF shares, the proportion of physical Gold that must be deposited for them is also growing. This reduces the freely available quantity. However, traders in London still seem to be well supplied – the so-called lease rate is currently just 0.05% for one month.

(Click on image to enlarge)

The situation is quite different in the Silver market, where a bottleneck is looming. More than 50% of physical demand is now driven by the solar, battery, and high-tech industries. Today, the lease rate has now risen to over 11% – a clear signal of increasing scarcity. What does this mean for the price? Anything is possible. A short squeeze is conceivable – or simply nothing at all. It is simply not possible to make an assessment because the reason for this cannot be determined. But one thing is certain: Silver is receiving more attention, which is often reflected in higher prices.

(Click on image to enlarge)

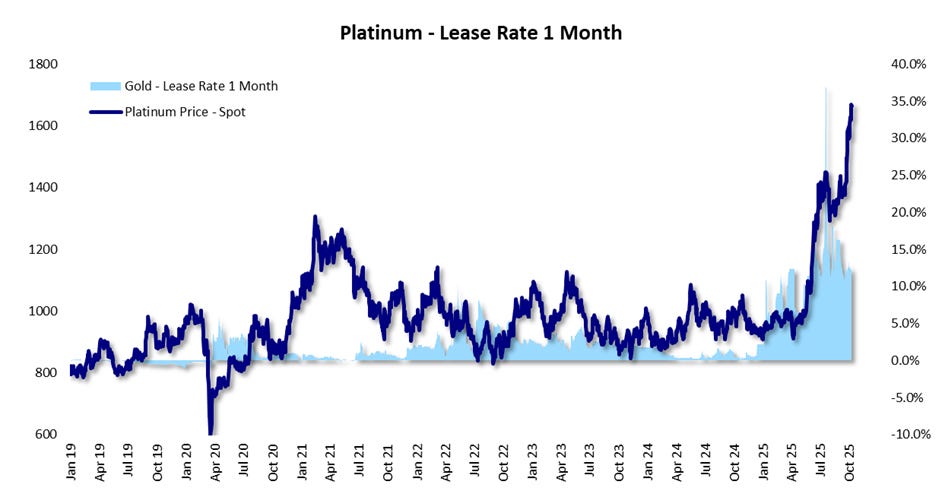

The situation is even more explosive when it comes to platinum. The lease rate temporarily exceeded 35% and currently stands at 12.5%. This is hardly surprising: around 80% of global production comes from Russia and South Africa. Hardly any material is flowing out of Russia, and South African mines are struggling with energy shortages and political turmoil. At the same time, demand from China remains high, as we already explained in May and July 2025.

(Click on image to enlarge)

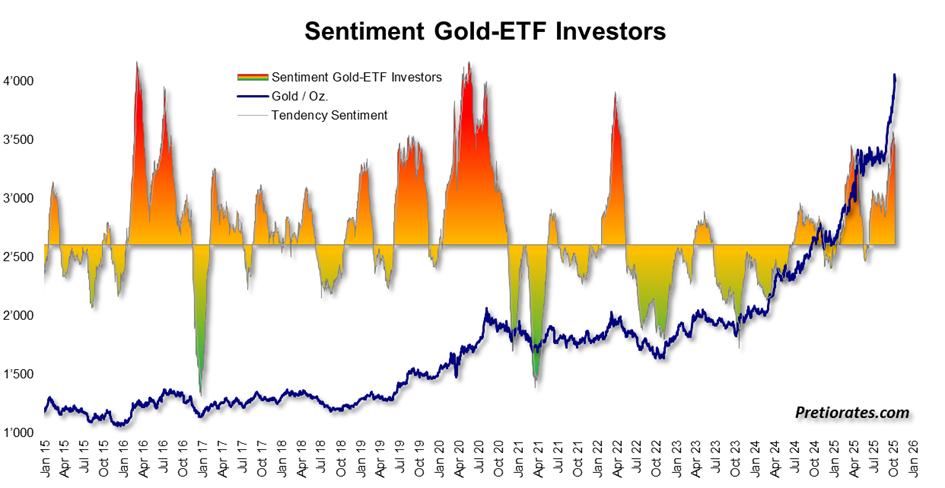

Gold has already gained around 50% in 2025, Silver around 70% and Platinum a good 60%. In fact, the rally in white metals could continue due to physical availability, while the price of Gold could soon enter a period of consolidation. Bullish sentiment in Gold has increased significantly in recent days – although the euphoria is not yet at the level of previous highs, it is getting closer.

(Click on image to enlarge)

More By This Author:

Gold & Silver Shine, But The Crowd Hasn’t ArrivedFuture In Overdrive, Present On Pause

The Fed's Quarter Pounder With Doubt

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more